Research Article: 2022 Vol: 25 Issue: 6S

A Study of Factors That Lead to Failure in Industrial Business

Yotsakorn Bomlai, King Mongkut's University of Technology North Bangkok

Sunee Wantanakomol, King Mongkut's University of Technology North Bangkok

Thanin Silpcharu, King Mongkut's University of Technology North Bangkok

Citation Information: Bomlai, Y., Wantanakomol, S., & Silpcharu, T. (2022). A study of factors that lead to failure in industrial business. Journal of Management Information and Decision Sciences, 25(S6), 1-12.

Keywords

Structural Equation Model, Business Failure, Industrial Business

Abstract

Industry is considered an important foundation for the development of the country and a mechanism that drives the economy, society and social well-being for a long time. The economic slowdown has resulted in structural problems of the industrial sector in terms of adapting to the ever-changing changes, causing a large number of businesses to go out of business. This research was to study the factors that lead to the failure in industrial business operation. Afterwards, it was developed into a structural equation model. Both qualitative and quantitative researches were conducted and quantitative data surveys were conducted from 500 enterprises operating at a loss for three consecutive years in Small and Medium and large industrial businesses.

The results showed that the causal factors leading to the highest average industrial business failure in each aspect were 1) Accounting and Finance components - the registered capital was not suitable for receiving a job. 2) Marketing components - The target customer group was not clearly defined. 3) Resource Management components - Organizational indicators were inconsistent with policies and performance. 4) Innovation and Technology components - there was still a lack of planning for resource management through a network that could be accessed quickly inside and outside the organization. The hypothesis found that there was no statistically significant difference between Small and Medium and large industrial businesses in the causal factors leading to industrial business failure at the 0.05.

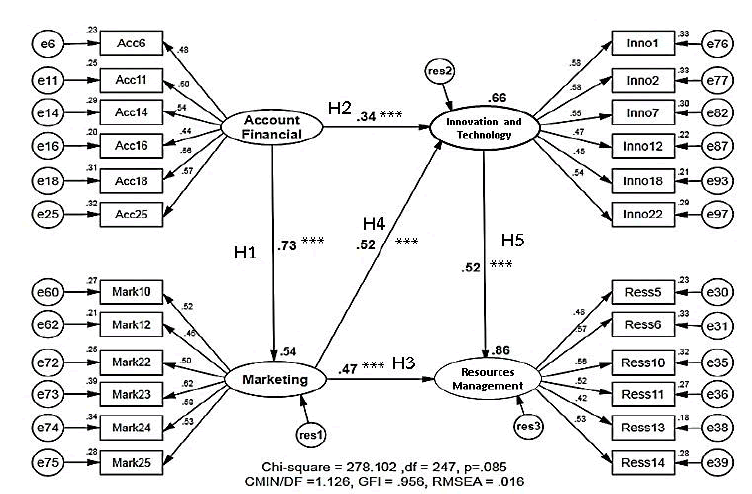

The analysis of the structural equation model showed that the results passed the assessment criteria with the empirical data. The Chi-square Probability Level (CMIN- ρ) was 0.085, The Relative Chi-square (CMIN/DF) was 1.126. The Goodness of Fit Index (GFI) was 0.956. The Root Mean Square Error of Approximation (RMSEA) was 0.016.

Introduction

Industry is considered an important foundation for the development of the country and a mechanism that drives the economy, society and social well-being for a long time. The ratio of Thailand's income to gross domestic product depends mainly on the industrial sector. It also exports many important industrial products such as automobiles, computers and industrial electrical appliances. The industrial sector is one of the key mechanisms leading to the development and enhancement of the country's competitiveness. The policy to drive the country's economy takes place in the context of the change of world trends in the new economic era, which drives and develops the country for higher progress in all dimensions. Frank, Dalenogare & Ayala (2019) found that the implementation of the "Industry 4.0" policy is changing the industrial process that creates challenges in the industry. This is because it introduces cutting-edge technology in the industrial process for connecting and working in digital systems as a driving tool. However, entrepreneurs are still lacking in emerging technology to connect applications for productivity in production processes, technology research and development and human capital development innovation. Roopsing & Suk-kavessako (2020) said that resource management requires systematic resource management because it maximizes management efficiency, whether it is personnel development and operational or financial potential, which reduces raw material costs and production losses. In addition, modern and environmentally friendly machinery should be provided along with creating a suitable environment for investment and development in terms of equality, opportunity, quality of life, security, and readiness to deal with future changes, as well as foundation for the next phase of development in a balanced way to prevent future failures.

Although the country has developed in all its forms, the internal economic conditions of the country have not changed according to development and investment. Different industries face different problems such as emerging businesses, business closures and intense competition. These are indicators of industrial competitiveness. (Charles, Hurst, & Schwartz, 2018) studying the changes industrial in the United States to the unemployment rate, found that process changes using modern technology resulted in higher unemployment. Bennett & Lemoine (2014) found that volatility, uncertainty, complexity, and ambiguity are real-world situations that are rapidly changing and have a huge impact on businesses. In addition, Small and Medium industrial businesses in the country still lack an analysis of the changing behavior of consumers and market competitors, and market share distribution to new markets, including a lack of knowledge and understanding of accounting and financial systems. Wantanakomol & Silpcharu (2020) found that operational transparency is a barrier to corporate management. Organizations should cultivate good morals and ethics. Executives should be a role model for morality and ethics without using corrupt powers for the benefit of themselves and their peers and create an organizational culture to prevent corruption. Okpara (2011) examines factors in terms of growth constraints and business survival due to lack of financial support, inefficient management, corruption, lack of training and experience, and inadequate infrastructure which makes management difficult.

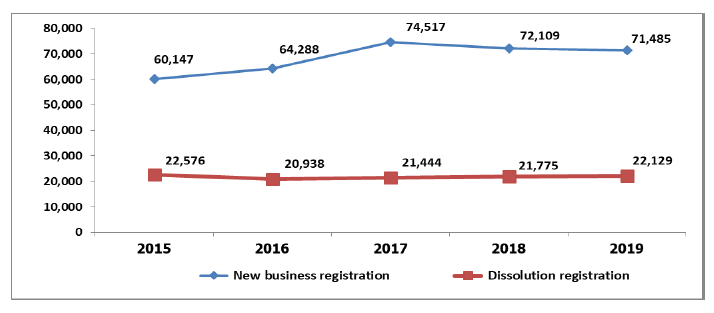

According to the data from the Department of Business Development in 2020, the number of business dissolution registrations tends to increase as shown in Figure 1.

Figure 1: Statistical Data on New Business Registration and Dissolution Registration (Department of Business Development, 2020)

Figure 1, the statistical data of new business establishment registration and business dissolution registration (Department of Business Development, 2020) found that new business registrations had been on a downward trend since 2017 with only 74,517, in 2018, the number decreased by 72,109, and in 2019, the number decreased by 71,485. As the number of business dissolution registrations increased: in 2017, the number increased by 21,444, in 2018, the number increased by 21,775 and in 2019 the number increased by 22,129.

As mentioned above, entrepreneurs need to make arrangements before the establishment of a business, and there must be a thorough consideration (Evans, 1987; Kangasharju, 2000; Kaikkonen, 2006). Organizations need to be prepared with information such as accounting and finance, marketing, resource management, as well as the use of technology in the production process. These factors are necessary for analysis and decision making prior to business incorporation.

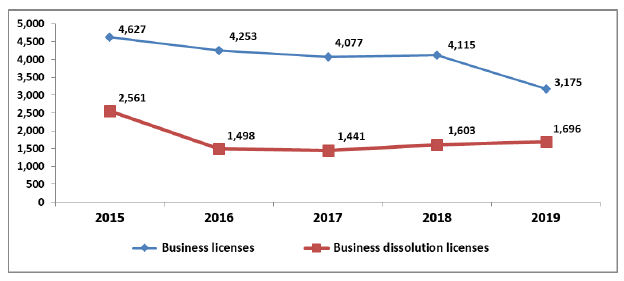

As for the additional issue of business licenses and dissolution licenses, it was found that in 2017, there were 4,077 licensed businesses, in 2018 the number decreased by 4,115 and in 2019 the number decreased by 3,175 .While the number of factories permitted to dissolve in 2017 was 1,441, in 2018 the number increased by 1,603 and in 2019 the number increased by 1,696. It could be seen that the approval for liquidation had a higher tendency (Manufacturing Business Information Center, Department of Industrial Works, 2020) as shown in Figure 2.

Figure 2: Statistics of Industrial Factories that have Business Licenses and Business Dissolution Licenses (Manufacturing Business Information Center Department of Industrial Works, 2020)

Figure 2, Therefore, it could be concluded that the problem of factors that led to the failure of industrial business in the sense that today's business world is changing rapidly and is connected by a free market in terms of buyers, sellers, financial systems, transportation systems, communication systems, information systems, capital flows, human resources and raw materials. Financial failure refers to the condition in which a company is in debt to the point of being unable to pay its debts for a specified period of time and makes the company more prone to bankruptcy risk situations. Technical insolvency is a company's lack of liquidity. Although the company's total assets exceed its total liabilities, it is a state of failure resulting from the company's inability to pay its current liabilities. Insolvency in Bankruptcy is a situation where the company's liabilities exceed the assets of the entity, which prevents the company from repaying its liabilities or its ability to pay less than before, including its total assets less than its total liabilities (Kongkiti & Repee, 2007). The aforementioned global crisis had resulted in a dramatic shift in our global, regional and national competitive advantages as well as industrial and corporate levels. It also meant the obligation to drive the organization by expanding from management to all employees. Importantly, the inability to gain competitive advantages in international trade and the inability to meet profitability expectations could also lead to failure of the organization. Alba, Claessens & Djankov (1998); Dhnadirek & Tang (2003) reported the relationship between an inefficient corporate governance system and the economic crisis. The relationship between corporate governance mechanism and firm's performance was performed in the expectation that increased operational efficiency of the entity would reduce its bankruptcy. Maher & Andersson (2003) also concluded that inefficient corporate governance was one of the catalysts for economic crises or failures in business.

Research Objective

To study the causal factors leading to the failure in industrial business.

To develop a structural equation model of causal factors leading to failure in industrial business.

Literature Review

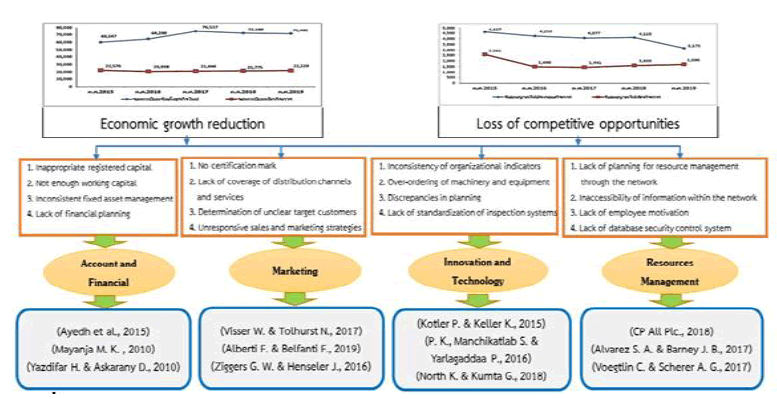

According to the study of the previous concepts and theories, the researcher could summarize the guidelines of the four causal factors leading to the failure in industrial business operations: account and financial, marketing, resources management and innovation and technology.

Figure 3: Sources of Research Elements Factors of a Study of Factors that Lead to Failure in Industrial Business.

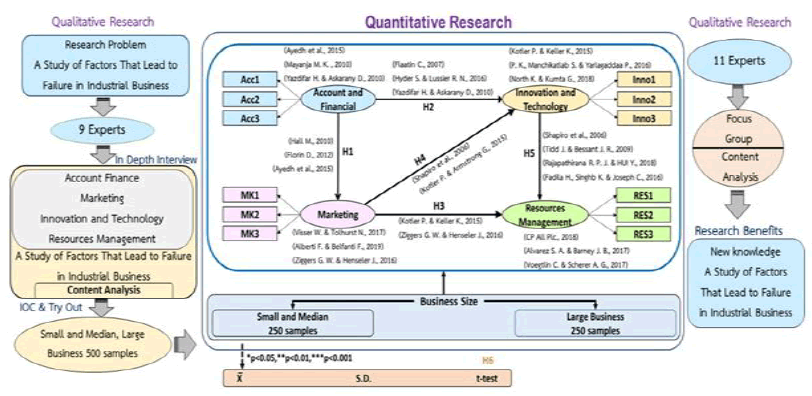

This research was to create a new body of knowledge by using mixed research. It was divided into 3 parts: a qualitative research using in-depth interview techniques, a quantitative research using exploratory data collection, and a qualitative research using focus group method to verify the validity of the research model. The methods of conducting the research were detailed as follows:

The population used in qualitative research consisted of 9 experts through a purposive sampling method. The experts were categorized in 3 groups: 3 entrepreneurs or executives in business organizations, 3 officers in government agencies and related agencies and 3 academicians.

The Quantitative Research was a survey by using a sample of entrepreneurs who run industrial businesses with 3 consecutive years of operating losses and still running their businesses (Department of Business Development, 2020). The sample size was determined using the criteria of elemental analysis research or structural equation modeling. The sample size was determined at the high level of 500 samples (Comrey & Lee, 1992) as cited in Silpcharu (2020) using the Multi Stage Sampling method (Babbie, 2010) as cited in Silpcharu (2020). The method consisted of the Cluster Sampling procedure which could be divided into two types: small and medium industrial businesses and large industrial businesses. Selection was performed using Lottery Probability Sampling and collecting sample data.

The research tool was a questionnaire with check list questions and rating scale items. Weighing criteria were set with five levels based on the Likert scale. The index of item objective congruence study found that the 100 observed variables had IOC values between 0.60-1.0. Check-list questions were determined by using standard deviation analysis with values between 0.45-1.75, and rating scale items were analyzed by using Corrected Item-Total Correlation values between 0.31 - 0.87. The reliability of the questionnaire was analyzed by using Cronbach's alpha coefficient of 0.99. To collect the data, a multi-stage randomized interview was used.

Data analysis was performed by using descriptive statistics, reference statistics, and multiple statistics for the development of a Structure Equation Model (SEM) by using SPSS and AMOS software packages. The criteria for Evaluating the Data-model Fit were defined in four values: 1) The Chi-square Probability Level (CMIN-ρ) was greater than 0.05. 2) The Relative Chi-square (CMIN/DF) was less than 2.0. 3) The Goodness of Fit Index (GFI) was greater than 0.90. 4) The Root Mean Square Error of Approximation (RMSEA) was less than 0.08. The conceptual framework was shown in Figure 4.

Another qualitative research was conducted using a focus group. The key informants in this study consisted of 11 experts selected with the purposive sampling method.

Results

The researcher presented an overview of the study of the causal factors leading to the failure of production business, and the results could be summarized as follows:

The results of the analysis of the causal factors leading to the failure of industrial business by using qualitative research through in-depth interview techniques from experts found that the elements of education could be classified into four categories: account and financial, marketing, resources management and innovation and technology.

The level of importance of the causal factors leading to the failure of the overall industrial business was high and the average score was 4.20. When considering each aspect, it was found that all aspects were of high importance. Account and financial had an average of 4.25. Marketing had an average of 4.20. Resources management had an average of 4.17. Innovation and Technology had an average of 4.17. When classified by item in each aspect according to the 3 highest importance level, it was found that Account and financial, the highest priority was the unsuitable registered capital with an average of 4.38, followed by insufficient working capital to operate the business, thus requiring high loan volumes with an average of 4.34 and uneven fixed asset management with an average of 4.32, respectively.

Marketing, the highest priority was unclear targeting with an average of 4.30, followed by sales and marketing strategies that did not respond to customer demand with an average of 4.29, and lack of opportunity to participate in projects with the public or private sectors that promote marketing for entrepreneurs with an average of 4.28, respectively.

Resource management, the highest priority was setting non-policy and performance KPIs with an average of 4.27, followed by the purchase of excess production equipment with an average of 4.26 and lack of continuity in planning and monitoring performance to be used to improve performance with an average of 4.23, respectively.

Innovation and technology, the highest priority was the lack of planning for resource management through a network that was quickly accessible both internally and externally with an average of 4.30, followed by intranet management with inaccessible data and workspace coverage with an average of 4.28 and personnel lacking inspiration to realize the importance of innovation with an average of 4.27, respectively.

The results of the analysis of the importance of the causal factors leading to the failure in the industrial business found that small and medium-sized industries focused on accounting and finance at the highest level with an average of 4.26, followed by marketing with an average of 4.18 and resource management with an average of 4.17, respectively. The large industrial business focused on accounting and finance at the highest level with an average of 4.23, followed by marketing with an average of 4.23 and innovation and technology with an average of 4.17, respectively.

Comparison of importance of causal factors leading to failure in industrial business could be classified by size of business and the difference between the mean of the two independent populations was tested by t-test, it was found that the significance level of the causal factors leading to the overall industrial business failure classified by business size was not significantly different at the 0.05 level. Small and medium- sized industrial businesses and large industrial businesses were equally concerned with this matter, as shown in Table 1 (Innovation and Technology).

| Table 1 Comparison of the Perceived Importance of a Study of Factors that Lead to Failure in Industrial Business |

||||||

|---|---|---|---|---|---|---|

| A Study Of Factors That Lead To Failure In Industrial Business | Small and Medium Business |

Large Business | t-Value | P-Value | ||

| x¯ C |

S.D. | x¯ C |

S.D. | |||

| Overall | 4.20 | 0.33 | 4.20 | 0.39 | 0.05 | 0.96 |

| 1.Account and financial | 4.26 | 0.33 | 4.23 | 0.41 | 0.92 | 0.36 |

| 2.Marketing | 4.18 | 0.43 | 4.22 | 0.44 | -1.00 | 0.32 |

| 3. Resources Management | 4.17 | 0.38 | 4.16 | 0.41 | 0.24 | 0.81 |

| 4.Innovation and Technology | 4.17 | 0.40 | 4.17 | 0.46 | 0.16 | 0.88 |

Structural equation model was used to study the causal factors leading to failure in industrial business in order to analyze and refine the model. In the study, Modification Indices were considered to eliminate some of the inappropriate observational variables one by one and reprocessed the model and did so until a model with all four statistical values passed. Finally, the model was complete and harmonious with the empirical data (Slipcharu, 2020) as shown in Table 1, the structural equation model in Figure 5 and the definition of the variables in Table 3.

| Table 2 Statistics Obtained form Congruence Assessment of the Structural Equation Model before and After the Improvement |

|||

|---|---|---|---|

| Index | Accepted Value | Before Improvement | After improvement |

| 1. CMIN- p (Chi-square Probability Level) | r > 0.05 | 0.000 | 0.085 |

| 2. CMIN / df (Relative Chi-square) |

< 2.00 | 2.427 | 1.126 |

| 3. GFI (Goodness of Fit Index) |

> 0.90 | 0.662 | 0.956 |

| 4. RMSEA (Root Mean Square Error of Approximation) |

< 0.08 | 0.053 | 0.016 |

Figure 5: Structural Equation Model of A Study of Factors That Lead to Failure in Industrial Business in Standardized Estimates Mode after Model Improvement

| Table 3 Meaning of Abbreviation Used of a Study of Factors That Lead to Failure in Industrial Business |

|||

|---|---|---|---|

| Variable | Meaning | Variable | Meaning |

| Acc6 | The financial system for investment and working capital is insufficient for business management. | Ress5 | The lack of regular maintenance of the main equipment and tools makes it unable to operate continuously. |

| Acc11 | The preparation of accounting and financial statements is inconsistent with the actual condition of the company and the organization's debt collection is inefficient. | Ress6 | There is no management of raw material utilization to ensure sufficient production and delivery. |

| Acc14 | The accounting recorder program is not suitable. | Ress10 | The organization's environment management system is not conducive to work. |

| Acc16 | Accounting records are inconsistent with production systems and organizational structures. | Ress11 | The location of the business is not conducive to business operations. |

| Acc18 | Inventory system is not defined appropriate for the production and distribution of goods. | Ress13 | Undirected personnel development does not respond to organizational strategies and goals. |

| Acc25 | The financial system for investment and working capital is insufficient for business management. | Ress14 | The knowledge management is not covered by all departments of the organization. |

| Mark10 | Existing Brand Image is not clearly explained. | Inno1 | No technology is used to support personnel performance appraisals. |

| Mark12 | Competitors' business potential assessments are uneven and the information is not used in sales and marketing plans. | Inno2 | There is no focus on finding new technologies or ideas to build on existing innovations. |

| Mark22 | After-sales service cannot satisfy the customer. | Inno7 | Production processing is delayed (Real Time) and lack of accuracy in data storage |

| Mark23 | The pricing policy is unclear. | Inno12 | People are not motivated to realize the importance of innovation. |

| Mark24 | Salespeople still lack good interaction with customers. | Inno18 | There is a lack of continuity in software and hardware investments. |

| Mark25 | Production line does not cover customer needs. | Inno22 | There is a lack of technologists to advice personnel. |

Hypothesis testing by analyzing the causal influence between latent variables in the causal factor model leading to industrial business failure found that 5 hypotheses were consistent with the 7 hypotheses. 1) Accounting and finance had a statistically significant direct influence on marketing at the 0.001 level. 2) Accounting and finance had a statistically significant direct influence on innovation and technology at the 0.001 level. 3) Marketing had a statistically significant direct influence on resource management at the 0.001. level. 4) Marketing had a statistically significant direct influence on innovation and technology at the 0.001 level. 5) Innovation and technology had a statistically significant direct influence on resource management at the 0.001 level.

Discussions and Conclusion

The researcher discussed the research findings in the following four areas:

The comparative results of the importance of the causal factors leading to the overall business failure found that there were no statistically significant differences at the 0.05 level. Consistent with Okpara (2011), a study of factors, limitations, growth and survival of businesses found that these constraints arose due to lack of financial support, inefficient management, corruption, training and experience, and inconvenient infrastructure that complicated management.

According to research results, accounting and finance had the highest direct influence on marketing. Consistent with Ayedh, et al., (2015), the application of management accounting techniques had a significant impact on overall operational success. The study also found that the use of operational equilibrium measures had a significant impact on profitability, customer satisfaction, market position and organizational growth (Hussain, 2005; Ittner et al., 2003; Rasid et al., 2014). International research on managerial accounting in the financial business showed that Organizations should use management accounting information to plan various operational strategies in order to increase the efficiency of the organization (Boso, 2013). If a business had access to capital as a supporting factor, it would create an export entrepreneurial behavior and an export market-oriented behavior that allowed businesses to introduce new products to the international market.

The overall influence of latent variables in the structural equation model could be summarized as: marketing had an overall influence on resource management. Standardized Regression Weight was 0.74 (0.47+0.27 = 0.74). Such results were obtained from: 1) Marketing had a direct influence on resource management, with a value of 0.47. 2) Marketing had an indirect influence on innovation and technology, with a value of 0.52 and passed on to resource management with a value of 0.52 (0.52x0.52=0.27). Consistent with Wiroterat, Ussahawanitchakit & Muenthaison (2015), accounting information reflected the performance, financial position of the business, opportunities and viability of the business. The presentation of accounting information must be up-to-date, relevant to business operations and beneficial to management decisions. Such information must be effective, complete, accurate and timely financial reports in order to build trustworthiness of investors in decision-making and not making the wrong decisions that would damage the business.

The results of an aspect-based analysis of the highest priorities of the causal factors leading to the highest failure in industrial business operations were accounting and finance. Consistent with Ayedh, et al., (2015), the application of management accounting techniques had a significant impact on overall operational success. The study also found that the use of operational equilibrium measures had a significant impact on profitability, customer satisfaction, market position and organizational growth (Hussain, 2005; Ittner et al., 2003; Rasid et al., 2014). Organizations should use management accounting information to plan various operational strategies in order to increase the efficiency of the organization.

Recommendations

The recommendations obtained from this research could be used as a guideline for interested entrepreneurs. The researcher summarized 11 recommendations as follows:

Governments should provide information as a connected platform and allow interested entrepreneurs to access information to increase their business potential.

Government sectors should have measures to formulate trade tax and export tax policies that are conducive to competition and reduce procedures such as laws or regulations that are not conducive to competition.

Government sectors should promote new market expansion without interference from trade protectionism measures and linkage with the tax system to create competitive opportunities.

Government sectors must develop technology and information infrastructure such as laboratories, testing centers and central testing centers, as well as promote research and development for potential in the industrial business sector, and working as an expert in consulting with entrepreneurs.

Government sectors should develop competence and potential in technology and management for new entrepreneurs by creating learning centers in each field.

The organization must engage and encourage employees as good members of the organization. Cultivation of morals and ethics should start with the executive as a role model. It also provides opportunities for organizational personnel to formulate management policies, goal setting, vision, mission, aligning, empowering, and communications that should indicate the outcomes of success or failure.

Organizations must be transparent in the preparation of accounting and financial systems in order to use organizational information as information for effective management.

The organization must be structured as an organization of learning and developing modern working systems.

The organization must have integrated marketing management between marketing and technology. Accelerating the response to consumers requires systematic resource management as it maximizes management efficiency in terms of personnel development and operational and financial capabilities. This will reduce the cost of raw materials and wastage in production.

The organization shall manage the resources and application of technology appropriately. Optimizing organizational resources can be achieved by linking information together. In addition, personnel should be encouraged to develop innovations through various incentives, including research and development to achieve quality innovations and create competitive advantages.

The organization shall plan the use of raw materials and determine the level of finished goods for sale in accordance with the purchase demand.

Future Studies

Successful and failed businesses should be studied and linked to results studies. Industry or size of industrial business must be categorized in order to study the differences in managing successful and failing businesses so that governments, organizations and interested parties can obtain useful information. In this regard, such issues should be studied as further research.

References

Alba, P., Claessens, S., & Djankov, S. (1998). Thailand’s corporate financing and governance structures: Impact on firms’ competitiveness. Conference on Thailand’s Dynamic Recovery and Competitiveness. 20- 21 May 1998. UNCC. BKK.

Alberti, F., & Belfanti, F. (2019). Creating shared value and clusters: the case of an Italian cluster initiative in food waste prevention. Competitiveness Review: An International Business Journal, 29(1), 39-60.

Alcott, B., Giampietro, M., Mayumi, K., & Polimeni, J. (2012). The Jevons paradox and the Myth of resource efficiency improvements. New York: Earthscan.

Crossref, GoogleScholar, Indexed

Alvarez, S.A., & Barney, J.B. (2017). Resource based theory and the entrepreneurial firm. In M. A. Hitt, D.R. Ireland, M.S. Camp., & D.L. Sexton (Eds.), Strategic entrepreneurship: Creating a new mindset (87- 105). New Jersey: Blackwell Publishing Ltd.

Crossref, GoogleScholar, Indexed

Ayedh A Mohamed, A., Eddine, H., & Oussama, C. (2015). The impact of advance management accounting technique on performance: The case of Malaysia. Middle East Journal of Business, 10(2)

Crossref, GoogleScholar, Indexed

Bennett, N., & Lemoine, G.N. (2014). What VUCA Really Means for You. Harvard Business Review, 92.

Boso, N. (2013). Firm innovativeness and export performance: environmental, networking, and structural contingencies. Journal of Marketing Research, 21(4), 62-87.

Crossref, GoogleScholar, Indexed

Charles, K.K., Hurst, E.C., & Schwartz, M. (2018). The Transformation of Manufacturing and the Decline in US Employment. The University of Chicago Press Journal.

Collison, C., & Parcell, G. (2003). Learning to fly: Practical lessons from some of the world's leading knowledge companies (2nd ed.). Oxford: Capstone.

Damanpour, F. (1992). Organizational size and innovation. Organization Studies, 13(3), 375-402.

Department of Business Development. (2020). Statistics of the dissolution of registered businesses: Business Documentation and Information Center.

Department of Industrial Works. (2020). Manufacturing industry development project to enhance competitiveness.

Dhnadirek, R., & Tang, J. (2003). Corporate governance problems in Thailand: Is ownership concentration the cause?. Asia Pacific Business Review, 10(2), 121-38.

Evans, D.S. (1987). Tests of alternative theories of firm growth. Journal of Political Economy, 95(4). 657-674.

Frank, G.A., Dalenogare S.L., & Ayala F.N. (2019). Industry 4.0 Technologies : Implementation Patterns in Manufacturing Companies. International Journal of Production Economics, 210, 15-26.

Crossref, GoogleScholar, Indexed

Hussain, M. (2005). Management accounting performance measurement systems in Swedish banks.European Business Review, 17(6), 566-589.

Crossref, GoogleScholar, Indexed

Ittner, C.D., Larcker, D F., & Randall, T. (2003). Performance implications of strategic performance measurement in financial services firms.Accounting Organizations and Society, 28(7), 715-741.

Crossref, GoogleScholar, Indexed

Kaikkonen, V. (2006). Exploring The Dilemmas Of Small Business Growth: The Case of Rural Food-Processing Micro Firms.Journal of Enterprising Culture, 14(2), 87-104.

Crossref, GoogleScholar, Indexed

Kangasharju, A. (2000). Growth of the Smallest: Determinacy of small firm Growth During Strong Macroeconomic Fluctuation. International Small Business Journal. 19(1). 28-43.

Crossref, GoogleScholar, Indexed

Kimberly, J.R., & Evanisko, M.J. (1981). Organizational innovation: the influence of individual, organizational, and contextual factors on hospital adoption of technological and administrative innovations. Academy of Management Journal, 24(4), 689-713.

Crossref, GoogleScholar, Indexed

Kongkiti, P., & Repee, K. (2007). Competitive priorities of manufacturing firms in Thailand. Industrial Management & Data Systems, 107, 979-996.

Crossref, GoogleScholar, Indexed

Kotler, P., & Keller, K. (2015). Marketing management plus my lab marketing with Pearson e-text access Card. New Jersey: Prentice Hall.

Kotler, P., & Armstrong, G. (2008). Principles of Marketing (12th Edition). Englewood Cliffs, New Jersey:Pearson Prentice Hall.

Maher, M., & Andersson, T. (2003). Corporate Governance: Effects on firm performance and economic growth. Paris. OECD.

Crossref, GoogleScholar,Indexed

Mayanja, M.K. (2010). Management accounting as an instrument for corporate governance in Botswana) Master’s thesis, University of South Africa.

Mongsawad, P. (2012). The philosophy of the sufficiency economy: a contribution to the theory of development.Asia-Pacific Development Journal, 17(1), 123-143.

Crossref, GoogleScholar, Indexed

North, K., & Kumta, G. (2018). Knowledge management: value creation through organizational learning. London: Springer.

Crossref, GoogleScholar, Indexed

Nonaka, I., & Takeuchi, H. (1995). The knowledge-creating company: How Japanese companies reate the dynamics of innovation. New York: Oxford university press.

Crossref, GoogleScholar, Indexed

Okpara J.O. (2011). Factors constraining the growth and survival of SMEs in Nigeria Implication for poverty alleviation. Management Research Review, 34(2) 156-171.

Crossref, GoogleScholar, Indexed

Oparanma , A.O. (2010). The organizational culture and corporate performance in Nigeria. International Journal of African Studies, 3, 34-40.

Crossref, GoogleScholar, Indexed

Pierce, J.L., & Delbecq, A.L. (1977). Organization structure, individual attitudes and innovation.Academy of Management Review, 2(1), 27-37.

Crossref, GoogleScholar, Indexed

Rasid, S.Z.A., Isa, C.R., & Ismail, W.KW. (2014). Management accounting systems, enterprise risk management and organizational performance in financial institutions. Asian Review of Accounting, 22, 128-144.

Crossref, GoogleScholar, Indexed

Roopsing, T., & Suk-kavessako, T. (2020). Academy of Strategic Management Journal, 19(6).

Ruttanaporn, S. (2005). Management accountingpractices in Thailand. In A. Nishimura, & R.Willett (Eds.), Management accounting in Asia (119–157). Malaysia: Thomson learning.

Schneider, S., & Spieth, P. (2013). Business model innovation: towards an integrated future research agenda. International Journal of Innovation Management, 17(01), 1340001.

Crossref, GoogleScholar, Indexed

Silpcharu, T. (2020). Researching and Statistical Analysis with SPSS and AMOS (18th Edition). Bangkok: Business Research and Development Institute.

Tiwana, A. (2000). The knowledge management toolkit: practical techniques for building aknowledge management system. New Jersey: Prentice Hall PTR.

Crossref, GoogleScholar, Indexed

Visser, W., & Tolhurst, N. (2017). The world guide to CSR :A country-by-country analysis of corporate sustainability and responsibility .NY: Routledge

Crossref, GoogleScholar, Indexed

Voegtlin, C., & Scherer, A.G. (2017). “Responsible innovation and the innovation of responsibility: Governing sustainable development in a globalized world”. Journal of Business Ethics, 143(2), 227-243.

Crossref, GoogleScholar, Indexed

Vongchavalitkul, B. (2018). Content marketing exposure of online consumers in Bangkok area [Special issue]. Journal of Business Administration APHEIT, 7(2), 85-94.

Wantanakomol, S., & Silpcharu, T. (2020). Strategy for preventing corruptions in industrial business organizations with Delphi technique. Academy of Strategic Management Journal.

Wiroterat, C. Ussahawanitchakit, P. & Muenthaisong, K. (2015). Audit Professional well Roundedness and Audit Success: An Empirical Investigation of Certified Public Accountants in Thailand. The Journal of American Business Review, Cambridge, 4(3), 158-180.

Crossref, GoogleScholar, Indexed

Yazdifar, H., & Askarany, D. (2010). A comparative investigation into the diffusion of management accounting innovations in the UK, Australia and New Zealand. Research Executives Summaries Series, 5(9).

Ziggers, G. W., & Henseler, J. (2016). The reinforcing effect of a firm’s customer orientation and supply-base orientation on performance. Industrial Marketing Management, 52, 18–26.

Crossref, GoogleScholar, Indexed

Received: 05-May-2022, Manuscript No. jmids-22-11932; Editor assigned: 07-May-2022, PreQC No. jmids-22-11932 (PQ); Reviewed: 19-May-2022, QC No. jmids-22-11932; Revised: 25-May-2022, Manuscript No. jmids-22-11932 (R); Published: 13-Jun-2022