Research Article: 2019 Vol: 23 Issue: 2

Achieving Total Quality Audit through Proper Auditing Management Practices

Ali Naeem Jassim Al Ghani, Ministry of Higher Education and Scientific Research, Republic of Iraq

Abstract

In the modern world, organizations are increasingly growing and becoming complex in their operations. The need for total quality control has become one of the primary necessities in the running and control of most organizations globally. Most managers believe that proper accountability systems are based on actual sufficient and professional audit practices. The operations within an organization always have to be enshrined on the quality of services, efficiency of work output and the openness of the work delivery structure. A proper quality management system will always ensure the appropriate flow of work, better service delivery, and production of high standard goods. The competence of an audit team will, therefore, become very crucial in the process of judging the extent of audit quality work. This study sought to carry out an analysis of the achievement of the complete quality audit. The study sample is composed of 150 auditing team members working in various Iraqi auditing firms and companies listed in Iraqi Stock Exchange. As for the research variables, the study is based on dependent variable that represents the audit quality management, and the independent variable, which represents different quality audit management practices such as leadership, strategic planning, and proper leadership goals. The researcher followed a questionnaire method for measuring the variables o the study. Based on the statistical analyses following Linear Regression Model, the research three hypotheses have been validated and approved. The study has reached a number of conclusions, the most important of which is that by implementing total quality management, the financial performance of a company will always likely improve.

Keywords

Total Quality Audit, Audit Management, Management Practices.

Introduction

According to Mitra (2016), the achievement of complete quality audit standards always denotes success. Total quality audit within an industrial set up entails the process of verification of documents, prevention of cases of fraud and financial wastage and the streamlining of the operational and procedural issues within firms. The management of organizations is tasked with the role of ensuring proper quality audit. The internal and external auditors always provide the required assurance after conducting statutory and non-statutory audits within organizations. The work of the auditors always requires the goodwill of the top management and the employees to be successful. An audit task still requires maximum corporation with the staff so that the auditor may find all the necessary assistance while carrying out the audit. The team should provide all the materials that auditors need during the process (Griffith et al., 2015). Consequently, the managers have to ensure that the independence of an audit remains strong and that there is no undue influence which may always compromise the results of the process. For a review to promote quality, the independent audits should still be able to identify the financial, tactical and operational loopholes that exist within the system. The audit team should always then provide recommendations and appropriate actions that are necessary for promoting quality production or service delivery processes. Despite the growing need for quality audit assurance amongst many organizations, it has been established that there are still many gaps in audit work which hamper the level of organizational growth and development. Much of the success of audit processes mainly lies with the management of goodwill in promoting free, independent and fair audit practices.

Unlike the past research, the above analysis was able to focus on the role of the adequately constituted auditing management practices in achieving quality audit process. The researcher was keen to explore new research areas by establishing the different means that the audit managers use such as the implementation of new policy guidelines in achieving success within the study. The researcher mainly aimed at identifying the different strategic decisions that are implemented by the management and are meant to improve the performance of auditing staff consequently, there was also an emphasis on the need to seek specialized advisory services from other specialists.

The approach that was used in outlining the findings from the study were also mostly different. One of the significant differences that were very obvious within the above research was related to the approach of testing the various hypotheses through the use of multiple regression analysis approaches. The above procedure was in contrast to current research achievement which is only focused on the collection and analysis of data based on the given responses from the respondents. Lastly, the study also differed from past research by looking at the roles of the managers from a different angle. Recent research has always focused on management roles that include planning, organizing, controlling and implementing objectives. The above study, however, sought to provide the research roles, primarily based on the need for an improved quality internal process.

Theoretical Framework

Problems of the Study

The growth in scope and depth of auditing has been increasing over the past decade. Most companies, local and international, are currently required by law to carry out statutory audits. Much pressure, however, is on the audit firm who are expected to provide a quality audit continually. The operations of different audit firms are always dynamic and thus prone to many changes. There is immense pressure on auditors to offer quality and proper audit process. Achieving the above function requires adequate management process, coordination, and effectiveness in carrying out the method of auditing. Amidst the high pressure on audit personnel, there has been a lack of proper managers who can take charge of audit processes and ensure achievement of quality work. The study, therefore, is exploring the inadequacies in audit management, which are necessary for achieving total quality audit.

Significance of the Study

The above research was useful to various audit and management bodies. First, different audit personnel may benefit from high research through the improvement of their audit management skills. The study would also be of significance to organizations which seek to improve their overall financial performance. An organization would consider upgrading management support to audit personnel in enhancing proper audit success. Lastly, the study would be used by audit institutions and research professionals in promoting fair audit practices. The professionals would design new ways of supporting audit technology as a means of ensuring quality audit success.

Objectives of the Study

General objective

The general objective of the study is to come up with the various audit management practices, which are necessary for achieving total quality audit.

Specific objectives

1. Identify the role of audit managers in promoting total quality audit.

2. Examine the impact of the entire quality audit on the performance of client companies.

3. Examination of the role of overall company management in the promotion of total quality audit management.

Literature Review

One of the fundamental considerations in the success of an organization is always based on the strength and quality of the management structure and practices. The managers have a critical role in policy formulation and goal attainment (Kerzner, 2018). The top managers and board of directors are always responsible for establishing proper internal structures, which enhance quality processes. Creating a quality internal audit department is one of the primary functions of the managers. The team must always also ensure that the audit team delivers efficiently to the organization by providing all the necessary assistance (Persakis & Iatridis, 2016). The Audit committee within most organizations is always set up to assist the internal audit department in achieving proper success and delivery of services. One of the critical factors which exist to support total quality audit is the independence of the audit team. Freedom may always be measured in many ways. First, the department should not ever receive any form of direct command or influence. As such, the internal auditors are still responsible for efficiently doing their duties and only reporting to the board.

The role of the external audit teams is also essential in promoting total quality audit processes within the firm (Heinz & Shapton, 2014). Most public companies around the globe are always bound by statutory requirements to declare their financial audit status at the end of a predetermined period. Most of the audited financial statement, especially for the public firms are meant to provide the true nature of the operations and performance of such organizations. Various stakeholders such as governments in assessing the tax returns always use an accurate and quality audit report. Shareholders also rely on the results to determine the level of performance and the dividends that are due. According to Pizzini et al. (2014), big audit firms such as Earnest and Young, P&G or PWC have proper management structures which are meant to ensure an appropriate audit function. The primary role of audit companies that conduct external assurance to public and private companies is to provide quality and reliable audit reports which are based on an in-depth analysis of the books of accounts and operational efficiency.

When ranking the performance of audit firms, most of the professionals always seek to use different parameters within the above process. (Byrnes et al., 2018) One of the best ways of determining the success of a firm is by looking at the performance index related to the performance and growth of wealth (Mosadeghrad, 2014). However, one of the best ways of measuring the success of an audit company is by carrying out comparisons with the other successful players within the industry. The performance index of a given firm is also a particular issue in addressing the effects on performance and competence (Netland et al., 2015). The audit company is known to be one of the biggest when the scope of work that it may undertake also passes a given threshold. Measuring the success of a given company may also be achieved by carrying out an analysis of the level of quality attainment in service delivery. Audit companies that provide quality work to its customers are always considered as some of the market leaders.

Quality Standards in the Audit Practice

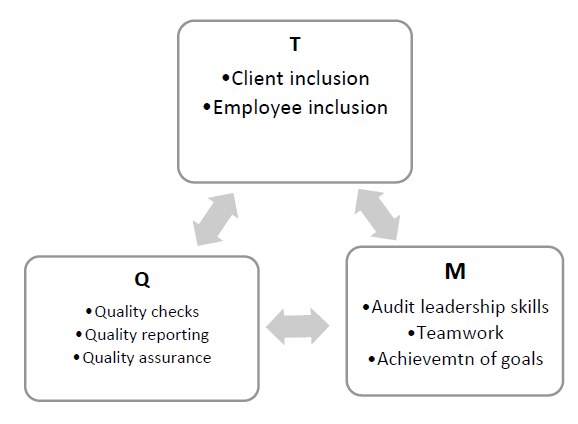

The work of auditors is always highly regulated (Tepalagul & Lin, 2015). All public audit companies are always found to work by the laid down procedures in auditing. Alternatively, private audit practitioners are also required to mostly follow some of the quality standards which are meant to improve quality and enhance proper audit work (Johnstone & Gramling, 2013). Many countries have always adopted the internationally recognized audit standards, especially that of The International Auditing and Assurance Standards Board (IAASB). Furthermore, the fact that business has evolved globally requires neutrality and uniformity in the process of conducting audit practices (Hoecht, 2006). The guidelines for achieving total quality management informed the need to come up with a regularized platform for performing audit work (Miko & Kamardin, 2015). In seeking to promote uniformity in auditing, the need for quality audit practices was then divided into three major components. The Figure 1 gives a simplification of the necessary quality standards which form part of Total Quality Management (TQM) practices.

Based on the Figure 1, the wholesome management of an audit activity will have to take into consideration the audit needs of the client. Before embarking on a full audit process, the planners have to have pre-audit meetings with the customer. Some of the main issues which such sessions will always address include the terms of engagement, the scope of the audit and any other problems that may come up during the process. Domingues et al. (2015) assert that employee motivation is one of the biggest drivers of Audit success. The range of employee engagement will also be considered in the above stage. The auditors will always have to ensure that there is adequate training for the team that is to conducts audit. Additionally, the audit leader has to brief the team on the expectations of the client on the audit outcome.

The diagram also relies on the components of proper audit management. The audit leaders have to show adequate leadership skills. Such skills are essential, especially when leading a team of less-experienced auditors in conducting an audit exercise (Lennox et al., 2014). Proper audit outcomes also have to rely on appropriate coordination and teamwork. The leadership of an audit team has to organize the members to work towards achieving a common objective and goal. The leaders should always provide direction and tactical advice (Soliman & Ragab, 2014). When considering the quality of the audit process, it is essential that the auditors should be ready to conduct proper quality checks and ensure that all the areas of interest within the audit are handled. When planning, the audit manual should be designed to cover all the necessary and critical regions within the review. The auditors always have to assure the client and the stakeholders of the company by carrying out comprehensive audit processes (Wealleans, 2017). Finally, the outcome should always be relayed on an audit report, which has to be standardized, yet reveal all the necessary information within the audit. The audit company should ensure proper procedural processes are enhanced to avoid any criminal or civil liability cases against them in courts.

The Framework for the Establishment of Total Quality Audit Management Practices

Over time, the regularization of the work of auditors has evolved into a complex system governed by many standard procedures. By 2014, IAASB developed a conceptual framework whose primary aim was to standardize all the operations that make up a proper audit. ISAB 2014 has so far established appropriate operational systems for auditing (Rebelo et al., 2014). The final format of the structure was finally published by IAASB in 2014 and addresses many issues and framework of an efficient audit. The context identified forum significant components of a properly managed and quality audit process. The factors were contextual factors, output factors, input factors, and proper interactions. Based on the fame wok given by IAASB, the input factors are made up of different components which influence the audit process, and they include the means, knowledge, and experience. The input factors are necessary as they provide a proper guideline and method which auditors require in processing useful information and promoting quality.

The contextual factors within an audit setup provide the platform within which the process is undertaken. Sharma & Kuan (2014) asserts that some of the significant contextual parameters which measure the success of an audit include the culture, environmental considerations, laws, and regulations on financial standards and governance issues. All the factors that are mentioned above are critical in ensuring that there is a platform through which an audit process can be undertaken. The audit teams will always need understanding al the contextual factors before they can embark on a full process of taking a complete audit process. Furthermore, the elements always give a guideline on the different procedural approaches that the team may put in place when making the audit exercise (Okes, 2017). The laws and regulations will also define the scope of the audit exercise that will be undertaken and provide an avenue for the existence and extent of a relationship between the auditors and the client company.

Lastly, the output factors within an audit process ensure the existence of a communications platform between the auditing firm and the client organization. The main components of an active output process include a standardized audit report which also contains the qualified or unqualified opinion of the auditor. The stories are the essential tools for communicating the full results of a given completed audit process. IAASB has recommended a standard which should always contain a proper release (Basu, 2014). However, not all the auditors are bound by the regulatory framework that defines the outcome of the report. It is imperative that most audits will vary in scope and depth of the work. The review, therefore, has the discretion to define the most appropriate report that would suit the kind of audit work that is being undertaken by the auditor (Bolton, 2018). Finally, the process has to contain an overall opinion of the auditor regarding the whole audit process and whether the outcome represents the true nature of the financial statement and the operational procedures.

Internally, the managers can also help in establishing a framework for total quality auditing practice. In most organization, an audit committee is always formed and regulates the operations of an audit department, including promoting their independence (Madu, 2018). The other primary function of such a committee is to provide the general framework through which an internal audit process is established, as such, the committee will be responsible for creating an overall structure that helps auditors in carrying out their tasks.

Audit Quality Control System

Achieving total quality audit requires control measures which are aimed at improving the outcome of the audit process. When conducting audit work, quality control systems make an essential part of the process. The evolution of auditing practice has always aimed at reducing errors while increasing the efficiency of conducted checks. Part of the improvement of auditing in the 21st century was the introduction of the automation in the auditing career (Ledikwe et al., 2014). Currently, computer-assisted auditing processes have become one of the essential methods when carrying out an auditing career (Mannan, 2014). Companies are increasingly using computerized accounting and financial systems in carrying out their activities. With the above development, it has become necessary also to include computer-assisted auditing techniques. However, it is important to point out that the system always has to be monitored and given commands to improve the efficiency of the outcome. Additionally, not all the components of manual auditing may be replaced by the automated auditing process.

There are currently many systems that may be used by auditors in carrying out verifications processes. The authenticity of audit processes and documentation fulfills a fundamental statutory obligation (Bowlin et al., 2015). The developers of the auditing systems have targeted most of the standard financial and accounting software that is currently being used by companies. Before conducting an audit, it is always necessary to confirm the kind of system that is being used by a firm. The above information will always inform the decision to select a given system. Also, the audit teams should have extensive knowledge and understanding of the different accounting and financial systems that are used by firms. According to Ege (2014), failing to have a critical view and knowledge of how to navigate the different methods will render the audit process invalid. Proper training of all the major systems should be part of the primary aims and objectives of audit companies.

Code of Ethics in Quality Audit Engagement

Ethics within an audit environment is also essential in the achievement of total quality audit results. In the past, there have been disagreements amongst audit regulators on the central role of ethical standards in conducting audit processes (Arter, 2013). With the growing importance in audit over the years, a quality audit has increasingly been linked to proper ethical practices. International audit regulatory bodies have seen the high stress and have thus continually established appropriate channels and methods in auditing which form part of the ethical standards. Currently, audit work is regulated by specific rules and regulations (Hoecht, 2006). Audit companies are now bound to provide public audit services based on the laid down rules and procedures. Ideally, the ethics are always meant to ensure that auditors only do their work and ensure quality service delivery. Ethics in the audit professions are intended to prevent issues which may lead to lack of auditor’s independence and delivery of proper service to the clients.

The role of enforcing the code of ethics in audit practice is always on the audit leaders. When carrying out an audit work, the team leaders and supervisors will always ensure that all the persons assisting in the process adhere to set standards (Bowlin et al., 2015). One of the main area where the team leaders ensure proper ethical conduct it during the planning process. All the team members should always be briefed on the expectations of the audit process, including the conventional procedures and processes. Having high stands of integrity is one other critical components of proper ethics. The audit management teams should ensure that they give all the information which they come across during the audit process (Arter, 2013). The final audit report should always reflect the true nature of the audit process by revealing all the information they come across. The code of ethics also promotes strict independence from the audited firm (Soliman & Ragab, 2014). To improve complete quality audit, the audit company should evaluate the existence of any form of conflict of interest and find out the likely impact that it might have on the audit outcome. Should there exist a close relationship between the auditing firm and the audited company, the audit work should never take place.

Hypothesis

To determine the various research objectives, the researcher developed three critical theories. The study focused on testing the hypothesis, in line with the goals. The results of the hypothesis were to be determined through multiple regression analysis methods to prove whether they are true or false. The explanations are listed below:

H1: Audit managers are solely responsible for promoting total quality audit process.

H2: Implementing Total Quality Audit Management in audit helps to improve the financial performance of a company.

H3: Total Quality Audit success is not the responsibility of the company management.

Research Methodology

It is worth mentioning that that the sample of the study is composed of 150 auditing team members working in various Iraqi auditing firms and companies listed in Iraqi Stock Exchange from 2015-2018. The auditing team members have different degrees in accounting and auditing. Moreover, the sample of the study has more than 10 years of experience in auditing profession. This means that the population of the study is professionally and academically competent and, hence, their judgments are reliable. As for the research variables, the study is based on dependent variable that represents the audit quality management, and the independent variable, which represents different quality audit management practices such as leadership, strategic planning, and proper leadership goals. The researcher followed a questionnaire method for measuring the variables o the study. The researcher used Linear Regression Model given by given by:

Where, (y=dependent variable and x=independent variable).

Y (audit management function).

X1=Strategic planning.

X2=Quality output.

X3=Process management.

Results

The study focus was mainly aimed at achieving proper quality audit by examining the role played by audit managers. The research results were aimed at attaining of the best results after testing the hypotheses. For a proper hypothesis results, the researcher used a sample comprising of different respondents. The above example consisted of members within the audit teams, organizational managers, those drawn from the separate audit committee and employees from other departments. The Table 1 represented below gives the size of the sample. When testing the above hypothesis, the researcher chose to have an independent and dependent variables. For testing the different hypothesis, the independent variable was Total Quality Audit. However, there were different dependent variables which were directly related to the different hypothesis that was being tested. Specifically, the independent variables consisted of the different quality audit management practices such as leadership, strategic planning, and proper leadership goals. The researcher applied multiple regression analysis in carrying out the hypothesis testing process.

| Table 1: Sample Respondents | |

| Type of respondents | Size of sample |

| Audit managers | 10 |

| Other Audit personnel | 20 |

| Audit committee members | 40 |

| Management staff | 70 |

| Other departmental employees | 10 |

| Total | 150 |

In undertaking the multiple regression analysis methods, an F-distribution analysis was conducted to determine whether total quality audit could influence the different dependent variables stated under the hypothesis statements. The study wanted to establish the relationship between overall quality audit process and factors such as the promotion of quality audit, Improvement of performance and contact with the management.

Hypothesis 1: Audit managers are solely responsible for promoting total quality audit process.

The testing of the above hypothesis was based on the understanding that the audit managers are the only persons whose actions may lead to a proper total quality audit within organizations. The analysis of the above study mainly focused on developing and retaining a long-term review of the high research. The above hypothesis is attained primarily based on some processes. There was a critical need of employing the use of multiple regression analysis and outcomes within the study. The hypothesis test process, therefore, sought to determine if there exists a positive relationship between audit management functions and total quality audit achievement.

The results from the data are shown below IN Table 2.

| Table 2: Which Audit Management Roles Support Quality Audit Process? | ||

| Audit management role | Support | Do not support |

| Strategic planning | 135 | 15 |

| Quality output | 30 | 120 |

| Process management | 110 | 40 |

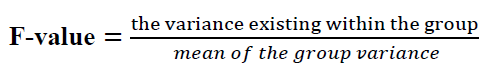

In calculating the values using the f-test, the researcher adopted the standard formulae:

(1)

(1)

The f-value generates the Table as shown below through the use of a regression table analysis. The researcher used a standard amount of 0.365.

A linear regression model was then used in calculating the results and shown in Table 3.

| Table 3: Coefficientsa Of audit management functions | |||||

| Audit management functions | Non-standardized coefficients | Standardized ratios | t | Sig. | |

| F-value | St. error | Beta | |||

| Standard value | 0.128 | 0.426 | - | 0.200 | 0.365 |

| Strategic planning | 0.247 | 0.139 | 0.263 | 1.635 | 0.113 |

| Quality output | 0.020 | 0.111 | 0.012 | 0.091 | 0.926 |

| Process management | 0.137 | 0.138 | 0.136 | 0.974 | 0.736 |

a: Dependent Variable.

The formulae for the linear regression model is given by Y=a+bX (2)

t: Represents the estimates of the standard deviation of coefficients divided by the standard error.

Where, (y=dependent variable and x=independent variable).

Y (audit management function)=0.365+0.113(x1)+0.926(x2)+0.736(x3)

X1=Strategic planning.

X2=Quality output.

X3=Process management.

In determining the coefficient of determination (R2), values, which are almost equal to zero, give a weak fit. The bigger coefficients of 0.926 and 0.736 show that they are components of management in auditing which are related to quality improvement since they are greater than 0.365. However, strategic planning does not have a significant outcome on quality management. Based on the above regression analysis results, the hypothesis is partially supported.

Hypothesis 2: Implementing Total Quality Audit Management in audit helps to improve the financial performance of a company.

The hypothesis sought to test the role of quality audit in improving the aspects of financial management. The researcher used different audit management functions to measure their contribution to business performance within companies. The Table 4 below shows the responses from the interviews.

| Table 4: What aspects of quality audit management roles have an impact on financial performance? | ||

| Audit management role | Support | Do not support |

| Strategic planning | 140 | 10 |

| Quality output | 130 | 20 |

| Process management | 37 | 113 |

Based on the values above, the calculation of the f-value was carried out will be achieved through the formulae given below:

(3)

(3)

The researcher used a standard value of 0.365.

linear regression model was then used in calculating the results and shown in Table 5.

| Table 5: Coefficientsa Of financial performance | |||||

| Audit management functions | Non-standardized coefficients | Standardized coefficients | t | Sig. | |

| F-value | St. error | Beta | |||

| Standard value | 0.137 | 0.736 | - | 0.100 | 0.365 |

| Strategic planning | 0.257 | 0.134 | 0.235 | 1.693 | 0.513 |

| Quality output | 0.070 | 0.120 | 0.115 | 0.073 | 0.926 |

| Process management | 0.192 | 0.174 | 0.530 | 0.574 | 0.736 |

a: Dependent Variable.

The linear regression model is given by Y=a+bX

t: Represents the estimates of the standard deviation of coefficients divided by the standard error.

Where, Y (financial performance)=0.137+0.257(x1)+0.070(x2)+0.192(x3)

X1=Strategic planning.

X2=Quality output.

X3=Process management.

Based on the results of the above analysis, the coefficients of strategic planning, quality output, and process management values (0.153, 0.926 and 0.736 respectively) were greater than the standard value of 0.365. The results therefore show that all the three major components of quality audit management promote the proper financial performance of the organization. The hypothesis is, therefore fully supported.

Hypothesis 3: Total Quality Audit success is not the responsibility of company management.

The above hypothesis wanted to confirm if the overall management of an organization was responsible for the proper quality management components. The respondents were asked to determine if they feel that strategic planning, quality output, and process management are all components of audit management that promote the proper financial performance of organizations.

The above data in Table 6 was used in the achievement of the F-value. The value was achieved through the formulae given below:

(4)

(4)

| Table 6: Does the overall management influence the components of quality audit success? | ||

| Audit management role | Support | Do not support |

| Strategic planning | 145 | 5 |

| Quality output | 7 | 143 |

| Process management | 125 | 35 |

The study adopted the standard amount of 0.365 for the research.

The calculations are as shown in Table 7.

| Table 7: Coefficientsa of overall company management responsibility | |||||

| Audit management functions | Non-standardized coefficients | Standardized coefficients | t | Sig. | |

| F-value | St. error | Beta | |||

| Standard value | 0.133 | 0.792 | 0.130 | 0.365 | |

| Strategic planning | 0.204 | 0.173 | 0.284 | 1.736 | 0.582 |

| Quality output | 0.063 | 0.102 | 0.126 | 0.035 | 0.900 |

| Process management | 0.109 | 0.183 | 0.487 | 0.738 | 0.773 |

a: Dependent Variable.

The linear regression model is given by Y = a + bX

t:Represents the estimates of the standard deviation of coefficients divided by the standard error.

Where, Y (overall management responsibility) =0.133+0.204(x1)+0.063(x2)+0.109(x3).

X1=Strategic planning.

X2=Quality output.

X3=Process management.

The results above show that the values of strategic planning, quality output and process management (0.582, 0.900 and 0.773 respectively) were higher than the standard value of 0.365. The above data points to the fact that the overall management was responsible for the promotion of proper audit management processes. The above hypothesis is, therefore, approved.

Discussion

This study is a continuation of previous Arab and foreign studies which took place in an environment other than Iraq. This research focuses on the role of the adequately constituted auditing management practices in achieving quality audit process in Iraqi audit firms and companies registered in Iraqi Stock Exchange. Unlike the previous studies, the study is keen to explore new research areas by establishing the different means that the Iraqi audit managers use such as the implementation of new policy guidelines in achieving success within the study. The study mainly aims at identifying the different strategic decisions that are implemented by the management and are meant to improve the performance of auditing staff consequently, there is also an emphasis on the need to seek specialized advisory services from other specialists.

Alqam & Alrajabi, (1997) implemented a study entitled “The factors which lead to change the external auditor in the Jordanian public companies: field study” in which they tackled audit quality management in some selected Jordanian companies by approaching the auditor rotation. The study found that auditor rotation is affected by three categories; firm specific factors such as management replacement, auditing office specific factors such as auditing quality, and factors related to international auditing standards and auditing ethics. AL-Khaddash (2013) conducted a study entitled 'Factors affecting the quality of auditing: the case of Jordanian commercial banks' in which the researcher identifies the most important factors affecting audit quality in Jordanian Commercial Banks (JCBs). The perceptions of JCBs' internal and external auditor's in addition to financial managers have been investigated as well. Awadh (2008) conducted a study entitled “The effect of unregulated audit on the quality of the auditor's professional performance” which provides an insight into the factors that they perceive to be important determinants of audit quality during the auditor nomination/selection process. Dunakhir (2016) conducted a study entitled 'Factors associated with audit quality: Evidence from an emerging market'. The study took into account the attributes of audit quality in Indonesia by considering input from groups of auditors, audit clients and external statement users. Abbott & Parker (1999) conducted a study entitled ' investigated auditor changes found that the presence of active and independent audit committees is associated with increases in audit quality at the time of auditor changes. Sadikoglu and Olcay (2014) conducted a study entitled “The effects of total quality management practices on performance and the reasons of and the barriers to TQM practices in Turkey” in which the researchers investigated the impacts of TQM practices on various performance measures as well as the reasons and the barriers of the TQM practices of firms in Turkey using a cross-sectional survey methodology.

Conclusion

To conclude, the above study was mainly aimed at deriving results based on the analysis of different hypothesis which was used in the validation of results. The study primarily focused on three significant assumptions and facts which are enumerated below:

1. Based on the first hypothesis, audit managers are solely responsible for promoting total quality audit process; the study found out the above hypothesis to be partially true. The researcher realized that the role of audit managers is critical in promoting the total quality of the process. However, process management is not one of their functions.

2. The second hypothesis, Implementing Total Quality Audit Management in audit helps to improve the financial performance of a company, was proven to be true. The researcher found out that the commercial success of any firm or entity depended heavily on the role played by audit managers in installing quality audit practices.

3. Quality Audit success is not the responsibility of the company management, which was also proven true. The researcher found out that the internal audit managers had the sole responsibility of ensuring that there exist proper total quality audit practices.

4. Based on the analysis of the hypothesis, the researchers realized that the audit managers are not entirely responsible for the promotion of all components of all quality audit processes. The first hypothesis was, therefore, proven to be partially correct.

5. By implementing the total quality management, the financial performance of a company will always likely improve. The last hypothesis was also held to be true. The overall management of a firm was found to be responsible for the success of a total quality audit management process.

Implications

The findings of the research would be significant to stakeholders, professionals and various researchers in the audit field. First, the study may be used by policy makers in improving the role of managers in promoting auditing success. The policies may include procedures on and steps that managers can take to encourage the improvement of audit functions without interfering with the overall poverty of auditors. The research outcome may also be used to promote the success of quality audit practice. The study revealed the components of proper quality audit functions. Therefore, different organizations may incorporate the standard auditing procedures and promote factors such as financial performance and overall achievement of organizational goals.

Recommendations

Based on the research outcome, many proposals may be put forward to support the findings of the study. First, the audit management teams may seek to improve financial performance by ensuring that there is a reorganization of the process management. The results of the respondents provided that the internal processes within most of the organization do not promote the success of the audit teams. The above factor may be improved by re-structuring the coordination processes within the audit success.

Another primary recommendation that may be useful in the improvement of quality audit functions is the promotion of quality audit procedures for audit processes. The researcher found out that the current audit procedures might not be entirely successful in enhancing the total quality audit process. The above process may be successful when the current systems are revised to include a proper step in auditing. Alternatively, the audit professionals may also establish adequate checks that enhance quality audit roles and procedures.

Acknowledgement

I would like to show my warm thank to Mr. Abdullah Najim Abd Al Khanaifsawy who supported me at every bit and without whom it was impossible to accomplish the end task. His translation, guidelines, and the substantial endeavors in providing the necessary sources and references have empowered me to positively finish this article.

References

- Abbott, L.J., & Parker, S. (1999). Auditor quality and the activity and Independence of the audit committee. Working Paper, University of Memphis and Santa Clara University

- Al-Khaddash, H., Al-Nawas, R., & Ramadan, A. (2013). Factors affecting the quality of auditing: The case of Jordanian commercial banks. International Journal of Business and Social Science, 4(11), 206-222.

- Alqam, M., & Alrajabi, T. (1997). The factors which lead to change the external auditor in the Jordanian public companies: Field study. Dirasat Journal, University of Jordan, 24(1), 185-204.

- Arter, D.R. (2013). Quality audits for improved performance. Milwaukee, Wisconsin: ASQ Quality Press.

- Awadh, A.M. (2008). The effect of unregulated audit on the quality of the auditor's professional performance. Journal of the Faculty of Commerce for Scientific Research, Alexandria University, Egypt, 3(45), 399-408.

- Basu, R. (2014). Managing quality in projects: An empirical study. International Journal of Project Management, 32(1), 178-187.

- Bolton, A. (2018). Quality management systems for the food industry: A guide to ISO 9001/2. Boston, MA: Springer US.

- Bowlin, K.O., Hobson, J.L., & Piercey, M.D. (2015). The effects of auditor rotation, professional skepticism, and interactions with managers on audit quality. The Accounting Review, 90(4), 1363-1393.

- Byrnes, P.E., Al-Awadhi, A., Gullvist, B., Brown-Liburd, H., Teeter, R., Warren Jr, J.D., & Vasarhelyi, M. (2018). Evolution of Auditing: From the Traditional Approach to Future Audit 1. In Continuous Auditing: Theory and Application (pp.285-297). Emerald Publishing Limited.

- Domingues, J.P.T., Sampaio, P., & Arezes, P.M. (2015). Analysis of integrated management systems from various perspectives. Total Quality Management & Business Excellence, 26(11-12), 1311-1334.

- Dunakhir, S. (2016). Factors associated with audit quality: Evidence from an emerging market. Asia Pacific Journal of Advanced Business and Social Studies, 2(2), 523-533.

- Ege, M.S. (2014). Does internal audit function quality deter management misconduct? The Accounting Review, 90(2), 495-527.

- Griffith, E.E., Hammersley, J.S., & Kadous, K. (2015). Audits of aggregate estimates as verification of management numbers: How institutional pressures shape practice. Contemporary Accounting Research, 32(3), 833-863.

- Heinz, H.J., Shapton, D.A., & Shapton, N.F. (2014). Principles and practices for the safe processing of foods. Kent: Elsevier Science.

- Johnstone, K.M., & Gramling, A.A. (2013). Auditing: A risk-based approach to conducting a quality audit. Australia: Cengage.

- Kazili?nas, A. (2014). The implementation of quality management systems in service organizations. Public Policy and Administration, 34, 71-82.

- Kerzner, H. (2018). Project management best practices: Achieving global excellence. John Wiley & Sons.

- Ledikwe, J.H., Grignon, J., Lebelonyane, R., Ludick, S., Matshediso, E., Sento, B.W., & Semo, B.W. (2014). Improving the quality of health information: A qualitative assessment of data management and reporting systems in Botswana. Health Research Policy and Systems, 12(7).

- Lennox, C.S., Wu, X., & Zhang, T. (2014). Does mandatory rotation of audit partners improve audit quality? The Accounting Review, 89(5), 1775-1803.

- Madu, C.N. (2018). Handbook of total quality management. Boston, MA: Springer US.

- Mannan, S. (2014). Lees' process safety essentials: Hazard identification, assessment, and control. Amsterdam: Butterworth-Heinemann

- Miko, N.U., & Kamardin, H. (2015). Impact of the audit committee and audit quality on preventing earnings management in the pre-and post-Nigerian corporate governance code 2011. Procedia-Social and Behavioral Sciences, 172, 651-657.

- Mitra, A. (2016). Fundamentals of quality control and improvement. Chicago, John Wiley & Sons.

- Mosadeghrad, M.A. (2014). Essentials of total quality management: A meta-analysis. International Journal of Health Care Quality Assurance, 27(6), 544-558.

- Netland, T.H., Schloetzer, J.D., & Ferdows, K. (2015). Implementing corporate lean programs: The effect of management control practices. Journal of Operations Management, 36, 90-102.

- Oakland, J.S. (2014). Total quality management and operational excellence: text with cases. New York, Routledge.

- Okes, D. (2017). Musings on internal quality audits: Having a more significant impact. Milwaukee, Wisconsin: ASQ Quality Press

- Persakis, A., & Iatridis, G.E. (2016). Audit quality, investor protection, and earnings management during the financial crisis of 2008: An international perspective. Journal of International Financial Markets, Institutions, and Money, 41, 73-101.

- Pizzini, M., Lin, S., & Ziegenfuss, D.E. (2014). The impact of internal audit function quality and contribution on audit delay. Auditing: A Journal of Practice & Theory, 34(1), 25-58.

- Rebelo, M., Santos, G., & Silva, R. (2014). The conception of a flexible integrator and lean model for integrated management systems. Total Quality Management & Business Excellence, 25(5-6), 683-701.

- Sadikoglu, E., & Olcay, H. (2014). The effects of total quality management practices on performance and the reasons of and the barriers to TQM practices in Turkey. Advances in Decision Sciences, 4(2).

- Sharma, V.D., & Kuang, C. (2014). Voluntary audit committee characteristics, incentives, and aggressive earnings management: Evidence from New Zealand. International Journal of Auditing, 18(1), 76-89.

- Soliman, M.M., & Ragab, A.A. (2014). Audit committee effectiveness, audit quality, and earnings management: an empirical study of the listed companies in Egypt. Research Journal of Finance and Accounting, 5(2), 155-166.

- Tepalagul, N., & Lin, L. (2015). Auditor independence and audit quality: A literature review. Journal of Accounting, Auditing & Finance, 30(1), 101-121.

- Wealleans, D. (2017). The quality audit for ISO 9001: 2000: A practical guide. Gower: ASQ Quality Press.