Research Article: 2024 Vol: 28 Issue: 4

A Study on Factors Affecting the Cashless Payment Mode: With Special Reference to Delhi

Atul Gautam, Guru Jambheshwar University of Science and Technology, Hisar, Haryana

Sanjeev Kumar, Guru Jambheshwar University of Science and Technology, Hisar, Haryana

Citation Information: Gautam, A., & Kumar, S. (2024). A study on factors affecting the cashless payment mode: with special reference to delhi. Academy of Marketing Studies Journal, 28(4), 1-12.

Abstract

The main objective of this research to create an appropriate framework by including essential elements from the well known theories to explore the factors that impact behavioral intentions towards implementing cashless payment mode(CPM). The sample region of the study is Delhi to identify the user’s viewpoint to adopt CPM. Further, this study used a “partial least squares-based structural equation modeling” technique to analyse the relationships between latent factors. The Outcome of the model showed that there are 11 independent variables together explain the intention to use CPM with a 60.5% explanatory power. The result shows that PU is the most important element which affects the user’s readiness to adopt CPM. Finally, the findings of moderator effects indicate that income and experience interact positively and strongly with behavioral intention to adopt CPM. This study integrated critical elements from the major theories, such as Theory of Reasoned Action, Technology Acceptance Model, Decomposed Theory of Planned Behaviour, the unified theory of acceptance and use of technology (UTAUT) model and UTAUT2, to investigate the adoption of CPM. Accordingly, these results could aid policymakers in addressing people’s concerns and facilitating a seamless transition to a cashless society.

Keywords

Cashless Payment Mode, Behavioral Intention, TAM, UTAUT, PLS-SEM.

Introduction

Prevention is better than cure, regardless the efforts of government to enhance the judicial system the crime has continued to grow and is adversely affecting our day to day life (Warwick, 1993). Further most of these crimes evolve around cash stealing, related to property which is the major source for illegal activities (Warwick, 1993; Armey et al., 2014). Person stealing this cash mostly deposit their illegal profits in some financial institutes through cash transactions which make it difficult for the government to trace the money (Alba, 2003, Goel and Mehrotra, 2012). Thus, the countries with high cash volumes are more prone to corruption among officials.

This cash is also used by terrorist and rebels for untraced transactions and only minimal quantity of physical cash is enough to finance broad range of their operations (Wright et al., 2017). In order to stop these criminal activities government must take steps to move toward cashless economy. Stopping physical cash completely criminals would be forced to use cashless payment modewhich can be easily traced leading to transparency and economic security (Vimal Raj et al., 2023; Raj et al., 2021). This change will also reduce government expenditure and generate employment. But for this benfit cacnot be achieved unless large percentage of the people regularly does cashless transaction (Vimal Raj et al., 2023). In CPM there is no exchange of tangible cash. This mode includes (RTGS), NEFT, IMPS, UPI, NFC QR codes etc which don’t involve physical cash. In 2015 after the launch of Digital India campaign this system is widely promoted in India. RBI, the central bank of India itself has itself undertaken several campaign s to promote CPM in general public of the country. For example, according to “Bank for International Settlements (BIS)” Statistics Explorer (BIS Statistics Explorer, n.d.): Table CT5, India’s average CPM per capita in 2021 was just 47 units, whereas the figure for advanced economies was above 400 units. Additionally, according to the RBI Bulletin published in August 2019, the average value of CPM made in India is 3,910 United States Dollars per person. In contrast, the value of CPM in developed nations was above 500,000 (Reserve Bank of India Bulletin, 2019). According to these figures we can easily say that the implementation of CPM in India is still in its infancy and has great opportunities for growth. Consequently, it is essential to comprehend users’ acceptance of CPM and identify the factors influencing their intent to use it through an extensive study model.

Theoretical Background

Earlier research shows that n number of theories has been used to study the invidual’s approach towards adaption and use of new technology (IT).” These models include the “Theory of Reasoned Action (TRA),” “Social Cognitive Theory (SCT),” “Technology Acceptance Model (TAM),” “Theory of Planned Behaviour (TPB),” “Model of PC Utilization (MPCU),” “Decomposed Theory of Planned Behaviour (DTPB),” “Innovation Diffusion Theory (IDT)” and “Unified Theory of Acceptance and Use of Technology (UTAUT).” Additionally, the TAM and the UTAUT are the most widely utilized theories to clarify users’ behavioural intentions to engage in any technology.

Davis developed the TAM model in 1989 and derived it from TRA, which assesses an individual’s willingness to participate in a technological activity. The TAM was exclusively designed for the IT field and is utilised to predict the adoption and usage of IT. The model is intention-based, estimating usage based on behavioural intention. This framework has 5 key elements “perceived usefulness,” “perceived ease of use,” “attitude toward use,” “intention to use” and “actual use.” This model is extensively used to identify the acceptance of several CPM systems based on its effectiveness, conciseness and simplicity, integrated major information system (IS) theories to develop UTAUT, which includes four fundamental constructs, namely “performance expectancy,” “effort expectancy,” “social influence,” and “facilitating conditions” that impact intention and use.. Further, given the context of CPM acceptance, a number of the assumptions made in UTAUT2 are rendered meaningless. As an illustration, the UTAUT2 incorporates the significant construct of hedonic motivation, which gauges individuals’ enjoyment while playing games or watching movies in the context of adopting mobile or computer technology. However, this construct is not applicable in the area of CPM adoption. Consequently, these theories did not provide a completely accurate explanation for adopting CPM. Therefore, to handle all the limitations it is mandatory to combine all the previous studies on CPM to form a comprehensive model that includes all aspects whether positive or negative and interaction variables.

Conceptual Framework and Hypothesis Development

The present research began with a literature review to create correct model that completely includes all the factors affecting behavioural intentions to adopt CPM without overlapping constraints. The following is the brief description of the procedure that was part of literature review studied for the current investigation to know the past history that is related to the research model. In the starting this study over 103, past published articles were reviewed and considered for several databases, including “Science Direct,” “Emerald,” “Sage,” “Springer,” “Taylor & Francis,” “IEEE,” and “Google Scholar.” After this 57 elements directly affecting the behavioural aspects towards CPM has been acknowledged. After this these elements were grouped based on the similarity to avoid any redundancy.

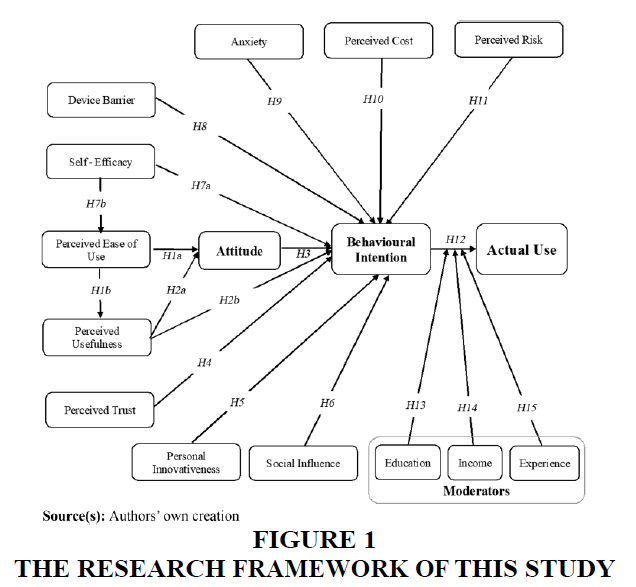

Furthermore, the essential elements of the CPM adoption process were determined to be picked from each of the groups investigated in this research. Consequently, to develop a comprehensive model that explains the uptake of CPM, this study has identified 13 dimensions, including “Perceived Usefulness (PU),” “Perceived Ease of Use (PEOU),” “Attitude (ATT),” “Perceived Trust (PT),” “Personal Innovativeness (PI),” “Social Influence (SI),” “Self-Efficacy (SE),” “Perceived Risk (PR),” “Perceived Costs (PC),” “Anxiety (ANX),” “Device Barrier (DB),” “Behavioural Intention (BI)” and “Actual Use (AU)” (Figure 1 illustrates the research framework).

Perceived Ease of Use (PEoU)

It is defined as the level to which an individual think that operating a specific system is ‘free of effort’ (Davis, 1989).” This definition emphasizes that if the new technology is used effortlessly by the user’s it is more likely to be accepted by them (Williams, 2021; Lisana, 2021; Alshurideh et al., 2021). The importance of ease to use plays crucial role in the acceptance of CPM system, as this is the most important and repeated element of all the earlier reserch (Alhassany and Faisal, 2018; Koksal, 2016; Bashir and Madhavaiah, 2015b) this element has been studied and analyzed by the several researchers towards adoption of CPM (Sarmah et al., 2021; Sripalawat et al., 2011; Priya et al., 2018). As such, we hypothesise:

H1a. PEoU positively influences individuals’ ATT towards the adoption of CPM.

H1b. PEoU positively influences individuals’ PU of CPM

Perceived Usefulness (PU)

It is the level at which individual think that using a specific technology will improve the efficiency and will make their job easy (Davis, 1989).” In this context usefulness means how easy and convenient it will be for the user to use CPM in place of cash. Consequently developing positive views about CPM. This exclusive factor strengthens the positive attitude towards CPM. From earlier studies we can clearly conclude that user’s PU of CPM, their attitude, and their behavioral intensions to use it are highly correlated (Williams, 2021; Sripalawat et al., 2011; Chawla and Joshi, 2019, 2020; Priya et al., 2018; Bashir and Madhavaiah, 2015b). Therefore, we hypothesise:

H2a. PU positively influences individuals’ ATT towards the use of CPM.

H2b. PU positively influences individuals’ BI towards the adoption of CPM.

Attitude (ATT)

The concept states the overall estimation of individual thoughts about a specific object or technology. This theory is profound through various other renowned theories which have studied the new IT, such as the TRA and the TAM (Flavian et al., 2020). These theories propose that a person’s BI to use an IT is determined by their ATT (Patil et al., 2020). Similarly, if an individual has a positive ATT towards CPM, they are more likely to have a higher BI to adopt it. On the other hand, if an individual has a negative ATT towards CPM, they are less likely to embrace it (Flavian et al., 2020). Besides, several studies on CPM have demonstrated a robust association between ATT and BI towards utilising CPM (Chawla and Joshi, 2019, 2020; Shin, 2009; Bailey et al., 2017; Bashir and Madhavaiah, 2015a). Therefore, we hypothesise:

H3. ATT positively influences individuals’ BI towards the adoption of CPM.

Perceived trust (PT)

The concept of PT means individual’s belief towards the consistency of the institution environment (Vimal Raj et al., 2023; Alalwan et al., 2017). This includes the trust in financial institutions and telecommunication Companies who are providing services, which can be result of past experiences or the good reputation. Later many other factors like goodwill, safety, usefulness regulation etc strengthen the trust and motivate individuals to follow CPM methods (Chawla and Joshi, 2020; Giovanis et al., 2019). Earliear research also give proofs of a positive relationship between PT and the BI to adopt CPM (Sarmah et al., 2021; Shin, 2009; Raj et al., 2023; Lisana, 2021; Alshurideh et al., 2021; Bashir and Madhavaiah, 2015a). Therefore, we hypothesise:

H4. PT positively influences individuals’ BI towards the adoption of CPM.

Personal Innovativeness (PI)

It states the condition how quic or openly an individual is ready to accep and use a new technology (Raj et al., 2023). A far as CPM is concernes M-banking, e wallets and cards transactions are new technologies for the users which requires them to be ready and comfortable to use them. We can say that people open for innovation and more tech savvy will have increased BI to use CPM as compare to less inventive people. Earlier study shows positive connection between PI and individual’s BI towards appropriate CPM (Williams, 2021; Vimal Raj et al., 2023; Raj et al., 2023). Hence, we hypothesise the following:

H5. PI positively influences individuals’ BI towards the adoption of CPM.

Perceived trust (PT)

It refers to the individual’s perception towards institutional background. It covers perception about all the parties involved from financial institutions to telecomm. Companies. Trust or perception can be based on their prior experiences or by their opinions. Furthermore, convenience, security, goodwill and ease to use are other elements which build and enhance their willingness for CPM methods. In addition, prior research indicates proofs of a positive link between PT and the BI to go for CPM. Consequently, we hypothesis: H4. PT positively impacts individuals’ BI towards acquiring of CPM.

Social Influence

It means the impact of society or social class on the person beliefs, attitude and behavior (Venkatesh et al., 2003). For CPM individual can get influenced by any sources like friends, family colleagues even through unknown persons. Individual behavior can also be influenced by the social media and digital platforms spreading knowledge and views about CPM. Social media marketing techniques like hiring influencers and informing user’s about the benefit of CPM can also motivate individuals to use CPM (Patil et al., 2020). Additionally, earlier research has shown that there is a favourable correlation between SI and BI in the adopting of CPM (Raj et al., 2023; Lisana, 2021; Patil et al., 2020; Vimal Raj et al., 2023; Giovanis et al., 2019). Therefore, we hypothesise the following:

H6. SI has a positive effect on a person’s willingness to adopt CPM.

Self-efficacy

It refers to the person sincerity and confidence to its full capacity to successfully use cashless payment mode (Lisana, 2021; Raj et al., 2023; Al-Saedi et al., 2020). Individuals having strong self efficacy are believed to use cashless payment methods effectively and can handle the challenges and are confident to use the technology efficiently (Vimal Raj et al., 2023). People having lack of confidence and low level of SE may be reluctant to use these methods (Singh and Srivastava, 2018). Prior reserchs also indicates that SE plays important role to evaluate the individual intention to adopt CPM.Therefore, we hypothesise:

H7a. SE positively influences individuals’ PEoU in CPM.

H7b. SE positively influences individuals’ BI towards the adoption of CPM.

Device barrier (DB)

There are several software which are not device friendly or is not compatible with all the devices. This is also a major challenge for the adoption of cashless payment method. All the devices have different resolutions, operating systems, user interface which can broadly affect the individual’s perception towards service quality and their willingness to use this ne method (Laukkanen, 2008). Further many softwares are their which need complex and detailed inputs which may create problem in adopting cashless method (Sripalawat et al., 2011).Thus it become necessary to tailor made mobile content to make it user friendly and easy. Previous study also shows the great relation between device barrier and BI to promote cashless transactions. Therefore, we hypothesise:

H8. DB negatively influences individuals’ BI towards the adoption of CPM.

Anxiety (ANX)

It refers to the users’ hesitance and concern related to the safety, security and utility of cashless method. Lack of trust and safety issues may develop anxiety in users towards the new method. They might fear of forgetting their user id and password which results in increasing anxiety that due to this they might loose access to their account. They also feel insecure about loosing their device because of theft which may lead to access of their personal private information by third party Thus, reducing CPM’s ANX may enhance users’ opinions of the technology and increase their desire to use it (Patil et al., 2020). Besides, previous research on the acceptance of CPM has verified that ANX is a crucial factor in shaping people’s technology adoption (Bailey et al., 2017; Patil et al., 2020; Celik, 2016). Therefore, we hypothesise:

H9. ANX negatively influences individuals’ BI towards the adoption of CPM.

Perceived Cost

It refers to the people thinking about bearing extra cost for using the new technology of cashless payment method. This mau include the device required, internet charges, bank feeor any other charges for these transactions. It might possible that due to high PC people may get discouraged from using new cashless payment method. Whereas low PC can encourage individuals to use the latest method. Moreover, earlier studies have shown that an users’ comprehension of the PC has an adverse effect on their BI to adopt CPM methods (Abegao Neto and Figueiredo, 2022; Vimal Raj et al., 2023; Raj et al., 2023; Priya et al., 2018; Al-Saedi et al., 2020). Therefore, we hypothesise the following:

H10. PC has an adverse effect on individuals’ BI concerning adopting CPM methods.

Perceived Risk

“Perceived risk” is the degree to which people believe CPM procedures will lead to adverse outcomes, including money loss, fraud or identity theft (Raj et al., 2023). Further, this certainty makes CPM approaches less appealing since it raises concerns about transaction security (Vimal Raj et al., 2023). Moreover, previous research has shown that the associated PR negatively impacts BI using CPM technologies (Abegao Neto and Figueiredo, 2022; Raj et al., 2023; Priya et al., 2018; Vimal Raj et al., 2023; Bashir and Madhavaiah, 2015b; Giovanis et al., 2019). Therefore, we hypothesise the following:

H11. PR has an adverse impact on individuals’ BI concerning accepting CPM methods.

Behavioural Intention

It is a subjective tendency of an individual to contribute in a specific behavior. This concept was previously used in TPB and TRA technology adoption models. Since than it is combined with many other adoption models also. Earlier research has also shown a very strong correlation between BI and actual behavior Therefore, we hypothesise the following:

H12. BI positively influences individuals’ adoption of CPM.

Moderators

The purpose is a main factor in any decision making process that ensures future course of plan.

Unfortunately no experiential proof in the present literature supports the hypothesis that being educated, high income and past experience plays moderators between BIs and performance. Therefore this research is focused to identify the moderators which can establish the relationship between intentions and actions. CPM does not mean cashless economy, So cash availability is necessary at bank for Cashless transactions. Because of this people in higher income category will get advantage to involve in CPM. Consequently, this research examines the interactive impact of education, income and experience with CPM on the relationship between behavioural intention and performance. Based on this, we propose the following hypothesis:

H13. The influence of BI on the AU of CPM will be moderated by education

H14. The influence of BI on the AU of CPM will be moderated by income.

H15. The influence of BI on the AU of CPM will be moderated by experience

Research Methodology

Data and Sample

The survey was conducted to identify the elements affecting BI in adopting CPM. The respondents were from Delhi, India. Total 512 respondents (CPM users) were evaluated using convenience sampling. Further 421 valid respondents were considered for final analysis from the 478 respondent who replied. Additionally, the study utilized previously published instruments with slight modifications to measure agreement using a “seven-point Likert scale,” ranging from “strongly disagree” to “strongly agree.” Furthermore, the scales were initially pretested twice with 105 participants to ensure validity and appropriateness.

Data Analysis Technique

The research is done by applying “partial least squares-based structural equation modeling (PLS-SEM)” to evaluate how various elements are correlated. This study is divided into two stages. In first stage SEM is used to identify how observed and latent variables are joined in measurement model. Later the research uses PLS method in the structural model to investigate how the latent constructs were related to each other.

Data Analysis and Results

Measurement Model

The measurement model’s reliability and validity are essential for accurate results. The analysis shows high Cronbachs Alpha readings ranging from 0.510 to 0.837 and “composite reliability” values ranging from 0.837 to 0.952, both surpassing the recommended thresholds of 0.6 (Hair et al., 2014). These outcomes indicate that the measurement model has dependable internal consistency. Further, “convergent validity (CV),” which examines the conceptual relationship between multiple items, was evaluated by analyzing factor loadings and “average variance extracted (AVE)” values. All factor loading levels exceeded 0.6, and AVE values ranged from 0.597 to 0.816, surpassing the threshold of 0.4 (Hair et al., 2010). Thus, the convergence approach is valid. “Discriminant validity” was tested by comparing correlation coefficients with the square root of AVEs. The square roots of AVEs were higher than the corresponding correlation coefficients, indicating high discriminate validity (Fornell and Larcker, 1981; Aparna et al., 2023).

Structural Model

Researchers used R2 and Q2 values and path significance to assess a structural model’s quality. A high-quality model has an R2 value of 0.1 or higher for the dependent variable and all paths (Hair et al., 2014). This study shows all R2 values are above 0.1, indicating excellent predictive ability. A Q2 value larger than 0 indicates the model is meaningful in its predictions (Hair et al., 2017), and the constructs studied have significant predictability. The model’s “Goodness-of-fit (GoF)” is evaluated with the standardized root mean square residual (SRMR) value, which compares the fit to a baseline. The SRMR value of 0.044 is below the acceptable threshold of 0.10 (Hair et al., 2021), indicating a satisfactory model fit.

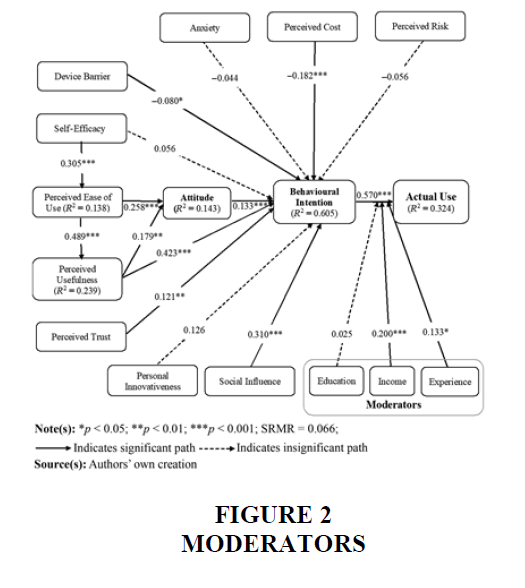

Furthermore, in addition to assessing the GoF, hypotheses were examined to determine the significance of the relationships. The findings of this investigation, as presented revealed that PU, ATT, PT and SI have a statistically significant and positive impact on BI to engage in CPM. Hence, H2b (β 0.416, t 7.567), H3 (β 0.122, t 4.070), H4 (β 0.112, t 3.312) and H6 (β 0.309, t 3.337) are supported. However, while PI and SE positively affect BI to use CPM, they are not statistically significant. Therefore, H5 (β 0.117, t 1.674) and H7a (β 0.051, t 1.412) are not supported. Additionally, the effects of PEOU on ATT, PEOU on PU, PU on ATT, SE on PEOU and BI on AU are all significantly and positively correlated to one another. Hence, H1a (β 0.212, t 4.076), H1b (β 0.473, t 9.038), H2a (β 0.165, t 3.570), H7b (β 0.302, t 6.009), and H12 (β 0.565, t 5 11.35) are supported (Figure 2).

Moreover, the present study found that the DB and PC have a considerably negative impact on the BI to use CPM, while ANX and PR have an insignificant negative impact. As an outcome, the hypotheses H8 (β - 0.070, t 2.181) and H10 (β 5 - 0.161, t 4.991) are supported, and H9 (β - 0.034, t 1.110) and H11 (β - 0.046, t 1.244) are not supported.

Besides, the study examined the moderating effects of education, income and experience on the relationship between the independent and dependent variables. The findings suggest that education does not have a statistically significant effect on BI to use CPM. Therefore, H13 (β 0.023, t 5 0.640) is not supported. However, income and experience significantly and positively moderate the relationship between the BI and AU of CPM. Consequently, H14 (β 0.203, t 3.997) and H15 (β 0.129, t 2.397) are supported.

Discussion

Current study is conducted in order to intregate all the previous rsearch on cashless payment modeto examine its worldwide adoption. Moreover this survey is conducted to obtain a thorough knowledge about the importance of every variable such as PU, PEoU, ATT, SE, PT, SI, PI, ANX, PR, DB, PC and BI in the CPM adoption process among users of such transactions.

As per the study we can conclude that the PEoU has a great influence on people’s attitude towards the use of CPM. It states that people are more likely to have positive attitude if it is user friendly and easy. In addition to this individuals’ perception plays significant role which affect their PU. This is also aligned with the earlier research (Sarmah et al., 2021; Williams, 2021; Lisana, 2021; Alshurideh et al., 2021). This shows that if user’s find something easy to use they believe that it is useful. Which further guide the CPM providers to design the user friendly applications and strengthen the perception of usefulness of CPM. According to the study we can conclude that user’s right attitude also affected by their PU, which further affect the BI in adopting CPM., consistent with earlier studies (Chawla and Joshi, 2019, 2020; Flavian et al., 2020; Patil et al., 2020). This shows that people having knowledge of benefits of Cashless transaction have positive view towards its use than people who think that it is not beneficial at all. Thus developers must design more user frisndly applications for CPM so that people can understand its benefits. The study also finds out that PT largely influences user’s BI to use CPM. (Sarmah et al., 2021; Vimal Raj et al., 2023; Lisana, 2021; Raj et al., 2023; Alshurideh et al., 2021; Chawla and Joshi, 2020), which also found that the trustworthiness of the CPM system positively affected the BI to use it. It is recommended that CPM service providers should work and upgrade their applications to preserve and grow the trustworthiness of their users. As study shows that SI have positive affect on user’s BI for CPM. As alighned with previous research (Vimal Raj et al., 2023; Giovanis et al., 2019). It also shows that the peer opinions and the social group also plays important role to affect BI for CPM. So, CPM providers can use this strategically to inspire social factors to motivate individuals towards CPM use.

The study also found that perceived SE did not directly affect BI but rather an indirect effect through PEoU and ATT. This result differs from previous studies (Singh and Srivastava, 2018). This suggests that most users believe they can use CPM and are willing to use them based on their ability. There are several constraints which hinders or limits the use of CPM like screen size and processing speed of certain devices and software’s used which results in user’s unwillingness towards CPM method. This constraint can be handled by the CPM providers by device optimization and making transaction easy and quick for the users.

The study also shows that PR has negative affect on the BI to adapt CPM, which contradict the earlier study (Abegao Neto and Figueiredo, 2022; Raj et al., 2023; Priya et al., 2018; Vimal Raj et al., 2023; Alhassany and Faisal, 2018). The users of Cashless transaction must be informed about the probable risks involved with the model. The study shows that users don’t shows interest to use any new technology if it is expensive and complicated and the fee they are paying to use the service is on higher side, as suggested in earliear research also (Raj et al., 2023; Vimal Raj et al., 2023; Saha et al., 2022). So, in order to rectify this CPM providers must confirm that the application they are designing is user friendly, device friendly and can be used by all the users properly irrespective of their device’s cost.

We can conclude that the income generated and user’s view are the basis to form positive relationship between BI and the use of CPM.Education plays role in adoption of CPM but its not that important. Studies showed that both high and low users of CPM are well educated.

Conclusion

Theoretical Implications

The output of this study showcases many crucial contributions to the theoretical frameworks. First, to discover the elements promoting the adoption of Cash Less Transaction, this research included several contributes from well known theories like TAM, TRA, DTPB, UTAUT and UTAUT2. Due to the result of this research, have identified 11 essential components from the existing body of research that impacts the adoption of CPM without overlapping one another. These factors are PU, PEoU, ATT, PI, PT, SI, SE, PR, PC, ANX and DB. Thus, this model is an clarifiesr why people follow CPM methods that is more detailed than any previous study. In addition, this survey efficiently analysed the importance and role of education, income and experience as moderators on BI and performance, which had not been included in the study previously. The results of this study indicate that income and experience play a significant role in moderating users’ BI towards their actual behavior.

Practical Implications

If we talk about practicality of the study we have first quantified all the elements affecting the adaption of CPM. This will help the policymakers and bankers in improved understanding of the factors impact on the growth of CPM infrastructure. Additionally, this would help the CPM application developers too consider these complications while designing and developing the software. Application developers mus focus on creating user friendly applications and the applications which are compatible with multiple devices , efficient in task completion, improve payment transaction performance, and socially responsible to sustain the positive intention of using CPM systems. Most importantly bankers must run a campaign to make the users aware and educate them about the benefits and also the risk involved in CPM. CPM service provider must ensure that their channels for CPM conduct financial transactions securely and efficiently, regardless of the location or time. As a result, this study would lead to the creation of user-friendly and secure CPM methods that match the preferences and demands of users.

Limitations and Future Research Perspectives

Though the result of the study adds knowledge particularly in Indian context, there are many constraints too. This study was conducted in Delhi where people are much more educated and aware about CPM in comparison to other part of the country. Also people with higher literacy are aware and ready to adapt the latest technological changes. Thus, the survey suggests emphasizing the rural area of the country. Another drawback is that this study only includes the user’s point of view, while other stakeholder’s like retailers , non users, merchants entrepreneurs perspective to have a broader idea is not been considered. Finally, despite the present research having enough participants, it is possible that the findings cannot be generalized to all Indian customers.

References

Abegao Neto, F. L., & Figueiredo, J. C. B. D. (2023). Effects of age and income moderation on adoption of mobile payments in Brazil. Innovation & Management Review, 20(4), 353-364.,

Indexed at, Google Scholar, Cross Ref

Alalwan, A. A., Dwivedi, Y. K., & Rana, N. P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management, 37(3), 99-110.,

Indexed at, Google Scholar, Cross Ref

Alba, R. M. (2003). Evolution of methods of money laundering in Latin America. Journal of Financial Crime, 10(2), 137-140..

Indexed at, Google Scholar, Cross Ref

Alhassany, H., & Faisal, F. (2018). Factors influencing the internet banking adoption decision in North Cyprus: an evidence from the partial least square approach of the structural equation modeling. Financial Innovation, 4(1), 1-21.

Indexed at, Google Scholar, Cross Ref

Al-Saedi, K., Al-Emran, M., Ramayah, T., & Abusham, E. (2020). Developing a general extended UTAUT model for M-payment adoption. Technology in society, 62, 101293..,

Indexed at, Google Scholar, Cross Ref

Alshurideh, M. T., Al Kurdi, B., Masa’deh, R. E., & Salloum, S. A. (2021). The moderation effect of gender on accepting electronic payment technology: a study on United Arab Emirates consumers. Review of International Business and Strategy, 31(3), 375-396.,

Indexed at, Google Scholar, Cross Ref

Aparna, K., & Amilan, S. (2022). Customers’ response to mandatory corporate social responsibility in India: an empirical evidence. Social Responsibility Journal, (ahead-of-print).,

Indexed at, Google Scholar, Cross Ref

Armey, L. E., Lipow, J., & Webb, N. J. (2014). The impact of electronic financial payments on crime. Information Economics and Policy, 29, 46-57.

Indexed at, Google Scholar, Cross Ref

Bailey, A. A., Pentina, I., Mishra, A. S., & Ben Mimoun, M. S. (2017). Mobile payments adoption by US consumers: an extended TAM. International Journal of Retail & Distribution Management, 45(6), 626-640.

Indexed at, Google Scholar, Cross Ref

Bashir, I., & Madhavaiah, C. (2015). Consumer attitude and behavioural intention towards Internet banking adoption in India. Journal of Indian Business Research, 7(1), 67-102.

Indexed at, Google Scholar, Cross Ref

Bashir, I., & Madhavaiah, C. (2015). Trust, social influence, self‐efficacy, perceived risk and internet banking acceptance: An extension of technology acceptance model in Indian context. Metamorphosis, 14(1), 25-38.

Indexed at, Google Scholar, Cross Ref

BIS Statistics Explorer (n.d.), “CT5: use of payment services/instruments: volume of cashless payments”.

Celik, H. (2016). Customer online shopping anxiety within the Unified Theory of Acceptance and Use Technology (UTAUT) framework. Asia Pacific journal of Marketing and logistics, 28(2).

Indexed at, Google Scholar, Cross Ref

Chawla, D., & Joshi, H. (2019). Consumer attitude and intention to adopt mobile wallet in India–An empirical study. International Journal of Bank Marketing, 37(7), 1590-1618.

Indexed at, Google Scholar, Cross Ref

Chawla, D., & Joshi, H. (2020). The moderating role of gender and age in the adoption of mobile wallet. foresight, 22(4), 483-504.

Indexed at, Google Scholar, Cross Ref

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly, 319-340.

Indexed at, Google Scholar, Cross Ref

Flavián, C., Guinaliu, M., & Lu, Y. (2020). Mobile payments adoption–introducing mindfulness to better understand consumer behavior. International Journal of Bank Marketing, 38(7), 1575-1599.

Indexed at, Google Scholar, Cross Ref

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of marketing research, 18(1), 39-50.

Indexed at, Google Scholar, Cross Ref

Giovanis, A., Assimakopoulos, C., & Sarmaniotis, C. (2019). Adoption of mobile self-service retail banking technologies: The role of technology, social, channel and personal factors. International Journal of Retail & Distribution Management, 47(9), 894-914.

Goel, R. K., & Mehrotra, A. N. (2012). Financial payment instruments and corruption. Applied Financial Economics, 22(11), 877-886.

Hair Jnr, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis.

Hair Jr, J., Hair Jr, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2021). A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications.

Hair, J.F., Hult, G.T.M., Ringle, C.M. and Sarstedt, M. (2017), A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), Sage, Thousand Oaks, CA.

Koksal, M. H. (2016). The intentions of Lebanese consumers to adopt mobile banking. International Journal of bank marketing, 34(3), 327-346.

Indexed at, Google Scholar, Cross Ref

Laukkanen, T. (2008). Determinants of mobile banking resistance: A preliminary model. In Proceedings of ANZMAC (Australian and New Zealand Marketing Academy) Conference, Sydney, Australia, December (pp. 1-3).

Patil, P., Tamilmani, K., Rana, N. P., & Raghavan, V. (2020). Understanding consumer adoption of mobile payment in India: Extending Meta-UTAUT model with personal innovativeness, anxiety, trust, and grievance redressal. International Journal of Information Management, 54, 102144.

Indexed at, Google Scholar, Cross Ref

Priya, R., Gandhi, A.V. and Shaikh, A. (2018), “Mobile banking adoption in an emerging economy”, Benchmarking: An International Journal, 25(2), 743-762

Raj, L. V., Amilan, S., Aparna, K., & Swaminathan, K. (2023). Factors influencing the adoption of cashless transactions during COVID-19: an extension of enhanced UTAUT with pandemic precautionary measures. Journal of Financial Services Marketing, 1-20.

Indexed at, Google Scholar, Cross Ref

Saha, T., Dey, T., & Hoque, M. R. (2022). Initial trust and usage intention: A study on mobile payment adoption in Bangladesh. Global Business Review, 09721509221120805.,

Indexed at, Google Scholar, Cross Ref

Sarmah, R., Dhiman, N., & Kanojia, H. (2021). Understanding intentions and actual use of mobile wallets by millennial: an extended TAM model perspective. Journal of Indian Business Research, 13(3), 361-381.,

Indexed at, Google Scholar, Cross Ref

Shin, D. H. (2009). Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behavior, 25(6), 1343-1354.

Indexed at, Google Scholar, Cross Ref

Singh, S., & Srivastava, R. K. (2018). Predicting the intention to use mobile banking in India. International Journal of Bank Marketing, 36(2), 357-378.,

Indexed at, Google Scholar, Cross Ref

Sripalawat, J., Thongmak, M., & Ngramyarn, A. (2011). M-banking in metropolitan Bangkok and a comparison with other countries. Journal of computer information systems, 51(3), 67-76.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS quarterly, 425-478.

Indexed at, Google Scholar, Cross Ref

Vimal Raj, L., Amilan, S., Aparna, K., et al., (2023), “Developing and validating a cashless transaction adoption model (CTAM)”, 25 January 2023, PREPRINT (Version 1) available at: Research Square.

Warwick, D.R. (1993), Reducing Crime by Eliminating Cash, National Council on Crime and Delinquency, San Francisco, CA, available at:

Williams, M.D. (2021), “Social commerce and the mobile platform: payment and security perceptions of potential users”, Computers in Human Behaviour, 115, 105557.

Wright, R., Tekin, E., Topalli, V., McClellan, C., Dickinson, T., & Rosenfeld, R. (2017). Less cash, less crime: Evidence from the electronic benefit transfer program. The Journal of Law and Economics, 60(2), 361-383.

Indexed at, Google Scholar, Cross Ref

Received: 26-Dec-2023, Manuscript No. AMSJ-23-14304; Editor assigned: 27-Dec-2023, PreQC No. AMSJ-23-14304(PQ); Reviewed: 16-Jan-2024, QC No. AMSJ-23-14304; Revised: 27-Jan-2024, Manuscript No. AMSJ-23-14304(R); Published: 08-May-2024