Research Article: 2022 Vol: 26 Issue: 1

Advice and analysis of regional government investment for badan usaha milik daerah in regional financial perspective

Budiman, UIN Sunan Gunung Djati Bandung

Engkus, UIN Sunan Gunung Djati Bandung

Fadjar Tri Sakti, UIN Sunan Gunung Djati Bandung

Salamatul Afiyah, UIN Sunan Gunung Djati Bandung

Nurmawan, UIN Sunan Gunung Djati Bandung

Citation Information: Budiman., Engkus., Sakti E T., Afiyah S., & Nurmawan. (2022). Advice and analysis of regional government investment for badan usaha milik daerah in regional financial perspective. International Journal of Entrepreneurship, 26(1), 1-10.

Abstract

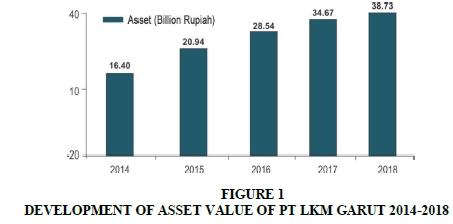

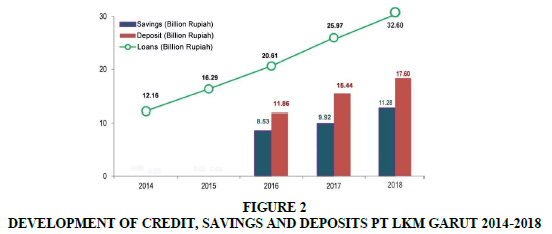

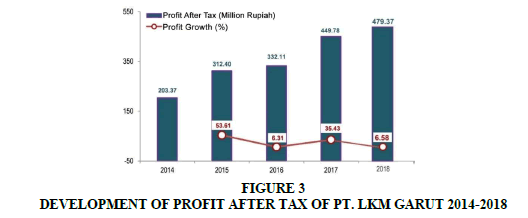

The problem behind this research is that the amount of core capital of the Garut Microfinance Institution (LKM) has not been fulfilled, which comes from the capital participation of the Garut Regency Government as the majority shareholder. This is an obstacle for PT LKM Garut in spurring its performance as a Regional Owned Enterprise (BUMD) which is expected to be able to support the development of Micro and Small Enterprises (SMEs) and reliable contributors of Regional Original Income. As a relatively young financial institution as a result of consolidation in 2014, PT LKM Garut periodically requires additional capital deposits from the owner, in accordance with a predetermined scheme. This study aims to examine and provide advice on the ideal amount of capital participation per fiscal year, which should be realized by the Garut district government at PT LKM, as well as the projection of dividends for the owner as a result of the investment. This research uses descriptive verification method with a quantitative approach, based on the 2014-2018 PT LKM financial report data. Based on the results of the evaluation, in general, the financial performance of PT LKM Garut in 2014-2018 shows a positive development. This is indicated by the growth of assets from Rp. 16.40 billion to Rp. 38.37 billion; Credit distribution from Rp. 12.16 billion to Rp. 32.60 billion; Savings from Rp. 8.53 billion (2016) to Rp. 11.28 billion (2018) and deposits from Rp. 11.86 billion to Rp. 17.60 billion (2018). From the health aspect, during that period, PT LKM Garut was also in the Healthy category as shown by its achievements: Capital Adequacy Ratio (CAR), Earning Asset Quality (KAP), Non-Performing Loan (NPL), Cash Ratio, Comparison of Operational Costs and Operational Income (BOPO), Return on Asset (RoA) and Loan to Deposit Ratio (LDR). This development has consequences for the increasing need for realization of equity participation from the owner. In order to improve the performance and profitability of PT LKM, the Regency Government is advised to make a minimum capital deposit of Rp. 1 billion.

Keywords

Analysis, Advice, Regional Capital Participation, Regional Financial Perspective

Introduction

The role of government in the economy, including local government, is very strategic, both in its capacity as a facilitator, regulator or stimulator, even as an economic actor. This role is no longer debated, both in theories and in the realms of economic thought. Through various policies in the public sector, the government plays a role in driving economic growth. This can be done in the form of investment (government investment), trying to attract investors, encouraging technological developments, or producing the workforce needed by the labour market (Hamid & Anto, 1997) In several countries, both in socialist and capitalist countries, the role of government in the fields of investment and capital formation is quite prominent. Even in Japan and Taiwan, more than half of the formation of Gross Domestic Capital is carried out by the government. It is interesting that one of the manifestations of the role of the government in these countries is “entrusted” to State-Owned Enterprises (BUMN), which is played as one of the engines of economic growth, as in Singapore and Malaysia (Akadun, 2007).

In carrying out this role, each country certainly has a different strategy. In Indonesia, the strategy to move the wheels of the economy through State-Owned Enterprises (BUMN) and Regional-Owned Enterprises (BUMD), is constitutionally stated in the Constitution (UUD) of the Republic of Indonesia, article 33. Especially for BUMD, it is further regulated in RI Government Regulation Number 57 of 2017, concerning Regional Owned Enterprises (Undang, 1945).

PT Garut Microfinance Institution (LKM) has the status of a Non-Bank Financial Institution (Budisantoso & Triandaru, 2011) as a result of the merger of 3 (three) similar financial institutions in 2014, which was formed by Regional Regulation of West Java Province Number 7 of 2015 as a jointly owned BUMD, between the Government West Java Province with the Garut Regency Government, with a shareholding composition: 91% Garut Regency Government, and 9% West Java Provincial Government. As a BUMD that is still in the introduction stage, even though in the first 4 (four) years of its journey, it shows a trend of improving performance and is categorized as healthy, but the level of efficiency is not optimal, because so far the fulfilment of its capital needs is still using loan funds, with interest at high relatively high. This is because the owner's obligation to pay up capital has not been fulfilled in accordance with the specified core capital (Soemitra & Andri, 2015). If this condition continues, it is very possible that the future development of PT LKM Garut will be constrained. For this reason, studies and advice are needed to encourage consistency of the owner in fulfilling the said capital payment obligations, in accordance with the scheme stipulated in the Perda on Equity Participation. Apart from that, all PT LKM costumers are expected to be able to use this study as a guide in efforts to improve the performance of these BUMDs, so that their main mission is as a PAD contributor, expanding employment, and supporting the development of the SME sector, as well as achieving the leverage of regional economic growth (Siswadi & Edi, 2012).

This study aims to provide an overview, as well as input to the owner of PT LKM Garut regarding the capital participation plan of the Garut Regency Government in particular, and the estimated returns & benefits that will be obtained by the owner and other stakeholders, if realized in a timely manner and in the right amount (Kamaludin & Indriani Rini, 2012). This study also aims to provide investment advice or recommendations to the owner and management of PT LKM regarding the allocation of investment funds in a targeted, effective and productive manner (Sukirno, 2001). According to Sukirno (2001) investment activities carried out by the community will continuously increase economic activity and job opportunities, increase national income and the level of community welfare. This view departs from three important functions of investment activities, namely: (a) Investment is one component of aggregate expenditure, so that an increase in investment will increase aggregate demand, national income and employment opportunities; (b) The increase in capital goods as a result of the investment will increase production capacity; (c) Investment is generally followed by technological developments for economic development originating from abroad (Undang, 1994). Regional Original Income (PAD). According to Article 6 of Law of the Republic of Indonesia Number 33 of 2004 concerning Financial Balance between the Central and Regional Governments, the revenue obtained by a region from sources within its own territory is collected based on Regional Regulations in accordance with the prevailing laws and regulations. In other words, Regional Original Income is a source of original revenue and comes from the potential of the region concerned. Local governments can optimize these PAD sources through various policies, both extensively and intensively (Undang, 2009). Sources of PAD generally come from: (1). Local Tax Results; Local taxes are mandatory contributions to regions that are owed by an individual or entity, which is compelling based on law, without receiving direct compensation and is used for regional needs for the greatest prosperity of the people (Article 1 of Republic of Indonesia Law Number 28 the Year 2009). (2) Result of Regional Retribution; Regional levies are regional levies as payment for services or the granting of certain permits specifically provided and/or given by local governments for the benefit of individuals or entities (Article 1 of Law Number 28 of 2009). (3). Proceeds from the Management of Separated Regional Assets; For regions that have BUMDs such as Regional Drinking Water Companies, Regional Development Banks, District Credit Agencies, PD Markets, or entertainment/recreation venues and the like, a portion of the profits earned by business entities or from the proceeds of the separated regional assets is a source of income. for the region concerned. The results of the separated regional wealth management include, among others, a share of profits, dividends and sales of shares belonging to the region. (4). Other Legal PAD; According to Nurcholis (2005), what is meant by Other Legal PAD includes Proceeds from the sale of regional assets that are not separated, current accounts, interest income, gains on the difference in the rupiah exchange rate against foreign currencies and commissions, discounts, or other forms as a result of sales and/or procurement of goods and/or services by local governments (Nurcholish, 2005).

Regional Equity Participation.Participation. Capital (capital) is the main resource driving the company's activities. The existence of capital in a company is related to the total assets of the company that are rotated or used in conducting business activities. The inadequacy of working capital will have implications for the limitations of the company in managing its activities and will lead to the ability to earn profits. According to Riyanto (2001) who is quoted from Meij's opinion, capital is defined as the collectivity of capital goods contained in the debit balance sheet, while what is meant by capital goods is all goods that are in the company's household in their productive function to form income. Thus, capital is the total assets of the company that are on the liabilities side of the balance sheet, whether included in the current debt class or fixed assets. Riyanto (2001), quoting Polak's opinion, defines capital as the power to use capital goods. In other words, capital is capital goods that are on the balance sheet next to credit. What is meant by capital goods are goods that are in the company that have not been used, which are on the debit balance sheet? From the above definitions, it can be concluded that capital is the total assets of a company invested in business activities, whether in the form of fixed assets, current assets or intangible assets, which are recorded in the balance sheet (Peraturan Daerah Kabupaten Garut Nomor 11 Tahun 2018). West Java Provincial Regulation Number 13 of 2016 concerning Regional Equity Participation defines Regional Capital Participation as an effort to include regional capital in a joint venture between regions, and/or with private business entities / other entities and/or capital utilization area by another business entity/entity with a specific purpose, purpose and reward. Regional Government Equity Participation is intended as an effort to increase the productivity of the utilization of land and/or buildings and other assets belonging to the Regional Government by forming joint and mutually beneficial businesses. The objective of Local Government Equity Participation is to increase: (a) Sources of Regional Original Income; (b) Economic growth; (c) Community income; and (d) Labor absorption (Mulyadi et al., 2016). To achieve this goal, local government equity participation should be carried out consistently and always adhering to the principles of good corporate governance (Peraturan Daerah Provinsi Jawa Barat Nomor 13 Tahun 2016) by the Regional Financial and Asset Management Office and related SKPD by taking into account the advice from the Garut Regency Government Investment Advisory Team, so that the capital participation is effective, efficient and productive (Keputusan Bupati Garut, 2018).

Method

This research uses descriptive verification method supported by a quantitative approach (Sugiyono, 2017). Quantitative methods are used in calculating the nominal capital participation plan and the projection of profits (simple linear regression and Financial Ratio Analysis). The descriptive approach is intended as a descriptive method of analysis, in order to describe a situation as a whole in written form and to be analyzed systematically. Data obtained from the Financial Statements of PT. Garut Microfinance Institutions 2014 to 2018 and Garut Regency Government Financial Statements 2012-2018 (Silalahi & Ulber, 2017). The data are then collected and analyzed in order to obtain an explanation of the correlation between research variables. The study aims to analyze the contribution of regional capital participation to the performance of PT LKM.

To calculate the amount of equity participation, two analyzes are used. First, an analysis of the business development of PT. MFIs in 2014-2018 are seen from the value of assets, income, liquidity and credit volume. Second, analysis of PT LKM financial performance which includes: Capital Adequacy Ratio (CAR), Return on Assets (ROA), Loan to Deposits Ratio (LDR), Operating Expense Ratio (OER), Cash Ratio, Non Performing Loans (NPL), and Earning Asset Ratio (Mulyawan, 2015).

Results and Discussion

Business Development Analysis of PT. LKM Garut (Setia Mulyawan, 2015). The business development of PT LKM Garut during 2014-2018 has an increasing trend, which is indicated by the increase in asset value, liquidity, credit volume and interest income. In 2014 (at the beginning of the merger) the asset value was Rp. 16.40 billion, and by the end of 2018, it increased to Rp. 38.37 billion. Cash and cash equivalents (liquidity) reached Rp. 2.6 billion, so as to be able to increase the volume of credit to Rp. 32.60 billion or an increase of 133.96% and generate income from services (interest) of Rp. 0, 456 billion. Thus, throughout 2014-2018 the business development of PT LKM Garut continued to increase as illustrated below Figure 1.

The below picture shows the asset value of PT LKM which has continued to increase over the last 4 (four) years. From Rp. 16.40 billion in 2014, to Rp. 20.94 billion in 2015 or an increase of 27.68%; in 2016 increased to Rp. 28.54 billion, or up 40.66 per cent. In 2017 it becomes Rp. 34.67 billion, or an increase of 21.48 per cent, and in 2018 amounting to Rp. 38.37 billion, or an increase of 10.76%. Thus, the company's average asset value per year reaches Rp. 5.65 billion, or 25.75%. The increase in these assets is able to increase the capacity of PT LKM Garut in channelling credit, both productive credit, consumptive credit, thereby increasing the opportunity for cumulative profit.

The development of Savings, Time Deposits and Credit Volume during 2014-2018 can be seen in Figure 2 below:

The number of PT LKM savings from 2016 to 2018 continues to increase. From Rp. 8.53 billion (2016), to Rp.9.92 billion (in 2017) and increased to Rp.11.28 billion in 2018. Deposits during the same period increased quite rapidly, namely by 30% (from Rp. 86 to Rp. 15,440 billion). The rapid growth in deposit funds prompted PT LKM to raise its deposit interest rate to 8.25%. This condition allows PT LKM to increase its loan volume from year to year, namely: from Rp. 12.16 billion (the year 2014) increased to Rp. 16.29 billion (in 2015), meaning that it increased by Rp. 4.13 billion (33.96%) and in 2016 it increased again to Rp. 20.61 billion or an increase of Rp.4.32 billion (26.52%). In 2017, this increased to Rp. 25.97 billion, or an increase to 5.36 billion rupiahs (26%), so that per year the average increase is Rp. 4.6 billion (28.82 per cent).

The acquisition and growth of PT LKM Garut's net profit in 2014-2018, is shown in Figure 3 below:

Total Profit After Tax of PT LKM, for 4 (four) consecutive years continued to increase, from Rp.203.37 million (in 2014) to Rp.312.40 million in 2015, then increased to Rp.332.11 million (2016), then increased again to Rp.449.78 million in 2017, and in 2018 it reached Rp.479.37 million. This shows, that the increase in the average profit of PT LKM Garut per year, reached Rp. 55.2 million or 25.48%.

Based on the results of the analysis using the Financial Ratio Analysis (Husnan S & Pudjiastuti E, 2006), the financial performance of PT LKM Garut is generally in the Healthy category, as shown by a number of financial performance indicators throughout 2016-2018 which include: CAR, KAP, NPL, ROA, BOPO, CASH RATIO and LDR in the Table 1 below:

| Table 1 Health level of pt. Lkm garut 2016-2018 (%) |

|||||||

|---|---|---|---|---|---|---|---|

| Indicator | Healthy Criteria | Ratio 2016 year | Information | 2017 projection | Inf | 2018 projection | Inf |

| CAR | >=8 | 29,16 | Healthy | 19,4 | Healthy | 23.58 | Healthy |

| KAP | <=10,35 | 2,11 | Healthy | 2,65 | Healthy | 1.6 | Healthy |

| NPL GROS | <=10 | 3,03 | Healthy | 2,60 | Healthy | 1.74 | Healthy |

| NPL NET | <=10 | 0,64 | Healthy | 2,60 | Healthy | 1,80 | Healthy |

| ROA | >=1,215 | 1,20 | Healthy | 1,46 | Healthy | 1.55 | Healthy |

| BOPO | <=93,52 | 94,42 | Unwell | 93,42 | Healthy | 91.76 | Healthy |

| CASH RATIO | >=4,05 | 24,37 | Healthy | 8,00 | Healthy | 10.4 | Healthy |

| LDR | <=94,75 | 72,94 | Healthy | 84,66 | Healthy | 85.63 | Healthy Source: PT LKM Garut Annual Report 2018. |

PT LKM Garut Capital Adequacy Ratio (CAR) in 2017 was 19.4%, or decreased by 9.76% compared to 2016 which reached 29.16%, and in 2018 it increased to 23.58%. Even though the 2016-2018 CAR is still at a safe limit, namely> = 8, for management, this decline should be noted, considering that a lower CAR will impact on the decline in the ability of institutions to bear credit / earning assets risk. The declining CAR also implies that the company's ability to finance operating activities and the probability of achieving profit will decrease. Normatively, the capital adequacy ratio / CAR of PT LKM Garut is still relatively good.

Earning Asset Quality (KAP), in 2016 was recorded at 2.11% or with a sound predicate because the maximum limit was declared healthy at 10.35%. The 2017 period was 2.65% or an increase of 0.54%, and in 2018 it was 1.60%. This occurred due to a decrease in the amount of Earning Assets channelled and an increase in the amount of Earning Assets at risk. Even though it is still within normal limits, it actually indicates unfavourable conditions, The Non-Performing Loan (NPL) ratio is 2017 was 2.60, meaning that it had increased by 0.43% compared to 2016, and in 2018 it reached 1.74%. If we look at the progress during 2016-2018, normatively this ratio is still included in the healthy category, because it is below 5%.

So, the ROA for the 2016-2018 period is predicated on healthy/good, because it rises above 1.22%.

The 2016 BOPO ratio was 94.42% or predicated as Unhealthy because the value was more than 93.52%. The BOPO ratio in 2017 was 93.42% or decreased by 1%. In 2018 it fell back to 91.76%. This shows a decrease in operating expenses compared to the previous period, but on the other hand, it was offset by an increase in operating income. Thus, the BOPO for the 2016-2018 period was predicated as Healthy because it was below the maximum figure (93.52%).

Current Ratio (CR) in 2016 was 24.37%. The CR standard has a healthy predicate of at least 4.05%. So, the CR for the 2016 period was predicated as Healthy because the value was more than 4.05%. The CR value in 2017 was 8%. Or has decreased by 16.37%. In 2018, the Current Ratio increased to 10.40%, this was possible because the amount of current debt increased and the availability of liquid funds increased. Likewise, the 2016-2018 Loan to Deposit Ratio (LDR) of PT LKM is generally considered healthy, because it is smaller than 93.75%.

Thus in accordance with the results of the analysis above, the health level of PT LKM throughout 2016-2018 is generally in the Healthy category and normatively stated as feasible to obtain additional capital participation from the owner (Kodifikasi Peraturan Bank Indonesia, 2012).

Profit-Sharing PT LKM Garut (Peraturan Daerah Provinsi Jawa Barat Nomor 14 Tahun 2006). The nominal amount of the share of annual profit for the owner (dividend), calculated from the total profit for the current year, based on the amount of share ownership and the actual paid-in capital from each owner, as illustrated in the following Table 2:

| Table 2 Composition Of Government Shares Garut And West Java Provincial Government At Pt Lkm Garut |

||||

|---|---|---|---|---|

| No | Shareholders | Amount (Rp) | % | Paid-in Capital(Rp) |

| 1 | West Java Goovernment | 1,35,00,00,000 | 9 | 1,35,00,00,000 |

| 2 | Garut Regency Government | 13,65,00,00,000 | 91 | 9,50,00,00,000 |

| Total | 15,00,00,00,000 | 100 | 10,85,00,00,000 | |

The share of PT LKM Garut which is owned by the West Java Provincial Government is 9%, with the Realization of Paid-in Capital amounting to Rp. 1,350,000,000, while the Garut Regency Government owns 91% of the shares with the total paid-in capital realization of Rp.9,500,000,000. The total profit of PT LKM Garut in 2018 was Rp. 479,367,731.00 or an increase of Rp. 29,589,295.00 (6.58 per cent) when compared to the 2017 profit which reached Rp. 449,775,436. With the composition of share ownership, the calculation of profit-sharing for each shareholder can be seen in the Table 3 below:

| Table 3 Pt Lkm Profit Sharing In 2018 |

||||

|---|---|---|---|---|

| No | Shareholders | % | Profit 2018 | |

| 1 | West Java Government | 9 | 47,93,67,731 | 4,31,43,096 |

| 2 | Garut Regency Government | 91 | 479.367.731 | 436.224.635 |

| Total | 100 | |||

Based on this composition, in 2018 the West Java Provincial Government is entitled to a share of profit (dividends) of Rp. 43,143,096, and the Government of Garut Regency of Rp. 436,224,635.

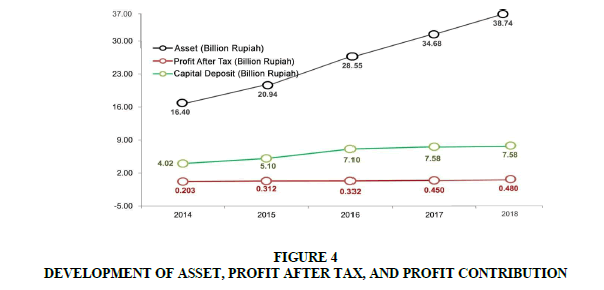

Regional Capital Participation Contribution to PT. LKM Garut. Analysis of the relationship between Regional Capital Inclusion, Asset Value and Credit volume of PT LKM Garut for 4 years (2014-2018), shows a positive relationship. This means that the increase in the amount of equity participation has a positive impact on the increase in the assets of PT LKM, as well as on the volume of loans granted and the company's revenue. This increase resulted in an increase in the contribution of PT LKM in the form of a share of profit (dividend) for the owners, although when compared to the growth of its assets, the profit growth was still relatively low.

The following graph illustrates the development of assets, profit after tax, and profit contribution of PT LKM Garut to local revenue (PAD) Garut Regency, 2014 – 2018 in Figure 4:

To predict PT LKM's profit and the amount of dividends or share of owner's profit (Yani, 2002). it is calculated by projecting Regional Capital Participation with Profit After Tax, through

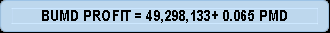

Information: PMD: Regional Capital Participation (in Thousands of Rupiah)

The hypothesis of the calculation results is: If the Garut Regency Government does not make capital participation, then PT LKM will get a profit of Rp. 49,289,133, and if there is Equity Participation of Rp. 1 billion, then BUMD's profit will increase by 0.065 times the nominal amount of capital participation, plus Rp. 49,289,133. This amount is predictive in nature, calculated by a simple linear regression model with a significance level of 5% (F count = 0.028), and for the dependent variable with a constant value of 0.065. Although the constant value is not significant, this model can be used to predict the total profit of PT LKM for the next/future year. The projection of PT LKM profit per year for each realization of capital participation of the Garut Regency Government can be seen in full in Table 4 below:

| Table 4 Projection of pt. Lkm Garut On Various Amounts Of Equity Participation 2014-2019 Years |

|||

|---|---|---|---|

| s.d 2014 | 4,02,03,25,209 | 31,06,19,271.60 | 20,33,71,604 |

| 2015 | 6,52,03,25,209 | 47,31,19,271.60 | 31,23,99,306 |

| 2016 | 8.520.325.209 | 60,31,19,271.60 | 33,21,06,128 |

| 2017 | 9.000.000.000 | 63,42,98,133 | 44,77,77,000 |

| 2018 | 9.500.000.000 | 66,67,98,133 | 479.367.731 |

| 2019 | 10.000.000.000 | 69,92,98,133 | |

“Source: Financial Report of PT. LKM Garut, 2014-2018, (Processed by Researchers), 2020”

The amount of equity participation in the table above is an accumulation for 6 (six) fiscal years. In order to get an overview of the earning share of profit (dividend), it is calculated by subtracting the total capital participation for the projected year from the total equity participation in the previous year. For example, to get profit after tax of Rp. 699,298,133, - Garut Regency Government in 2019 needs to make additional capital participation, a minimum of IDR 500,000,000.00. This figure, calculated from the assumption of the accumulated amount of Equity Participation by the Garut Regency Government until 2019, is Rp. 10,000,000,000 deducted from Rp. 9,500,000,000.00.

Conclusion

Based on the results of the analysis and discussion, the researchers concluded: (a) The financial performance of PT LKM Garut throughout 2016 the Fiscal Year 2018, is classified as Healthy as reflected in a number of key indicators of the institution's financial performance, which include: Capital Adequacy Ratio (CAR), Earning Asset Quality (KAP), Non-Performing Loan (NPL), Cash Ratio, comparison of Operational Costs to Operating Income (BOPO), Return on Assets (RoA) and Loan to Deposit Ratio (LDR). (b) Additional Local / Garut Regency Government Capital Participation in PT LKM Garut has a positive impact on the increase in asset value, credit volume and profit after tax (Earning after Tax). (c) Each additional capital participation of Rp. 1 billion, is predicted to get a profit of 0.065 times the nominal amount of realized capital participation plus Rp. 49,289,133, and if there is no capital participation, PT LKM will get a profit of Rp. 49,289,133.00.

In an effort to improve the performance of PT LKM Garut, while at the same time encouraging an increase in dividends, in each budget year the Garut Regency Government is advised to increase the minimum capital participation of Rp. 1 billion; The management of PT LKM Garut is expected to increase the number of financial performance indicators which are still low or even have decreased.

References

Akadun, (2007). Administrasi Perusahaan Negara. Bandung: Alfabeta.

Budisantoso, T., & Triandaru, S. (2005). Banks and other financial institutions.

Hamid, ES, & Anto, MH (1997). Indonesian Economic Development Study. Economic Journal of Emerging Markets , 2 (1), 16-28.

Husnan, S., & Pudjiastuti, E. (2015). Fundamentals of Financial Management, Seventh Edition. Yogyakarta: Upp Stim Ykpn .

Keputusan Bupati Garut Nomor 582/kep.438. Pereko/2018, tentang Penasihat Investasi Pemerintah Daerah Kabupaten.

Kodifikasi Peraturan Bank Indonesia, (2012). Penilaian Tingkat Kesehatan Bank, Jakarta : PRES Bank Indonesia.

Nurcholish, H. (2005). Theory and practice of government and regional autonomy. Gramedia Widiasarana Indonesia.

Peraturan Daerah Kabupaten Garut Nomor 11 Tahun (2018) tentang Perubahan atas Peraturan Daerah Kabupaten Garut Nomor 14 Tahun 2014 tentang Penambahan Penyertaan Modal Pemerintah Daerah Kabupaten Garut ke Dalam Modal Dasar Perusahaan Daerah Bank Perkreditan Rakyat Garut.

Peraturan Daerah Provinsi Jawa Barat Nomor 13 Tahun (2016) tentang Penyertaan Modal Daerah. Gubernur Jawa Barat. Gubernur Jawa Barat

Peraturan Daerah Provinsi Jawa Barat Nomor 14 Tahun (2006) tentang Perusahaan Daerah Bank Perkreditan Rakyat dan Perusahaan Daerah Perkreditan Kecamatan.

Riyanto Bambang, (2001). Dasar-dasar Pembelanjaan Perusahaan, Edisi 4, Yogyakarta : BPFE

Setia Mulyawan, S, (2015). Manajemen Keuangan". Pustaka Setia.

Silalahi, Ulber, (2017). Metode Penelitian Sosial Kuantitatif. Bandung: Refika Aditama.

Siswadi, Edi, (2012). Reengineering BUMD - Mengoptimalkan Kualitas Pelayanan yang Unggul

Soemitra, Andri, (2015). Bank dan Lembaga Keuangan Syariah,Edisi Pertama, Jakarta: Prenadamedia Group.

Sukirno, S. (2001). Pengantar Teori Makro, Raja Grafindo, Jakarta. Jakarta: Raja Grafindo.

Undang-undang Dasar Negara Republik Indonesia Tahun (1945). Presiden RI.

Undang-Undang RI Nomor 28 Tahun (2009). Tentang Pajak Daerah dan Retribusi Daerah. Presiden Republik Indonesia. 15 September.

Undang-undang RI Nomor 33 Tahun (2004). tentang Perimbangan Keuangan antara Pemerintah Pusat dengan Pemerintah Daerah.