Research Article: 2025 Vol: 29 Issue: 2

Adopting Social Media Payment Platforms: A Systematic Literature Review and Future Research Agenda

Lata Kumari Pandey, Indian Institute of Information Technology Allahabad, Uttar Pradesh

Ranjit Singh, Indian Institute of Information Technology Allahabad, Uttar Pradesh

Ambrish Singh, Rajkiya Engineering College, Uttar Pradesh

Citation Information: Pandey, L K., Singh, R., & Singh, A. (2025). Adopting social media payment platforms: A systematic literature review and future research agenda. Academy of Marketing Studies Journal, 29(2), 1-20.

Abstract

A social media payment platform is a digital service that allows users to send and receive money through social media platforms. In the light of popularity of social media, it is important to understand the factors that influence its adoption. Therefore, the purpose of the study is to identify the factors that influence adoption of Social Media Payment Platform (SMPP), research methodology used in the previous researches along with the tools and techniques used along with the research gaps. The methodology adopted in this study is of systematic literature review that synthesizes the findings from the studies published between 2013 and 2024. The systematic literature review was done using Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) Protocol and Theory, Context and Method (TCM) framework of analyzing literature. The forty-one factors have been identified that motivates adoption of SMPP and seven factors that are the major challenges encountered during its adoption. The significant factors that motivate the adoption of SMPP are perceived usefulness, perceived ease of use, gender, age and perceived trust at individual level, social media platform, perceived social influence at social level. Similarly, the most important inhibitors at the individual level are perceived risk, safety and security and social inclusion, financial social analytics at social level. This study also presents the summary of methodology used in the previous researches and finally future research agenda is discussed along with the discussion. Our findings have implications for policymakers and managers in formulating strategies to influence people to adopt SMPP.

Keywords

Social-Media, Digital Payment, Social Media Payment Platform (SMPP), Digital Transaction, Technology Adoption, Payment Innovation.

JEL Code

G21, G41, O33, O35.

Introduction

Payment platforms have evolved significantly in the digital era, giving rise to Social Media Payment Platforms (SMPP). SMPP, defined as online spaces for communication, information sharing, and content creation, have integrated payment functionalities to facilitate seamless transactions (Kaplan & Haenlein, 2010). SMPPs, pioneered by WeChat in 2013, have gained traction due to their convenience and integration with popular social media apps such as Snapchat, Facebook Messenger, WeChat Pay, Twitter, Venmo, and WhatsApp Payment App (Acker & Murthy, 2020). Businesses can leverage SMPPs to enhance security, reduce costs, and accelerate payment collection. It can simplify online payments by consolidating chatting, networking, and payment functions into a single app, eliminating the need for users to switch between multiple applications. Additionally, SMPPs provide a secure payment gateway for transactions, utilizing UPI interfaces to facilitate in-chat payments. Despite their advantages, SMPPs need help with widespread adoption. First is its inherent vulnerability of financial transactions to technological disruptions (He et al., 2020). Second is understanding user behaviour and adapting to shifting technological trends (Li'ebana-Cabanillas et al., 2021). While Kajol et al. (2022) identified factors affecting digital financial transaction adoption, research into SMPP adoption remains limited. Furthermore, SMPP adoption patterns differ from those of digital financial transactions. SMPPs are particularly popular among Generation Z (Hanafiah et al., 2021; Lisana, 2024). The familiarity and ease of use make SMPPs an attractive payment option for this segment of people. Despite this, SMPP adoption rates are relatively low compared to other digital payment methods, particularly in emerging markets like India, Malaysia, and China (Singh et al., 2020; Aziz & Naima, 2021). This issue is particularly acute in low-income countries (Aziz & Naima, 2021). The unexpectedly low diffusion of SMPPs warrants further investigation into the underlying reasons behind adoption behaviour (Talwar et al., 2020; Demir et al. 2022). Highlighting the significance of well-structured review articles, our study identifies critical research gaps that can guide future endeavours (Paul & Criado, 2020; Paul et al., 2021). Employing a structured literature review methodology covering 2013-2023, we present prevalent theories, contexts, constructs, and methods through tables and figures. Our analysis reveals the evolution of past literature and theories, frequently studied topics and standard research methodologies. Our systematic literature review on SMPP papers used the TCM (Theory, Context, and Method) framework (Paul et al., 2023). We have also used the PRISMA protocol to select the articles for the review (Moher et al., 2015). Utilizing the TCM approach (Paul et al., 2017; Paul & Rosado-Serrano, 2019; Paul & Criado, 2020), we identify factors contributing to SMPP adoption and uncover research gaps. To address these gaps, this study aims to answer the following five research questions (RQs):

RQ1: What are the theories involved in SMPP papers?

RQ2: What is the current landscape of SMPP publication?

RQ3: What factors motivate and inhibit the adoption of SMPPs?

RQ4: What research methodology and technique have been used by researchers in past studies?

RQ 5: What is the future scope of research involving and related to SMPPs?

This paper is structured as follows: Section 2 discusses the literature search, and Section 3 addresses our review approach and the findings. Section 4 provides a discussion of the findings and their implications. Section 5 outlines a future research agenda for SMPPs, and Section 6 provides the conclusion.

Literature Search Approach

We employed a systematic literature review (SLR) to analyze the latest SMPP research comprehensively. SLRs offer several advantages, such as rigorous search strategies, transparent reporting, and the ability to synthesize findings (Petticrew & Roberts, 2008).

This approach allows us to address complex research questions and better understand the field's status quo (Kraus et al., 2020).

Review Process and Database Search

Focusing exclusively on empirical research published between 2013 and 2023, it captures the latest trends in this dynamic field. For rigour and transparency, data is sourced from two renowned electronic databases, Web of Science and Scopus, guaranteeing the inclusion of high-quality, global studies (Podsakoff et al., 2005).

Furthermore, prioritizing articles published in top-ranked journals acknowledges the potential value associated with such publications (Kuskova et al., 2011). Besides, some quality conference proceedings were also included in the literature search.

Including conference proceedings in the literature search gives early access to new findings, faster updates in evolving fields, insights into emerging trends, and diverse perspectives for changing fields, such as SMPP.

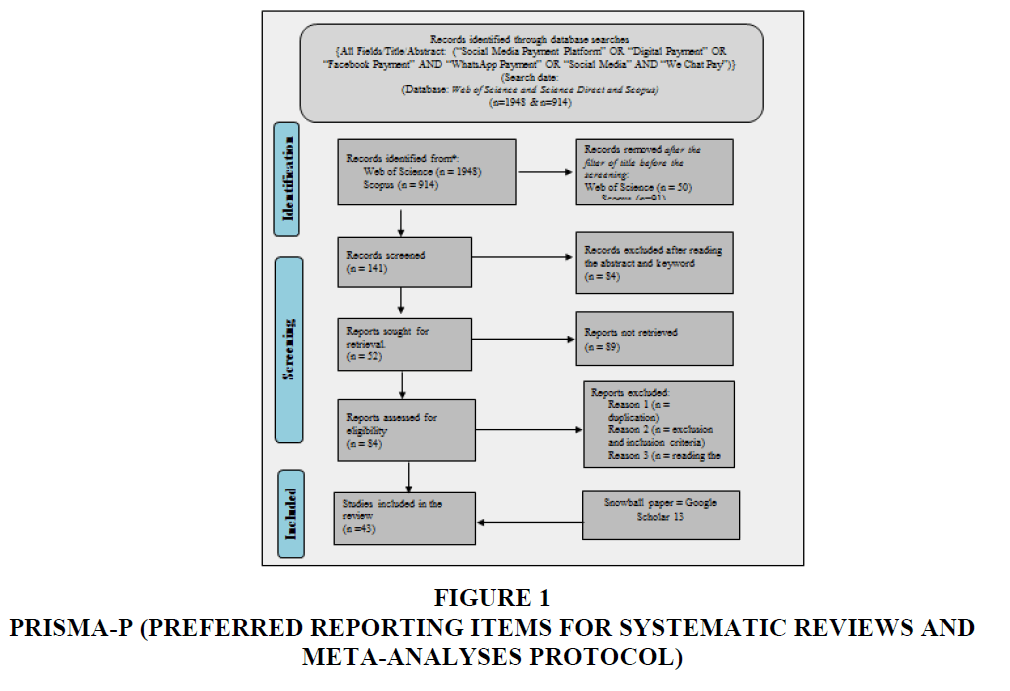

We used a systematic review approach that adhered to the PRISMA-P (Moher et al., 2015). We looked at previous review articles (Paul et al., 2017; Paul & Rosado-Serrano, 2019; Paul & Criado, 2020) to find relevant keywords. A total of 43 papers were considered for study after a thorough process of elimination and inclusion.

In Figure 1, titled "PRISMA-P (Preferred Reporting Items for Systematic Reviews and Meta-Analyses Protocol)," the SMPP literature review flow diagram is shown. We found commonalities and differences among the research by doing thorough within-study and between-study analyses on the chosen papers. Social media payment platforms, digital payment systems, Facebook payment, WhatsApp Payment and WeChat pay were the keywords used in this SLR.

Following a rigorous full-text review, we applied established inclusion and exclusion criteria to select 43 relevant papers. Through random searches on Google Scholar, we further identified twelve additional studies. This meticulous literature review revealed a surprising scarcity of research on SMPPs worldwide, emphasizing the vast potential for future exploration in this understudied field.

Findings

The findings of the study are reported in the following paragraphs:

Theory

RQ1 aims to identify the theories and models involved with SMPP papers, which is addressed in Table 1. This shows that the Technology Acceptance Model (TAM) emerged as the most frequently used framework, appearing in nine out of forty-two examined papers. Notably, these studies either directly applied TAM or extended its core concepts. Among 43 past studies on SMPP,only 30 (71.43%) utilized models or theories,with TAM and TRA being the most prevalent frameworks.

| Table 1 Theories and Models Used in Past Studies | ||

| Serial No. | Models / Theories | No. of Papers |

| 1 | Technology Acceptance Model (TAM) | 9 |

| 2 | Theory of Reasoned Action (TRA) | 3 |

| 3 | Unified Theory of Acceptance and Use of Technology Model (UTAUT) | 2 |

| 6 | Social Exchange Theory | 2 |

| 7 | Theory of Planned Behavior (TPB) | 1 |

| 9 | Mobile payment Model (MPM) | 1 |

| 10 | Digital Service Usage Satisfaction Model (DSUSM) | 1 |

| 11 | Leveraged Business Model | 1 |

| 12 | Structure Modelling | 1 |

| 13 | Prospect Theory | 1 |

| 14 | Expectation Confirmation | 1 |

| 15 | Consumer Value Behavior Theory | 1 |

| 16 | Leavitt’s Diamond Model of Socio-Technical System | 1 |

Contexts

RQ2 deals with the SMPP research landscape, also called the research context. It is described in the subsequent paragraphs:

Geographical Location of Past Studies

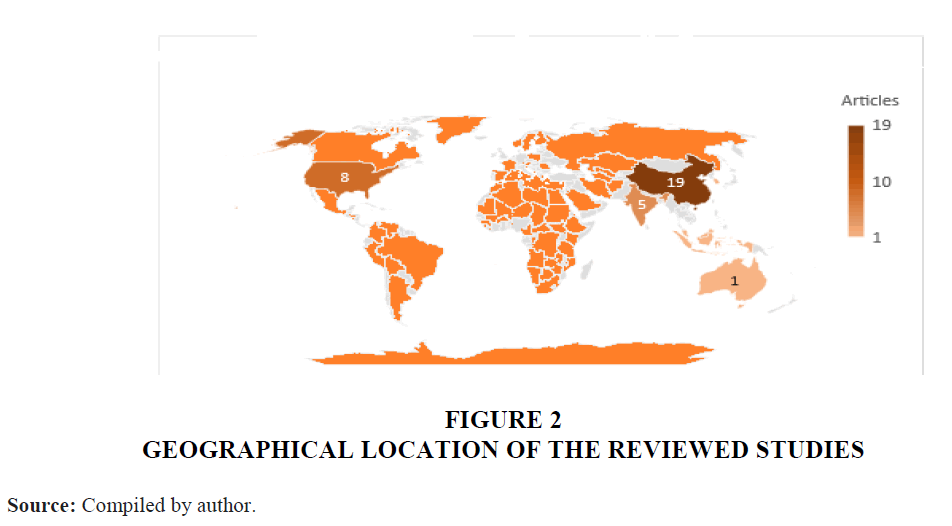

Figure 2 highlights a concentration of SMPP research in Asian and American institutions,with 19 papers in China,eight papers in the United States, four papers published in India, and Africa accounting for most authors.

Year-Wise Classification of Past Studies

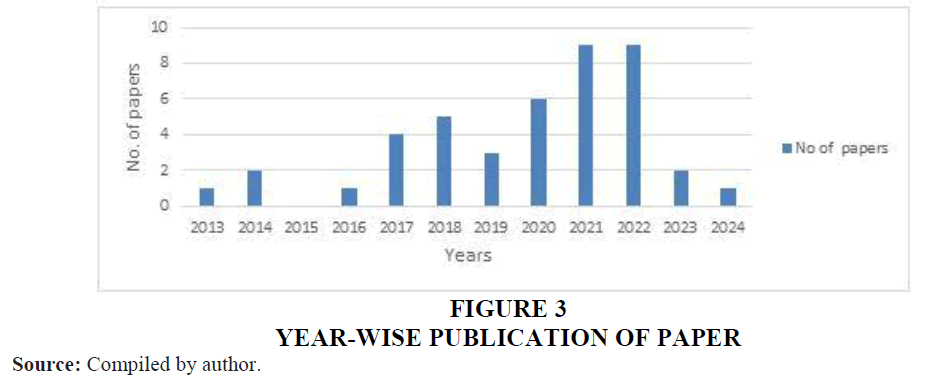

Figure 3 highlights a surge in SMPP research,with 61.90% of studies published in the last four years.This suggests growing academic interest in this area.

Journal-Wise Classification of Past Studies

Table 2 further details the distribution of papers across various journals that signifies the growing interest and impact of SMPPs across various academic fields, paving the way for further research and exploration.

| Table 2 Avenues of SPMM-Related Publications | ||

| Serial no. | Journal Name | Numbers of papers |

| 1 | Conference Proceeding. | 9 |

| 2 | Journal of Theoretical and Applied Electronic Commerce Research | 2 |

| 3 | Journal of Electronic Commerce in Organization | 1 |

| 4 | Service Business | 1 |

| 5 | Financial Innovation | 1 |

| 6 | Journal of Consumer Policy | 1 |

| 7 | Media, Culture, and Society | 1 |

| 8 | International Journal of Communication | 1 |

| 9 | Information Technology and People | 1 |

| 10 | Journal of Retailing and Consumer Service | 1 |

| 11 | The China Quarterly | 1 |

| 12 | Digital Arts and Entertainment | 1 |

| 13 | Behavior and Information Technology | 1 |

| 14 | European Business Organization Law Review | 1 |

| 15 | International Journal of Data and Network Science | 1 |

| 16 | British Sociological Association | 1 |

| 17 | Big Data and Society | 1 |

| 18 | Global Knowledge, Memory, and Communication | 1 |

| 19 | Information Systems Frontier | 1 |

| 20 | Telematics and Informatics | 1 |

| 21 | Economic and Business Aspects of Sustainability | 1 |

| 22 | Journal of Theoretical and Applied Electronic Commerce Research | 1 |

| 23 | Doctoral Dissertation | 1 |

| 24 | Issues in Information Systems | 1 |

| 25 | Global Knowledge, Memory, and Communication | 1 |

| 26 | Institute for Electrical and Electronics Engineers | 1 |

| 27 | Journal of Information System | 1 |

| 28 | Journal of Service Science and Management | 1 |

| 29 | Electronic Commerce Research and Application | 1 |

| 30 | Information Technology and Management | 1 |

| 31 | International Journal of Application or Innovation in Engineering & Management | 1 |

| 32 | Sociology | 1 |

| 33 | INTI Journal | 1 |

| 34 | Bangladesh Journal of Multidisciplinary Scientific Research | 1 |

Top Cited Studies

Citation analysis was used to identify the most influential SMPP studies (Paul et al., 2017; Cai, 2018). Table 3 showcases the top-cited SMPP papers,with citations ranging from 4.28 to 89.00.

| Table 3 The Ten Most Cited Studies | ||

| Author(s) | Total Citations | Yearly Citations |

| Lie`bana-Cabanillas et al. (2017) | 228 | 45.6 |

| Kar (2021) | 178 | 89 |

| Wei et al. (2021) | 85 | 85 |

| Broby (2021) | 74 | 74 |

| Mombeuil et al. (2021) | 55 | 55 |

| Tang et al. (2021) | 42 | 40 |

| Wong et al. (2022) | 40 | 40 |

| Murthy et al. (2020) | 36 | 12 |

| Mu & Lee (2017) | 32 | 6.4 |

| Qu et al. (2015) | 30 | 4.28 |

Factors Affecting Adopting Smpp

RQ3 investigates the multifaceted influences on SMPP adoption, categorizing individual and social factors as motivators or inhibitors to provide a structured framework for analysis.

SMPP Motivators

Tables 4 and 5 explore the factors driving SMPP adoption, analyzing individual and societal perspectives. Table 4 explicitly focuses on the incentives motivating individuals to engage with SMPPs.

| Table 4 Individual Factors for Adopting SMPP | ||

| Factors | Definition | Citation |

| Perceived usefulness | A person's level of optimism over the potential utility of a given technological development. | Qu et al. 2015; Mu & Lee, 2017; Havidz et al. 2018; Liébana-Cabanillas et al. 2018; Ma et al. 2018; Qu et al. 2018; Chua et al. 2019; Nan et al. 2020; Wong et al. 2022; Tavera-Mesías et al. 2023; Pandey et al. 2024 |

| Gender | The characteristics of women and men. | Wang & Gu, 2017; Liébana-Cabanillas et al. 2018; Tinmaz & Doan, 2022; Tavera-Mesías et al. 2023; Pandey et al. 2024 |

| Age | A time interval that begins at the moment of birth and ends at a predetermined moment in the future, typically while statistics are being collected. | Wang & Gu, 2017; Liébana-Cabanillas et al. 2018; Tang et al. 2021; Pandey et al. 2024 |

| Experience | One's understanding and mastery of a particular field after years of study and practice. | Liébana-Cabanillas et al. 2018; Kar 2021. |

| Cost of Use | The amount paid by the customer and the benefit derived. | Mu & Lee (2017). Singh et al. 2019 |

| Financial Literacy | An awareness of and familiarity with a range of financial commodities. | Seldal & Nyhus, 2022 |

| Continued Usage Intention | The desire and intent to continue using a product over an extended period. | Li et al. 2023. |

| Platform Feature | Technological aspects of the platform. | Li et al. 2023; Pandey et al. 2024 |

| Media System Dependency | Reliance on the media system. | Li et al. 2023. |

| Perceived ease of use | A person's level of confidence in a system's ease of use. | Qu et al. 2015; Mu & Lee, 2017; Havidz et al. 2018; Ma et al. 2018; Qu et al. 2018; Chua et al. 2019; Tang et al. 2021; Tavera-Mesias et al. 2023; Pandey et al. 2024 |

| Perceived Networking Ability | Users' perceptions of their networking abilities. | Wang & Gu, 2017 |

| Perceived convenience of relationship maintenance |

Condition to keep the relationship in existence. | Wang & Gu, 2017 |

| Education | The basic level of education increases and enhances an individual's thinking ability. | Wang & Gu, 2017; Pandey et al. 2024 |

| Occupation | The type of work an individual performs to earn or live their livelihood. | Wang & Gu, 2017; Pandey et al. 2024 |

| Perceived Trust | Users have faith that their expectations will be met. | Qu et al. 2015; Mu & Lee, 2017; Ma et al. 2018; Qu et al. 2018; Tang et al. 2021 |

| Perceived compatibility | The mobile innovation is reconcilable with potential adopters' past experiences, needs, values, and behavioural pattern | Ma et al. 2018. |

| Perceived financial risk | The danger of losing money due to fraud or identity theft. | Ma et al. 2018. |

| Perceived Information risk | When someone thinks one might lose control over their personal information, as when someone uses it without the knowledge or consent. | Ma et al. 2018. |

| Perceived value | The value people pay for the product and their expectations about that product. | Xu 2017; Li et al. 2023. |

| Perceived functional value | The value which provides the solution to the product and service. | Li et al., 2023. |

| Perceived social value | The value an individual gets from the society in which they live. | Li et al. 2023. |

| Perceived Interactive value | The value we get through the online interactive platform. | Li et al. 2023. |

| Perceived Enjoyment | An innovative and significant activity that boosts user enthusiasm. | Qu et al. 2015; Qu et al. 2018; |

| Perceived Entertainment Value |

Perceived entertainment value is essential for the user to adopt the app. | Li et al. 2023. |

| Use Context | The context in which technology is used. | Qu et al. 2015; Qu et al. 2018 |

| Service Quality | Customers' happiness, the quality of the service they receive, and the value they receive for their money. | Tang et al. 2021 |

| Table 5 Social Factors for Adopting SMPPS | ||

| Factors | Definition | Citation |

| Social image | How people judge others in society. | Liébana-Cabanillas et al. 2018 |

| Subjective Norms | The force that motivates a person to conform to the opinions of others and the degree to which they feel social pressure to do so. | Mu & Lee, 2017; Liébana-Cabanillas et al. 2018 |

| eWOM | Whether positive or destructive, customer reviews are posted online and accessible to many individuals and organizations. | Tarigan et al. 2022 |

| Perceived Effectiveness | People’s perceptions of how effective the promoted agronomic practice is undertaken. | Nan et al. 2020; Wong et al. 2022 |

| Payment apps | Buying anything using a mobile app on a tablet or phone and then transferring the money to the merchant. | Wang & Gu, 2017; Acker & Murthy, 2020; Kar 2021; Tavera-Mesías et al. 2023 |

| Social Media Community | An online community of people with a shared interest or background meeting regularly to discuss it. | Tarigan et al. 2022 |

| Utilitarian | A framework for social improvement based on a theory of morality that promotes activities that make people happy and discourages those that make them sad. | Murthy et al. 2020 |

| Culture | The ideas, customs, and social behaviour of a particular people or society. | Huang & Rau, 2017 |

| Social Media Games | Games played on social media. | Huang & Rau, 2017 |

| Social Media / Social Media Platform | An electronic medium that allows users to create and participate in online communities. | Havidz et al. 2018; Acker & Murthy, 2020; Nan et al. 2020; Kar 2021; Li et al. 2021; Mailland 2021; Mombeuil & Uhde, 2021; Tinmaz & Doan, 2022; Pandey et al. 2024 |

| Digital service | Set of processes allowing a user to engage with some entity. | Nan et al. 2020; Kar 2021. |

| Social Media Analytics | The process of collecting and analyzing public data available on social media. | Kar 2021. |

| Ubiquitous | The existing data are present everywhere simultaneously. | Mu & Lee, 2017; Acker & Murthy, 2020; Nan et al., 2020 |

| Perceived social Influence |

It is the kind of social Influence that spreads through personal recommendations. | Qu et al. 2015; Mu & Lee, 2017; Wang & Gu, 2017; Qu et al. 2018; Manzeroll & Daubs, 2021; Tang et al. 2021; Li et al. 2023. |

| Social Networking ability |

Ability to network on social media. | Wang & Gu, 2017 |

Table 5 summarises the fifteen factors influencing the adoption or intention to adopt SMPPs within a consumer society.

SMPP Inhibitors

Tables 6 and 7 explore barriers to SMPP adoption. Table 6 focuses on individual barriers,while Table 7 examines social fact.

| Table 6 Individual Factors Inhibiting SMPP Adoption | ||

| Facto | Definition | Citation |

| Financial Inclusion | The method by which all people, particularly those disadvantaged or otherwise neglected, can obtain suitable and inexpensive financial services. | Tavera-Mesías et al. 2023 |

| Emoji | An emotional or conceptual expression represented by a tiny digital image or icon. | Murthy et al. 2020 |

| Transactional Interaction | An interaction in which one is just going through the motions to get the task or discourse done. | Acker & Murthy, 2020 |

| Safety and Security | Safety means avoiding potential dangers. | Mu & Lee, 2017; Miraz & Haikel-Elsabeh, 2019; Singh et al. 2019; Tang et al. 2021; Pandey et al. 2024 |

| Perceived Risk | The factor includes emotion, contextual factors, and personal experience. | Xu, 2017; Liébana-Cabanillas et al. 2018; Ma et al. 2018; Chua et al. 2019; Nan et al. 2020; Mombeuil & Uhde, 2021; Tang et al. 2021; Wei et al. 2021; Li et al. 2023; Bhattacharjee et al. 2024. |

| Table 7 Social Factors Inhibiting SMPP Adoptions | ||

| Factors | Definition | Citation |

| Social Inclusion | The methsod by which all people have a fair chance to succeed and realize their potential. | Havidz et al.2018; McDonald 2020 |

| Financial Social Analytics | The process by which the financial data are considered to improve the business performance and decisions with the help of social channels. | Acker & Murthy, 2020; Kar, 2021. |

SMPP Apps Considered in the Past Research

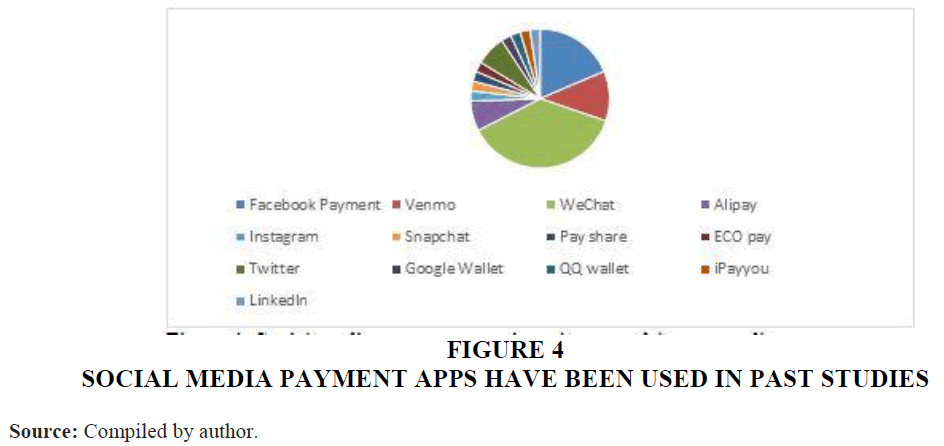

From the observation of Figure 4, we can vividly clarify that WeChat Pay is the most used app, followed by Facebook and Venmo.

Methodologies Used

The last component of the TCM (Theory, Context and Methods) framework is about the methodologies used in past research. The subsequent sub-section deals with the methodologies used in the past studies.

Software Used In the Past Studies

Despite Python's popularity,Table 8 shows a surprisingly low software Software SMPP research. Around 62% of the studies utilized MS-Excel, followed by Statistical Package for Social Science (SPSS), as shown in Table 8.

| Table 8 Software Used in the Past Studies | ||

| Serial No | Software | No. of papers |

| 1. | Microsoft Excel | 26 |

| 2. | Statistical Package for Social Science (SPSS) | 8 |

| 3. | Python | 3 |

| 4. | Analysis of Moment Structures18 (AMOS18) | 2 |

| 5. | Smart PLS version 3.0 | 2 |

| 6. | R language | 1 |

Tools and Techniques Used In the Past Studies

As shown in Table 9, the Partial Least Square-Structural Equation Model (PLS-SEM) reigns supreme as the most utilized tool in SMPP studies involving analytical techniques.

| Table 9 Tools and Techniques Used in the Past Studies | ||

| Serial No. | Tools and Techniques | No. of papers |

| 1. | Partial Least Square -Structural Equation Model | 13 |

| 2. | Regression | 5 |

| 3. | Sentiment Analysis | 4 |

| 4. | Descriptive Statistical Analysis | 2 |

| 5. | Paired- t-test | 2 |

| 6. | Exploratory Factor Analysis | 2 |

| 7 | Topic modelling | 2 |

| 8. | Analysis of Variance (ANOVA) One Way | 2 |

| 9. | Stimulus Organism Response (S-O-R) | 2 |

| 10. | Confirmatory Factor Analysis | 2 |

| 11. | Thematic Analysis | 2 |

| 12. | Artificial Programming Interface (API) | 1 |

| 13. | Social Media Analytics | 1 |

| 14. | Polarity Analysis | 1 |

| 15. | Multivariate Analysis | 1 |

| 16. | Graphical Representation | 1 |

| 17. | Correlation Analysis | 1 |

| 18. | F test | 1 |

Data Collection Methods

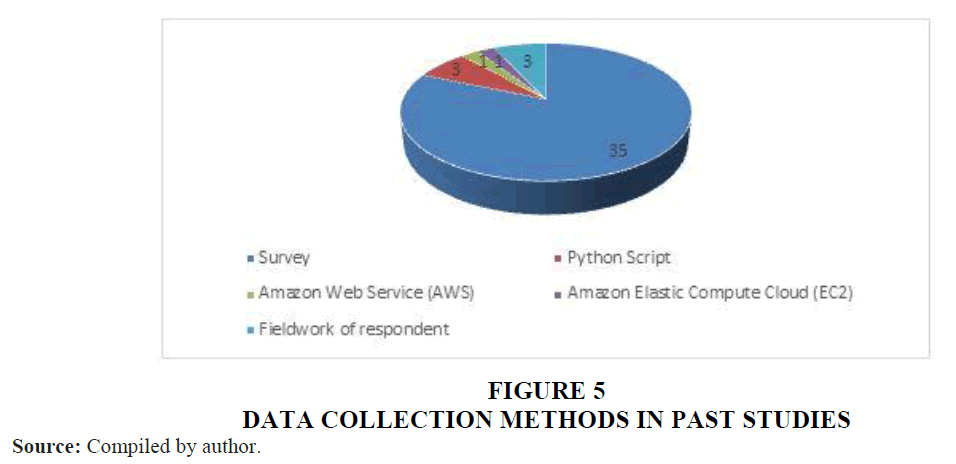

As shown in Figure 5,most past studies (80.95%) used survey methods to collect data for analysis.

Types of past research on SMPP

As illustrated in Table 10, past studies and systematic reviews on SMPP favour descriptive methodologies.

| Table 10 Types of Study Done on SMPPS | ||

| Serial No. | Types of Study | No. of papers |

| 1. | Descriptive | 18 |

| 2. | Empirical | 9 |

| 3. | Qualitative | 5 |

| 4. | Quantitative | 5 |

| 5. | Experimental | 4 |

| 6. | Ethnography | 1 |

| 7. | Explorative | 1 |

Sample Size of Past Studies

Among 43 studies reviewed,only 19 past studies met the sample size criteria specified in Table 11.The 50-500 range (10 studies) seems most favoured, suggesting researcher’s value moderate samples for understanding SMPP adoption and usage intent.

| Table 11 Sample Size Considered in Past Studies | ||

| Serial No. | Range of Sample | No. of papers |

| 1. | 50 - 500 | 10 |

| 2. | 100-1000 | 7 |

| 3. | 1000-2000 | 0 |

| 4. | 2000-3000 | 2 |

Discussion

This study deals with various aspects of SMPP, focusing on recent trends and adoption patterns. RQ1 was to identify the theories and models involved with SMPPS research. The majority of SMPP papers have utilized the Technology Acceptance Model (TAM), with a small number also citing the Theory of Reasoned Action (TRA) (Liébana-Cabanillas et al., 2018; Nan et al. 2020). RQ-2 was to find the current landscape and context of SMPP research. Most SMPP research originates from China, followed by the USA. Building on prior research in China by Huang & Rau (2017) and Tinmaz & Doan (2022), this study further contributes to understanding SMPPs in this context. This focus resonates with the rapid growth of social media users and government digital transaction initiatives in emerging economies. Figure 3 highlights a surge in SMPP research between 2020 and 2024, with clusters of six, nine, nine, two and one publications each. This recent rise in scholarly output demonstrates the growing momentum and interest in SMPPs. Table 2 reveals conference proceedings as the main channel for SMPP research dissemination. In emerging fields such as SMPP, initial research findings often appear first in conference proceedings, eventually progressing to publication in academic journals. By incorporating conference proceedings into a literature search, early access to groundbreaking discoveries can be attained. It can stay abreast of rapid advancements and glean insights into emerging trends and diverse research perspectives. To further illustrate the SMPP publication landscape, Table 3 showcases the most cited SMPP papers. Liebana-Cabanillas et al. (2017) stand out with the highest citation count of 228. RQ-3 was to find out the motivators and inhibitors of SMPP adoption. First, after conducting a thorough literature analysis, we have divided the factors impacting the adoption of SMPPs into two groups: factors that motivate and inhibit the adoption of SMPPs and this category we get from Tables 4,5,6 and 7. Motivators were further classified into individual factors (e.g., perceived usefulness, perceived ease of use, perceived risk, safety and security, gender, experience, age, cost of use, financial literacy) and social factors (e.g., social Influence, perceived networking ability) from table 4 and 5 respectively. Similarly, inhibitors were also classified into individual factors (e.g., perceived compatibility, perceived time, perceived effort, perceived value) and social factors (e.g., financial, social analytics, culture, social media analytics, utilitarian, social media game), which we get from table 6 and 7 respectively, such type of factors has also been identified by Kajol et al. (2022). This classification provides a clear understanding of each factor that influences the adoption of SMPP.

RQ 4 was to discover the research methodology and technique the researcher used in past studies of SMPPs. Among all the software programs used in previous SMPP studies, Microsoft Excel was the most prevalent, followed by SPSS, as shown in Table 8. Table 9 reveals that Partial Least Square-Structural Equation Modeling (PLS-SEM) and Regression are the most frequently employed analytical techniques in studies of SMPPs. This observation is further supported by the work of researchers like Miraz & Haikel-Elsabeh (2019), Broby (2021), and Singh et al. (2019). There are various ways to collect data for research, as in most of the past studies, primary data collection methods have been accomplished through survey techniques, as depicted in Figure 5. Tavera-Mesias et al. (2023); Tarigan et al. (2022) have also used survey methods in their respective studies. Figure 4 reveals that WeChat emerged as the most popular social media app for implementing SMPPs, followed by Facebook payment. Huang & Rau (2017) and Tinmaz & Doan (2022) have also studied mobile payment systems using WeChat Pay. Pandey et al. (2024) have also explored about the adoption of different types social media payment platform using thematic analysis. Table 10 reveals that descriptive studies constitute the majority of research on SMPPs, followed by empirical studies. This indicates a strong emphasis on understanding and characterizing the existing landscape of SMPPs before diving into in-depth investigations of their causal effects. Acker & Murthy (2020) and Nan et al. (2020) are examples of researchers who used descriptive approaches to study social mobile payments. Table 11 indicates that the sample size range used in SMPP research falls explicitly between 50 and 500.

RQ 5 was to assess the future scope based on the given literature review. The future scope of research is presented in section 6 of this paper.

Managerial Implications

The study's results can be helpful for financial institutions, internet enterprises, and banking institutions that offer or will use SMPP to help digital transactions go more smoothly. Perceived usefulness emerged as a critical factor in SMPP adoption from an individual's perspective. Incorporating new features into SMPP to enhance payment usefulness is crucial. One such feature could be the development of specialized functionalities for differently-abled individuals (Okonji & Ogwezzy, 2018). Additionally, introducing an offline payment facility within social media accounts could enhance SMPP's usefulness. Digital marketing companies promoting their products on various social media platforms should be encouraged to utilize SMPP for product and service payments. This not only benefits the company but also promotes SMPP adoption. Implementing a feature that allows users to hide sensitive information, such as phone numbers and email IDs, during transactions would enhance the system's security and privacy (Muralidhar et al., 2019). SMPP can also serve as a platform for crowdfunding, particularly for initiatives like Peer-to-Peer Lending (David-West et al., 2020). Developing adequate features in SMPP to support this functionality is essential. Companies could also consider offering reward points to users for specified amounts of SMPP usage, fostering a positive perception of the platform. Social media's growing popularity worldwide presents an opportunity for SMPP to promote social and financial inclusion among individuals who are socially, geographically, or financially excluded from mainstream society and financial services can be provided where bricks and mortar model is not reachable (Makanyeza, 2017; Valaei et al., 2019).

One of the primary concerns associated with SMPP is privacy, safety, and security. Given social media's unparalleled reach, social media platforms should take proactive measures to launch comprehensive information security awareness campaigns for their users in general and SMPP users in particular (Miraz & Haikel-Elsabeh, 2019; Singh et al., 2019). Chawla & Joshi (2019) hypothesize that individuals are more likely to adopt digital payments if they meet their expectations for safe and secure transactions. Businesses should strive to enhance their app design to make it more engaging and enjoyable (Palau-Saumell et al., 2019).

Policy Implication

Policymakers should mandate that all SMPPs incorporate financial literacy resources into their websites or apps, promoting financial literacy in general and digital financial literacy (Seldah & Nyhus, 2022). Given the vast amount of personal data social media platforms collect from their customers and users, stringent policies should be implemented to protect this data and prevent unauthorized access (Okonji & Ogwezzy, 2018). Specific policies should be tailored to accommodate the needs of differently-abled individuals. Governments also need to implement protective measures to safeguard against potential payment fraud.

Academic Contribution

Adding to previous research, this paper summarizes all currently known about the intention to adopt SMPP. This systematic and structured literature review is a valuable resource for academics and practitioners seeking to grasp the current state of knowledge in this domain. Based on these results, researchers may determine which journals publish the most SMPP studies, which authors are the most prolific, which countries are surveyed most frequently, and which social media apps have been used most frequently in previous SMPP studies. The factors identified in this study stem from diverse research contexts, and their generalizability requires further empirical validation in future work. Given the relatively emerging nature of SMPP in the digital payments landscape, research on this topic remains scattered. This study aims to provide a comprehensive overview of the existing research landscape, highlighting the need for more empirical research in areas.

Future Research Agenda

As interest in SMPP grows, the study identifies potential avenues for future research. Building upon the approach adopted in prior research studies by Paul et al. (2017) and Paul & Singh (2017), this research shows potential avenues for further study. It lays out a comprehensive plan for future investigations utilizing a TCM framework. Scholars perceive theories as lenses through which to investigate phenomena. At the same time, the context encompasses the premise of the investigation, and the methods illuminate empirical evidence about SMPP that can be used to extend the analysis. It also recommends the introduction of augmented reality, as pioneered by Snapchat, into other social media apps and graphic facilities to enable identification and interaction with the surrounding environment (Daubs & Manzerolle, 2021).

Future Research Agenda-Theory

Despite the abundance of established theories, several under-explored yet promising theories could be applied to SMPP research. For example, the Pull-Push-Mooring model provides a helpful framework for analyzing the elements people consider when switching between platforms. As digital transitions evolve, users' perceptions and behaviours may change significantly. The affordance theory of social media, which posits that the use of an object is intrinsically determined by its physical shape (Gibson, 2014), holds promise for understanding how social media affordances influence SMPP adoption (Hafezieh & Eshraghian, 2017). s

Wang & Gu (2017) proposed the Social Exchange Theory, which emphasizes the interpersonal interactions of users within a cost-benefit perspective. This theory could be applied to investigate how users' perceptions of SMPP's benefits and costs influence their adoption behaviour. The authors challenge young researchers to think beyond the box and create models that include mediation and moderation effects. These models would also shed light on the complicated adoption behaviours of various user groups, such as institutions, customers, and consumers.

Future Research Agenda-Context

The decision to adopt SMPP hinges on trust, security, and ease of use (Broby, 2021). SMPP adoption patterns exhibit significant variations across different age groups. Consequently, the decision to adopt SMPP may be impeded due to perceived financial vulnerability (Seldal & Nyhus, 2022). Singh et al. (2019) underscore the importance of effective promotion and awareness campaigns regarding SMPP. These efforts can be pivotal in influencing decision-making and facilitating SMPP adoption.

Further research is warranted, as per Choi et al. (2023), to understand and address the unique challenges faced by people with disabilities, older adults, and women in the context of SMPP adoption. We need further studies to determine how people's views on environmentally friendly and sustainable practices affect their propensity to use SMPP. Future research might investigate whether payment can be made without proper access to the internet, emoji feedback, and facial recognition-based payment and whether it may be used in the banking sector for deposit and transfer purposes.

SMPPs ubiquitous nature enables seamless integration into users' daily activities. Social factors play a significant role in influencing the adoption of SMPP, particularly in peer-to-peer mobile payment systems (Wang & Gu, 2017). These insights highlight the need for further research on the complexities of SMPP adoption behaviour across diverse user groups. The accountability for any failure or fraud should be fixed. Researchers can work further in this direction to develop the context and model to fix accountability, as done by Agarwal & Singh (2023).

Future research agenda- Methods

Most of the literature reviewed in this study is based on primary data collected through survey methods. This necessitates the utilization of secondary data for research purposes. Studies conducted in countries where SMPP is not yet prevalent could prove valuable in assessing the potential adoption rates among users. Secondary data collection methods, mainly quantitative, can be efficiently employed in such studies to provide accurate insights into SMPP adoption intentions. Focus group studies can also be conducted to deal more profoundly with the complexities of SMPP adoption, exploring users' perspectives, concerns, and challenges. The author suggests bibliometric analysis, meta-analysis, and hybrid reviews as tools for academics reviewing the empirical works published on SMPP. The cross-sectional research design commonly employed in quantitative studies identified in this study could be further enhanced by incorporating longitudinal approaches.

Understanding user perceptions and attitudes is crucial for developing effective SMPP adoption strategies. Since there are no models that can quantify social engagement, we can use Social Network Analysis (SNA) methods to look at how people in a particular group are connected (Kajol, Biswas, et al. 2020; Kajol, Nath, et al. 2020; Singh et al., 2021; Singh et al., 2022). Therefore, the author recommends that researchers employ SNA to determine the extent to which social factors influence user adoption decisions. It was shown that the two most important factors influencing the inclination to utilize SMPP were perceived usefulness and perceived security. The author recommends that future researchers utilize Twitter to promote and raise awareness about SMPP (Singh et al., 2019). Machine learning's versatility lies in its ability to be applied to both primary and secondary data types.

Conclusion

In the modern day, the digital payment system has grown indispensable. This revolutionary change has impacted the whole financial sector and social media companies. Therefore, the authors have decided to undertake a literature review on the variables influencing the choice to adopt SMPP in light of the low adoption rate of SMPP and the paucity of literature on this topic. The current study begins with a comprehensive literature analysis covering 2013–2024, then discusses the significant factor adoption and contemporary research trends. The author's contribution lies in the factors identified as being related to past studies and highlights the research gap in this area. We employed the PRISMA-P methodology to find the proper research, leading to 43 empirical papers. The authors have followed a structured literature review method by presenting theories, context, and methods. The author offers an overall explanation of observed inconsistency towards SMPP. The most important factors identified while going through the literature review and specific factors influencing the intention to adopt SMPP are identified. Perceived usefulness, perceived effectiveness, gender, social media/social media platforms, mobile payment apps, and ubiquitous were the most cited motivator factors in past studies. Perceived risk, safety and security, and financial and social analytics are identified as significant inhibitors of SMPP.

The empirical studies are analyzed in countries like China and the USA, followed by India. Most empirical articles on adopting SMPP are found in social media apps like Facebook Pay, WeChat Pay, and Venmo, followed by Twitter. Recent empirical investigations have overwhelmingly used the TAM theoretical framework. According to the statistical tools and techniques analysis, sentiment analysis and PLS-SEM were the most popular techniques. Finally, the study provides managerial, policy, and theoretical implications. The implication enlightens the minds of researchers on the grey area of this study, and it also helps in speeding the adoption of SMPP. The future agenda has also been discussed for further study in this area. The study's implication addresses a strong presence and comprehensive coverage of basic and social media payment infrastructure. To drive adoption of SMPP, the authors suggest that banks and social media companies create captivating short-form content, like social media posts and videos, to educate users within their platforms. Institutions and businesses facilitating digital transactions via social media applications might sway user decisions about SMPP adoption by staging eye-catching events, bizarre happenings, and street visuals. Additionally, the current study serves as a research manual for future academics interested in this field. Researchers should draw on certain under-researched but potentially helpful hypotheses to determine future switching intentions and adoption rates.

References

Acker, A., & Murthy, D. (2020). What is Venmo? A Descriptive Analysis of Social Features in the Mobile Payment Platform. Telematics and Informatics, 52, 101429.

Indexed at, Google Scholar, Cross Ref

Agarwal, S., & Singh, R. (2023). Customers’ Perception Towards Accountability of Diagnostic Centres: Evidence from India. Journal of Multidisciplinary Healthcare, 2947–2961.

Indexed at, Google Scholar, Cross Ref

Aziz, A., & Naima, U. (2021). Rethinking Digital Financial Inclusion: Evidence from Bangladesh. Technology in Society, 64, 101509.

Broby, D. (2021). Financial Technology and the Future of Banking. Financial Innovation, 7(1), 1–19.

Cai, C. W. (2018). Disruption of Financial Intermediation by FinTech: A Review on Crowdfunding and Blockchain. Accounting & Finance, 58(4), 965–992.

Chawla, D., & Joshi, H. (2019). Consumer Attitude and Intention to Adopt Mobile Wallet in India–An Empirical Study. International Journal of Bank Marketing, 37(7), 1590–1618.

Indexed at, Google Scholar, Cross Ref

Choi, Y., Córdova, C., Hsin, P. S., Lam, H. T., & Shao, S. H. (2023). Non-invertible condensation, duality, and triality defects in 3+ 1 dimensions. Communications in Mathematical Physics, 1-54.

Daubs, M., & Manzerolle, V. (2021). Snapchat, Augmented Reality, and Transactional Affordances. Media, Culture & Society.

David-West, O., Iheanachor, N., & Umukoro, I. (2020). Sustainable Business Models for the Creation of Mobile Financial Services in Nigeria. Journal of Innovation & Knowledge, 5(2), 105–116.

Indexed at, Google Scholar, Cross Ref

Demir, A., Pesqué-Cela, V., Altunbas, Y., & Murinde, V. (2022). Fintech, Financial Inclusion and Income Inequality: A Quantile Regression Approach. The European Journal of Finance, 28(1), 86-107.

Indexed at, Google Scholar, Cross Ref

Gibson, J. J. (2014). The ecological approach to visual perception: Classic edition. Psychology Press.

Hafezieh, N., & Eshraghian, F. (2017). Affordance Theory in Social Media Research: Systematic Review and Synthesis of the Literature. In 25th European Conference on Information Systems (ECIS 2017).

Hanafiah, M. H., Asyraff, M. A., Ismail, M. N. I., & Sjukriana, J. (2024). Understanding the key drivers in using mobile PaymentPayment (M-Payment) among Generation Z travellers. Young Consumers.

Huang, H., & Rau, P. L. P. (2017). Understanding Users’ Acceptance of Money Gifting in a Social Game. In Cross-Cultural Design: 9th International Conference, CCD 2017, Proceedings 9 (pp. 659-668). Springer International Publishing.

Kajol, K., M. Nath, R. Singh, H. R. Singh, and A.K. Das. (2020). Factors Affecting Seasonality in the Stock Market: A Social Network Analysis Approach. International Journal of Accounting & Finance Review, 5(4), 39-59.

Kajol, K., P. Biswas, R. Singh, S. Moid, and A. K. Das. (2020). Factors Affecting Disposition Effect in Equity Investment: A Social Network Analysis approach. International Journal of Accounting & Finance Review, 5(3), 64-86.

Kajol, K., Singh, R., & Paul, J. (2022). Adoption of Digital Financial Transactions: A Review of Literature and Future Research Agenda. Technological Forecasting and Social Change, 184, 121991.

Kaplan, A. M., & Haenlein, M. (2010). Users of the World, Unite! The Challenges and Opportunities of Social Media. Business Horizons, 53(1), 59-68.

Indexed at, Google Scholar, Cross Ref

Kraus, S., Breier, M., & Dasí-Rodríguez, S. (2020). The Art of Crafting a Systematic Literature Review in Entrepreneurship Research. International Entrepreneurship and Management Journal, 16, 1023-1042.

Kuskova, V. V., Podsakoff, N. P., & Podsakoff, P. M. (2011). Effects of Theoretical contribution, Methodological rigor, and Journal Quality, on the impact of Scale Development Articles in the field of Entrepreneurship. Strategic Entrepreneurship Journal, 5(1), 10-36.

Indexed at, Google Scholar, Cross Ref

Liébana-Cabanillas, F., Marinkovic, V., De Luna, I. R., & Kalinic, Z. (2018). Predicting the Determinants of Mobile Payment Acceptance: A Hybrid SEM-neural Network Approach. Technological Forecasting and Social Change, 129, 117-130.

Lisana, L. (2024). Understanding the key drivers in using mobile PaymentPayment among Generation Z. Journal of Science and Technology Policy Management, 15(1), 122-141.

Makanyeza, C. (2017). Determinants of Consumers’ Intention to adopt Mobile Banking Services in Zimbabwe. International Journal of Bank Marketing, 35(6), 997-1017.

Manzerolle, V., & Daubs, M. (2021). Friction-free authenticity: Mobile Social Networks and Transactional Affordances. Media, Culture & Society, 43(7), 1279-1296.

Indexed at, Google Scholar, Cross Ref

Miraz, M. H., & Haikel-Elsabeh, M. (2019, August). Analysis of Users' Behaviour and Adoption Trends of Social Media Payment Platforms. In 2019 International Conference on Computing, Electronics & Communications Engineering (iCCECE) (pp. 197-202). IEEE.

Moher, D., Shamseer, L., Clarke, M., Ghersi, D., Liberati, A., Petticrew, M., & Prisma-P Group. (2015). Preferred reporting items for systematic review and meta-analysis protocols (PRISMA-P) 2015 statement. Systematic reviews, 4, 1-9.

Muralidhar, S. H., Bossen, C., O. & Neill, J. (2019). Rethinking Financial Inclusion: From Access to Autonomy. Computer Supported Cooperative Work, 28, (3-4), 511-547.

Murthy, D., Sudarshan, S., Lee, J. A., Ghosh, C., Shah, P., Xiao, W. J., ... & Acker, A. (2020). Understanding the meaning of Emoji in Mobile Social Payments: Exploring the use of Mobile Payments as Hedonic versus Utilitarian through Skin Tone modified Emoji Usage. Big Data & Society, 7(2), 2053951720949564.

Indexed at, Google Scholar, Cross Ref

Nan, D., Kim, Y., Park, M. H., & Kim, J. H. (2020). What Motivates Users to Keep Using Social Mobile Payments?. Sustainability, 12(17), 6878.

Okonji, P., & Ogwezzy, D. (2018). Financial Inclusion: Perceptions of Visually Impaired older Nigerians. Journal of Enabling Technologies, 12(1), 10-21.

Palau-Saumell, R., Forgas-Coll, S., Sánchez-García, J., & Robres, E. (2019). User Acceptance of Mobile Apps for Restaurants: An Expanded and Extended UTAUT-2. Sustainability, 11(4), 1210.

Indexed at, Google Scholar, Cross Ref

Pandey, L. K., Bhattacharjee, J., Singh, R., & Singh, A. (2024). Unravelling the Determinants of Social Media Payment Platform (SMPP) Usage: A Qualitative Study on User Intentions and Adoption.Bangladesh Journal of Multidisciplinary Scientific Research, 9(3), 33-41.

Paul, J., & Criado, A. R. (2020). The Art of Writing Literature Review: What do we know and what do we need to know?. International Business Review, 29(4), 101717.

Paul, J., & Rosado-Serrano, A. (2019). Gradual Internationalization vs Born-Global/International New Venture Models: A Review and Research Agenda. International Marketing Review, 36(6), 830-858.

Indexed at, Google Scholar, Cross Ref

Paul, J., & Singh, G. (2017). The 45 years of Foreign Direct Investment Research: Approaches, Advances and Analytical Areas. The World Economy, 40(11), 2512-2527.

Paul, J., Khatri, P., & Kaur Duggal, H. (2023). Frameworks for developing impactful systematic literature reviews and theory building: What, Why and How?. Journal of Decision Systems, 1-14.

Indexed at, Google Scholar, Cross Ref

Paul, J., Lim, W. M., O’Cass, A., Hao, A. W., & Bresciani, S. (2021). Scientific Procedures and Rationales for Systematic Literature Reviews (SPAR-4-SLR). International Journal of Consumer Studies, 45(4), O1-O16.

Paul, J., Parthasarathy, S., & Gupta, P. (2017). Exporting Challenges of SMEs: A Review and Future Research Agenda. Journal of World Business, 52(3), 327-342.

Indexed at, Google Scholar, Cross Ref

Petticrew, M., & Roberts, H. (2008). Systematic reviews in the social sciences: A practical guide. John Wiley & Sons.

Podsakoff, P. M., MacKenzie, S. B., Bachrach, D. G., & Podsakoff, N. P. (2005). The Influence of Management Journals in the 1980s and 1990s. Strategic Management Journal, 26(5), 473-488.

Indexed at, Google Scholar, Cross Ref

Seldal, M. N., & Nyhus, E. K. (2022). Financial Vulnerability, Financial Literacy, and the Use of Digital Payment Technologies. Journal of Consumer Policy, 45(2), 281-306.

Singh, P., Dwivedi, Y. K., Kahlon, K. S., Rana, N. P., Patil, P. P., & Sawhney, R. S. (2019). Digital Payment Adoption in India: insights from Twitter Analytics. In Digital Transformation for a Sustainable Society in the 21st Century: 18th IFIP WG 6.11 Conference on e-Business, e-Services, and e-Society, I3E 2019, Proceedings 18 (pp. 425-436).

Indexed at, Google Scholar, Cross Ref

Singh, R., J. Bhattacharjee, & K. Kajol. (2022). Factors Affecting Awareness Towards Investment in Equity Shares: A Social Network Analysis Approach. Academy of Marketing Studies Journal, 26(5), 1-15.

Singh, R., J. Bhattacharjee, and K. Kajol. (2021). Factors Affecting Risk Perception in Respect of Equity Shares: A Social Network Analysis Approach. Vision, 09722629211046082.

Singh, S., Sahni, M. M., & Kovid, R. K. (2020). What Drives FinTech Adoption? A Multi-Method Evaluation using an Adapted Technology Acceptance Model. Management Decision, 58(8), 1675-1697.

Sun, Y., Xue, W., Bandyopadhyay, S., & Cheng, D. (2022). WeChat mobile-payment-based brilliant retail customer experience: an integrated framework. Information Technology and Management, 1–18.

Talwar, S., Dhir, A., Khalil, A., Mohan, G., & Islam, A. N. (2020). Point of Adoption and Beyond. Initial Trust and Mobile-Payment Continuation Intention. Journal of Retailing and Consumer Services, 55, 102086.

Tang, Y. M., Chau, K. Y., Hong, L., Ip, Y. K., & Yan, W. (2021). Financial Innovation in Digital Payment with WeChat towards Electronic Business Success. Journal of Theoretical and Applied Electronic Commerce Research, 16(5), 1844-1861.

Indexed at, Google Scholar, Cross Ref

Tarigan, Z. J. H., JONATHI, M., Siagian, H., & Basana, S. R. (2022). The effect of e-WOM through intention to use technology and social media community for mobile payments during the COVID-19. (Doctoral dissertation, Petra Christian University).

Tavera-Mesías, J. F., van Klyton, A., & Collazos, A. Z. (2023). Technology Readiness, Mobile Payments and Gender-A Reflective-Formative Second Order Approach. Behaviour & Information Technology, 42(7), 1005-1023.

Indexed at, Google Scholar, Cross Ref

Tinmaz, H., & Doan, V. P. (2022). User Perceptions of WeChat and WeChat Pay in China. Global Knowledge, Memory and Communication, 72(8/9), 797-812.

Valaei, N., Nikhashemi, S. R., Bressolles, G., & Jin, H. H. (2019). A Symmetric Perspective towards Task-Technology-Performance Fit in Mobile App Industry. Journal of Enterprise Information Management, 32(5), 887-912.

Indexed at, Google Scholar, Cross Ref

Wang, J., & Gu, L. (2017). Why is WeChat Pay so Popular?. Issues in Information Systems, 18(4), 1-8.

Wei, M. F., Luh, Y. H., Huang, Y. H., & Chang, Y. C. (2021). Young Generation’s Mobile Payment Adoption Behavior: Analysis based on an Extended UTAUT Model. Journal of Theoretical and Applied Electronic Commerce Research, 16(4), 618-637.

Wong, D., Liu, H., Meng-Lewis, Y., Sun, Y., & Zhang, Y. (2022). Gamified Money: Exploring the Effectiveness of Gamification in Mobile Payment Adoption among the Silver Generation in China. Information Technology & People, 35(1), 281-315.

Indexed at, Google Scholar, Cross Ref

Xu, W. (2017). The study of WeChat Payment Users Willingness Factor. Journal of Service Science and Management, 10(3), 251-259.

Indexed at, Google Scholar, Cross Ref

Received: 12-Nov-2024, Manuscript No. AMSJ-24-15443; Editor assigned: 13-Nov-2024, PreQC No. AMSJ-24-15443(PQ); Reviewed: 26- Dec-2024, QC No. AMSJ-24-15443; Revised: 28-Dec-2024, Manuscript No. AMSJ-24-15443(R); Published: 28-Jan-2025