Research Article: 2024 Vol: 28 Issue: 5

Adoption of Digital Payments: Do One Size Fits All?

Brajesh Bolia, K J Somaiya Institute of Management, Mumbai

Sanjeev Verma, Indian Institute of Management, Mumbai

Citation Information: Bolia, B. & Verma, S. (2024). Adoption Of Digital Payments: Do One Size Fits All? Academy of Marketing Studies Journal, 28(5), 1-14.

Abstract

Digital payments instrumentalize the cashless economy and boost economic development. Rapid IT developments fueled e-payments, but the potential of the domain remained latent due to the paucity of an integrated e-payment model. To fill the research gap, the present study proposes an integrated framework based on TPB, TRI, TAM, and Trust model using the PLS tool (SEM PLS3). Findings suggest the significant role of e-readiness, trust, and perceived benefit in driving e-payment adoption. Results reveal the shadowing effect of e-readiness, trust, and perceived benefit on personal factors like self-efficacy and ease of use. Practitioners should instrumentalize secured and hassle-free digital payments to capture a larger market share.

Keywords

Perception, Digital Payment, TAM, TPB, TRI, Trust, Self-Efficacy, Ease of Use, E-readiness, Security, Benefits.

Introduction

Digital payments are executed through a digital system that allows clients to remotely get connected and exchange a numeric estimation of installment from a payer to the payee. Digital payment uses a digital channel for any trade of products & any installments made through digital signs connected straightforwardly to store or acknowledge records is characterized as digital payment (Seldal & Nyhus, 2022). Digital payments instrumentalize the cashless economy and many countries recently have started moving towards a cashless economy. A cashless economy boosts economic development through various measures like checks on crimes related to cash stealing, government control on transactions, checks on corruption, and bringing the entire population under the banking system. Rapid developments in information technology have fueled the new paradigm of e-transactions and digital payments (Oxford Analytica, 2020).

The global payment system will grow exponentially, and India’s digital payment (e-payment) sector will move up to $10 trillion by 2026 (BCG& PhonePe report, 2023). Digital payments in India got a push by the demonetization decision on November 8, 2016 and the rising number of internet users (Internet usage in India- Statistics & Facts- Statista, 2022). The dawn of innovative digital payment solutions will not only boost the e-commerce industry but also address issues related to the grey economy along with attaining the financial inclusion aim. For businesses, the ease of transaction through various digital payment modes will increase revenue, improve operational efficiency, and lower operating costs.

Due to the significance of the topic and its importance in boosting the economy, several researchers have attempted to study the digital payment phenomenon and its drivers. But most of the previous studies have focussed on specific technology for a digital transaction like the mobile wallet but the results of previous studies may not hold for other technologies like internet banking, mobile banking, or telebanking. Digital payments are still an embryonic concept in developing countries like India where demographic diversity is large and sustained efforts on a concrete action plan are required. Chawla and Joshi (2020) attributed perceived ease of use (PEOU), perceived usefulness (PU), trust, security, facilitating conditions, and lifestyle compatibility as drivers of consumer attitude and intention to use mobile wallets.

To concretize the strategic framework for the adoption of digital payment channels and their wider acceptability, it would be important to answer the following research questions.

1. What are the consumer concerns for digital payment adoption (or non-adoption)?

2. What is the relative importance of these consumer concerns?

3. Which consumer concern drive or hinder the adoption of digital payment adoption most in order of their relative importance?

To answer the research questions, a systematic literature review helped in theorizing a series of hypotheses and the resultant conceptual model. The model is examined using PLS-SEM to assess the empirical strengths of the relationships and the model’s explanatory power. Post hoc analysis helped in diagnosing the differences in consumer perception due to differences in demographic characteristics. The findings of this paper would be significant for policymakers and practitioners in framing their digital drive strategy. This study attempts to connect the dots between consumer behavior toward digital payments and how practitioners can use the same to develop a successful policy framework, resulting in growth, ease, inclusion, and reduced burden on cash management.

This paper is structured into four parts. Section 1 outlines the introduction of the paper. Section 2 entails systematic literature and builds an integrated conceptual framework based on TPS, TAM, TRI, and Trust Model. Section 3 presents a detailed research methodology, and section 4 includes findings and conclusions.

Review of Literature

Past research studies have looked at digital payment in terms of the adoption of online payment and determinants affecting the adoption of digital payments (Kar, 2020), classification and characteristics of digital payment systems, internet shopping (Khatibi, Haque & Karim, 2006), security and trust in digital payments. The technology Adoption Model (TAM) was used widely to explain perception toward digital payment systems (Rigopoulos & Askounis, 1970). Research on drivers and inhibitors of digital payment adoption has attracted researchers’ attention not only in developing nations but also is studied widely in developed nations (Gehrt et al., 2019). Execution and security are common worries alongside the classification of individual record information. The literature review has revealed various aspects of e-transactions adoption, including the evolution and adoption of internet banking, awareness and readiness levels of the users, digital payment dynamics (benefits and concerns), and state agencies' initiatives to promote digital channels for payment. State agencies across the globe are shifting to e-governance mode and e-transaction mode to promote transparency and speed. E-governance mandates transactions on electronic platforms and creates an environment for the wider acceptability of digital payments.

Present-day governments face unmatched challenges with citizens' rising aspirations, displeasure with the government, and political indifference. E-governance involves the use of information and communication technologies (ICTs) to transact the business of government (Saxena, 2005). The use of information technology and e-services can improve awareness and access to government services citizens (Solvak et al., 2019). The adoption of e-governance has revolutionized the administrative machinery of governments worldwide by improving efficiency, transparency, and accountability. E-government is one of the applications of information communications & technology (ICT) to ensure the smooth exchange the information between the various stakeholders for the government, such as the government itself (G2G), government to citizens (G2C), and government to business (G2B). It can be termed as providing citizen online services. This results in reduced expenditure encourages economic development, increases transparency in government, improving service conveyance and public administration.

The changing consumer behavior, coupled with a highly competitive scenario and the adoption of e-governance, has compelled the banks to speed up the digitalization process as a matter of urgency (Cuesta et al., 2015). The fast progression of technology, together with artificial intelligence (AI), in the banking industry, has played a disruptive role in traditional banking channels. Fierce competition in the financial sector has driven banks to embrace digital banking. Digital banking has substantial implications for banks’ marketing efforts in enhancing and ensuring a robust customer interface. It has facilitated the banks to provide multi-channel services, changing the way they interacted with customers in the past.

Theoretical Foundation and Hypothesis Building

In the current economic scenario, digital payments can be used to serve as the primary payment mode for e-shopping; apart from that, it is also used for e-learning platforms and some other e-services (Fadhilah & Aruan, 2023). There is ample opportunity for digital payments in markets; however, different channels of payments including cash, are still more dominantly used. Davis (1989) observed that a client's general conduct assumes a significant part in figuring out if an individual would utilize a framework toward a data innovation in information technology (IT). Convenience and perceived ease of use of IT applications, as needs are, would direct the behavior toward the technology and its utilization. The acceptance of digital payment is significantly impacted by the user’s perception of the method and elements such as innovation, security, trust, and effectiveness. Banks are putting additional efforts to generate awareness among citizens for the adoption of digital payments and their paybacks.

E- Readiness

E-Readiness is defined as the degree to which a population is ready to contribute to the networked world (Dada, 2006). The transition from offline to online channels for e-transactions without proper planning can result in loss of time and money, making the products unattractive and thus leading to failure. Adoption of new transaction channels like digital payments makes sense when a larger population is willing to learn and e-readiness is high (Rohayani, 2015). E-Readiness is assessed by gauging a population’s relative progression in the areas that are significant for information and communication technology (ICT) adoption. E-readiness measurement is intended to direct development efforts by providing yardsticks for evaluation and gauging advancement. It can also be a vital instrument for adjudicating the effect of ICT, to substitute barren claims and unreliable evidence about the role of ICT in development with detailed data for assessment.

E-readiness is a measure in which individuals can take part in an undeniably arranged world, and it doesn't reflect just the quantity of computers, web associations, phones and mobiles, and so on in the nation. E-readiness is a multidimensional concept that can alter consumer orientation toward new technologies (Shankar & Datta, 2018). While moving towards e-friendly nations, an e-readiness appraisal using comparative models can help in building up essential benchmarks for provincial correlation by market verticals and national arranging. Citizens and the community are the major stakeholders in the e-government initiative and the e-readiness of citizens is a must for the digital payment adoption journey. Thus, it hypothesized

H01: e-readiness positively influences the perception of digital payment adoption

Trust

Trust fosters faith in exchanging parties involved in monetary exchanges that the transaction does not carry any risk and it can prompt positive aims (Raman & Aashish, 2021). Past researchers observed that to channelize web-based commercial exchanges, trust plays a critical determining role in impacting clients' intention to use these exchanges. To influence shoppers' attitudes toward digital payments and to expand the odds of their convenient acceptance, trust is one of the essential elements for comprehending interpersonal conduct and monetary trades in digital exchanges. Trust is hoisted significantly in digital payments due to a high level of vulnerability in online transactions and is being more essential than security.

The emergence of digital payment tools has attracted risk and security issues, and there is a growing concern about safe and secured transactions. Most users are not familiar with the technical aspects of digital payment tools, and they evaluate the security level based on word of mouth and experiences with the user interface. Hence, it becomes vital to keep consumers’ trust intact during the use of digital payment transactions. Based on these premises, it is hypothesized

H02: Trust positively influences the perception toward digital payment adoption

Security

As per Lee, Lim & Lim, (2013), security is referred to as the recognition of safe systems for transmission of information. Web security is looked at from the specialized perspectives that guarantee uprightness, privacy, verification, and non-acknowledgment of connections, that can be accomplished by encryption, computerized mark, and checksum/hash calculation. Security plays a hindrance to the web management of an account, which influences the utilization of digital payment frameworks. For e-transactions, security is classified into three categories viz. frameworks security, exchange, and legitimate. Even though buyers' confidence in their bank is strong, their trust in innovation stays powerless in the absence of security. Security is a significant antecedent of trust, followed by platform reputation (Shao & Zhang, 2018). While digital payments mean cashless transactions saving time and effort, there are limitations such as lack of awareness levels, lack of trust, unsecured transactions, restrictions on the number of cards permitted, etc. that compels service providers to take initiatives to reduce security issues and design secured digital systems. Thus, it is hypothesized,

H03: Security positively influences the perception toward digital payment adoption.

Ease of Use

Literature suggests that the apparent benefit of innovation will be higher when it is simpler to utilize (Sankaran & Chakraborty, 2020). The user’s acquaintance with web interface capabilities empowers the client intelligence to utilize digital payment. The ability to address clients' issues using diverse components like analytics and artificial intelligence ensures both clients and non-clients transact electronically. An interactive web interface and attractive website connect users to purchase effortlessly. For digital payments, download speed is also an essential element that is critical for client fulfillment. Besides download speed, malware and infectious code susceptibility are among the most crucial factor to attract or repel users from doing online transactions (Liébana-Cabanillas et al., 2020). Trust results in faster adoption and a positive perception of digital payments. Moderate reaction time after any e-exchange will prompt a deferral of administration conveyance and makes shoppers unverifiable regardless of whether the exchange is finished. Thus, it is essential from a bank's point of view to develop an interactive interface that is easy to use for consumers to stay attracted to it and feel comfortable about the use of digital payments. Thus, based on the above arguments, it is hypothesized,

H04: Ease of use positively influences the perception of digital payment adoption.

Self-Efficacy

Individual’s belief in their abilities to encounter and be successful in any situation or task is termed as self-efficacy (Bandura, 1986) while self-adequacy was defined as an individual’s capacity to understand and have confidence in his or her abilities to achieve the assigned task. Self-efficacy theory (Bandura, 1986) postulates that it is primarily perceived inefficacy in dealing with potential aversive events that give rise to both fearful expectations and avoidance behavior. Self-efficacy plays a very significant role in how an individual looks at tasks, targets, and challenges. There are four sources of self-efficacy beliefs: Mastery experiences (achievement and disappointment), vicarious experiences (watching others' triumphs and disappointments); verbal persuasion (from associates, partners, and relatives); emotional and physiological states - passionate excitement, nervousness. Internet self-efficacy (ISE), or the belief in one’s skills to establish and implement progressions of Internet actions including digital payments, is a potentially significant factor to elucidate the consumers’ decisions in e-commerce use. Thus, it is hypothesized,

H05: Self – Efficacy positively influences the perception of digital payment adoption

Benefits

Benefits drive the use of digital payment frameworks significantly (Chou, Lee & Chung, 2004). Benefits in the form of convenience and monetary advantages like discounts in web-based services such as internet shopping lure consumers to adopt digital payment channels. In the appropriation of e-installment, Gerrard and Cunningham (2003) observed the monetary advantages to incorporate settled and exchange costs. Exchange expenses are those brought about by clients and vendors when they do a business exchange where the users need to pay a nominal fee to their respective banks for the services used while they can enjoy the benefits of low cost. With an increase in digital connectivity across the globe and the internationalization of markets, businesses in developing countries can access global markets quickly and can operate efficiently with fair competition. Perceived benefit and trust are also figured in the literature as critical factors affecting the consumers’ adoption of digital payment tools. Based on these premises, it is hypothesized

H06: Benefits of digital banking positively influence the perception of digital payment adoption.

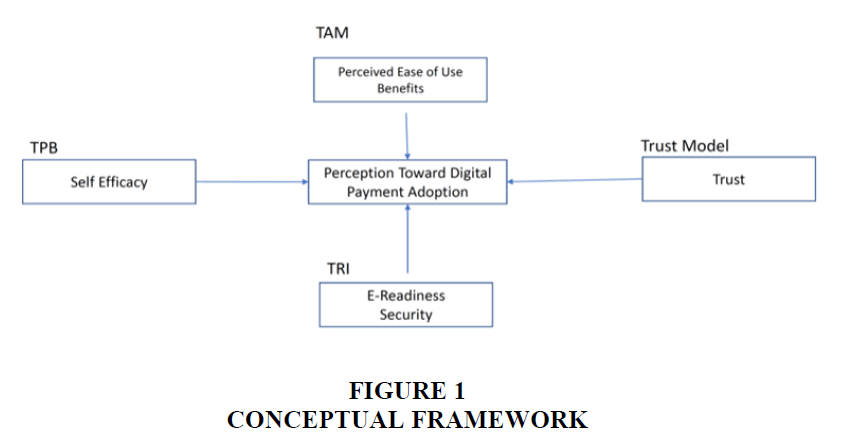

In the preceding sections, six categories of factors that can affect consumers' perception of digital payment channels were discussed. These six factors are e-readiness, ease of use, perceived benefit, self-efficacy, trust, and security. Existing theoretical frameworks form the basis for the identification of factors that drive consumers' perception of digital payment. For instance, perceived ease of use (PeU) was drawn from TAM Model (Technology Acceptance Model), e-Readiness and security were drawn from TRI Model (Technology Readiness Index) and self-efficacy (perceived behavioral control) came from the TPB (Theory of Planned Behavior). The integrated framework is presented in Figure 1.

Research Methodology

The research is conducted based on knowledge, observations, and interest on the topic, along with literature and theories have been searched for deeper understanding. The main idea of this type of research is based upon opinion, attitude, or behavior held by a group of people on a given subject. A questionnaire has been developed; the research method has been established, followed by data collection and analysis to conclude. The research is a type of analytical research trying to connect the dots between consumer behaviors toward digital payments and how can it be used to develop a successful policy framework. The significant factors are being identified, and they are being presented as statistically inferable data for the study of the population. The research is conducted in a manner of deductive approach, where theory has been figured out first, and the data is collected to test it further.

Sample Design Process

The sample is designed to understand consumer behavior change toward government policies to promote digital transactions. The participants are selected based on non-probability sampling methods. The type of non-probability sampling method which has been used in the research is snowball sampling to take responses from people who have existing knowledge about digital payments. The questionnaire has been designed (Table 4) using the conceptual framework obtained from the literature review.

Data Preparation and Data Analysis

The data collected has been organized in tabular form, and each question is categorized into many headings like demographic variables, internet usage patterns, E-governance awareness, E-readiness, trust, security, Ease of use, self-efficacy, benefits, and digital payment perceptions. The multiple questions under each category are being used to calculate the average score of the overall category. The final data has been pulled into PLS-SEM 3 for doing the final analysis. The accuracy of raw data has been generated through PLS-SEM 3. This software has been widely adopted for statistical analysis. The data are presented in the form of tables, diagrams, or bar charts, and following the figures, a detailed explanation is offered. The choice of the statistical tool PLS-SEM 3 stems from the fact that the data collected is not normally distributed (Sarstedt, 2008).

Sample Characteristics

The sample was comprised of 60.2% Males and 39.8% females, with the majority (190) falling in the age group of 18-30 years. A total of 304 respondents were chosen for the analysis, and the age ranged from 18 years to 60 years. Many of the respondents (262) were graduates and postgraduates.

Common Method Bias

The probability of common method bias is prevalent in survey-based studies; hence, it becomes imperative to address the same. The common method bias was addressed through two methods- process-based and statistical investigation (Viswanathan & Kayande, 2012). The respondents were informed about the purpose and nature of the study. The respondents were also assured about the confidentiality of the responses. There was no compulsion for any respondent to fill out the forms. Some questions were reverse coded on the Likert scale to check uninterested responses. The data collection was done in person by the author as well as through social networking sites by connecting with prospective respondents personally; hence, procedural integrity was not compromised. The study used statistical tools such as Harman's single-factor test and common method factor (CMF) to address common method bias, and no significant difference was found between the responses of respondents at the early and later stages of data collection.

PLS Model Assessment

In this paper, PLS-SEM path modeling was applied to test the proposed hypotheses and validate the measures (Sarstedt, 2008). This approach does not need normally distributed data as required in the covariance-based procedures. Given the theory-building nature of the study and non-normal data, PLS-SEM is the appropriate multivariate tool for testing the structural model.

Reliability

The extent to which a scale produces consistent results if repeated measurements are made on the characteristic is called the reliability of the measure. The coefficient alpha, or Cronbach’s Alpha, is the average of all the possible split-half coefficients resulting from different ways of splitting the scale items. The coefficient varies from 0 to 1, and a value of 0.6 or below generally indicates poor internal consistency reliability. Coefficient alpha remains a commonly applied estimate, and the values aligned with the desired values (Table 1). A different pointer value is frequently used in structural equation models to measure construct reliability (CR). It is computed from the square sum of factor loadings for each construct and the sum of the error variance terms for a construct. The thumb rule estimates 0.7 or higher as excellent reliability (Hair et al., 2014). The average variance extracted (AVE) is the summary indicator of convergence. AVE values of greater than 0.5 are considered adequate indicating good convergence (Hair et al., 2014).

| Table 1 | ||||

| Variable | Cronbach Alpha | CR | AVE | f2 |

| E-Readiness (ER) | .827 | .885 | .657 | .011 |

| Trust (TR) | .840 | .892 | .675 | .017 |

| Security (SE) | .760 | .799 | .511 | .001 |

| Ease of Use (EU) | .641 | .811 | .604 | .006 |

| Self – Efficacy (SF) | .806 | .884 | .718 | .010 |

| Benefits (BE) | .812 | .878 | .650 | .296 |

| Perception toward digital payment adoption (EP) | .838 | .885 | .609 | |

Discriminant Validity

As per the Fornell-Larcker Criterion (Hamid, et al. 2017), discriminant validity refers to the degree to which the concept is different from one another empirically. The discriminant validity can be estimated by using the cross-loading of the indicator. By observing the cross-loadings, factor loading indicators on the given construct must be higher than all loading of other constructs with the condition that the cut-off value of factor loading is higher than 0.70. Discriminant validity has been addressed successfully in this model Table 2.

| Table 2 Discriminant Validity | |||||||

| BE | EP | ER | EU | SE | SF | TR | |

| BE | 0.806 | ||||||

| EP | 0.647 | 0.781 | |||||

| ER | 0.507 | 0.496 | 0.811 | ||||

| EU | 0.526 | 0.516 | 0.551 | 0.777 | |||

| SE | 0.163 | 0.288 | 0.421 | 0.398 | 0.715 | ||

| SF | 0.173 | 0.287 | 0.248 | 0.428 | 0.381 | 0.848 | |

| TR | 0.385 | 0.472 | 0.555 | 0.607 | 0.587 | 0.380 | 0.821 |

Structural Model Assessment

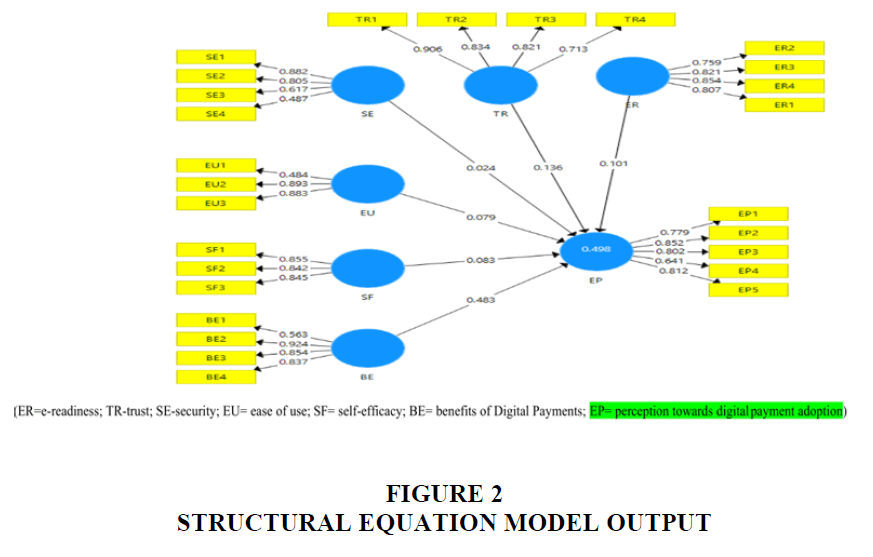

After the constructs have been confirmed as reliable and valid (inner model assessment), the structural model results are assessed. The path coefficients (Table 3) are obtained by applying a nonparametric bootstrapping process (Vinzi et al., 2010) with 304 cases and 5,000 samples. It was observed that factors e-readiness, trust, and benefits of digital banking were impacting the perception towards the adoption of digital payments while the factors such as security, ease of use, and self-efficacy were not impacting significantly; however, the model results showed congruence with the suitability of the model.

| Table 3 Path Coefficients and Hypothesis Testing | |||||

| Hypothesis | Hypothesis | Direct Effects | Path Coeff. | P Values | Status |

| H01 | e-readiness positively influences the perception of digital payment adoption | BE -> EP | 0.483 | 0.000 | Accepted |

| H02 | Trust positively influences the perception of digital payment adoption | ER -> EP | 0.101 | 0.044 | Accepted |

| H03 | Security positively influences the perception of digital payment adoption | EU -> EP | 0.079 | 0.185 | Not Accepted |

| H04 | Ease of use positively influences the perception of digital payment adoption | SE -> EP | 0.024 | 0.697 | Not Accepted |

| H05 | Self – Efficacy positively influences the perception of digital payment adoption | SF -> EP | 0.083 | 0.200 | Not Accepted |

| H06 | The benefits of digital banking positively influence the perception of digital payment adoption | TR -> EP | 0.136 | 0.024 | Accepted |

The study observed a significant impact of e-readiness (H01) trust (H02) and benefits of digital banking (H06) as significant on perception towards adoption of digital payments (Table 4), while security (H03), ease of use (H04), and self-efficacy (H05) were found to be not impacting the perception towards adoption of digital payments. The indicators for the appropriateness of the model seem close to desirable values with R2 value as .498 and adjusted R2 value as .488, thereby explaining 48.8% variance in the dependent variable (EP) explained by the independent variables under study (Figure 2). The predictive relevance value Q2 is .274, which is >0 as desired for effectiveness (Ringle, Wende & Becker, 2015) obtained by using the blindfolding technique.

| Table 4 Items for Data Collection |

| Rate your view on electronic banking services? [Overall Trust] |

| Rate your view on electronic banking services? [Trust in banks] |

| Rate your view on electronic banking services? [Trust in the technology of mobile banking] |

| Rate your view on electronic banking services? [Trust in third party agent (e.g., pay outlet, cash-out point)] |

| Rate your view on electronic banking services? [Security from fraud] |

| Rate your view on electronic banking services? [Possibility of leakage of my personal information] |

| Rate your view on electronic banking services? [My username and passwords information will not be safe] |

| Rate your view on electronic banking services? [It is a risk for me not to see the product in real] |

| Rate your view on electronic banking services? [E-banking services should be interactive] |

| Rate your view on electronic banking services? [Mobile/ Internet banking is easy to learn] |

| Rate your view on electronic banking services? [You find learning newer technologies beneficial] |

| Rate your view on electronic banking services? [E-banking services will be easy to use if someone shows me how to use it first] |

| Rate your view on electronic banking services? [I will use an e-payment system when my friends introduce it to me] |

| Rate your view on electronic banking services? [The comments of other people will influence my intention to use an e-payment portal] |

| how would you rate the following benefits of internet Banking? [Cost saving (Lower rates, transaction fees)] |

| how would you rate the following benefits of internet Banking? [Time-saving (no need to go to bank or ATM)] |

| how would you rate the following benefits of internet Banking? [24 hr Access (can make transaction any time)] |

| how would you rate the following benefits of internet Banking? [Physical security (no need to go out with cash)] |

| how would you rate the following perception of internet Banking? [E-payment is better than traditional payment channels] |

| how would you rate the following perception of internet Banking? [Use trusted e-payment channels to make transactions] |

| how would you rate the following perception of internet Banking? [User-friendly e-payment system will influence me to adopt the system] |

| how would you rate the following perception of internet Banking? [E-banking provides latest and accurate information] |

| how would you rate the following perception of internet Banking? [Internet banking services will improve my efficiency in conducting bank transactions] |

Discussion and Conclusion

While investigations of e-government are limited to the web time, and essential to the most recent couple of years, there is more drawn outstanding writing on new open administration and the reexamination of government that from multiple points of view lays the basis for the e-government activities that were to take after. The study focused on the significant factors which are important in the view of customers and the results revealed that e-readiness, trust, and benefits of digital banking are highly significant factors which need the attention of policymakers.

The effect of e-readiness was observed to be significant (β=.101, p=.044) which strengthens the proposition that moving towards e-friendly nations, an e-readiness appraisal using comparative models can help in building up essential benchmarks for provincial correlation by market verticals, thereby resulting in positive perception towards e- payment adoption. On comparing the e-readiness initiatives between various countries, it was observed that motivations for implementing E-Government are different for different governments, and that will formulate the initial implementation strategies.

Trust is considered significant in digital payments due to a high level of susceptibility in online exchanges (Zhou, 2011) and is being considered essential. The results for hypothesis H02 effect of trust on perception towards adoption of digital payment (β=.136, p=.024) support the findings that trust plays a critical determining factor impacting clients' intention to use web-based commercial exchanges and perceived risk is not a significant factor impacting adoption of digital payments. Trust in an online exchange medium can take care of security issues and customers are less bothered about security on that platform. The significance of trust over security was evident from the results of hypothesis H03 of the effect of security on the perception towards the adoption of digital payments (β=.024, p=.697), where security is the most significant antecedent of trust, followed by platform reputation. This gives insights towards exploring security as an antecedent of trust and having no significant impact on perception towards the adoption of digital payments.

The user interface and different capacities which empower client intelligence is an essential rule that draws in purchasers to utilize digital payment, however the results for hypothesis H04 didn’t support the proposition (β=.079, p=.185) which might be due to maturity of digital platforms which are user friendly with higher download speed in the current scenario and has been similar across different payment methods. This could be interpreted that the factor of ease of use would have lost its significance in impacting perception towards the adoption of e –payment due to the user-friendly interface provided by various digital payment platforms and customers getting educated towards adopting the methods. The results contradict the findings of Liébana-Cabanillas et al., (2020), that ease of use is a significant factor in driving the adoption of digital payments, which might be due to difference in how Indian consumers behave.

Self-efficacy can play a very significant role in how an individual looks at tasks, targets, and challenges. Internet self-efficacy (ISE), or the belief in one’s abilities to establish and implement progressions of Internet actions required to yield given attainments, is a potentially significant factor to elucidate the consumers’ decisions in e-commerce use. With information readily available and friendly user interface provided by various digital payment platforms, customers have gained confidence in using digital platforms, and they might not be giving importance to self-efficacy in using digital payment platforms as indicated by the results of the hypothesis H05 (β=0.083, p=0.200). Ratten (2014) indicated that Indian consumers might be affected differently in expecting performance from the products, suggesting strong support to the low emphasis on self-efficacy impacting attitude towards adoption of digital payments.

Customers continuously evaluate the benefits and sacrifices in acquiring any product. Perceived benefit figured in the literature as one of the critical factors affecting the consumers’ adoption of digital payment tools. The results of hypothesis H06 support the proposition that the benefits of digital banking positively influence the perception of digital payment adoption.

The challenge which the government faces in implementing e-governance can be attributed to any of these significant factors such as e-readiness, trust, and benefits in the current scenario where customers seem to have given lesser importance to personal aspects such as self-efficacy, ease of use, and emphasis on individual norms in the USA as compared to social norms in India. Security remains an essential aspect in understanding the perception towards the adoption of e-payment; however, this study challenges the proposition for security to be a significant factor in the Indian consumer behavior context (Ratten, 2014).

E-Governance can undoubtedly revolutionize the administrative machinery with more accountability, transparency, and efficiency, paving the way towards a technology-enabled government makeover. This study looked at various aspects to explore what impacts the favorable perception towards digital payment adoption. The results from the survey indicate that lesser importance is being given to personal issues such as ease of use and self-efficacy which might be due to the maturation of digitalization activities and awareness and consumer inclination towards social desirability factors.

Managerial Implications

This study focuses on customer perception of digital payments and their associated concerns for their adoption. Future researchers may investigate the dyadic relationship between customer intention-customer behavior resulting due to customer perceptions. The study has used a deductive approach to measure customer perception; future researchers may use an inductive approach for rich consumer insights for the adoption of digital payments. The inductive-deductive approach would be interesting to build a holistic scenario and for mapping future strategic initiatives.

A study looking at businesses could be helpful in looking at the implementation of goods and services tax (GST) in India and the government’s push for strict compliance. Policymakers and practitioners should take into cognizance the significance of e-readiness, trust, and the benefits of digital banking (Turhan, 2023) in the formation of positive customer perception towards digital payments. Strategic initiatives should focus on trust-building among customers to reduce their anxiety and risk perception related to digital payment concerns. The advantages of digital banking and digital payments should be ingrained among customers for building their positive outlook. Practitioners should not forget the complexity and inner resistance customers face while transitioning from physical to digital channels of payments and transactions. Policymakers and practitioners should empathize with customer perception of digital payments and improve their e-readiness through a multitude of initiatives like training, awareness, mentorship, etc.

References

Ab Hamid, M. R., Sami, W., & Sidek, M. M. (2017). Discriminant Validity Assessment: Use Of Fornell & Larcker Criterion Versus HTMT Criterion. In Journal Of Physics: Conference Series (Vol. 890, No. 1, P. 012163). IOP Publishing.

Indexed at, Google Scholar, Cross Ref

Bandura, A. (1986). The Explanatory and Predictive Scope of Self-Efficacy Theory. Journal Of Social And Clinical Psychology, 4(3), 359-373.

Chawla, D., & Joshi, H. (2020). The Moderating Role Of Gender And Age In The Adoption Of Mobile Wallet. Foresight, 22 (4), 483-504.

Chou, Y., Lee, C., & Chung, J. (2004). Understanding M-Commerce Payment Systems Through The Analytic Hierarchy Process. Journal of Business Research, 57(12), 1423-1430.

Indexed at, Google Scholar, Cross Ref

Cuesta, C., Ruesta, M., Tuesta, D., & Urbiola, P. (2015). The Digital Transformation Of The Banking Industry. BBVA Research - (Available At Https://Www. Bbvaresearch. Com/Wp - Content/Uploads/2015/08/EN_Observatorio_Banca_Digital_Vf3. Pdf)

Dada, D. (2006). E-Readiness For Developing Countries: Moving The Focus From The Environment To The Users. The Digital Journal Of Information Systems In Developing Countries, 27(1), 1-14.

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease Of Use, And User Acceptance Of Information Technology. MIS Quarterly, 319-340.

Indexed at, Google Scholar, Cross Ref

Digital Payments In India Projected To Reach $10 Trillion By 2026: BCG And Phonepe Pulse Release Report On Digital Payments Accessed On 11th March 2023 @1.41 A.M.

Fadhilah, I., & Aruan, D. T. H. (2023). Understanding Consumer Adoption And Actual Usage Of Digital Payment Instruments: Comparison Between Generation Y And Generation Z. International Journal Of Electronic Marketing And Retailing, 14(1), 39-60.

Gehrt, K. C., Rajan, M. N., Shainesh, G., Czerwinski, D., & O'Brien, M. (2012). Emergence Of Online Shopping In India: Shopping Orientation Segments. International Journal Of Retail & Distribution Management, 40(10), 742-758.

Indexed at, Google Scholar, Cross Ref

Gerrard, P., & Barton Cunningham, J. (2003). The Diffusion Of Internet Banking Among Singapore Consumers. International Journal Of Bank Marketing, 21(1), 16-28.

Hair, J. F. R. E., Black, W. C., & Babin, B. Anderson (2014). Multivariate Data Analysis.

Internet Usage In India - Statistics & Facts | Statista Accessed On 11th March 2023 @1.44 A.M.

Kar, A. K. (2020). What Affects Usage Satisfaction In Mobile Payments? Modelling User Generated Content To Develop The “Digital Service Usage Satisfaction Model”. Information Systems Frontiers, 1-21.

Khatibi, A., Haque, A., & Karim, K. (2006). E-Commerce: A Study On Internet Shopping In Malaysia. Journal Of Applied Sciences, 6(3), 696-705.

Lee, J. H., Lim, W. G., & Lim, J. I. (2013). A Study Of The Security Of Internet Banking And Financial Private Information In South Korea. Mathematical and Computer Modelling, 58(1-2), 117-131.

Indexed at, Google Scholar, Cross Ref

Liébana-Cabanillas, F., Japutra, A., Molinillo, S., Singh, N., & Sinha, N. (2020). Assessment Of Mobile Technology Use In The Emerging Market: Analyzing Intention To Use M-Payment Services In India. Telecommunications Policy, 44(9), 102009.

Oxford Analytica. (2020). Whatsapp Move Signals Indian Digital Regulatory Trend. Emerald Expert Briefings, (Oxan-Es).

Raman, P., & Aashish, K. (2021). To Continue Or Not To Continue: A Structural Analysis Of Antecedents Of Mobile Payment Systems In India. International Journal Of Bank Marketing.

Ratten, V. (2014). Indian and US Consumer Purchase Intentions of Cloud Computing Services. Journal of Indian Business Research, 6 (2), 170-188.

Indexed at, Google Scholar, Cross Ref

Rigopoulos, G., & Askounis, D. (1970). A TAM Framework To Evaluate Users㢠  Perception Towards Online Digital Payments. The Journal Of Internet Banking And Commerce, 12(3), 1-6.

Ringle, C. M., Wende, S., & Becker, J. M. (2015). Smartpls 3. Bönningstedt: Smartpls. Retrieved July, 15, 2016.

Rohayani, A. H. (2015). A Literature Review: Readiness Factors To Measuring E-Learning Readiness In Higher Education. Procedia Computer Science, 59, 230-234.

Sankaran, R., & Chakraborty, S. (2020). Why Customers Make Mobile Payments? Applying A Means-End Chain Approach. Marketing Intelligence & Planning. 39 (1), 109-124.

Indexed at, Google Scholar, Cross Ref

Sarstedt, M. (2008). A Review Of Recent Approaches For Capturing Heterogeneity In Partial Least Squares Path Modelling. Journal of Modelling In Management, 3(2), 140-161.

Saxena, K. B. C. (2005). Towards Excellence In E-Governance. International Journal Of Public Sector Management, 18(6), 498-513.

Indexed at, Google Scholar, Cross Ref

Seldal, M. N., & Nyhus, E. K. (2022). Financial Vulnerability, Financial Literacy, And The Use Of Digital Payment Technologies. Journal of Consumer Policy, 45(2), 281-306.

Shankar, A., & Datta, B. (2018). Factors Affecting Mobile Payment Adoption Intention: An Indian Perspective. Global Business Review, 19(3_Suppl), S72-S89.

Shao, Z., & Zhang, L. (2018). What Promotes Customers’ Trust In The Mobile Payment Platform: An Empirical Study Of Alipay In China. In CONF-IRM 2018 Proceedings (P. 45).

Solvak, M., Unt, T., Rozgonjuk, D., Võrk, A., Veskimäe, M., & Vassil, K. (2019). E-Governance Diffusion: Population Level E-Service Adoption Rates And Usage Patterns. Telematics And Informatics, 36, 39-54.

Turhan, G.T. (2023). The Impact Of Digital Transformation On Personnel Number In The Banking Sector. In Economic And Social Implications Of Information And Communication Technologies (Pp. 171-180). IGI Global.

Vinzi, V., Chin, W.W., Henseler, J., Wang, H., (2010). Handbook Of Partial Least Squares: Concepts, Methods And Applications. Springer Science & Business Media

Viswanathan, M., & Kayande, U. (2012). Commentary On “Common Method Bias In Marketing: Causes, Mechanisms, And Procedural Remedies”. Journal Of Retailing, 88(4), 556-562.

Indexed at, Google Scholar, Cross Ref

Zhou, T. (2011). An Empirical Examination Of Initial Trust In Mobile Banking. Internet Research, 21(5), 527-540.

Indexed at, Google Scholar, Cross Ref

Received: 07-Mar-2024, Manuscript No. AMSJ-24-14586; Editor assigned: 08-Mar-2024, PreQC No. AMSJ-24-14586(PQ); Reviewed: 30-Apr-2024, QC No. AMSJ-24-14586; Revised: 2-Jun-2024, Manuscript No. AMSJ-24-14586(R); Published: 15-Jul-2024