Research Article: 2021 Vol: 24 Issue: 1S

Accountability Optimization of Local Budget Policy in Indonesia

Siti Aisyah, Universitas Terbuka

Zainur Hidayah, Universitas Terbuka

Darmanto, Universitas Terbuka

Meita Istianda, Universitas Terbuka

Keywords

Accountability, Achievement, Local Budget Policy, Local Government, Strategies

Abstract

The purpose of this study is to analyze and formulate strategies to enhance the accountability of local budget policy by determining the supporting and inhibiting factors. This is a qualitative research carried out in South Tangerang City, Banten Province. Data were analyzed by coding and elaborating on the policies, in accordance with the objectives of local government in Indonesia. The research focuses on achieving accountability from the aspects of legitimacy, moral conduct, responsiveness, openness, optimal resource utilization, with an increase in efficiency and effectiveness to optimize regional budget policy. The result showed that performance-based budgeting has not supported the achievement of accountability of local budget policies in Indonesia because it tends to measure agency performance more than the impact on society. Therefore, the optimization in the implementation of local budget policy accountability can be carried out by balancing the orientation of local budget policy from pro-bureaucracy to pro- citizens, local government leaders committed to government ethics and local budgets prioritize openness and public participation. The implication of this research is the importance associated with evaluating the performance-based budgeting policy for citizens' welfare.

Introduction

Law Number 17, 2003 of the Republic of Indonesia on State Finance, stated that budget is an instrument of accountability, a concept used to describe the government's obligations. Accountability is also related to the government's obligation to explain and account for its performance to the community. According to Callahan (2006), it is also associated with the ethics, morals, and obligation used by the government to exercise authority, and implement programs (Callahan, 2006).

Accountability of local government budget policy performance is reflected in the allocation of local budgets that illustrate the government's plan regarding the activities to be carried out within a certain period. Due (1985) reported that a government budget is a financial plan used to make decisions regarding expenditures and further oversight. The local budget policy is a blueprint that explains the activities to be carried out in one fiscal year. In addition, Hamdi (2014) stated that the local budget policy is a public policy used to solve existing community problems. In practice, local budget policies in Indonesia are generally used for internal processes carried out by the bureaucracy than for society's welfare. Furthermore, the 1945 Constitution's preamble stated that the main task of forming the government of Indonesia was to protect all peoples, improve their welfare, and participate in carrying out world order. Article 18 paragraph (2) stated that the provincial, district, and city governments regulate and manage their affairs in accordance with the principle of autonomy and assistance. The constitutional mandate implies that the task of the government is to prosper the community, while the local government has the authority to regulate its budget for the welfare of the people. Several studies show that local budget policy is more oriented to bureaucracy and leads to the ruling political elite's interests. An instance is the research carried out by Hutapea (2013).

In Indonesia, the management of state finances follows the principle of performance-based budgeting in accordance with Law Number 17, 2003. Osborne & Hutchinson (2004) stated that performance-based budgeting prioritizes output rather than the budget's impact on the wider community. Some of the problems found in implementing local budget policies, using performance-based budgeting are as follows:

a) The realization of capital expenditure from 2014-2018 was 35.11% of the total local expenditure. This fact is supported by the poor maintenance of city infrastructure and Green Open Space and the ratio between the numbers of students/classrooms (1:37) that do not comply with the Minimum Service Standards of 1:32.

b) The commitment of the City Government is still low in carrying out efforts to increase public participation, as indicated by a closed meeting in the budgeting process carried out at the Regional Parliament (DPRD) Budget Board.

c) Ethical and moral issues, as indicated by the existence of cases of corruption and nepotism in local government agencies. This is associated with the non-commendable behaviors of the leaders and members of the Regional Parliament in wasting public money by purchasing luxury cars and the tendency of transaction fees for local budget approval.

d) As indicated by the return of development funds in the last 5 (five) years, government affairs have not been implemented optimally. In addition, there are also audit findings from the Indonesian Supreme Audit Institution (BPK) related to non-compliance with regulations in several aspects and the poor quality of internal auditors.

The implementation of performance-based budgeting is still far from the realization of the welfare of local communities as mandated by the Constitution 1945. This is also not in line with the principles of accountability and democracy, as indicated by the Gettysburg Formula, which defined democracy as a government of the people, by the people, and for the people. On the other hand, there are principles of performance based on budgeting, which acts as an alternative for implementing budget policies.

Literature Review

Some measures used to achieve accountability include the validity of decision-makers, moral standards, responsiveness, openness, optimal use of resources, and efforts to improve efficiency and effectiveness (Turner & Hulme, 1997). Based on type, it is classified into 4 (four), namely bureaucratic/administrative, legal, professional, and political (Romzek & Dubnick, 1998). Furthermore, Jabra & Dwivedi (1989), scientifically grouped into 5 (five) types, namely administrative/organizational, legal, political, professional, and moral accountability. In this research, accountability is classified into 4 types, namely administrative/organizational, legal, political, and moral, with bureaucratic accountability inherent the administrative.

In addition to analyzing the achievement of public accountability based on aspects and type as described by Turner & Hulme (1997) and Romzek & Dubnick (1998), it is also analyzed in line with the review of government performance. Analysis of the allocation of government budget policies is useful to determine the alignments of government budget policies, in terms of more pro-community welfare or the bureaucracy's benefit. The BSC approach looks at organizational performance from the perspective of communities, learning and growth, internal processes, and finance (Niven, 2008; Kaplan & Norton, 2004). BSC implementation in the public sector is different from the private sector. In the public sector, the measure of success depends on customer satisfaction, while in private, it is from the financial perspective. Table 1 shows the differences between BSC in the private and public sectors.

| Table 1 Differences in BSC Private Sector and Public Sector Orientation |

|||

|---|---|---|---|

| No. | Feature | Private Sector | Public Sector |

| 1 | Strategic Objectives | Competition and Difference | Success in realizing goals |

| 2 | Financial Perspective | Profit, Growth, and Market Share | Creating value and effectiveness of activities |

| 3 | Strategic followers of the organization (stakeholders) | Shareholders, Managers, and Buyers | Government, Tax Payers, and Partners |

| 4 | Demand Result | Customer satisfaction | Customer satisfaction |

| Source: Krukowski & Kamieniak, 2010 | |||

BSC in the public sector varies depending on the organization's function and role for consumers or the community it serves (Krukowski & Kamieniak, 2010). Its advantage as a strategic performance management tool lies in the cause and relationship effect in the strategy map that allows for the proper understanding of the public organization and the possible techniques needed for everyone to contribute to the strategy's implementation. Organizations need to pay attention to various factors that hamper success as a Strategic Performance Management System (SPMS). While Umashev & Willett (2008) stated the factors that can hamper the success of SPMS as follows: 1) the strategies used by organizations to connect business unit levels, which is very important in determining the scorecard design, 2) effective communication, 3) leadership, 4) training, 5) feedback and adaptation systems, 6) low employee empowerment and 7) inadequate incentive structures.

Syahdan, et al., (2020) stated that cascading is similar to the concept of alignment, indicated in the private sector, as defined by Kaplan's "Car" case study. In Indonesian local governments, the cascading factor is a problem that arises while aligning government activities with the blueprint for sustainable development. However, Osborne & Hutchinson (2004) reported that leaders use scorecards to make performance public, and at the same time, it can be used as the basis for financial rewards. However, various studies in Indonesia showed that the implementation of performance-based budgeting, both by the central and local governments, are still not in accordance with a predetermined grand design (Surianti & Dalimunthe, 2015).

Law Number 17 of 2003 on State Finance budget policy in Indonesia is based on the concept of performance-based budgeting and the implementation part of reforms undertaken by the government after the Orde Baru regime. However, after more than 20 years of reforms implemented in Indonesia, the performance-based budgeting is still far from expectations. This is due to the increase in poverty in regional and individual disparities, poor education, health, and infrastructure. Therefore, a policy to boost qualified local spending for fiscal decentralization consolidation is needed (Juanda & Heriwibowo, 2016). Various studies carried out in Indonesia showed that the implementation of performance-based budgeting is still a 'potluck' (Surianti &Dalimunthe, 2015).

According to Osborne & Hutchinson (2004), performance-based budgeting is included in the traditional agency and cost-based budgets (old game), which uses the previous year's figures to increase or reduce the coming year's budget. Therefore, budget size is not based on the community's problems or needs, thereby leading to errors in policymaking. Performance-based budgeting compiled by the staff, executives, and legislators use data obtained from institutional performance measurements to use money. Osborne & Hutchinson's (2004) theory on budgeting for outcomes offers concepts that prioritize community needs based on historical data. Therefore, budgeting for outcomes is not based on the previous year's basic budget, rather it is on government priorities that are decided together with direct benefits to the welfare of society.

Research Methods

This research aims to explore strategies that can be taken to improve the application of local budget policy accountability in Indonesia by determining the supporting and inhibiting factors. This is a qualitative research with data obtained from informants using the purposive and snowball sampling techniques. The purposive sampling is used to determine informants from local government agencies, which include the Mayor, members of Regional Parliament, and heads of Regional Development Planning Agency, Regional Revenue Service, and Regional Personnel Agency. Meanwhile, snowball sampling is used to determine informants from the community, namely community leaders, members of political parties, and local academics, comprising of 3, and 1 persons, respectively. Data needed in this study includes data from in-depth interviews, documents, and other supporting data.

The analysis focuses on strategies to increase accountability, obtained from data processing based on the coding results and the formulation of categories needed by the local government administrators in order to improve the accountability of budget policies, by taking into account its performance, supporting factors, and obstacles.

Discussion

Analysis of the achievement of accountability based on aspects of legitimacy, moral conduct, responsiveness, openness, optimal resource utilization, and improving efficiency and effectiveness are shown in Table 2.

| Table 2 Analysis Table of Achieving Accountability of Local Budget Policy |

|||

|---|---|---|---|

| No | Accountability aspects | Focus of Analysis | The Achievement |

| 1 | Legitimacy | The adequacy of laws and regulations supports the legitimacy | Good: |

| Laws and regulations are adequate: | |||

| · Regulation on Regional Medium-Term Development Plans (RPJMD) | |||

| · Regulation on budget policy | |||

| · Regulations on local tax and retribution. | |||

| Bureaucratic representation strengthens the legitimacy | Less: | ||

| Size: bureaucracy is too big and tends to overlap in carrying out government affairs. | |||

| Capacity: bureaucracy is capable of identifying problems, using IT, however, it is unable to realize the program. | |||

| Culture: kinship element is relatively high. | |||

| Legitimacy is supported by good legislation. | Good: | ||

| The government runs in accordance with statutory regulations | |||

| Delegation of Authority | Good: | ||

| Formal delegation is realized through the existence of a source of authority for the administration of regional government. | |||

| The attributive authority lies with the State Government, which is subsequently delegated to oversee the autonomous regions. | |||

| Standing Order | Good. | ||

| Regulations are sufficient | |||

| 2 | Moral Conduct | Internalization of social values, justice, and public interest | Less: |

| There are cases of corruption and nepotism involving the leader's family | |||

| Professional values ??and training programs | Less: | ||

| KORPRI has not functioned adequately in increasing the corp's enthusiasm for bureaucracy | |||

| 3 | Responsiveness | Public meeting | Less: |

| Although the Musrenbang mechanism is available, the output has not been maximized | |||

| Public hearing | Enough: | ||

| Carried out by the DPRD through a recess mechanism | |||

| Space for public participation and debate | Less: | ||

| Public forums for budget policies are unavailable, and input is not utilized for the formulation of local policies | |||

| 4 | Openness | Openness to the public in discussing policies in parliament | Less: |

| Regional budget discussions are closed to the public therefore, they are prone to corruption, collusion, and nepotism | |||

| Annual report information to the public | Less: | ||

| People are not aware of the Mayor's annual report (LKPJ) information. | |||

| 5 | Optimal Resource Utilization | Budget income | Very Good: |

| Exceeds target | |||

| Realization of expenditure | Less: | ||

| The realization target of direct and capital expenditure is not achieved. | |||

| Financial procedure | Kurang: | ||

| Rules tend to frequently change, which causes confusion among program implementers. | |||

| Auditing | Enough: | ||

| Internal auditor competencies are low, however, the BPK audit is good. | |||

| Public question | Less: | ||

| The right to ask is represented by DPRD members, and this depends on the orientation of DPRD members. | |||

| 6 | Improving Efficiency and Effectiveness | Information systems | Good: |

| LAN connection and online services are properly run. | |||

| Aaudits | Good: | ||

| Implemented by BPK to evaluate the efficiency of inputs, outputs, and outcomes | |||

| Value for money | Less: | ||

| The outcome has not yet been measured | |||

| Setting objectives and standard | Good: | ||

| Using standards: ISO 9001: 2008, Government Accounting Standards (SAP), and Community Satisfaction Survey. | |||

| Program guidelines | Good: | ||

| Available technical and operational guidelines | |||

| Appraisal | Good: | ||

| There are an audit mechanism and an annual report | |||

| Feedback from public | Less: | ||

| There is no mechanism. | |||

| Source: Analysis Results, 2018 | |||

Table 2 shows that accountability can be used to analyze trends of local budget policies. The inappropriate and appropriate measures used to analyze accountability is the Royal Prerogative Aspect. According to Turner & Hulme (1997), the tools offered are an option for analyzing accountability. Creswell (2013) stated that the process of data analysis and categorization is carried out by analyzing the overall data, the findings of achieving accountability in terms of legitimacy, optimal resource utilization, and improving efficiency and effectiveness. However, the aspects of moral conduct, responsiveness, and openness are lacking, irrespective of the fact that the three aspects are supporting elements in democratic government administration. This finding leads to the conclusion that local governments have not been able to provide guarantees that local budget policies are prepared for the interests and welfare of the people. In other words, local budget policies have not been optimally utilized for regional autonomy. This study's findings are in line with the theory proposed by Callahan (2006), which stated that accountability is the government's obligation to explain to the public the activities based on democratic principles, good morals, and ethical actions.

Furthermore, based on type, the achievement of budget policy accountability in the City of South Tangerang can be sorted from the best to the lowest, namely administrative, legal/juridical, political, and moral accountability. Based on the analysis of budget policy performance by mapping budget achievements with the Balanced Scorecard on Government and Non-Profit Organizations, there are several supporting factors in achieving budget accountability:

a) From a financial perspective, the City Government is able to exceed local revenue targets. This achievement is supported by the potential for adequate local taxation and retribution, as well as sufficient funds, which originate from central government transfer funds.

b) From the learning and growth perspective, the City Government is able to encourage the use of information technology to support speed in services and governance. The availability of human resources is quite adequate with the level of education of employees including bachelor, master and doctoral 75% and the average young age, that are technology literate. This potential is used to develop information technology-based services, thereby accelerating services to the public, such as online licensing services, taxation, correspondence, and electronic budgeting. Learning and growth are also supported by the government's desire to improve public services. This is evident from the acquisition of ISO Certification for licensing services with an increase in audit status by the Indonesian Supreme Audit Institution (BPK) over financial statements. In addition, the climate of information technology-based innovation has found a place to grow and develop within the government environment. However, in the past five years, technological innovations have not been targeted by the government.

c) From the perspective of internal processes, support from the political elite and the community for government programs were determined. This can be seen from the mutual communication between the executive and the Regional Parliament in implementing the Local Medium-Term Development Plan for five years. Furthermore, the process of informing the public of government activities through mass media and information technology has greatly assisted the government in delivering its programs. In general, the social and political situation in South Tangerang City is conducive and allows the government to achieve its various programs, thereby increasing accountability to the public.

The inhibiting factors in the implementation of local budget policy accountability are as follows:

a) From a financial perspective, it was found that the budgeting process is less open to the public. The Regional Parliament Standing Orders found that the meeting between the Budget Council and the Local Budgeting Team (TPAD) was internal or not open to the public. Therefore, there was no public control in allocating the budget. Furthermore, community participation is limited to the local development planning discussion (Musrenbang). This because the public is not allowed to obtain more information on the proposals submitted in the Musrenbang. Budget planning is not open to the public and vulnerable to irregularities, thereby leading to corruption and nepotism in South Tangerang City. An example is the procurement of medical devices for general medicines in Health Services that occurred in 2015.

b) Government ethics have not been properly implemented as an ethical enforcement agency within the bureaucratic environment, as seen from the malfunctioning of the Indonesian Employee Corps (KORPRI). Therefore, although KORPRI is the only place for Civil Servants, their activities and programs are not related to Civil Servants' ethical enforcement. In addition, a professional code of ethics was also not found.

c) From a customer/citizen perspective, bureaucratic weaknesses are found in translating visions, missions, and strategies into programs, especially those related to public services. This is because there are still many activities and programs related to the community's services that cannot be realized. The budget for development programs tends to be returned to the State Treasury. An example is the failure to construct a school building, which was caused by a failed auction. In addition, the ability of the bureaucracy is also not yet supported by certain professionals, such as city park and tax audit experts, although one of the visions of South Tangerang City is to be a Comfortable City

d) Changes that often occur in laws and regulations cause confusion to the implementing apparatus in the area. Changes in regulations need to be adjusted to the dynamics that occur in society. However, with frequent changes in regulations, the bureaucracy becomes confused and needs time to adjust to new regulations. This makes the government slow in realizing development programs, thereby affecting local governments' performance, especially those related to public services.

This research indicated that customers /citizens' perspective has not become the orientation of the local budget policy. This is reflected in the field of public services with infrastructure development programs that are unable to materialize due to several reasons such as failed auction, incorrect pricing, etc. This contradicts the policy of structuring urban infrastructure as one of the main priorities in the Local Medium-Term Development Plan (RPJMD). For example, in health services, the average programs and educational services that can be realized are 71.62% and 79.69% in five years. Meanwhile, the education and health services sector is basic in the local government's administration with discouraging achievements. Organizational swelling is found from the perspective of internal processes, and this causes overlaps in the implementation of government affairs, which leads to a waste of budget. Furthermore, difficulties in determining job analysis are perceived to interfere with the fulfillment of Human Resources in accordance with the fields and needs of local government organizations. However, from a financial perspective, there are problems with the management of local assets, which are non-compliance with regulations, as indicated in Indonesian School Operational Assistance Programs/BOS funds. Improper planning and the inability to manage development programs led to the State Treasury's return of development funds.

From the description above, the root problems in implementing local budget policy accountability are as follows. Firstly, the local budget policy performance is still weak in the field of public service provision due to overlapping tendencies, inappropriate employee placement, and incomplete job analysis. Secondly, the application of government administrators' moral aspects is still low, as indicated by the achievement of accountability from the aspect of moral behavior, which ranks lowest. Thirdly, the lack of openness in the budgeting process is based on the Local Budget Team's agreement with the Regional Parliament and not on the development priorities needed by the community. Fourthly, city governments are less responsive in solving community problems because budgeting is not a problem-solving argument in society.

Based on the findings of strengths and weaknesses in implementing performance-based budgeting, this study explores further strategies that can be developed to optimize the accountability of local budget policies. For instance, Yarger (2006) implemented a strategy at all levels to calculate the objectives, concepts, and resources within acceptable risk limits to create more profitable results. However, in the context of this study, the strategy is aimed at determining the advantages of people's welfare. Popescu (2020) stated that the strategy's function is to ensure a match between policy objectives and the means used to achieve goals. Therefore, in implementing a strategy, it is necessary to ensure that the local government policy's objectives are in line with the existing budget and utilized means. In addition, a strategy is defined as the art and science of developing and using national strength and instruments in an integrated way to achieve multinational goals. The strategy provides direction for countries that seek to maximize profit while minimizing loss through a complex and rapidly changing environment into the future. The following strategies can be developed based on the problems discussed above.

Design Local Budget Policies that are Pro-Citizens

Government activities funded by local budgets are mapped into four aspects, namely interests of citizens, internal processes, learning as well as growth and finance. The breakdown of these activities into four aspects is expected to make it easier to evaluate each unit by utilizing reliable information technology. Furthermore, each unit's performance is more easily monitored by the leadership to ensure the performance assessment is more objective. The government needs to provide space for innovation with Information Technology used to support the services that are fast, precise, transparent, and open to its users' Performance-based budgeting. This is only associated with detailed activities based on work programs, therefore, it only stops at the output and does not measure its impact on the welfare of citizens.

Committed Government Leadership on Accountability

Data from the Indonesian Corruption Eradication Commission (KPK) shows that there were 124 cases of regents and majors involved in corruption from 2014-2019. Meanwhile, the Indonesian Corruption Watch noted that 2554 members of the were involved in corruption from 2014-2019. One of the factors triggering the spread of corruption cases in the local government is kinship, which acts as a determining factor in head office units' leadership. Rasyid (2017) stated that the elected regents/mayors do not need to accommodate loyalists and opportunists that are only interested in maintaining power stability by embracing representatives of existing political forces. Therefore, without making competency an important consideration factor, difficulties are experienced in developing a solid and effective work team. Government leadership needed in upholding accountability need to be committed to obeying the ethics and enforcing discipline within the environment. Hence, leadership that promotes accountability needs to be upheld. Krahmann (2017) reported that in the era of global governance, legitimacy, performance, and performativity of actors are needed by the public as a commitment to uphold accountability.

The Enforcement of Government Ethics

The existing data and information indicate that the boundary between good, bad, appropriate, and inappropriate behavior does not underline government administrators' mindset. This is due to the absence of a code of ethics for Civil Servants (ASN), and the malfunctioning of the Indonesian Civil Servants Corps (KORPRI) in carrying out ethical enforcement properly. Therefore, efforts to uphold ethics need government intervention to shape the community's mindset on the strict boundaries between good and bad. Fukuyama (2004) reported that the state plays a significant role in forming society, which is defined by Nietzsche (2004) as a moral community that accepts good and bad ideas. Rasyid (2007) stated the importance of government regulating ethics, as an ethical basis for good governance, to reduce the abuse of power. Therefore, ethics enforcement in government circles needs to be improved by their intervention.

Improving the Climate of Openness and Community Participation in the Budgeting Process.

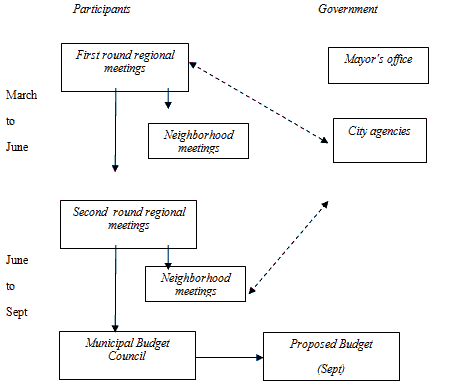

It is very important for the public to understand the reasons governments fund a specific project. Similarly, the public needs to be involved in the budget policies preparation process and the strategies used to spend the money. According to Fung & Weil (in Lathrop & Ruma, 2010), the reasons for public knowledge are not only for reasons of laws and policies, rather it is due to the decision-making processes regarding the allocation of local budget policies. Existing data and information indicate that local governments lack the intention to apply the openness concept, as shown in the closed discussion of the draft on Local Revenue and Expenditure. Space for public participation is also limited, while the mechanism is only reflected in the planning of development proposals, which at a later stage prevents the community from knowing the status of the proposal. According to Shah (2007), community participation in budgeting is essential because it increases social justice and helps individuals become better citizens. It also strengthens social justice and helps people become better citizens. Shah (2007) further stated that participatory budgeting aims to instill citizen engagement values in the most basic and formal governance procedures. Therefore, citizen involvement can encourage more effective accountability, transparency, and distribution of resources. Openness in the budgeting process is shown in Figure 1, which illustrates the concept of participation often used as a reference in implementing the participatory budgeting process as implemented in Porto Alegre, Brazil. Citizen involvement encourages better accountability, transparency, and distribution of available resources. Countries that implement participatory budgeting include Brazil, the US, South Africa, Uganda, and India.

At the initial level, a climate of openness in the budgeting process is carried out by allowing interested people to follow the process as invited guests. This is also carried out when discussing other Local Draft Discussion sessions. In addition, the climate of openness in the budgeting process can be conducted by providing continuous information on the development of discussions through the mass media or by utilizing Information Technology.

Optimizing the Role of Ombudsman

It is necessary to optimize the Ombudsman's role and function to optimize citizen satisfaction with public services. Ombudsman is a state institution that has the authority to oversee the administration of public services carried out by the state and government administrators or individuals that are partially or wholly funded from the state or local budget. According to Article 18 of the Republic of Indonesia Law Number 25/2009 concerning Public Services, the public is allowed to complain against organizers that divert service standards and fail to improve services to the organizers. The Ombudsman of the Republic of Indonesia (ORI) was formed in accordance with the Law of the Republic of Indonesia Number 37 of 2008. Indonesian Ombudsmen can be formed in provinces, districts, and cities. Existing information shows that the Banten Province Ombudsman, in 2013, found the occurrence of illegal levies at the Office of the Local Environmental Agency related to the management of the requirements of an Environmental Impact Analysis (AMDAL) for the industry in South Tangerang City. However, in subsequent years the Banten Province Ombudsman function was passive, and numerous activities were carried out related to the quality of public services provided. In some countries, the Ombudsman's role and function is significant in determining efforts to improve public services. This is because one of the government's functions is to provide quality services to the public, to ensure that they take advantage of the existence of the Ombudsman in overseeing services to the community, to increase the accountability of state administrators.

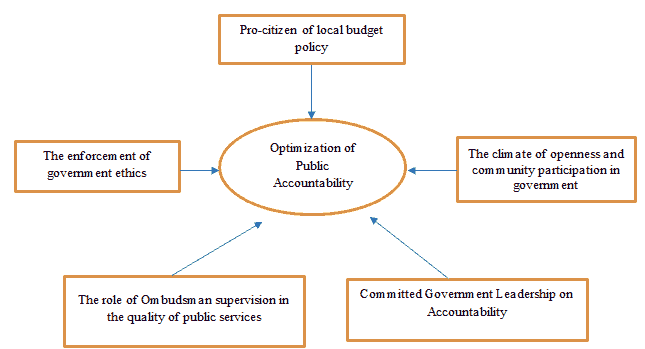

The above strategies are efforts to overcome weaknesses in the implementation of local budget policy accountability in accordance with Law Number 17/2003 of the Republic of Indonesia. Therefore, based on the above findings, the concept map of strategies to optimize the application of public accountability is shown in Figure 2.

The figure shows that performance-based budgeting tends to be rigid and result-oriented, with little consideration for community proposals and their welfare impact. The failure of the auction in the procurement of urban infrastructure is due to a mismatch of planned prices prevailing in the market, which is also an example of the weakness of performance-based budgeting that is less flexible. Meanwhile, the flexibility in allocating budget for the community's benefit is an effort to realize accountability. Osborne & Huthcinson (2004) stated that governments have expanded flexibility for accountability agreements to individual departments and institutions. The idea is to give them adequate freedom to manage their budgets, personnel, and pricing, demanding greater accountability. Furthermore, the flexibility (discretion) with certain limitations in the use of the budget can be justified as long as it increases the wider community's accountability and interests.

The result of local budget imbalances regarding public perspectives and growth compared to internal and financial processes implies that local budget policies do not emphasize community interest. In addition, the findings of the large number of government activities financed by the local budget, which emphasizes more on internal processes and the achievement of revenue targets, show that accountability of local budget policies is still weak. Efforts to optimize internal processes and local revenue targets are optimal, however, it needs to be accompanied by a consideration that the activities carried out in accordance with the objectives of local autonomy with significant benefits for the community. Therefore, the application of performance-based budgeting needs to be further evaluated.

Conclusion

In conclusion, this research determined the strategies needed for the optimal implementation of regional budget policy in Indonesia, which currently tends to prioritize agencies' performance rather than citizens, with the less open and responsive budgeting process, thereby ignoring moral conduct. The research also showed that the implementation of performance-based budgeting is still far from the goal of forming the government, especially local governments in Indonesia. Furthermore, performance-based budgeting cannot function as an accountability tool because it focuses more on its output than its impact. However, strategies to optimize the achievement of budget policy accountability can be carried out by developing a budgeting model that balances the interests of the welfare of citizens, internal processes, learning, growth, and local revenue targets. This is carried out to ensure that government activities are carried out comprehensively. Moral and ethical enforcement strategies for government administrators aim to improve moral ethics. Therefore, the strategy to increase open government and community participation aims to prevent discrepancies, thereby promoting transparency. The research implication is needed to change performance-based budgeting, which only measures the success of the output aspect and does not pay attention to the actual problems that occur in the community and the policy's impact in accordance with the objectives of local government in Indonesia.

Declarations

Funding

This study was funded by Indonesian Open University.

Conflicts of Interest/Competing Interest

The implementation of performance-based budgeting began to be applied in Indonesia in 2003. Its implementation tends not to side with the public interest. Government budgets, especially local governments, are spent more on internal bureaucratic processes, so that the public budget is less than bureaucratic spending and tends not to fulfill the principle of public accountability. Even though the government budget should be used more for the public interest in accordance with the principles of government of the people, by the people, for the people. This article seeks to explore strategies to optimize accountability of local budget policy in Indonesia.

Availability of Data and Material

Some data can be accessed on the tangsel.go.id, tangselkota.bps.go.id, and tangerangselatankota.go.id page.

Code Availability

Not applicable.

Authors Contributions

Basic ideas: [Siti Aisyah]; Writing outlines: [Siti Aisyah]; Presenting research data: [Siti Aisyah]; Presenting literature reviews: [Zainur Hidayah]; Aligning ideas, data, and language: [Zainur Hidayah]; Translate articles: [Darmanto]; Assist in presenting research data: [Meita Istianda].

References

- Callahan, K. (2006). Elements of effective governance. measurement, accountability and participation. New York: Taylor & Francis.

- Creswell, J.W. (2013). Research designs: Qualitative, quantitative, and mixed approaches. Translate. Yogyakarta: Student Library

- Due, J.F. (1985). State finances: Translation of Iskandarsyah and Arief Janin. Jakarta: UI Press.

- Fukuyama, F. (2004). Terj. The end of history and the last man. Victory of capitalism and Liberal Democracy. Yogyakarta: Qalam.

- Hamdi, M. (2014). Public policy. Process, Analysis, and Participation. Jakarta: Ghalia Indonesia.

- Hutapea, M. (2013). Fee transactions on the dynamics of the formation of a divided or unified government in Pemangsiantar City: A case study of making regional revenue and expenditure budget policies for 2005-2010. Dissertation on Public Administration Doctoral Education Program FISIP-UGM.

- Jabra, J., & Dwivedi, O. (1989). Public Service Accountability. Inc. Connecticut: Kumarian Press

- Juanda, B., & Heriwibowo, D. (2016). Decentralization fiscal consolidation through policy reform of local quality spending. Journal of economics and public policy.

- Kaplan, R.S., & Norton, D. (2004). Focusing your organization on strategy-with the balanced scorecard. Harvard Business School Publishing Cambridge.

- Krahmann, E. (2017). Legitimizing private actors in global governance: From performance to performativity. Politics and Governance (ISSN: 2183–2463), 5(1), 54–62.

- Krukowski, K., & Kamieniak, K., (2010). The balanced scorecard as a tool for designing the strategy of a public sector institution. Scientific Papers - Ostro??ka Scientific Society for them. Adam Ch?tnik, Ed. XXIV, 171-184.

- Lathrop, D., & Ruma, L. (Edistion). (2010). Open Government: Collaboration, Transparency, and Participation in Practice. USA: O'Reilly

- Law Number 17/ 2003 concerning State Finance

- Law Number 23 /2014 concerning Local Government

- Law Number 5/ 2014 concerning Civil Servant

- Law Number 30/ 2014 concerning Government Administration.

- Constitution 1945

- Niven, P.R. (2008). Balance scorecard step by step for government and non profit agencies. New Jersey: John Wiley & Sons, Inc.

- Osborne, D., & Hutchinson, P. (2004). The price of government: Getting results we need in an age of permanent fiscal crisis. New York: Basic Boocs

- Popescu, I.C. (2020). Strategic theory and practice: A critical analysis of the planning process for the long war on terror. Contemporary Security Policy, 30(1), 100-124.

- Rasyid, M.R. (2007). Meaning of Government. Overview in terms of Ethics and Leadership. Jakarta: PT Mutiara Sumber Widya.

- Romzek, B.S., & Dubnick, M.J. (1998). Accountability. Nashville: Westview Press.

- Shah, A. (2007). Participatory budgeting. Washington DC: The World Bank

- Surianti, M., & Dalimunthe, A.R. (2015). The implementation of performance based budgeting in public sector (Indonesia Case: A Literature Review). Research Journal of Finance and Accounting.

- Syahdan. (2020). Balance scorecard implementation in public sector organization, a problem? International Journal of Accounting, Finance, And Economic.

- Turner, M., & Hulme, D. (1997). Governance, Administration, and Development.Making the State Work. London: Macmillan Limited Press.

- Umashev, C., & Willett, R. (2008). Challenges to implementing strategic performance measurement systems in multi?objective organizations: The case of a large local government authority. Abacus, 44(4), 377-398.

- Yarger, H.R. (2006). Strategic Theory for the 21st Century: The Little Book on Big Strategy. USA: US Government.