Research Article: 2021 Vol: 20 Issue: 3

Accounting Information Systems Implementation under Enterprise Resource Planning (ERP) and Successful Decision-Making

Pannarai Lata, King Mongkut’s University of Technology North Bangkok

Siriwiwat Lata, Rajabhat Maha Sarakham University

Abstract

The purposes of this research were: 1) to investigate the effect of accounting information systems implementation under enterprise resource planning (ERP) on useful information and successful decision-making. 2) to investigate the effect of accountant competency on useful information and successful decision-making. 3) to confirm the model’s influences of accounting information systems implementation under enterprise resource planning (ERP) and accountant competency on useful information and successful decision-making.

The research sample consisted of 210 Thai-listed firms. Data were collected through a survey questionnaire. Descriptive analysis, Multiple regression analysis, and Path analysis were used for the data analysis.

The results revealed: 1) accounting information systems implementation under ERP had a positive effect on useful information, and successful decision-making. 2) Accountant competency positively affects useful information. 3) The model’s influences of accounting information systems implementation under ERP and accountant competency on useful information, and successful decision-making fit the empirical data (Chi-square=3.738, df=2, p=0.154, χ2/df=1.869, GFI=0.991, RMSEA=0.064). The variables in the model explained 16.70% and 43.80% of the variance of useful information and successful decision-making, respectively.

Keywords

Accounting Information Systems, Enterprise Resource Planning, Accountant Competency, Useful Information, Successful Decision-Making.

JEL Classifications Code

M41, M49, D81, D83, L86

Introduction

Information technology systems have made enormous progress. It can modify the way information is collected, stored, processed, and distributed among internal and external organizations. Information technology plays a role in various activities for communication purposes, solve problems, and decisions for planning and managing tasks (Adamides & Karacapilidis, 2020). There are constant improvements in equipment and machines to be responsive to support and generate information from such systems. It has also resulted in all professions and business sectors responding and improving their operating mechanisms to update with the information to keep up with the world. Besides, the business sector has also built many of its in-house information systems, such as the use of enterprise resource planning systems, decision support systems, accounting information systems to deal with large volumes of transactions within the organization and to link information across the organization for broad and cost-effective benefits (Nabeeh et al., 2019; Samiei & Habibi, 2020). Therefore, information technology systems are very important. It is the main tool for combining and linking different business components, such as planning, production, sales, human resources, accounting, finance, purchasing, etc., so that information is shared from the same database. This is to support the most efficient operation of the organization's business processes.

Enterprise Resource Planning (ERP) systems are organized-wide and integrated information systems that can manage and coordinate all the resources, information, and functions of a business from shared data stores. Since ERP systems can integrate transaction-based corporate information into one central database and allow that information to be retrieved from different organizational divisions, they can improve the capability of accountants to fulfill the roles by providing management with access to relevant and real-time operational data in the support of decision making and management control (Samiei & Habibi, 2020). ERP systems have many functions and help with data consolidation (integration of internal and external data, simplified extraction, transformation, and loading of data, deletion of unwanted and unrelated data) data quality (prepare data to improve overall accuracy reporting, user-defined and standard reports generated at any level, personalized reports for any level of management) forecasting and modeling (supports analytics used in predictive and prescriptive analytics which use historical and real-time data, qualitative or quantitative) (Appelbaum et al., 2017).

ERP systems are generally divided into modules or sub-programs, such as sales, purchasing, financial, accounting, human resource management (Al-Harthi & Saudagar, 2020). Accounting information systems are specialized modules in ERP systems for accounting and the embedding of accounting systems to retrieve financial information from the purchasing system, a sales system, billing system, payment systems, etc. Although the information generated from an accounting information system can be effective in the decision-making process, purchase, installation, and usage of such a system are beneficial when the benefits exceed its costs (Chofreh et al., 2020).

The benefits of accounting information systems implementation under ERP can be evaluated by its impacts on the improvement of the decision-making process, the quality of accounting information, performance evaluation, internal controls, and facilitating the firm’s transactions (Kocsis, 2019). The usefulness of accounting information systems depends upon the quality of the output of the information system that can satisfy the users' needs. Generally, accounting information systems 1) provide financial reports on a daily and weekly basis and 2) provide useful information for monitoring the decision-making process and performance of the organization. The design of good accounting information systems implementation under ERP will help the operational success (Daoud & Triki, 2013).

The previous literature review indicates accounting information systems (AIS) are considered as a subsystem of ERP systems and as important organizational mechanisms that are critical for the effectiveness of decision and control of organizational management. The success of accounting information systems implementation under ERP depends on a fit between three factors. First, the fit of AIS implementation under ERP must be achieved with the dominant view in the firm or perception of the situation. Second, such systems must appropriate the technology for the organization when problems are normally solved. Third, such systems must correspond to the culture and characterize the organization. Systems will be useful when the information provided by them is used effectively in the decision-making process by users. Previous literature reviews found that there is a relationship among AIS implementation under ERP, accountant competency, useful information, and successful decision-making. Trends and themes in AIS implementation research relate to an individual, organizational, and technology perspective. The gaps in the research are benefits in the AIS research and implementation issues (Fisher & Bradford, 2006; Grabski et al., 2011; Kosis, 2019; Kung et al., 2015; Nur & Irfan, 2020). The characteristics of useful information currently prepared can help decision-makers seek more alternatives to the solution of the problem. Accessibility of useful information related to the main transactions of an organization leads to categorized detailed information which facilitates decision making in any difficult situation. Generally, useful information depends on reliability, the form of reporting, timeliness, and relevance to the decisions. The usefulness of information generated by the system to satisfy informational needs for operational processes, managerial reports, budgeting, and control within the organization. As for traditional problematic issues, managers rely solely on accounting information systems implementation to creating useful information, support decision-making, and evaluate performance in the organization (Kosis, 2019). On the other hand, the traditional accounting information systems implementation has been heavily criticized for several reasons as follows: 1) it presents a one-sided view of operational activities, making effective, coordination difficult; 2) it lacks linkage of accounting information system with ERP systems. 3) It lacks connection to the conceptual framework of the accounting information system under ERP, accountant competency, useful information, and Successful decision-making in a holistic. The previous empirical studies still lack confirm such a relationship. Therefore, the key question of this research is how do accounting information systems implementation under ERP and accountant competency affect useful information and successful decision-making?

As a result, the main objectives of this research are to 1) investigate the effect of accounting information systems implementation under enterprise resource planning on useful information and successful decision-making, 2) to investigate the effect of accountant competency on useful information and successful decision-making, 3) to confirm the model’s influences of accounting information systems implementation under enterprise resource planning and accountant competency on useful information and successful decision-making. Consequently, this research generates a significant study of literature reviews of accounting information systems implementation under ERP and accountant competency. Firstly, it expands theoretical contributions to the previous knowledge and literature of accounting information systems implementation under ERP and accountant competency. Secondly, the RBV is applied to back up and explain the relationships between all variables of the conceptual model. Moreover, the antecedents of useful information and successful decision-making are offered by this research in different ways. Thai-listed firms are chosen as the population because: 1) these firms represent a large firm that has sufficient resources and higher capacities to use enterprise resource planning. 2) They focus on using information from their ERP systems to increase the high level of the firm’s capability and to measure their overall performance. 3) The business operational nature of Thai-listed firms has the high competitiveness and emphasis to apply useful information for creating success in the long-term. The chief financial officers or accounting manager is the key informant.

Theoretical Foundations

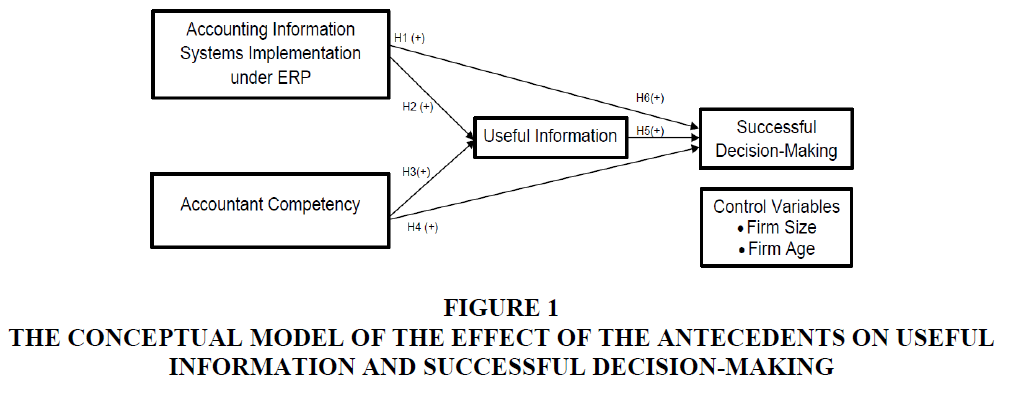

The theoretical relationship between accounting information systems implementation under ERP and successful decision-making is explained by the resource-based view (RBV). RBV is valuable, rare, inimitable, and non-substitutable resources that make a firm’s competitive advantages that enhance their operations by enabling firms to implement strategies that improve efficiency and effectiveness (Barney, 1991; Wernerfelt, 1984). These theories can explain how firms utilize resources to create competitive advantages. This theory explains that information technology (ERP system) and human resources are fundamental to the firm’s survival and growth (Aral & Weill, 2007; Bharadwaj, 2000; Lata et al., 2018). They determine a firm’s overall organizational effectiveness by combining IT resources such as hardware/software, human resources like management supporting or flexible organizational culture and business resources by management’s plan to integrate a new capability into the overall business process within or across business function to create a new capability for decision making. This research defines AIS implementation under ERP as a part of IT capability to mobilize and deploy information in combination or co-present with other resources. Furthermore, accounting information systems implementation is often connected to the other resource base embedded in the business process. Hence, the RBV theory is employed to explain the linkage between accounting information systems implementation under ERP, accountant competency, useful information, and successful decision-making. The conceptual model is presented in Figure 1.

Figure 1 The Conceptual Model of the Effect of the Antecedents on Useful Information and Successful Decision-Making

Accounting Information Systems Implementation under Enterprise Resource Planning

Accounting information systems implementation under enterprise resource planning (ERP) is defined as a computer-based system that responsible for collecting transactions, files, databases, and processing both financial information and non-financial information from various ERP subsystems, while there are sharing and communicating collectible financial information to all users of the organization. Large firms have adopted ERP systems to coordinate and store information, business processes, and resources. Integration of AIS with ERP leads to coordination in the organization which, in turn, increases the quality of the decisions. The effectiveness of accounting information systems implementation under ERP depends upon the quality of the output of useful information that can satisfy the users' needs. Normally, AIS under ERP offers financial reports on a daily and weekly basis and 2) provide useful information for monitoring the user’s decision-making process. It helps the top manager to see the operational perspective from all segments, including control of production processes, products, and services to be responsive. But ERP systems have their disadvantages, which is their high cost. The accounting information systems implementation under ERP provides the necessary accounting and financial information, both internal and external organizations to users. Particularly, in a decision-making process, a well-designed accounting system provides useful information to managers in time. It helps the decision-making of managers to be effective, timely, and accurate, plays critical roles in fulfilling managers’ obligations of accountability, and provides the information to explain the usage of resources and operations. Alzoubi (2011) found that the integration of the accounting information system within ERP systems, improving the quality of accounting outputs and the internal control in organizations. Firms that adopt ERP systems are a result of their high performance as well. Daoud & Triki (2013) found that accounting information systems in an ERP environment positively influence firm performance. Samiei & Habibi (2020) found that ERP improves the knowledge management process, communications inside and outside the enterprise, and efficiency of capital utilization. Nur & Irfan (2020) found that high-quality accounting information systems implementation generates useful information. Moreover, the accounting information systems implementation under ERP is related to user skill, satisfaction, and knowledge sharing, which enhanced personal skill contributes to high organizational performance. Mardi et al. (2020) found that accounting information systems and teamwork positively and significantly affect the timeliness of financial report submission which is one component of useful information. Kabir (2020) found that ERP implementation has significantly improved both productivity and profitability. Productivity is measured by service time, lead time, inventory turnover, output-input ratio, and warehouse cost. Profitability is evaluated by gross profit margin. Agbani & Nnadi (2020) found that the accounting information system had a positive significant effect on profitability. It can help the organization plan and making far-reaching decisions that will help the organization achieve a competitive advantage. Therefore, it can be concluded that there is a positive correlation between accounting information systems, performance, information quality, information utilization, and the quality of decision-making. Hence, hypotheses are proposed as follows:

H1 Accounting information systems implementation under enterprise resource planning has a positive effect on useful information.

H2 Accounting information systems implementation under enterprise resource planning has a positive effect on Successful decision-making.

Accountant Competency

Accountant competency is defined as the existing capacities of an accountant that help predict competent performance in a certain job that it encompasses the knowledge, skills, abilities, experience, and personality of an accountant, including elective training, cognitive abilities, and technical skills (Lata & Ussahawanitchakit, 2015). A highly skilled accountant is an accountant who has capacities that help predict competent performance and can use technology effectively (Ley & Albert, 2003; El-Asame & Wakrim, 2018). Accounting competencies moderate the relationship between a firm’s capability of management accounting techniques and internal and external contextual factors. Besides, a firm’s accounting competency that complies with dynamic environments supports efficient management practices and operational performance. Daoud & Triki (2013) found that the interaction effect of accounting information systems in an ERP environment with accounting staff competency has a positive impact on firm performance. Kasim (2015) found that there is a significant effect of the accountant competency on financial reporting quality. Rahmasari & Suardana (2020) found that the accountant's technical competency strongly affects the use of computer-based accounting information systems and enhances firm performance. Dewi et al. (2019) found that human resource competence positively affects information quality. In summary, it has the likelihood of high accountant competency to increase useful information and successful decision making. Hence, the hypotheses are proposed as follows:

H3 Accountant Competency has a positive effect on useful information.

H4 Accountant Competency has a positive effect on successful decision-making.

Useful Information as a Moderator Variable

Useful Information is defined as the information quality produced by AIS implementation under ERP systems to be composed of relevance, reliability, completeness, timeliness, understanding, verifiable, accessible, and cost-effectiveness to provides the goal achievement of planning, investigating, coordinating, evaluating, supervising, staffing, negotiating, and representing, and includes an overall assessment of performance. Relevant is information consistent with the work and the needs of all users to reduce uncertainty and increases the efficiency of making decisions. Reliability is defined as it is not biased and inaccurate. Completeness means that major issues or activities being measured are fully reported. Report information in time to the needs of users. The information is used up to date and able to respond to users immediately. Understanding is information should be compact, the non-abusive format may be informal, but easy to understand. Verifiable is cross-validation, and if the same batch is processed twice, the results of both processes cannot be different. Besides, the information must be able to verify the source of who is responsible for the input. Accessibility is user access to the information easy. The rights are set according to the level of users to prevent unauthorized entry into the system and to preserve the confidentiality of information. The cost of systems is often determined by the number of transactions and sales and the number of multi-users. This is because the price of the accounting software package and the related expenses are quite different. Therefore, the cost paid by an entity to acquire accounting software to generate good information should be less than or equal to the profit gained back (Lata & Ussahawanitchakit, 2015). Previous research found that useful information improves the effectiveness of planning and decision making, as well as increases organizational performance (Bourguignon, 2005; Chong & Eggleton, 2007). Keller & Staelin (1987) found that the quality and quantity of information positively affect decision effectiveness. Raghunathan (1999) found that the decision quality is improved with higher information quality for a decision-maker that knows the relationships among problem factors. Speier (2006) found that the relationship between the information presentation format and decision performance is moderated by the complexity of the task. Nabeeh et al. (2019) found that the IoT in enterprises helps decision-makers to estimate the influential factors which affect firm success. Esch et al. (2019) found that the integrated reporting information influences internal decision-making by providing decision-makers with a more comprehensive picture of the impact of the firm's strategy leads to decisions with higher sustainable value creation. Accounting information systems provide useful information that influences and facilitates the decision-making process and is mostly used for coordination within an organization. Hence, the hypothesis is proposed as follows:

H5 Useful Information has a positive effect on Successful decision-making.

Successful Decision-Making as a Dependent Variable

Successful decision-making is defined as the achievement of decision-making which relies on analysis, comparison, and selection among business alternatives under the situation and information that are provided by AIS implementation under ERP systems to enable firms to achieve their business objectives or goals. Accounting information plays an important role in the decision-making process in two main areas: 1) It provides information that motivates management by identifying recent or current situations and needs immediate management decisions. For example, a cost report indicates a substantial difference between the estimated cost of production and the actual cost. The report may also motivate management to consider the problems that arise immediately. 2) Accounting information can help establish the basis for making possible choices by reducing incidents of uncertainty. For example, accounting information systems are largely used to determine prices or to select assets. For accounting information system designers, they must decide what information needs, and if changes occur to those needs, they must also be able to respond quickly. If management is unable to obtain adequate information or only obtain ineffective information, the performance will be ineffective and will cause adverse consequences affecting the organization. Accounting information systems implementation under ERP originated as an attempt to eliminate data redundancies, data inconsistencies, and overall organizational inefficiency by integrating core business activities into one single database. Besides integration, the purpose is to enhance decision support accurate and timely information. Hence, accounting information systems implementation continually collects information and provides timely availability of the information for managing, reporting, data mining, and communicating internally and with outside parties. AIS implementation under ERP and accountant competency create useful information that responds to the requirement of managers. Hence, the related hypothesis is postulated as follows.

H6 Accounting information systems implementation under enterprise resource planning (ERP)and accountant competency have a positive influence on successful decision making through useful information as a moderator.

Methodology

Sample Selection and Data Collection Procedure

The population of this research is Thai-listed firms, which refers to the firms that have registered with the Stock Exchange of Thailand because these firms have complex financial and accounting information, a variety of accounting Information systems, multi-layered responsibilities, the sub-decision-making authority. It is necessary to have accounting information systems to manage firm performance. The unit of analysis is firm, and the key informant is the IT manager or accounting manager. Thai-listed firms, which are chosen from the database of the Stock Exchange of Thailand (SET) amounts to 696 firms, are used as the population of this research. The required sample size was representative of Thai-listed firms as 248 firms by using the minimum usable sample size of Krejcie & Morgan (1970). In the previous literature, an adequate response rate for a mail survey is 20% (Aaker et al., 2001), and to maximize the response rate to 100 percent, this research systematically confines 1,240 (248x5) firms as a sampling frame. However, with a population of 696 firms, the population and sample become the same groups. Thus, 696 firms were selected as the sample for data collection. Data were collected by questionnaire mail survey. The questionnaires are directly distributed to 696 firms. The time of data collection is approximately ten weeks. In the first five weeks, questionnaires were answered and returned to the researcher. After the first five weeks, to increase the response rate, a follow-up letter and online questionnaire were sent to firms and e-mails of the firms. Thus, a total of the received questionnaires are 215 responses. However, there are only 210 complete and usable questionnaires. Thus, 210 firms were used for data analysis, and the effective response rate was 30.17%. Moreover, the non-response bias is tested for generalization based on Armstrong and Overton (1977) to test the significant differences of the demographic firm characteristics between 105 early respondents (the first group) and 105 late respondents (the second group). The result of t-test comparison provides evidence that there are no statistically significant differences between the two groups at a 95% confidence level. Thus, it shows that non-response bias.

Measurement

To measure each construct in the conceptual model, all variables are anchored by a five-point Likert scale, ranging from 1 (strongly disagree) to 5 (strongly agree), excluding control variables. Additionally, all constructs are developed for measuring from the definition of each construct and examining the relationship between the theoretical framework and previous literature reviews. Thus, the measurement of a dependent variable, independent variables, and control variables are described as follows:

Dependent variable

Successful decision making is measured by using five items which involve the achievement of decision making which relies on analysis, comparison, and selection among business alternatives under the situation and information that are provided by an accounting information systems implementation under ERP systems to enable firms to achieve their business objectives or goals. The construct of this variable is developed by a new scale based on its definition.

Moderator variable

Useful Information is measured by using eight-items which involve these attributes that reflect the goal achievement of planning, investigating, coordinating, evaluating, supervising, staffing, negotiating, and representing, and includes an overall assessment of performance. The construct of this variable is developed by a new scale based on its definition.

Independent variables

This research has two independent variables as accounting information systems implementation under ERP to be measured by using twenty-three items which involve these attributes reflect AIS on the expenditure cycle: purchasing to cash disbursements, the revenue cycle: sales to cash collections, production cycle, payroll cycle, general ledger, and reporting system. The construct of variables is developed by a new scale based on their definition.

Accountant competency is measured by using ten-items that involve the accountant’s existing capacities consist of knowledge, skills, abilities, experience, personality, elective training, cognitive abilities, and technical skills. The construct of variables is developed by a new scale based on their definition.

Control Variables

The control variables may affect the relationship between the independent variables and dependent variables so firm age (FA), and firm size (FS) are the control variables of this research (Lata, 2020). Firm size is measured by total assets of the firm, which is a dummy variable (0 = total assets of the firm is below or equal to 500,000,000 baht, 1=total assets of the firm that higher than 500,000,000 baht). And firm age is measured by the duration in business by 0=below or equal to 10 years, 1=higher than 10 years (Lata, 2020).

Reliability and Validity

The questionnaire has seven parts. Part one asks about personal information. Part two asks about the information and details of the firms such as the type of business, the period of time in operation, authorized capitals, the total assets of the firm, the number of employees, and average revenues per year. Part three to part six asks about accounting information systems implementation under ERP, accountant competency, useful information, and successful decision-making. The last part is the recommendations and suggestions. Three academic experts who have experience in this area reviewed the instrument to ensure that the questionnaires use suitable wordings, and all constructs are adequate to cover the content of the variables. Then, the pre-test is conducted with the first 30 returned questionnaires. The range of factor loadings by EFA is between 0.662-0.918. These values are greater than the cutoff score of 0.40 to indicate acceptable construct validity (Hair et al., 2010). Moreover, the results of Cronbach’s alpha coefficients are 0.765-0.983 which exceed the acceptable cutoff score. The recommendation of Cronbach’s alpha coefficient should be equal to or greater than 0.70 to indicate that the measured items are similar enough to be considered acceptable (Nunnally & Bernstein, 1994). It ensures that validity and reliability of the questionnaires (Table 1).

| Table 1 Results of Validity AND Reliability Testing | |||||

| Variables | n | Item | IOC | Validity(Factor Loadings) | Reliability(Cronbach’s Alpha) |

| Accounting Information Systems Implementation under Enterprise Resources (AISunderERP) | 30 | 23 | 1 | 0.662-0.918 | 0.983 |

| Accountant Competency (ATC) | 30 | 10 | 1 | 0.745-0.837 | 0.931 |

| Useful Information (UIF) | 30 | 8 | 1 | 0.810-0.874 | 0.765 |

| Successful decision-Making (DMS) | 30 | 5 | 1 | 0.856-0.903 | 0.927 |

Statistical Techniques

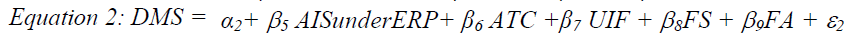

Multiple regression analysis is used to test hypotheses 1-5 to examine the relationship between a dependent variable and independent variables which are based on data qualified as interval scales (Hair et al., 2010). The regression equation is a linear combination of the independent variables that are the best for explaining and predicting the dependent variable. As a result, all proposed hypotheses are transformed into a statistical equation as shown:

....(1)

....(1)

.....(2)

.....(2)

Results

Table 2 presents descriptive statistics and correlation matrix for all variables. The Pearson correlation coefficient of all variables is between=0.011-0.578. Although a multicollinearity problem exists when inter-correlation between independent variables exceeds 0.80 (Hair et al., 2010), correlation analysis is employed to investigate initially. Meanwhile, VIF is more related to the statistical testing of interrelationships among independent variables in each equation. Concerning potential problems relating to multicollinearity, variance inflation factor (VIF) is used to provide information on the extent to which non-orthogonality among independent variables inflates standard errors. Table 3 shows that the maximum value of VIF is 1.051 (Equation 1) and 1.216 (Equation 2), well below the cutoff value of 10 as recommended by Hair et al. (2010), and Neter et al. (1989), meaning the independent variables are not correlated with each other. Thus, there are no multicollinearity problems encountered in this research.

| Table 2 Descriptive Statistics and Correlation Matrix | ||||||||

| Variables | Mean | S.D. | DMS | UIF | AIS Under ERP |

ATC | FS | FA |

| Successful Decision-Making (DMS) | 4.12 | 0.66 | 1 | |||||

| Useful Information (UIF) | 3.88 | 0.54 | 0.520** | 1 | ||||

| Accounting Information Systems Implementation under Enterprise Resource Planning (AIS under ERP) | 4.08 | 0.76 | 0.578** | 0.379** | 1 | |||

| Accountant Competency (ATC) | 4.28 | 0.55 | -0.011 | 0.181** | 0.041 | 1 | ||

| Firm Size (FS) | n/a | n/a | -0.074 | -0.076 | -0.075 | 0.033 | 1 | |

| Firm Age (FA) | n/a | n/a | -0.018 | -0.019 | 0.064 | -0.021 | 0.209** | 1 |

| Table 3 Results of Multiple Regression Analysis | ||

| Independent Variables | Dependent Variables | |

| Useful Information | Successful Decision-Making (DMS) | |

| (UIF) | ||

| Equation 1 | Equation 2 | |

| Constant | 0.104 | 0.071 |

| -0.106 | -0.087 | |

| Accounting Information Systems Implementation | 0.373** | 0.445** |

| under Enterprise Resource Planning (AIS under ERP): H1, H2 | -0.064 | -0.056 |

| Accountant Competency (ATC): H3, H4 | 0.165** | -0.094 |

| -0.063 | -0.052 | |

| Useful Information (UIF): H5 | 0.365** | |

| -0.057 | ||

| Control variables | ||

| Firm Size (FS) | -0.149 | -0.068 |

| -0.13 | -0.107 | |

| Firm Age (FA) | -0.047 | -0.068 |

| -0.13 | -0.106 | |

| Adjusted R2 | 0.162 | 0.438 |

| Maximum VIF | 1.051 | 1.216 |

Multiple Regression Analysis

Table 3 shows the regression analysis results of hypotheses 1 and 2. Firstly, the result shows that accounting information systems implementation under ERP positively affects useful information (β1= 0.373, p < 0.01) and successful decision making (β5= 0.445, p < 0.01). It is consistent with lzoubi (2011) and Daoud & Triki (2013) who found the integration of accounting information systems within ERP systems improving the quality of accounting information and higher firm performance. Nur & Irfan (2020) and Mardi et al. (2020) found that accounting information systems implementation generates useful information. The benefit of accounting information systems implementation under ERP improves the decision-making process and provides the quality of accounting information (Kocsis, 2019). Thus, Hypotheses 1 and 2 were supported.

Secondly, the finding of hypotheses 3 and 4 shows that accountant competency positively influences useful information (β2= 0.165, p<0.01), but has not an effect on successful decision making (β6= -0.094, p<0.10). Accordingly, there is a significant effect of the accountant's competency on information quality (Kasim, 2015). Besides, accountant competence positively affects information quality (Dewi et al., 2019). Moreover, Lata & Ussahawanitchakit (2015) found that high accountant competency increases useful information. Thus, Hypothesis 3 was supported, but Hypothesis 4 was not supported.

Thirdly, the finding of hypothesis 5 shows that useful information has a positive effect on successful decision making (β7= 0.365, p < 0.01). Useful information improves the effectiveness of decision-making (Chong & Eggleton, 2007). This is consistent with the studies of Keller & Staelin (1987) and Raghunathan (1999) who found that the quality of information enhances decision effectiveness. Esch et al. (2019) found that integrated information increases internal decision-making leads to higher sustainable value creation. Thus, Hypothesis 5 was supported.

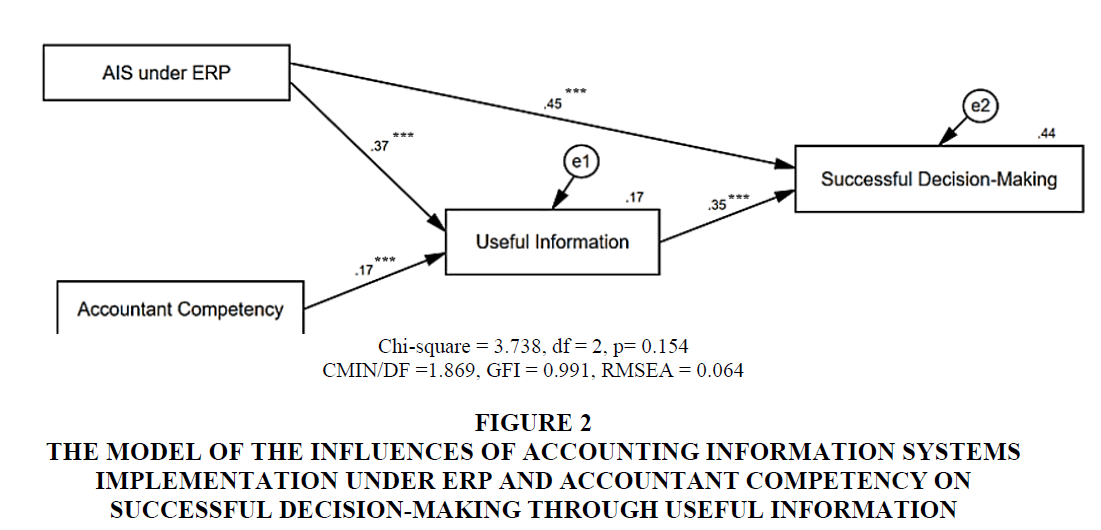

Path Analysis

The hypothesized model illustrated in Tables 4 and Figure 2 presents the results of the hypothesized relationships among accounting information systems implementation under enterprise resource planning, accountant competency, useful information, and successful decision-making (H6). The sample (n=210) was used to test the hypothesized relationships. The hypothesized model was tested using statistics indicating an acceptable model fit and was demonstrated to have a non-significant chi-square statistic (χ2=3.738 with df =2; ρ < 0.154).

| Table 4 Results of Total Effect (TE), Direct Effect (DE), and Indirect Effect (IE) Between Latent Variables | ||||||||||

| Endogenous | Parameter Coefficient |

Useful Information | Successful Decision-Making | |||||||

| Variables | ||||||||||

| Exogenous Variables |

TE | IE | DE | TE | IE | DE | ||||

| Accounting Information Systems Implementation under ERP | Unstandardized | 0.372*** | - | 0.372*** | 0.575*** | 0.131*** | 0.444*** | |||

| Standardized | 0.373*** | - | 0.373*** | 0.576*** | 0.131*** | 0.445*** | ||||

| Accountant Competency | Unstandardized | 0.163*** | - | 0.163*** | 0.057*** | 0.057*** | - | |||

| Standardized | 0.166*** | - | 0.166*** | 0.058*** | 0.058*** | - | ||||

| Useful Information | Unstandardized | - | - | - | 0.351*** | - | 0.351*** | |||

| Standardized | - | - | - | 0.351*** | - | 0.351*** | ||||

| Squared Multiple Correlations | ||||||||||

| Variables | Useful Information | Successful Decision Making | ||||||||

| R2 | 0.167 | 0.438 | ||||||||

| Note: *** p < 0.001, ** p < 0.01, * p < 0.05 | ||||||||||

Figure 2 The Model of the Influences of Accounting Information Systems Implementation Under ERP and Accountant Competency on Successful Decision-Making Through Useful Information

Goodness-of-Fit Test

The results of the Goodness of Fit Index (GFI), Adjusted Goodness of Fit Index (AGFI), Comparative Fit Index (CFI), and Normed Fit Index (NFI) exceed the threshold value of 0.90 and the hypothesized model revealed a good fit. A ratio of model fit statistics based on degrees of freedom below 3 indicates adequate model fit (χ2/df = 1.869). Root Mean Square Error of Approximation (RMSEA) value reached an acceptable value of 0.064. Specifically, GFI, CFI, AGFI, and NFI values reached an acceptable value of 0.90 (0.991, 0.998, 0.956, and 0.977, respectively). The hypothesized model can be classified as closely fitting the empirical data.

To test hypothesis 6 in Table 4, the hypothesized model was tested using Amos, where the paths between AIS implementation under ERP, accountant competency, useful information, and successful decision-making were estimated. The hypotheses regarding the relationships were tested based on the associated t-statistics. P-values were considered significant at the 0.05, 0.01, and 0.001 levels, respectively. Accounting information systems implementation under ERP significantly and positively influenced (ρ<0.001) useful information (Direct effect=0.373). Accounting information systems implementation under ERP significantly and positively influenced (ρ<0.001) successful decision-making (Direct effect=0.445) and indirectly, and positively influenced successful decision-making (Indirect effect=0.131), respectively. Accountant competency significantly and positively influenced (ρ<0.001) useful information (Direct effect=0.166). Accountant competency indirectly and positively influenced successful decision-making (Indirect effect=0.058), respectively. Useful information significantly and positively influenced (ρ<0.001) successful decision-making (Direct effect=0.351). Considering the standardized parameter estimates, the results of the hypothesized relationship were classified as significant. Thus, Hypothesis 6 was confirmed that accounting information systems implementation under ERP and accountant competency are positively associated with useful information and successful decision-making. It corresponds with the studies of Fisher & Bradford (2006); Grabski et al. (2011); Kung et al. (2015); Dewi et al. (2019); Esch et al. (2019); Kosis (2019); Nur & Irfan (2020); Rahmasari & Suardana (2020).

Conclusion

The purposes of this research were 1) to investigate the effect of accounting information systems implementation under enterprise resource planning on useful information and successful decision-making. 2) To investigate the effect of accountant competency on useful information and successful decision-making. 3) To confirm the model’s influences of accounting information systems implementation under enterprise resource planning and accountant competency with useful information and successful decision-making. In Thai-listed firms’ context, the results indicate that accounting information systems implementation under the ERP positively affects useful information and successful decision making. Secondly, accountant competency positively influences useful information but does not influence successful decision making. Thirdly, useful information has a positive effect on successful decision-making. The result of path analysis confirms the influences of accounting information systems implementation under ERP and accountant competency on useful information and successful decision-making. The results are following the resource-based view (RBV) that valuable, rare, inimitable, and non-substitutable resources make a competitive advantage and enhance firm performance. AIS implementation under ERP and accountant competency is valuable, rare, inimitable, and non-substitutable resources that utilize to create competitive advantages and the firm’s growth. This research contributes to theoretical implications including, 1) the research expands to the previous literature on there is the relationship among AIS implementation under ERP, accountant competency, useful information, and successful decision-making. Secondly, this research confirms the prior research about the link between AIS implementation under ERP, accountant competency, useful information, and successful decision-making in Thai-listed firms. Thirdly, this research extends the holistic view of accounting information systems implementation under ERP and accountant competency. The first limitation is the results lack confirmation again such as focus groups of the key informants. Secondly, data collected from Thai-listed firms cannot explain comprehensively the context of other sections. Future research should use a mixed-method between qualitative and quantitative research to gain the most precise analytical results.

References

- Aaker, D.A., Kumar, V., & Day, G.S. (2001). Marketing Research. New York, NY: John Wiley and Sons

- Adamides, E., & Karacapilidis, N. (2020). Information technology for supporting the development and maintenance of open innovation capabilities. Journal of Innovation & Knowledge, 5(1), 29-38.

- Agbani, E., & Nnadi, C.S.O. (2020). The role of accounting information systems on organizational performance (a study of Nigerian bottling company, 9th mile corner, Enugu). Sapientia Global Journal of Arts, Humanities and Development Studies. 3(2), 76-87.

- Al-Harthi, N.J., & Saudagar, A.K.J. (2020). Drivers for successful implementation of ERP in Saudi Arabia public sector: A case study. Journal of Information and Optimization Sciences, 41(3), 779-798.

- Alzoubi, A. (2011). The effectiveness of the accounting information system under the enterprise resources planning (ERP). Research Journal of Finance and Accounting, 2(11), 10-19.

- Appelbaum, D., Kogan, A., Vasarhelyi, M., & Yan, Z. (2017). Impact of business analytics and enterprise systems on managerial accounting. International Journal of Accounting Information Systems, 25, 29-44.

- Aral, S., & Weill, P. (2007). IT assets, organizational capabilities, and firm performance: How resource allocations and organizational differences explain performance variation. Organization Science, 18(5), 763-780.

- Armstrong S.J., & Overton T.S. (1977). Estimating non-response bias in mail surveys. Journal of Marketing Research. 14(3), 396-402.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Bharadwaj, A.S. (2000). A resource-based perspective on information technology capability and firm performance: an empirical investigation. MIS Quarterly, 16(4), 169-196.

- Bourguignon, A. (2005). Management accounting and value creation: the profit and loss of reification. Critical perspectives on accounting, 16(4), 353-389.

- Chofreh, A.G., Goni, F.A., Klemeš, J.J., Malik, M.N., & Khan, H.H. (2020). Development of guidelines for the implementation of sustainable enterprise resource planning systems. Journal of Cleaner Production, 244(1), 118655.

- Chong, V.K., & Eggleton, I.R.C. (2007). The impact of reliance on incentive-based compensation schemes, information asymmetry and organizational commitment on managerial performance. Management Accounting Research, 18(2), 312-342.

- Daoud, H., & Triki, M. (2013). Accounting information systems in an ERP environment and tunisian firm performance. International Journal of Digital

- Dewi, N., Azam, S., & Yusoff, S. (2019). Factors influ18). Towards a competency model: A review of the literature and the competency standards. Education and Information Technologies, 23(1), 225-236.

- El-Asame, M., & Wakrim, M. (20Accounting Research, 13(2), 1-35.

- encing the information quality of local government financial statement and financial accountability. Management Science Letters, 9(9), 1373-1384.

- Esch, M., Schnellbächer, B., & Wald, A. (2019). Does integrated reporting information influence internal decision making? An experimental study of investment behavior. Business Strategy and the Environment, 28(4), 599-610.

- Fisher, I.E., & Bradford, M. (2006). New York State agencies: a case study for analyzing the process of legacy system migration: Part II. Journal of Information Systems, 20(1), 139-160.

- Grabski, S.V., Leech, S.A., & Schmidt, P.J. (2011). A review of ERP research: A future agenda for accounting information systems. Journal of Information Systems. 25(1), 37-78.

- Hair, J.F., Black, W.C., Babin, B., Anderson, R.E., & Tatham, R.L. (2010). Multivariate Data Analysis. Englewood Cliffs, NJ: Pearson Education Inc.

- Kabir, M.R. (2020). Impact of ERP implementation on productivity and profitability: An empirical study on the largest Bangladeshi steels manufacturer. International Journal of Entrepreneurial Research, 3(4), 88-94.

- Kasim, E.Y. (2015). Effect of government accountants competency and implementation of internal control to the quality of government financial reporting. International Journal of Business, Economics and Law, 8(1), 97-105.

- Keller, K.L., & Staelin, R. (1987). Effects of quality and quantity of information on decision effectiveness. Journal of Consumer Research, 14(2), 200-213.

- Kocsis, D. (2019). A conceptual foundation of design and implementation research in accounting information systems. International Journal of Accounting Information Systems, 34(4), 1-10.

- Krejcie, R.V., & Morgan, D.W. (1970). Determining sample size for research activities. Educational and Psychological Measurement, 30(3), 607-610.

- Kung, L., Cegielski, C.G., & Kung, H.J. (2015). An integrated environmental perspective on software as a service adoption in manufacturing and retail firms. Journal of Information Technology, 30(4), 352-363.

- Lata, P. (2020). The influences of participatory management and corporate governance on the reduction of financial information asymmetry: Evidence from Thailand. The Journal of Asian Finance, Economics, and Business, 7(11), 853-866.

- Lata, P., & Ussahawanitchakit, P. (2015). Management accounting system effectiveness and goal achievement: Evidence from automotive businesses in Thailand. The Business and Management Review, 7(1), 322-334.

- Lata, P., Boonlua, S., & Raksong, S. (2018). Integrated performance measurement system strategy and firm success: an empirical investigation of Thai-Listed Firms. Journal of Accountancy and Management, 10(3), 33-50.

- Ley, T., & Albert, D. (2003). Identifying employee competencies in dynamic work domains: methodological considerations and a case study. Journal of Universal Computer Science, 9(12), 1500-1518.

- Mardi, M., Perdana, P.N., Suparno, S., & Munandar, I.A. (2020). Effect of accounting information systems, teamwork, and internal control on financial reporting timeliness. The Journal of Asian Finance, Economics, and Business, 7(12), 809-818.

- Nabeeh, N.A., Abdel-Basset, M., El-Ghareeb, H.A., & Aboelfetouh, A. (2019). Neutrosophic multi-criteria decision-making approach for IOT-based enterprises. IEEE Access, 7, 59559-59574.

- Neter, J., Wasserman, W., & Kutner, M.H. (1989) Applied Linear Regression Models (2nd ed.). Homewood, IL: Richard D. Irwin, Inc.

- Nunnally J.C., & Bernstein I.H. (1994). Psychometric theory. New York, NY: McGraw Hill.

- Nur, D.P.E., & Irfan, M. (2020). ERP-based accounting information system implementation in organization: A study in Riau, Indonesia. The Journal of Asian Finance, Economics, and Business, 7(12), 147-157.

- Raghunathan, S. (1999). Impact of information quality and decision-maker quality on decision quality: a theoretical model and simulation analysis. Decision Support Systems, 26(4), 275-286.

- Rahmasari, L.P.I., & Suardana, K.A. (2020). User technical capability moderate the effect computer-based accounting information system on individual performance. American Journal of Humanities and Social Sciences Research, 4(5),196-203.

- Samiei, E., & Habibi, J. (2020). The mutual relation between Enterprise resource planning and knowledge management: A review. Global Journal of Flexible Systems Management, 21(1), 53-66.

- Speier, C. (2006). The influence of information presentation formats on complex task decision-making performance. International Journal of Human-Computer Studies, 64(11), 1115-1131.

- Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171-180.