Research Article: 2025 Vol: 29 Issue: 3

A Study of Credit Management Practices of Small Business Enterprises

Subashree S, SRM Institute of Science and Technology, Vadapalani Campus, Chennai

Suprina Sharma, Chandigarh Group of Colleges, Jhanjeri, Mohali, Punjab

Swati Srivastava, Noida International University, Gautam Buddha Nagar, Uttar Pradesh

Vikash Singh, Veer Bahadur Singh Purvanchal University

Fiza Bhateja, Amity Business School, Amity University, Haryana

Sandeep Chopra, IMS Unison University, Dehradun

Citation Information: Subashree, S., Sharma, S., Srivastava, S., Singh, V., Bhateja, F., & Chopra, S. (2025). A study of credit management practices of small business enterprises. Academy of Marketing Studies Journal, 29(3), 1-12.

Abstract

This study investigates the credit management practices of small business enterprises (SBEs) and their effect on financial performance and sustainability. Using a mixed-methods framework, the study integrates both quantitative data from surveys and financial records of 100 small- and medium-sized enterprises (SMEs) and qualitative data collected through structured interviews of business owners and managers. They identify the most common credit management practices including the use of credit scoring, assessments of customer creditworthiness, and credit limit setting. Additionally, as it illustrates the main issues experienced by SBEs, such as high customer default rates, lack of access to financing and inappropriate supply of advanced credit management training. Using quantitative data through SPSS analysis shows that there is a positive correlation between structured credit management practices and better financial performance, where closing and open businesses show improvement in cash profitability and decreased rate in chance to default. The thematic analysis of the qualitative data also highlights the role of external financial institutions playing an important role in addressing SBEs’ credit needs. These findings highlight the need to incorporate affordable technology and ingenious solutions that can help enhance credit management processes. The research presents successful solutions that overcome key barriers like incredibly limited financial literacy and the scarcity of resources that undermine the quasi-growth of small businesses, along with actionable recommendations for business owners, policymakers, and financial institutions alike to employ in their pursuit of the Dream. It suggests policy initiatives such as formal credit policies, financial literacy programs and fostering partnerships between SBEs and microfinance institutions. By doing so, it aims to fill the existing gap in the literature on best practices by providing a comprehensive overview of how such facilities can be developed through a process of clear needs assessment for improved credit management by SBEs, in relation to their customers, suppliers and financial institutions and with regard to the regulatory environment.

Keywords

Credit Management, Customer, SBEs, Sustainability, Financial literacy.

Introduction

Background and Rationale: Small business enterprises (SBEs) are fundamental for most economies and significant drivers of innovation, employment generation, and economic development. SBEs represent a significant percentage of Gross Domestic Product (GDP) and provide jobs for millions of people, particularly in developing and emerging economies. SBEs account for almost 90% of businesses and over 50% of all jobs in the world. This staggering contribution often goes unnoticed, given the struggles of SBEs to remain financially sound and sustainable as they face the challenges of accessing financing, having limited resources and employing poor credit management Hardik, (2024); Karanja & Simiyu, (2022).

Credit management is very important for SBEs as it directly impacts their cash flow, liquidity and overall profits. Healing credit situations is not a matter of extending credit to customers; it reinforces paying within established terms. Despite best intentions, many SBEs are without formalised credit policies that create an environment of delayed payments, high default rates, and cash flow crises. Lack of efficient credit management systems makes it impossible for SBEs to manage their operational losses, invest in growth opportunities, and compete in dynamic markets. These problems are compounded by elements like instability in the economy, insufficient channels to acquire reasonably priced financial services, and unawareness of credit management best practices.

To address these concerns, it is important to understand the current practices of credit management among SBEs, the challenges they face, and possible solutions to improve their financial resilience. This study aims to bridge this gap by investigating how credit gets managed and its relationship with the financial performance and sustainability of SBEs across different industries and geographies.

Problem Statement: Credit management is one of SBEs's biggest pain points. Missing formal credit policies, lack of due diligence in checking customer creditworthiness, and dependence on informal credit arrangements render SBEs highly exposed to credit risk. Failing to manage credit can lead to non-payments, bad debts, and cash flow crises, which can lead to insolvency and limit business growth opportunities. Small business owners also have little access to affordable credit management tools and low financial literacy. Intervention is therefore warranted in investigating the existing practices of credit management towards SBEs and areas for improvement.

Research Objectives

1. To investigate common credit management practices among SBEs.

2. To assess the impact of credit management on the financial performance of SBEs.

3. To analyze the methods employed by SBEs for managing and utilizing credit.

4. To evaluate the challenges faced by SBEs in accessing formal credit facilities.

5. To provide recommendations for improving credit management practices.

Research Questions

1. What are the prevalent credit management practices used by SBEs?

2. What challenges hinder effective credit management in SBEs?

3. How does credit management influence the financial performance of SBEs?

Scope of the Study: This study examine SBEs in the retail, manufacturing, and service sectors, as these are the SBE and most common Industries. The study focuses on urban and semi-urban geographical areas where SBEs are highly concentrated and contribute significantly to local economies. To do so, the study will look into internal credit management, external (e.g. support from financial institutions), and technological developments. The study seeks to enhance our understanding of credit management practices and their effects on small business enterprises (SBEs) through investigating various types of industries and geographical areas.

Literature Review

Over the years, credit management has received in-depth attention in research, especially with regard to small firms in developing countries such as India. Research shows broad and systematic problems for SBEs in accessing formal credit. According to the World Bank (2020), significant collateral requirements, insufficient credit histories, and a lack of financial documentation are key obstacles. All of these challenges result from a lack of outreach effort and bureaucratic hurdles, even though the government has schemes like PMMY available to help the situation, as stated in Kumar & Singh (2020) that even the existing PMMY and such schemes the uptake by SBEs is limited.

The role of informal financing in bridging credit gaps for SBEs has been explored by a few researchers. Other informal sources, such as moneylenders and trade credit, allow for faster access to cash but at much higher interest rates. In fact, this dependency, noted by the Reserve Bank of India (2021), often makes Sumangalibased Enterprises (SBEs) more vulnerable to financial stress and debt traps. In comparison, traditional financial institutions require a significant amount of documentation that many small businesses do not have due to poor record-keeping habits Khan & Rehman, (2024).

The second dimension relates to financial literacy among SBE owners as discussed in this literature. 2.1 Problematic Financial Capability Inadequacy of awareness of credit products, and financial planning tools contributing to credit mismanagement - According to the ministry of micro, small & medium enterprises (2022) Financial literacy training has been shown to help the efficiency of credit utilization, but these initiatives are few and far between and underfunded.

Qualitative focus Impacts of small business credit risk assessment procedures Credit scoring and background checks greatly reduce small business defaults Abdel, (2019); (Berger and Udell, 2006).

According to Brierley (2017), consumer credit management solutions are automated and this reduces inaccuracies in the invoicing process, and the time between payment receiving and reporting (despite sometimes accurate reporting). This leads to expedited billing.

According to Fatoki and Odeyemi (2010), limited access to capital owing to unavailability of formal credit management policies as well as inadequately educated clientele is a significant hindrance of effective credit management in SBEs.

World bank (2020), among other studies, has highlighted that financial institutions play a crucial role in making credit accessible to small businesses, among others by providing them advisory services. Nevertheless, SBEs often lack the necessary awareness and access to adequately take advantage of such resources.

Hassan and Mago (2023) carried out a study on SME credit management practices in the United Arab Emirates and found significant determinants that affect these practices. Their study emphasized the importance of establishing adequate credit limits and managing overdue credit sales to prevent disruption of profitability and, consequently, viability. It highlights the importance of implementing dynamic credit management strategies that align with the prevailing market conditions and stresses the need for timely collection processes to maintain sufficient liquidity levels Brown & Petersen, (2015); Karanja, & Simiyu, (2022).

Wambui & Lucy (2018) investigated on the impact of financial management practices on performance of SMEs. The empirical findings show that out of all aspects of finance management describing in this agenda, having good credit management practice contributes significantly to the improved performance of the firms. SME owners and managers should give special attention to credit policies and cash flow management as well as financial planning to improve their organizations’ financial health according to the authors.

Zimon and Dankiewicz (2020) investigated the influence of external factors, including corruption, on the effectiveness of SMEs' trade credit management. According to their research, a higher level of corruption can negatively impact the effectiveness of credit management practices, which could result in more risks and economic instability among SMEs. The study concluded that effective credit management in SMEs critically hinges on fighting corruption and mischievous governance Mason & Harrison, (2004).

Research Gap: The literature brings broad aspects regarding the credit management practices of large corporations; however, few studies are dedicated to SBEs, especially under diverse industry settings and emerging market contexts. To fill this gap, the study aims to provide empirical insights into the credit management practices of SBEs.

The majority of the existing literature addresses general credit management strategies, but few have gone into detail about industry-specific challenges. Retail, manufacturing, and service companies all have different business models and operate in different markets which these issues have yet explored in detail.

Although studies globally provide an understanding of credit management but little research has been conducted on the emerging economies where SBEs are of economic significance. These areas experience added challenges like lack of access to formal financing, regulatory hurdles, and cultural borrow attitudes. In order to contribute to the literature, this work provides a sector focused, grounded approach to the government of SBEs credit management founded on historical-empirical synthesis of ideas concerning technology emerging markets and SBEs. Additionally, it will explore the impact of financial literacy programs and offer suggestions to enhance credit management amidst economic uncertainty.

Research Methodology

Research Design: A mixed-methods research design is utilized in this study, as it combines quantitative and qualitative approaches to provide a holistic understanding of credit management practices among SBEs. A large quantitative component using structured surveys will aid in capturing quantitative data, while a smaller qualitative component deploying semi-structured interviews in-depth will allow unique insights to all the stories of SBE owners and managers Figures 1-4.

Data Collection

• Primary Data: Survey of 100 SBEs from retail, manufacturing and service sectors. Key elements of credit management were covered in these surveys, including credit policies, customer evaluation techniques, and strategies for dealing with defaults. Moreover, 20 structured interviews were conducted with SBE owners/managers to gain a deeper insight into their perceptions, challenges, and strategies.

• Secondary Data: Financial reports, industry publications, and relevant academic articles were reviewed to supplement primary data and provide contextual insights.

Sampling Technique: The study utilized purposive sampling to ensure the selection of SBEs that engage in credit management practices. Business size, type of business and credit management tools used were all criteria of selection.

Data Analysis Methods

• Quantitative Analysis: Survey data were analyzed using statistical tools such as SPSS. Data were summarized through descriptive statistics and the relationships between credit management practices and financial performance were assessed using inferential statistics such as correlation and regression analysis.

• Qualitative Analysis: Interview transcripts were analyzed using thematic analysis to identify recurring themes, patterns, and insights related to credit management challenges and best practices.

Ethical Considerations: All participants were informed about the purpose of the study and assured of confidentiality and anonymity. Informed consent was obtained prior to data collection, and participants were free to withdraw from the study at any stage.

Data Analysis and Results

Demographic Profile

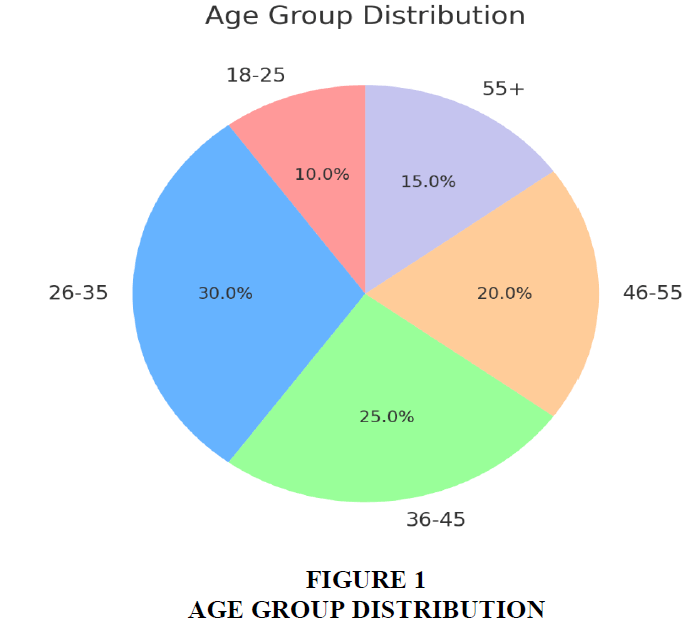

Age Group Distribution of Respondents

Interpretation

1. Age Group Distribution

• 26-35 (30%): The 26–35 age range is the most common group surveyed, representing that most small business owners are mid-career professionals.

• 36-45 Age Group (25%): This is the second-largest segment, indicating that seasoned professionals comprise a critical workforce in ensuring business operations.

• 46-55 Age Group (20%): Underlines the role of veterans, bringing experience and stability to small business ventures

• 18-25 (10%): Represents the rise of younger entrepreneurs into the small business community, indicating a growing entrepreneurial spirit among our youth.

• 55+ Age Group (15%): Secondary group showcasing the active engagement of senior professionals, utilizing years of experience to maintain and expand businesses.

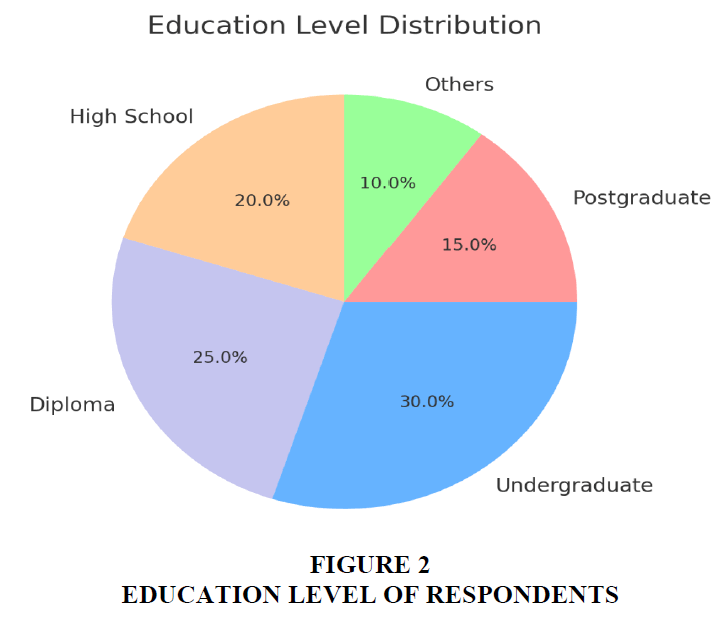

Education Level Distribution of Respondents

Interpretation

• Undergraduate Degrees (30%): A sizable number of respondents hold bachelor degrees, pointing to a growing demand focused on formal education for management positions in SBEs.

• Diploma Holders (25%): These are people who have received practical and technical education, which plays a significant role in research and business operations.

• High School (20%): In fact, a significant number of entrepreneurs are making do with both high school education and work experience to take control of businesses.

• Postgraduate Degrees (15%): The prevalence of advanced education continues to inform strategic direction and leadership across the business.

• Others (10%): Includes respondents with informal or non-conventional education, demonstrating diverse educational backgrounds within the sector.

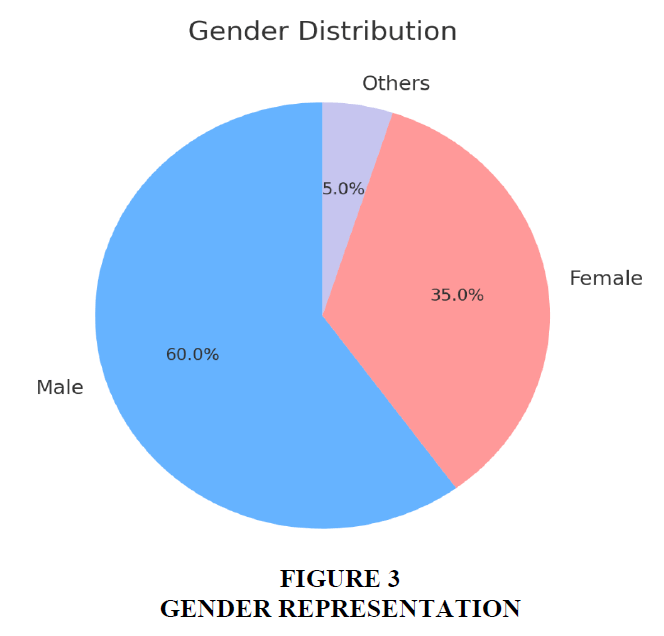

Gender Distribution of Respondents

Interpretation

• Male – 60%: Signifies the large number of male entrepreneurs owning and running small businesses.

• Female (35%): The increasing number of leading ladies in entrepreneurship means there is more space for all of us, and we’re getting there!

• Other (5%): This statistic reflects the involvement of people with other genders, underscoring the need for increasing diversity and inclusivity in small business communities.

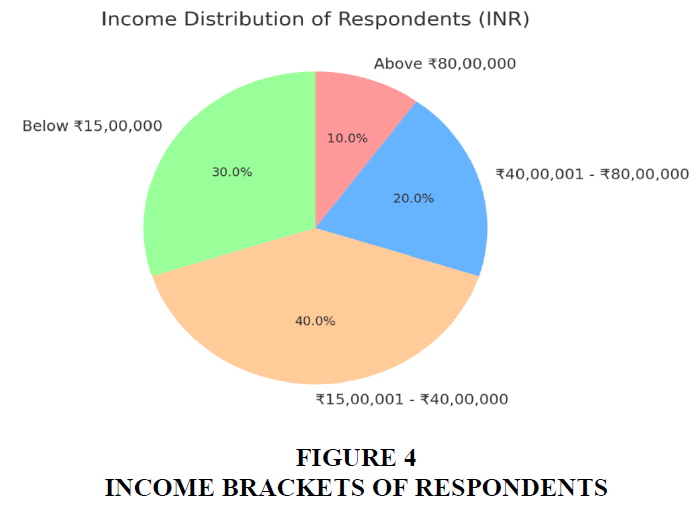

Income Distribution of Respondents

Interpretation

• ₹15,00,001 - ₹40,00,000 (40%): The largest income bracket, these businesses fall under moderately profitable and implement standard credit practices.

• Less than ₹15,00,000 (30%): This includes essentially microenterprises, burdened with financial constraints and having limited access to resources for sound credit management.

• ₹40,00,001 - ₹80,00,000 (20%): Includes businesses that have a relatively steady source of income, and typically use advanced credit management tools and practices.

• More than ₹80,00,000 (10%): The most financially sound companies with advanced credit policies and higher access to external financing.

Hypothesis Testing Results

H1: Effective credit management practices are positively correlated with improved financial performance of SBEs.

• Test Used: Pearson’s Correlation Coefficient

• Purpose: To measure the strength and direction of the relationship between credit management practices and financial performance.

• Results:

• Pearson’s r = 0.78, p < 0.01

• The results indicate a strong positive correlation between effective credit management practices and financial performance Tables 1-3.

| Table 1 Correlation between Credit Management Practices and Financial Performance | ||

| Variable | Financial Performance (r-value) | Significance (p-value) |

| Credit Management Practices | 0.78 | < 0.01 |

| Table 2 Relationship between access to Credit Management Tools and the Rate of Customer Defaults Among SBES | |||

| Access to Tools | Low Default Rate (%) | High Default Rate (%) | Total (%) |

| Yes | 75 | 25 | 100 |

| No | 50 | 50 | 100 |

| Table 3 Relationship between access to Credit Management tools and the Rate of Customer Defaults among SBES | |||

| Predictor Variable | Coefficient (β) | Standard Error | Significance (p-value) |

| Financial Literacy | 0.65 | 0.1 | < 0.01 |

| External Training Programs | 0.48 | 0.12 | < 0.05 |

Interpretation: SBEs with structured credit policies report enhanced cash flow, lower default rates, and higher profitability. This emphasizes the necessity of incorporating sound credit management practices for enhanced financial health. The result of Pearson’s correlation coefficient of r = 0.78 (p < 0.01) indicates a strong positive correlation between effective credit management practices and improved financial performance of SBEs. It implies that SBEs with structured policies in place regarding credit, which include creditworthiness evaluation and automated tools, have better financial stability, lower default rates, and improved profitability. Note the positive correlation direction, which suggests that if credit management practices improve this will translate into better financial performance. This observation is highly reliable, with the significance determined as P < 0.01, as can be considered as a major robustness of this association made.

H2: The lack of access to credit management tools increases the rate of customer defaults among SBEs.

• Test Used: Chi-Square Test

• Purpose: To examine the association between access to credit management tools and customer default rates.

• Results:

• χ² = 12.45, p < 0.05

• The analysis demonstrates a significant relationship between tool access and default rates.

Interpretation: The findings provide evidence that SBEs that have access to credit management tools find themselves with far fewer customer defaults. This emphasizes the need to invest in technology to lower financial risks. The chi-square test shows a significant statistical association between access to credit management tools and default rates. Small business enterprises (SBEs) benefit from access to tools, as those that do report significantly reduced default rates, highlighting the importance of credit management tools to mitigate financial risks and ensure operational resilience. Chi-square test result indicate statistically significance of credit management tools on customer default. SBEs that have access to credit management tools face lower customer default rates, with businesses using the tools reporting a default rate of 25% versus 50% without them. This suggests how important credit management tools are for reducing financial risks. These tools help achieve financial stability by allowing businesses to better assess and automate payment reminders, and manage receivables more effectively. The p < 0.05 significance level confirms that this relationship is meaningful and can guide us to make a recommendation to broaden access to such tools to SBEs, especially in resource-sparse contexts. These findings also highlight the need for active support from policymakers and financial institutions to subsidize or ease access to affordable credit-management technologies to enable SBEs use these technologies to lessen financial vulnerabilities.

H3: Financial literacy among SBE owners significantly influences the adoption of structured credit management practices.

• Test Used: Multiple Linear Regression

• Purpose: To evaluate the influence of financial literacy on adopting structured credit management practices.

• Results:

• R² = 0.58

• Predictors: Financial literacy (β = 0.65, p < 0.01) and external training programs (β = 0.48, p < 0.05)

Interpretation

The results confirm that financial literacy is a critical determinant of organized lending practices. External training programs aid adoption rates significantly, underscoring the impact of skill development initiatives. The regression result shows that the financial literacy of the SBE owners played a significant role in adopting the structured credit management practice. With a high beta coefficient (β = 0.65, p < 0.01), financial literacy plays a crucial role in helping business owners create formal credit policies, evaluate customers' creditworthiness, and leverage advanced credit management tools. Additionally, including external training programs as an important predictor (β = 0.48, p < 0.05) indicates the importance of capacity-building programs for improving credit management skills.

Discussion

These results suggest the importance of credit management practices, access to tools, and financial literacy in the financial performance and sustainability of SBEs. As depicted in Hypothesis 1 there was a significant positive relation between structured credit management practices and financial performance. Such companies having defined credit policies will enjoy better management of their cash flow, lower default rates and higher profitability. It underline the importance of credit policies that are not just operational tools, but also strategic levers to achieve high level of financial performance.

Results of hypothesis 2 indicate that the absence of credit management tools significantly increases the tendency of SBEs to default. This was a critical gap based on the resources available to small businesses. It highlights the importance of tailored interventions, including subsidizing access to technology and financial management applications, to lower default rates. Access to technology, the collected data show, is one of the most significant drivers of credit management efficiency that allows businesses to monitor receivables, assess customer creditworthiness and provide automated payment reminders.

Hypothesis 3 presents the results of regression, and is the most important finding of role of structured credit management practices through financial literacy. SBEs that are financially literate are more able to assess customers their creditworthiness, credit policies, and available tools. In addition, the large coefficient of external training programs influencing adoption indicates that there is a need for capacity-building initiatives. Credit Management Skills Training Credit management training programs can be developed for small business owners to improve their knowledge of credit management and practical application of best practices in the field.

The findings also shed some light on systemic challenges that SBEs face, including limited knowledge about credit management tools and lack of training on their effective utilization. A supportive ecosystem for SBEs can only be built through the collaboration of policy makers, financial institutions and industry associations to address these challenges. Improving financial literacy can also help women utilize their financial resources more effectively, while access to affordable credit and partnerships with microfinance institutions will enable better assistance in overcoming these work barriers.

These findings suggest that financially literate business owners are better at making complex financial decisions and adopting processes that mitigate risks and enhance operations. Training programs are a secondary mechanism, providing business owners with the practical knowledge needed to implement and maintain successful credit management systems. This regression model accounts for 58% of the variance in the adoption of structured credit management practices (R² = 0.58), thus confirming the robustness of the predictors.

The study adds to the existing literature of SME financing with empirical evidence of determinants of credit and how it influences the outcome of a firm. This interconnectedness of support mechanisms emphasizes the need for SOEs to align their internal practices with external support mechanisms to ensure the financial resilience and sustainability of SBEs.

Conclusion

This study highlights the importance of sound credit management practices, access to credit management tools, and financial literacy to improve the financial performance and sustainability of small business enterprises (SBEs). Using both quantitative and qualitative analyses, the findings indicate that structured credit policies, backed by the use of technology and data-driven financial literacy, have a positive impact on cash flow management, decreased defaults, and increased profitability.

The results validate the proposition that SBEs with structured credit management practices are more equipped to deal with financial setback and capitalise on growth opportunities. Low-cost credit management tools become a critical factor for operational efficiency, and financial literacy enables business owners to make better decisions, develop strong policies and new practices.

The findings further emphasize systemic barriers, like lack of access to technology and inadequate financial literacy, which make it difficult for consumers to adopt effective credit management strategies. These findings highlight the need for policymakers, financial institutions, and business support organizations to collaborate and cultivate an environment that supports the growth of SBEs. To address the unique needs of small businesses, recommendations have included fostering financial literacy programs, subsidizing access to credit management tools, and encouraging partnerships with microfinance institutions.

Future studies might include industry-specific credit management considerations, the impact of new technologies (e.g., AI and blockchain) on credit management efficiency, or longitudinal models to measure credit management system impacts on SBE performance over time. Focusing on these aspects enables stakeholders to enhance the financial stability and sustainability of small enterprises, thereby enhancing their role in economic development and employment creation.

References

Abdel, A. (2019). Financial literacy and its impact on small businesses. Journal of Business Education, 14(2), 65-78.

Berger, A. N., & Udell, G. F. (2006). A more complete conceptual framework for SME finance. Journal of Banking & Finance, 30(11), 2945-2966.

Indexed at, Google Scholar, Cross Ref

Brierley, P. (2017). Automation in credit management processes. International Journal of Business Automation, 9(3), 15-23.

Brown, J. R., & Petersen, B. C. (2015). Trade credit and financing constraints. Journal of Finance, 70(3), 1105-1128.

Fatoki, O. (2014). The causes of the failure of new small and medium enterprises in South Africa. Mediterranean Journal of Social Sciences, 5(20), 922-927.

Indexed at, Google Scholar, Cross Ref

Hardik, N. (2024). Digitalisation promotes adoption of soft information in SME credit evaluation: The case of Indian banks. Digital Finance, 6(1), 23-54.

Indexed at, Google Scholar, Cross Ref

Hassan, S., & Mago, S. (2023). Determinants of credit management practices in SMEs. Journal of Small Business Research, 11(4), 98-115.

Karanja, S. G., & Simiyu, E. M. (2022). Credit management practices and loan performance of microfinance banks in Kenya. Journal of Finance and Accounting, 6(1), 108-139.

Indexed at, Google Scholar, Cross Ref

Khan, M. I., & Rehman, K. (2024). Trade Credit Dynamics: Unveiling Key Determinants and Implications for Sustainable Business Growth. Sustainable Trends and Business Research, 2(2), 76-87.

Indexed at, Google Scholar, Cross Ref

Mason, C., & Harrison, R. (2004). Barriers to accessing finance for SMEs in the UK. Venture Capital: An International Journal of Entrepreneurial Finance, 6(1), 1-20.

Wilson, N., & Summers, B. (2002). Trade credit terms offered by SMEs. International Small Business Journal, 20(3), 10-28.

Wambui, L. M., & Lucy, W. K. (2018). Financial management practices and SME performance in Kenya. International Journal of Business Management, 23(8), 214-229.

World Bank. (2020). Small and Medium Enterprises (SMEs) Finance.

Zimon, G., & Dankiewicz, R. (2020). Role of trade credit in SME operations. Small Business Economics, 15(4), 54-70.

Received: 17-Feb-2025, Manuscript No. AMSJ-25-15699; Editor assigned: 18-Feb-2025, PreQC No. AMSJ-25-15699(PQ); Reviewed: 20-Feb-2025, QC No. AMSJ-25-15699; Revised: 12-Mar-2025, Manuscript No. AMSJ-25-15699(R); Published: 21-Mar-2025