Research Article: 2023 Vol: 27 Issue: 3S

A Review ESG Performance as a Measure of Stakeholders Theory

Sumit Kumar, Indian Institute of Management, Kozhikode

Citation Information: Kumar, S. (2023). A review esg performance as a measure of stakeholders theory. Academy of Marketing Studies Journal, 27(S3), 1-18.

Abstract

An analysis of the literature reveals that the "ESG performance" has not been defined explicitly, making it hard to evaluate and analyse prior corporate ESG actions. Furthermore, all available research on ESG performance (save one) considers the cumulative and integrated consequences of environmental, social, and governance practices on sustainability and value generation for all stakeholders. To make better ESG investment decisions, we need to understand how various ESG components affect stakeholder value development. When it comes to value, it is made up of both positive and negative externalities. Thus, value must be perceived and supplied individually within environmental and social restrictions. The purpose of this research study is to build a hypothesis describing the link between ESG and stakeholders' values within the context of sustainability. It is founded on a methodical evaluation of the current literature utilizing the grounded theory method. The variables described and utilized in various ESG literatures, as well as the values of stakeholders, are assembled from numerous research, together with the techniques of inquiry, study measurements, and conclusions, to construct the model for this theory. The relevant literatures were studied to extract the components used to describe various elements of ESG performance studies to develop a theory of value creation for stakeholders through the usage of an ESG performance indicator. In this article, a modified version of "Grounded theory" is implemented using "selective coding." The current research reveals that "ESG success" is not well defined from the standpoint of stakeholders' value generation, making it difficult to quantify and assess organizations' ESG activities.

Keywords

ESG, Stakeholders’ Values, Valuation, ESG Matrices, ESG Rating, Corporate Risks, Stakeholders’ Theory, Socially Responsible Investments, Market Capitalisation, Grounded Theory.

Introduction

The functioning of business organisations has changed now with the emergence of new expectations and regulatory norms. The boardroom of a company is having discussions on strategic plans encompassing environmental concerns along with governance practices. With investors and consumers more conscious in investing and buying from companies whose values align with their own, ESG reporting, and its rating are the ways to expand corporate accountability beyond the boardroom for socially responsible investments. Displaying ESG progress with metrics to the public helps boost how conscious consumers perceive the corporation and its social responsiveness. ESG performance and its rating depicts exposures of the company for its long-term risks associated with environmental, social, and governance aspects. These risks are associated with various aspects like protection of environment, efficiency with energy, safety of the workers etc. along with its financial implication. Altogether it affects the values for the stakeholders.

With the growing importance sustainability and sustainable development in the business models, the theories of sustainability are also evolving since last six decades. These evolutions have created a framework for assessing the performance on various metrices of ESG.

In a study of McKinsey, common agreement was found among executives and investment professionals for objectives of various programmes of a company on corporate social responsibility. Precisely, they agreed that environmental, social, and governance practices and activities always create value perceptions among the stakeholders, and it has changed since last decade (McKinsey’s survey on sustainability, 2020). It is also concluded that ESG is considered commonly among business executives as well as potential investors during their operational as well as strategic decisions. Due to these reasons, demand for transparency in corporate disclosures are on rise especially on the aspects of the practices for sustainability and socially responsible practices. The accountability of the companies are perceived for various perspectives by stakeholders on ESG aspects. Hence, analysis of practices for Environmental, Social and Governance (ESG) and its reporting would lead to a valuable insight can provide valuable insights for value creations in long term for the stakeholders. ESG performance indicators can significantly impact the competitive advantages and financial, and it leads to better decisions. Hence it could be hypothesized that sustainability creates a framework within which stakeholders’ values is to be created with ESG.

In this research article a theory explaining the relationship between ESG and stakeholders’ values within the framework of sustainability is developed. It is based on the structured review of the existing literatures using grounded theory approach. Variables which are defined and used in various literatures on ESG, and stakeholders’ values are compiled from different studies along with the methods of investigations, measures of study and inferences to develop the model for this theory.

Introduction to ESG

Recent years have seen a considerable increase in the number of securities regulators and trading exchanges globally, recognizing the relevance of ESG (environmental, social, and governance) considerations in investment. Three pillars of ESG are believed to be the environment, social responsibility, and governance. The following is an indicative list (Table 1) of the objects contained in the various pillars.

| E (Environment) | S (Social) | G (Governance) |

|---|---|---|

| Climate Change | Human Rights | Board Independence |

| Carbon Emission | Labour Standards | Board Diversity |

| Pollution | Poverty | Transparency |

| Resource Erosion | Equal Health Opportunities | Share Holder’s Participation |

| Biodiversity | Equal Education Opportunities | Employee Wellness |

| Green Coverage | Social Security | Equal Opportunity |

Table 1: ESG Pillars with Indicative Constituents

There is empirical research suggesting the benefits of the ESG integration into the portfolio of assets in terms of more stable return, less-volatile stock performance, and overall, a much better risk-adjusted return of investment. The word sustainable development was first coined in 1987 by the World Commission of Environment and Development. It was defined as advancement into the future without compromising the ability of future generations to meet their needs. According to Eurosif (2014), ESG integration is defined as the “explicit inclusion by asset managers of ESG risks and opportunities into traditional financial analysis and investment decisions based on a systematic process and appropriate research source.” In recent years, there is a trend the measuring and evaluating companies on their environmental (E), social (S), and governance (G) factors. The Paris Climate Agreement and the United Nations Sustainable Development Goals (SDGs), accepted in 2015, have acted as catalysts for increased adoption and monitoring of sustainable corporate practices. There have been initiatives to raise awareness among companies regarding ESG policies and issues, with the goal for companies to view said policies and issues as part of risk management, separate and distinct from efforts for corporate social responsibility or CSR (UNPRI, 2018). The United Nations Principles for Responsible Investment (UN PRI), launched in 2007, is an example of this initiative. According to the World Bank (2018), ESG investing activities are defined as:

For the environmental (E) aspect, the common issues involve climate change, resource efficiency, pollution, biodiversity, and carbon emissions.

For the social (S) aspect, the key elements are related to health and safety, health and education, labour standards, community relations, human rights, and diversity policies.

For the governance (G) aspect, the key issues are law, transparency, corruption, institutional strength, and corporate governance.

A clean environmental record, equality, and sustainability are essential facets of financial investment. From an investment perspective, environment, social, and governance (ESG) factors are critical drivers of portfolio risk and return. Based on the studies on ESG issues in investment, it is evident that investment managers should incorporate these issues in their investment decisions. A significant percentage of the studies indicate a positive association between ESG integration and economic performance. Syed (2017) conducted a study on incorporating the ESG principle in the decision-making procedures of fund managers. Data was compiled using questionnaires completed by finance managers based in France and the United Kingdom. Generally, the results were varied. However, the study concluded that both environment and social responsibility (ESR) and corporate governance (CG) promote better management of investment risks and foster long-term shareholder value. The seven tribes of sustainable investing, as suggested by Krosinsky and Purdom (2017) in their book Sustainable Investing: Revolutions in Theory and Practice, are the following: (1) values first, (2) value of an investment, (3) impact investing, (4) thematic investment, (5) integration, (6) shareholders engagement and advocacy, and (7) minimum standards. OECD (2017) examined how asset managers, insurance firms, and pension funds counter ESG-based risks and the opportunities in their investment portfolios. The information was gathered through in-person interviews, the circulation of surveys to regulators, and desk research. The examination concluded that ESG components shape investment yields through their effect on economic performance. Furthermore, these ESG factors pose a considerable risk to financial market stability and broader economic growth. Fund managers are using ESG information for risk management and red flagging. Mervelskemper and Streit (2016) conducted a study on the direction and the extent that financial market investors value the organization's ESG performance. Overall, ESG performance is more valuable when an ESG report is published. Likewise, ESG reporting is linked to superior outcomes. A recent study by Landau et al. (2020) on integrated reporting of ESG and financial data confirmed that the superiority of ESG reports is material to market valuation. Meanwhile, Sultana et al. (2018) conducted research on ESG and investment decision in Bangladesh. A questionnaire survey filled by individual investors in both the DSE and CSE provided data for assessment. The study concluded that the adoption and implementation of ESG policies ultimately foster sustainable investment returns, which paves the way for sustainable development. Amel-Zadeh and Serafeim (2018) researched on why and how venture capitalists apply ESG data. The sample of the survey data stemmed from senior investment professionals who consider ESG information financially material to investment performance. Nonetheless, the study concluded that investment professionals use ESG information for varied purposes, including financial reasons and risk assessment, among others. Henisz et al. (2019) support that a strong ESG proposition paves the way for higher value creation. This includes outstanding growth, cost minimization, regulatory and legal interference, capacity uplift, and investment and asset streamlining. Sridharan (2018) studied the top metrics and reporting structures that investors observe while managing their portfolio investments. Overall, the results show that ESG metrics are different across sectors. However, the issue of governance was consistent across all industries. Nonetheless, the environmental and social risks are crucial to economic performance. Friede et al. (2015) combined the findings of roughly 2,200 studies to establish the relationship between corporate financial performance (CFP) and the ESG criteria. The majority of the studies reported positive results. According to this comprehensive overview of academic research, there is a sizeable non-negative association between CFP and ESG.

Stakeholders Theory and ESG

Edward Freeman’s stakeholder theory defined the stakeholders of a company as "those groups without whose support the organization would cease to exist." Various entities under stakeholder theory are customers, employees, suppliers, policy maker, action groups and environmental groups. Stakeholders also include society, media and financial institutions as well as groups of government. This view creates a framework for the working environment of the company. It could be considered as variables of an ecosystem of related entities or groups. These all need to be properly considered and satisfied for the health of the company and running the company successfully in long term.

Large numbers of studies are available on ESG (Environment, Social and Governance) and CSR (Corporate Social Responsibility) from different perspectives and on different industries. However, the conceptualisation of factors responsible for value creations to stakeholders within the framework of sustainability are diverse and lack consensus. This research paper has reviewed the relevant literatures to extract the factors used to describe different aspects on the studies on ESG performance to develop a theory of value creation for stakeholders with ESG performance indicator. Modified method of Grounded theory is used in this research paper with selective coding only.

Stakeholders’ theory provides a framework for analysing Sustainability. One of the Study (Horich, Freeman & Switzger,2014) compared and contrasted sustainable management and stakeholder theory. Garvare and Johansson (2010) present a stakeholder-based conceptual paradigm. That's one of our study's goals: linking organizational and global sustainability.

Freudenreich et al. (2020) argued in favour of the value creation hypothesis, claiming that business models may be managed and modified in ways that enhance corporate sustainability. Gibson (2012) asserted, in a very similar vein, that stakeholder management contributes favourably to sustainability. Sustainable development, according to Filho et al. (2015), benefits stakeholders. Steurer et al. (2005) discovered that S.D. (Sustainable Development) and SRM (Stakeholder Relationship Management) are inextricably linked, and the strength of the relationship is measured by corporate sustainability and social responsibility performance. Economic performance assessments, according to Evangeline Elijido-Ten (2007), have little effect on a firm's environmental performance. Queiroz (2009) examined the stakeholders' idea of sustainable city planning and their interaction in promoting sustainable tourism as part of sustainable city development. Based on the literature review in this part, we would want to utilize the performance of the sustainable Bond as a proxy for stakeholder theory. In our research, the performance parameter is defined as the number of United Nations Sustainable Development Goals (UNSDGs) that a sustainable bond aspires to cover, as stated in their sustainable bond framework. According to Benson and Davidson (2010), firms will often reward CEOs for following the firm's objectives, whether shareholder or stakeholder maximization.

Methodology

This research work has analysed relevant research papers to understand different measures and indicators used to assess the firm’s orientations towards sustainability and value creation for the stakeholders. Following three types of studies are explored for literature review to understand the theoretical foundation and contemporary issues in ESG performance and value creation for the stakeholder with sustainability.

i. Literature review on the conceptualisation of ESG, Sustainability and Stakeholders’ Values

ii. Literature review on the conceptualisation of measures and indicators of ESG in the corporate disclosures.

iii. Literature review on the impacts of ESG indicators on stakeholders’ value creation.

The research papers were analysed to evaluate the theoretical foundations, aspects and issues to extract the conceptualisations of variables, methodologies and outcomes to conclude the relationships of ESG performance indicators on sustainability and stakeholders’ values.

The structured literature review is compiled primarily on following aspects and presented in the Table 1.

i. Aspects of ESG performance and indicators which are considered in various literatures to analyse its impacts of sustainability and value creation for stakeholders i.e. Non-Financial or Financial.

ii. Scope of study for data collection

iii. Prime objective of the study

iv. Types of methodology used in the study

v. Components of ESG performance in corporate disclosure i.e. all components (Integrative) of Individual Components (Environmental or Social or Governance)

vi. Independent variable in the study

vii. Dependent variables variable in the study

viii. Major finding or recommendation

For each study, an analysis is done to identify the relevant aspect which could be considered for value creation for stakeholder. At the end selective coding (with variables) is used to develop a model for explaining the phenomena of value creation through ESG performance indicators.

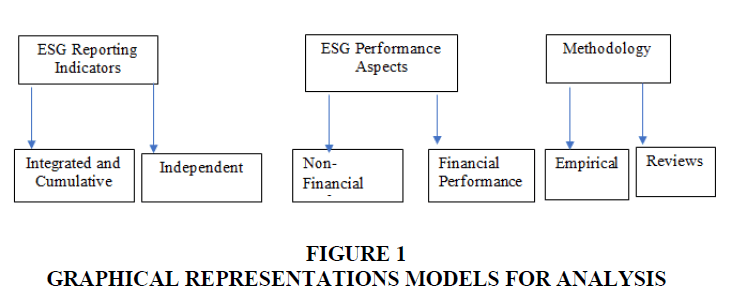

Models for Analysis

It is always useful to have well defined models for analysis. In this research paper models for analysis of literatures are also developed for structured reviews on selected aspects. The literatures are interpreted by using following models to understand the extents to which different aspects are used to explain the ESG performance and its impacts in the values creation for stakeholders with orientations towards sustainability Figure 1.

Model’s Constructs Explanations

ESG Reporting Indicators (ESRI) is used here to describe the characteristics of Sustainability Reporting or Corporate Disclosure Practices. Two broad types are identified for this purpose. One is integrated and Cumulative Reporting i.e., combined reporting of Environmental, Social and Corporate governance and independent reporting i.e., separate reporting for each component of ESG.

ESG Performance (ESGP) is used here to classify the aspect of firm’s performance considered in literatures while impacts of ESG or CSR are considered to draw inference. Financial and Non-Financial performance are used in this research paper to classify the studies from research papers.

In literature review it is always important to interpret the methodologies followed for research and analysis. After review of various research papers, two types of methodologies are identified as empirical and reviews and used in this research paper for analysis.

Theoretical Background

Value creation depends on the business models in the ecosystem that are developed and managed by the company to create value for its stakeholders. The value creation with sustainability has been emphasized in stakeholders’ theory. In a study by Brit et.al (2019) it is suggested that “the concept and analysis of sustainability and value creation in different business models must be elaborated with different types of value creation for different stakeholders and different kinds of value exchange between stakeholders and the firm”.

Regarding conceptualising the construct of “value” in the theories of corporate governance, different perspectives are available in various literatures. It is inferred by Windsor, D. (2017), that the theoretical precision lacks in defining the construct of “value”. The “value” also lacks its empirical verification in most of the research. Within this perspective, the debate arises on the approaches to be selected to understand the “values created for the stakeholders” on various ways of performance and investments by the firms. The vital issue is in assessing the superiority of managerial stakeholder theory for multiple stakeholders in long run including environment and society over the conventional agency theory.

The literature review was carried on the conceptualisation of the word “ESG” and its impacts on the conceptualisation of “CSR” in different literatures. Although both are representing the impacts of a company on society and environment, but ESG is more specific and used by investors to invest in the company. ESG word was used in the year 2004 in the reports of various institutions offering financial services. These reports were prepared and published to consider the call of UN for socially responsive investing with growing importance on the disclosures of environmental, social and governance. It refers the integration of environmental, social and governance practices within the framework of sustainability. Hence, how a company and investors are concerns for sustainability aspects of their business models.

Although the ESG factor are used in various literatures to represents non-financial performance (Ruhaya Atan, et.al 2018), but in some contemporary literatures, large numbers of studies are available defining it from the perspective of financial performance also. Further, these are used in the corporate disclosure practices of CSR.

While comparing ESG with CSR, it is found that some literatures are using ESG and CSR interchangeably in different contexts. There are large numbers of literatures where ESG is used as synonym of CSR. However, there are significant numbers of literatures that have specifically differentiated between ESG and CSR. It is concluded after going through such literatures that the “Governance” issues are explicitly included in ESG while it is not so explicitly considered in CSR, when practices of corporations are analysed for their considerations to environmental and social issues within the framework of sustainability. Thus, a general perception in literature reflects more expressive and precisely defined approach on independent or integrated aspects on ESG reporting and its impacts, specifically on financial performance. Hence, ESG has evolved as widely accepted and precisely defined terminology than CSR in contemporary corporate disclosure practices and reporting in financial performance of the company.

Numbers of research literatures have used “ESG investing” in their theoretical foundation while relating ESG practices with financial performance. ESG investing is used to define a framework of investment strategy of a firm that emphasizes governance structure along with the impacts of firm’s products and practices on environmental on society (Schanzenbach, Max Matthew and Sitkoff, Robert H.2020). Research literatures which have studied the impacts of ESG factors on investment decisions of institutional investors have concluded with the significant importance of ESG reporting in investments. Several third-party data providers are “ESG rating” the companies on “ESG performance” or “ESG activities” which are widely used by institutional investors also. There are various frameworks for ESG rating used by ESG rating agencies and some of them are Global Reporting Initiative (GRI), Carbon Disclosure Project (CDP), Sustainability Accounting Standard Board (SASB), Workforce Disclosure Initiative (WDI), Climate Disclosure Standard Board(CDSB), UN Principles for Responsible Investments(PRI), UN Sustainable Development Goal (SDG) etc. Diverse frameworks for ESG rating indicate the subjectivity in the conceptualisation of ESG in corporate disclosure practices.

It is found in various research literatures that “ESG rating is also evolving in form of ESG indices to create the trust for the investors”. Hence, it could be inferred that ESG indices is impacting on the “trust of the investors”. However, the causality of ESG rating on the trust of investors are missing in the literatures.

Sustainability and Values for the Stakeholders

Sustainability is used in various contexts in different research works. Precisely it could be defined as “a model of business and development that meets the needs of the present without compromising the ability of future generations to meet their own needs”. Business or corporate sustainability is often defined as “managing all levels and bottom lines of business ecosystem with a process by which companies manage their financial, social and environmental risks” (Armstrong and Sweeney 2002; Armstrong et al. 2001).

In the research literatures it was found that the interest in sustainability has started and grew from mid of 20th century. It was further increased with growing awareness towards the challenges posed by changing climates and resultant environmental threats emanated from the functioning of the corporations. Issues related to greenhouse gases, forest clearing and fossils fuels are widely studies in the research literatures to create a theoretical foundation for sustainability.

In various studies, different perspectives are considered for the “values of stockholders”. The conceptualisation of construct “value” for the stakeholders are mainly referred as “economic value” in various research. However, some research works have conceptualised the “value” as “the expectations of a stakeholder when the stakeholder starts an occasional transaction or a lasting relationship with a company”.

In the process of construct extraction from different research work by which “values for the stakeholders” are conceptualised, followings four aspects are mainly found under which values for the stakeholders are categorised: -

i. Extrinsic Values

ii. Intrinsic Values

iii. Psychological Values

iv. Transcendent values

Economic values are normally monetary in natures and quantifiable while intangible values are non-monitory in nature and difficult to quantify. In some literature “Psychological values” are also used to analyse the impacts of ESG or CSR performance on stakeholders’ values. Intrinsic values are defined as a form of learning and capabilities enhancements and used to define a new dimension of stakeholders’ values as “transcendent value, which consists of evaluative learning acquisition of virtues or vices” (Argandoña, 2008b).

Hence, research literatures and various reports of disclosures and corporate reporting are using the constructs of “values for stakeholders” differently in different contexts which depends on the types of studies conducted, scope of data, objective of the study and methodology used for the research.

Stakeholders’ Value Creation

Large numbers of studies are available on the process of values creation for the stakeholders. This research has done studies for value creation using different terms for definition and ways to measure the values. It is in inferred “the question of stakeholder value creation in term of its definition, ways to measure it etc. and the mechanisms explaining its causes in successful stakeholder management is the focus of much research” (Harrison and Wicks 2013; Jones et al. 2018; Bosse et al. 2008).

Stakeholders’ theory had implicitly defined that “success of value creation of stakeholders is dependent on relational dynamics originating in reciprocal behaviour and distributional justice”. Research literatures are very much debated on the process of allocation of resources to stakeholders so that it could be considered within the framework of sustainability for value creation. It is concluded that “the preoccupation of some theorists with the proper or 'just' distribution of economic value (i.e. divvying up of 'spoils') has been criticized as contrary to the inherent “joint-ness” implied by the stakeholder perspective” (Harrison and Wicks 2013). Some literatures have tried linking stakeholder management process and resource allocation with value creations, but mainly on economic values. Hence other aspects in which values are conceptualised are missing from the various studies. However, it is concluded that traditional performance indicators are suffice for assessing the firm’s process and practices for value creation to stakeholders. It is concluded that “although economic returns are important to stakeholders, it does not capture all of the things they look for in their relationship with the firm” Harrison and Wicks (2013). Harrison and Wicks (2013) argue that “value provided to stakeholders can be understood as the sum total of all utility the stakeholder experience in their association with the firm. In other words, utility can be understood to be a reflection of that which has worth in the eyes of the stakeholder and is thus dependent on individual preferences”. In term of other research work it is mentioned that “incorporation of non-material sources of utility is an important aspect of the theory and is the focus of some conceptions of stakeholder management” (e.g., Bosse et al. 2008).

Most of the literatures agreed on “reciprocal relationships” between “stakeholder groups” that can enhance the value creation. The reciprocal relationship is defined between stakeholders as “increased trust is leading to increased cooperation and coordination”

While exploring the social dynamics, I the context of reciprocal relationships among stakeholders, “distributional”, “procedural” and “interactional-justice” words are also used. Within these contexts it is concluded by Harrison and Wicks (2013) that “the preferences for certain types of value originate from transactions, relationships and interactions that the stakeholder enter into with focal firm. The firm’s performance is best understood as the total value created by the firm though its activities, which is the sum of the utility created for each of a firm's legitimate stakeholders.”

On complex perception of transactions and relationships among stakeholders in different research literatures it is concluded that “one often reads in the literature that firms must be managed not only for shareholders but, more generally, for stakeholders” (Freeman 2008; 2007; Harrison et al., 2010). It is also suggested that corporations must “create value for all stakeholders” or even that they must “create the greatest possible value for all stakeholders” (Post, Preston, and Sachs, 2002). Hence, the conceptualisation of values is still not free from some ambiguity in term of preciseness of the concept “values for the stakeholders”. It is more conceptualise as perceived benefits of transactional relationships among stakeholders.

ESG Performance Indicators and Stakeholders’ Values

Research literatures although abundant but having diverse opinions on the impacts of ESG performance on stakeholders’ values. It is concluded that “despite the relatively late appearance of the concept of ESG, studies on the association between ESG and firm value or operating performance are abundant” (Miralles-Quirós, J.L 2018, Manag. 2009, Han, J.J.; Kim, H.J.; Yu, 2016).

The diverse opinions are narrated as “the academic debate on the theory of the firm and its value has been monopolized for a long period by the contraposition between the shareholders model (or finance model) and the stakeholders’ model” (Zamagni 2006).

Jensen (2001) has taken the debate further by introducing "enlightened value maximization" concept leading to the corresponding idea of “enlightened stakeholders’ theory". It emphasises on considerations of the value maximisation of shareholders as well as stakeholders both. Taking this debate further, it is inferred that “despite numerous studies investigating the economic effects of good stakeholder management, the emphasis was mostly strictly given to financial performance and shareholder benefits” (Choi, J.; Wang, H; 2009, Henisz, W.J.; Dorobantu, S , 2014, Hillman, A.J.; Keim, G.D, 2001, Sisodia, R.; Sheth, J.N.; Wolfe, D.B, 2014).

Literatures on ESG performance indicators and its impacts on stakeholders’ values were reviewed. It is found that significant consensus is existing among researchers on following aspects as instrumental in value creation for stakeholders: -

i. The concerns and operations of corporations for protection of environment indicates the firm’s efforts towards sustainability by reducing consumption of natural resources and pollutant emissions. It results in the building trust of stakeholders in the sustainability with reference to environment.

ii. The social performance of a firm is assessed to qualitatively gauge its values for human rights, quality in the employment, conformance of social norms, relationship with community, and acceptance of its products among community. It results in greater acceptability of the firm and its products among society.

iii. The performance of a firm on corporate governance indicates the accountabilities and responsibilities of the top management of a firm in term of its compositions and processes of governance structure to discharge the duties with ethics and transparency. It results in building a trust of stakeholders in the functioning of the company.

Recently with advancements in the technologies and increased globalisations, the research interest in value creation for stakeholders has increased again, but with different contexts. In research literatures, different methods are proposed to assess the measures for value creations by CSR or ESG performance indicators. In most of the cases the main perspective is still value creation for shareholders rather stakeholders. Research studies on the relationship of ESG performance rating and added values for stakeholders are also available in large numbers, with additional aspects of sustainability along with value creations. However, the research literatures are having diverse opinions on the impacts ESG rating on value creation. In a study it is concluded that “ESG ratings are able to capture companies that are characterized by their capacity for generating higher Value Added for stakeholders, but ESG indices cannot be used as an indicator of value creation for stakeholders but, rather, must be considered as only one of the components” (Silvana Signori et. al, 2021). According to (Basen, A.; Kovacs, 2008), “the understanding and conceptualisation of ESG are used in different contexts and has no specific definition”. It is further concluded that “for academic community ESG is represented by the terms CSR, ESG, and EGSEE (Economic, Governance, Social, Ethical, and Environmental) and sustainability interchangeably (Rezaee, 2016; Jain, 2016).

Lack of Consensus in Interpreting the Impacts of ESG Performance on Value Creation

Large numbers of research studies are available for understanding the relationship between firm’s ESG or CSR performance with financial performance of the firm. However, substantial numbers of studies are unable to conclude specifically to show “positive correlations between ESG indicators and financial performance of the company”.

The recent studies on assets management companies have analysed the relationship between ESG performance or ESG rating of the companies with their financial risks and financial performance. Th findings are mixed one. Some studies have shown positive correlation, while others have shown negative. Some studies are having shown non-existent relationship also. Although, majority of research her studies founded positive correlation.

In one study by Ali Fatemia Martin Glaumb Stefanie Kaiser (2018) investigating the effect of ESG activities and their disclosure on firm value, it was found that “ESG strengths increase firm’s value and that weaknesses decrease it. ESG disclosure, per se, decreases valuation”. It is also found in this study that “ESG disclosure plays a crucial moderating role by mitigating the negative effect of weaknesses and attenuating the positive effect of strengths”.

Patrick Velte (2017) in the study investigated the cumulative impacts of “ESG performance disclosure” on financial performance of the company. The financial performance was divided into Return on Assets (ROA) and Tobin Q. It was found that “ESG performance indicator has a positive impact on Return on Assets (ROA) but no impact on Tobin’s Q”. Furthermore, by analysing the three independent components of ESG, it is found that the performance on governance has the strongest impact on “financial performance” in comparison to “environmental performance” and “social performance”.

Research studies on the governance side are primarily considering the “composition of a firm’s board of directors” and its characteristics to discharge its duties that can influence ESG performance of the company. Empirically the studies have used the characteristics, such as, Independence, Size, Frequency of Meeting and CSR practices etc. In a study in banking sector, positive link is found between ESG performance and board size with gender diversity or the presence of a CSR committee in the board. The same is negatively related with the increased numbers of independent directors. In a study by Cucari, N.; De Falco, E.S.; Orlando, B (2018) and Ortas, E.; Álvarez, I.; Zubeltzu, E(2017), it was found that the “structure of the company board is an important factor to ensuring effective board monitoring and linking the firms’ strategic policies to stakeholders’ interests and expectations”. It was also found that, “unlike inside directors, an independent director’s compensation is not related to short-term financial performance. Hence, boards with higher independence are supposed to be better at monitoring only” (Ahmed, K.; Hossain, M.; Adams, M.B, 2018). It is also concluded that “the independent directors more inclined towards social responsibility” (Cheng, E.C.M.; Courtenay, S.M, 2006). Hence, financial performance may not be prime consideration in such case. It was inferred by using stakeholder theory, “greater board independence reduces the conflicts of interests between different stakeholders, encouraging management activities to maximize long-term value and higher levels of transparency”. Further it is inferred that “board independence is generally considered the main characteristic of a board associated with protecting stakeholder interests. For these reasons, many authors suggest that boards with higher proportions of independent directors encourage higher level of voluntary disclosure and facilitate engagement in CSR investments” (Chau, G.; Gray, S.J, 2010)

There seems to be a general consensus in the literature regarding the positive impact of female directors on sustainability performance. In a study of composition of board, it was found that “having more women on the board influence the firm’s sensitivity towards social and environmental issues and women on boards positively impact the firm’s charitable contributions” (Williams, R. (2003) & Zhang, J.Q et.al (2013). It also enhances the apprehension for climate change (Ciocirlan, C et. al. ,2012), Kinder, Lydenberg, Domini (KLD) strengths (Zhang, L; 2012) and reputation-based CSR measures.

In a study on examining the extent to which the appointment of employees to the board of directors’ influences market perceptions of ESG using sample of French firms it was found that “investors react positively to ESG performance but negatively to the presence of employees on the board”. It could be inferred that within this context the social and environmental performance are not financially rewarded and possibility of existence on conflict of interest between employees and shareholders are more.

A study by Alexandre S. Garcia et.al (2018) on ESG performance in sensitive industries and its impacts it was concluded that “market capitalization is the main predictor of ESG performance”. It was also found that “companies in sensitive industries present superior environmental performance even when controlling for size and country”.

Studies are also available on the impacts of sustainability or CSR reporting in corporate disclosures. A study was conducted by Aikaterini Papoutsi & ManMohan S.Sodhi(2020) by using factor analysis to investigates whether sustainability reports indicate corporate sustainability performance i.e., the extent to which such disclosure is informative. It was found “sustainability reports appear to indicate actual sustainability performance”. In a study by Bohyun Yoon, Jeong Hwan Lee, in Korea it was found that “a firm’s corporate social responsibility (CSR) plays a significant role in promoting its market value in an emerging market”.

Various research literatures have concluded that CSR practices are positively and significantly affecting the market value of the firm. However, “its impact on share prices can differ according to firm characteristics and for firms in environmentally sensitive industries, the value-creating effect of CSR is lesser than for firms that do not belong to sensitive industries”. Review of literature corporate reporting on sustainability performance, it has been found that “many investors complain about the confusing nature of ESG data in financial disclosure and sustainability reporting” (Eccles, Robert G. and Stroehle, Judith (2018).

Extraction of Variables, Methodology and Key Findings from Research Literatures

A summary of selective and relevant literature reviews is presented in the Table 2 with variables and aspects of ESG performance used and its conclusion for value creations for stakeholders and sustainability Tables 3-7.

| Sl | Author(s) | ESG Aspects | Methodology | Components of ESG Indicators | Independent Variables | Dependent Variables | Key findings | Values for Sustainability and Stakeholders |

|---|---|---|---|---|---|---|---|---|

| 1 | Orlitzky, Schmidt, and Reynes (2003) | Financial Performance | Empirical | Cumulative and integrated | Corporate Social Performance (CSP) |

Financial Performance | Positive correlation between CSP and financial performance. | Positive |

| 2 | Derwall et al. (2005) | Financial Performance | Empirical | Environmental | Socially responsible investing (SRI) | Share price | Positive Environmental performance leads positive firm’s performance. | Positive |

| 3 | Bosse et al. (2008). | Financial Performance | Reviews | Cumulative and integrated | ESG Practices | Investment decisions. | Social and ethical practices are having significant impacts on market valuations of the firm and its strategy for green innovation | Positive |

| 4 | Cheng, et. al. (2011), | Financial Performance | Empirical | Cumulative and integrated | CSR performance | Access to Finance | CSR performance, is important in reducing capital constraints | Positive |

| 5 | Alena et. al. (2012) | Financial performance | Empirical | Environment | Sustainability Reporting | Investment decisions | Incomplete and inadequate reporting are considered as riskier. | Positive |

| 6 | Jeffrey S. et.al (2013) | Financial performance | Reviews | Cumulative and integrated | CSR Perception | Stakeholders’ values | Positive CSR perceptions for investors leads to increased stakeholders’ values | Positive |

| 7 | Clark, Feiner, and Viehs (2014) | Non-Financial | Reviews | Cumulative and integrated | ESG Activities | Firm’s values | Diverse conceptualisation for the values | Undefined |

| 8 | Eccles, Ioannou, and Serafeim (2014) | Financial Performance | Empirical | Cumulative and integrated | Corporate Sustainability | Organizational performance | High orientation towards sustainability may leads to established stakeholders’ management processes | Weak |

| 9 | Thomas M. Jones, et.al. (2018), | Non-Financial Performance | Review | Cumulative and integrated | ESG Practices | Competitive advantages | Literatures have limited ability to explain variance in Competitive advantages. | Undefined |

| 10 | Ruhaya Atan, et.al (2018) | Non- Financial Performance | Empirical | Cumulative & integrated | ESG Practices | Firms’ profitability Firms Values |

ESG practices are positively impacting the firm’s profitability and firms value | Positive |

| 11 | Federico Barnabè, et.al. (2019) | Non-financial performance | Reviews | Cumulative and integrated | Integrated Reporting (IR) | Stakeholder Values | Effective integrated reporting leads to increased stakeholders value | Positive |

| 12 | María Mar et.al. (2019) | Financial performance | Empirical | Cumulative and integrated | Integrated Reporting | Tobin’s Q | Positive relationship hence, shareholder value creation. | Positive |

| 13 | Mozaffar Khan(2019) | Financial performance | Reviews | Cumulative and integrated | Corporate governance practices | Stock returns | ESG performance, which includes corporate governance strength can predicts stock returns | Weak |

| 14 | Buallay, A. (2019) | Financial Performance | Reviews | Cumulative and integrated | ESG Reporting | Return on assets, and Tobin’s Q |

Positive relationship between ESG performance and ROA and Tobin’s Q | Positive |

| 15 | Landi, G. and Sciarelli, M. (2019) | Financial Performance | Empirical | Cumulative and integrated | ESG Rating | Stock returns | No statistically significant impacts of ESG Rating in terms of market premium | Undefined |

| 16 | Blaine Townsend(2020) | Financial performance | Reviews | Cumulative and integrated | ESG Investing | Investment Decisions | ESG Investing is not significantly impacting the investment decisions. | Undefined |

| 17 | Junius, D., et.al. (2020). | Financial Performance | Empirical | Cumulative and integrated | ESG Rating | Return on Assets, Return on Equity, and Tobin’s Q) and Price-Earnings ratio | No significant influence from ESG Score to Firm’s Performance and Market Value | Undefined |

| 18 | Silvana Signori, et.al. (2021) | Non-Financial Performance | Empirical | Cumulative and integrated | ESG Rating | Value creation for stakeholders | ESG indices cannot be used as an indicator of value creation for stakeholders. | Weak |

| 19 | Sudipta bose, et.al. (2020) | Financial Performance | Empirical | Cumulative and integrated | CSR Expenditure | firm's market value | Inverted U-shaped curvilinear association between CSR expenditure and market value | Weak |

| 20 | Ilze Zumente and Julija Bistrova(2021) | Financial Performance | Empirical | Cumulative and integrated | ESG Conscious | Stakeholders’ long-term values | Higher ESG Consciousness is positively related to sustainability awareness and shareholder value creation. | Positive |

| 21 | Salim Chouaibi and Jamel Chouaibi(2021), | Financial Performance | Empirical | Cumulative and integrated | ESG Practices | Market Valuation | Positive relationship between societal and ethical practices and businesses’ market valuation | Positive |

| 22 | Renata Paola Dameri and Pier Maria Ferrando(2021) | Financial performance | Reviews. | Cumulative and integrated | Integrated reporting | Stakeholder values | The stakeholder ‘value creation by Integrated reporting depends upon models of reporting | Undefined |

| 23 | Aleksandra Szewieczek et. al. (2021) | Financial performance | Empirical | Cumulative and integrated | Integrated Reporting | Stakeholders value creation | Positive correlation between the detail of disclosures with stakeholder’s value creation | Positive |

Table 2: Summary Of Studies On Esg And Its Impacts On Sustainability And Value Creation.

Analysis and Interpretations

| ESG Aspects | Methodology | ESG Reporting Indicators | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Financial Performance | Non-Financial performance | Empirical | Reviews | Cumulative | Independent | ||||||

| Count | % | Count | % | Count | % | Count | % | Count | % | Count | % |

| 18 | 78.26 | 5 | 21.73 | 16 | 72.72 | 7 | 27.27 | 20 | 90.90 | 3 | 9.09 |

Table 3: Aspects of ESG, Methodology and ESG Indicators in disclosures across various literatures.

| Table 4 Variables used in literatures to describe the importance for sustainability and value creation for stakeholders with ESG Performance Indicators |

|||||

|---|---|---|---|---|---|

| Sl | Independent Variables | Count | Sl | Dependent Variables | Count |

| 1 | Integrated Reporting | 5 | 1 | Stakeholder Values | 6 |

| 2 | ESG Practices | 4 | 2 | Return on Equity/Stock |

5 |

| 3 | ESG Rating | 3 | 3 | Investment Decisions |

4 |

| 4 | Sustainability Reporting |

2 | 4 | Firm’s Values | 3 |

| 5 | Corporate governance practices |

1 | 5 | Tobin’s Q | 3 |

| 6 | Corporate Social Performance (CSP) |

1 | 6 | Return on Assets |

2 |

| 7 | Corporate Sustainability | 1 | 7 | Competitive Advantages | 1 |

| 8 | CSR Expenditure | 1 | 8 | Corporate Financial Performance |

1 |

| 9 | CSR Perception | 1 | 9 | Firms’ Profitability | 1 |

| 10 | ESG Activities | 1 | 10 | Market Valuation |

1 |

| 11 | ESG Conscious | 1 | 11 | Organizational performance |

1 |

| 12 | ESG Investing | 1 | 12 | Price - Earnings Ratio |

1 |

| 13 | Socially responsible investing (SRI) |

1 | |||

| Table 6 Cross Tabulation For The Esg Aspects And Esg Indicators |

||||

|---|---|---|---|---|

| ESG Aspects | ESG Reporting Indicators | |||

| Cumulative and integrated | Independent | |||

| Count | % | Count | % | |

| Financial Performance(n=18) | 15 | 83.33 | 3 | 16.66 |

| Non-Financial Performance(n=5) | 5 | 100 | 0 | 0 |

Analytical Model for Analysis of ESG Performance and its impacts of Value Creations for Stakeholder with Selective Coding

| Table 7 Representative Model For Relationship Between Esg Performance And Stakeholders Values |

|||||||

|---|---|---|---|---|---|---|---|

| Measurabl e Outcomes |

ROI on Stock | Investmen t Decisions |

Firms Values | Tobin’s Q | Return on Assets | Competitiv e Advantages |

Financial Performanc e |

| Perceived Outcomes |

Values for Stakeholders and Sustainability | ||||||

| INTEGRATED REPORTING | |||||||

| SRI | ESG Consciousnes s |

ESG Activities |

CSR Perception |

CG Practices |

Sustainability Reporting | ESG Rating |

ESG Practices |

Discussion

1. After review of literatures based on selective coding, it is found that “ESG performance” is not clearly defined so far and, therefore, it is not easy to quantify and measure the ESG activity of companies as a measure of stakeholder’s value creation and value maximization. Further, in maximum cases of the existing literatures on ESG performance, cumulative and integrated aspects of ESG is considered, i.e., combined impacts of environment, social and governance practices for sustainability and value creation of stakeholders. Hence, it opens further scope of research on identifying impacts of activities of individual components of ESG on stakeholders’ value creation for better ESG investing decisions. Since value consists of dipolar characteristics i.e., positive and negative, i.e., value that is felt by agents other than those with whom the relationship or transaction is conducted, needs to be perceived and delivered in customised way within sustainability parameters of environment and society. The majority of literature is conspicuously silent on environmental, social, and governance variables that create value. The firm's environmental performance reflects its efforts to reduce resource usage and carbon emissions. More study is needed to better understand how ESG practices impact a firm's financial success.

2. It is observed that most of the literatures are silent on environment aspects of value creation, especially on financial performance indicator on environmental component of ESG. A firm’s environmental performance indicates the firm’s effort to reduce natural resource consumption and carbon emissions, it involves costs. Hence, studies are needed to explore those aspects also on values for sustainability in ESG practices and how is it impacting financial performance of the company.

3. In term of corporate disclosure practices, it has been observed that a significant and positive correlations exist between value creation and the attributes namely integrated reports; corporate governance and financial measures were established. It is widely discussed also in contemporary literatures. ESG data is now much more widely available than even 10 years ago, making ESG investing much more viable. But less literatures are available on the study of investment risks posed by climate change and poor corporate governance provided a huge catalyst in the growth of ESG investing.

Conclusion

There are two types of ESG studies available in contemporary literatures. In one category, the scholars have directly examined the dimensions of ESG and its correlations with firm performance. The studies on the results of the relationships between ESG and financial performance are having mixed responses.

Most of the studies are conducted on financial performance as measurable indicator for ESG. Regarding values creation for sustainability and stakeholders in ESG performance, although the literatures have shown positive outcomes, but significantly indicated approximately equal combined impacts of undefined & weak outcomes. It may be due to very focused concentration on financial performance in various studies, while more studies are needed for non-financial performance of ESG also. Further, maximum studies are empirical in nature and majority of them have used integrated and cumulative reporting as independent variables. Hence, studies for independent reporting of ESG needed.

References

Ahmed, K.; Hossain, M.; Adams, M.B (2006). The effects of board composition and board size on the informativeness of annual accounting earnings.Corp. Gov. Int. Rev.2006,14, 418–431.

Indexed at, Google Scholar, Cross Ref

Aikaterini Papoutsi & Man Mohan S.Sodhi (2020) Does disclosure in sustainability reports indicate actual sustainability performance? Journal of Cleaner Production Volume 260,1 July 2020, 121049

Indexed at, Google Scholar, Cross Ref

Aleksandra Szewieczek, Beata Dratwi?ska-Kania & Aleksandra Ferens(2021) Business Model Disclosure in the Reporting of Public Companies—An Empirical Study, Sustainability2021

Indexed at, Google Scholar, Cross Ref

Alena Kocmanova, Petr Nemecek2 , Marie Docekalova(2012), Environmental , Social and Governance Key Performance Indicators for Sustainable Reporting., Conference Proceedings International Scientific Conference “Business and Management 2012” May 10-11, 2012, Vilnius, LITHUANIA

AlexandreS.Garcia, WesleyMendes-Da-Silva & RenatoJ.Orsato(2018); Corporate Sustainability, Capital Markets, and ESG Performance

Ali Fatemia Martin Glaumb Stefanie Kaiser(2018): ESG performance and firm value: The moderating role of disclosure, Global Finance Journal Volume 38,November 2018, Pages 45-64

Indexed at, Google Scholar, Cross Ref

Allouche, J., & Laroche, P. (2005). A meta-analytical investigation of the relationship between corporate social and financial performance.Revue de Gestion des Ressources Humaines, 57(1), 8–41.

Amel-Zadeh, A. & Serafeim, G. (2018). Why and how investors use ESG information: Evidence from a global survey, 74(3), pp. 87-10.

Indexed at, Google Scholar, Cross Ref

Aras, G., Aybars, A., & Kutlu, O. (2010). Managing corporate performance: Investigating the relationship between corporate social responsibility and financial performance in emerging markets.International Journal of Productivity and Performance Management, 59(3), 229–254.

Indexed at, Google Scholar, Cross Ref

Basen, A.; Kovacs, A.M. Environment. Social and Governance Key Performance-Indicators from a Capital Market Perspective.Z. Wirtsch. Und Unternehm J. Bus. Eth.2008,9, 182–192.

Indexed at, Google Scholar, Cross Ref

Benson and Davidson (2010), The Relation between Stakeholder Management, Firm Value and CEO Compensation: A test of Enlightened Value Maximization, Financial Management, Vol. 39, No.3 PP 929-964

Indexed at, Google Scholar, Cross Ref

Blaine Townsend (2020) From SRI to ESG:The Origins of Socially Responsible and Sustainable Investing The Journal of Impact and ESG InvestingFall 2020,1(1)10-25;DOI: https://doi.org/10.3905/jesg.2020.1.1.010

Indexed at, Google Scholar, Cross Ref

Buallay, A.(2019), "Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector",Management of Environmental Quality, Vol. 30 No. 1, pp. 98-115.https://doi.org/10.1108/MEQ-12-2017-0149

Indexed at, Google Scholar, Cross Ref

Chau, G.; Gray, S.J.(2010) Family ownership, board independence and voluntary disclosure: Evidence from Hong Kong.J. Int. Account. Audit. Tax.2010,19, 93–109.

Indexed at, Google Scholar, Cross Ref

Cheng, Beiting and Ioannou, Ioannis and Serafeim, George(2011), Corporate Social Responsibility and Access to Finance (May 19, 2011). Strategic Management Journal, 35 (1): 1-23.,http://dx.doi.org/10.2139/ssrn.1847085

Cheng, E.C.M.; Courtenay, S.M(2006). Board composition, regulatory regime and voluntary disclosure.Int. J. Account.2006,41, 262–289.

Indexed at, Google Scholar, Cross Ref

Choi, J.; Wang, H.(2009) Stakeholder relations and the persistence of corporate financial performance.Strateg. Manag. J.2009,30, 895–907.

Indexed at, Google Scholar, Cross Ref

Christensen, D.M. Corporate accountability reporting and high-Profile misconduct.Account. Rev.2016,9, 377–381.

Indexed at, Google Scholar, Cross Ref

Ciocirlan, C.; Pettersson, C(2012) Does workforce diversity matter in the fight against climate change? An analysis of Fortune 500 companies.Corp. Soc. Responsible. Environ. Manag.2012,19, 47–62.

Indexed at, Google Scholar, Cross Ref

Crespi, F.; Migliavacca, M. The Determinants of ESG Rating in the Financial Industry: The Same Old Story or a Different Tale?Sustainability2020,12, 6398. https://doi.org/10.3390/su12166398

Indexed at, Google Scholar, Cross Ref

Cucari, N.; De Falco, E.S.; Orlando, B(2018):. Diversity of Board of Directors and Environmental Social Governance: Evidence from Italian Listed Companies.Corp. Soc. Responsib. Environ. Manag.2018,25, 250–266.

Indexed at, Google Scholar, Cross Ref

Dratwi?ska-Kania, B.; Kania, P. Corporate Social Responsibility in Poland and Abroad—A Comparative Analysis. Ecology, Economics, Education and Legislation. In Proceedings of the 13th SGEM GeoConference on Ecology, Economics, Education and Legislation, Albena, Bulgaria, 16–22 June 2013; Volume II, pp. 655–662. Available online:www.sgem.org(accessed on 6 September 2021).

Indexed at, Google Scholar, Cross Ref

Eccles, Robert G. and Stroehle, Judith(2018), Exploring Social Origins in the Construction of ESG Measures (July 12, 2018). Available at SSRN:https://ssrn.com/abstract=3212685orhttp://dx.doi.org/10.2139/ssrn.3212685.

Indexed at, Google Scholar, Cross Ref

Eurosif (2014), Eurosif Report 2014, Eurosif Report 2014 - EUROSIF

Evangeline Elijido-Ten (2007), Applying Stakeholders theory to analyze corporate environmental performance: Evidence from Australian listed companies, Asian Review of Accounting, Volume 15 (2).

Indexed at, Google Scholar, Cross Ref

Filho et al. (2015), Integrative Approaches to Sustainable Development at University Level: Making the Links. Springer Publications, ISBN - 978-3-319-10690-8.

Indexed at, Google Scholar, Cross Ref

Freeman, R. E. (2008b), “Ending the so-called ‘Friedman-Freeman’ debate,” in B. R. Agle, T. Donaldson, R. E. Freeman, M. C. Jensen, R. K. Mitchell, and D. J. Wood “Dialogue: Toward superior stakeholder theory,” Business Ethics Quarterly, 18, 2, 153-190, on pp. 162-166.

Freudenreich, B., Lüdeke-Freund, F. & Schaltegger, S. A Stakeholder Theory Perspective on Business Models: Value Creation for Sustainability.J Bus Ethics166,3–18 (2020). https://doi.org/10.1007/s10551-019-04112-z

Indexed at, Google Scholar, Cross Ref

Frey, B. S. and S. Neckermann (2009), “Awards: A view from economics,” in G. Brennan and G. Eusepi (eds.), “The Economics of Ethics and the Ethics of Economics,” Cheltenham: Edward Elgar, pp. 73-88.

Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), pp. 210-233.

Indexed at, Google Scholar, Cross Ref

Gibson (2012), Stakeholders theory and sustainability, An Evolving theory, Journal of Business Ethics, 109, 15-25 (2012)

Indexed at, Google Scholar, Cross Ref

Hahn, R.; Kühnen, M. Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research.J Clean Prod.2013,59, 5–21.

Indexed at, Google Scholar, Cross Ref

Harrison, J. S., D. A. Bosse, and R. A. Phillips (2010), “Managing for stakeholders, stakeholder utility functions, and competitive advantage,” Strategic Management Journal, 31, pp. 58-74.

Indexed at, Google Scholar, Cross Ref

Henisz et al. (2019), Five ways that ESG creates Value, McKinsey Quarterly, http://dln.jaipuria.ac.in:8080/jspui/bitstream/123456789/2319/1/Five-ways-that-ESG-creates-value.pdf

Henisz, W.J.; Dorobantu, S.; Nartey, L.J(2014). Spinning gold: The financial returns to stakeholder engagement.Strateg. Manag. J.2014,35, 1727-1748.

Indexed at, Google Scholar, Cross Ref

Hillman, A.J.; Keim, G.D(2001). Shareholder value, stakeholder management, and social issues: What’s the bottom line?Strateg. Manag. J.2001,22, 125–139.

Indexed at, Google Scholar, Cross Ref

Horisch, Freeman & Schaltgger (2014), Applying Stakeholders theory in Sustainability Management: Links, Similarities, Dissimilarities and a Conceptual framework. Organizations and environment, https://doi.org/10.1177/1086026614535786

Indexed at, Google Scholar, Cross Ref

Jain, P.K.; Jain, A.; Rezaee, Z(2016). Value-relevance of corporate social performance: Evidence from short selling.J. Manag. Account. Res.2016,28, 29–52.

Indexed at, Google Scholar, Cross Ref

Jensan, M. (2001), "Value maximization, stakeholder theory, and the corporate objective function", Journa/ oj App!ied Corpora te Finance, voI. 14, no. 3, pp. 8-2I

Indexed at, Google Scholar, Cross Ref

Jeroen Derwall, Nadja Guenster, Rob Bauer and Kees Koedijk(2005), The Eco-Efficiency Premium Puzzle, Financial Analysts Journal, Vol. 61, No. 2 (Mar. - Apr., 2005), pp. 51-63 (13 pages)

Indexed at, Google Scholar, Cross Ref

Junius, D., Adisurjo, A., Rijanto, Y. A., & Adelina, Y. E. (2020). The Impact of ESG Performance to Firm Performance and Market Value.Jurnal Aplikasi Akuntansi,5(1), 21–41. https://doi.org/10.29303/jaa.v5i1.84

Indexed at, Google Scholar, Cross Ref

Khan, M.; Serafeim, G.; Yoon, A. Corporate Sustainability: First Evidence on Materiality.Account. Rev.2016,91, 1697–1724.

Indexed at, Google Scholar, Cross Ref

Kocmanová, M. Do?ekalová (2012) Construction of the Economic Indicators of Performance Indicators of Performance in Relation to Environment, Social and Corporate Governance Factors, ACTA UNIVERSITATIS AGRICULTURAE ET SILVICULTURAE MENDELIANAE BRUNENSIS(2012)

Indexed at, Google Scholar, Cross Ref

Kolk, A. Sustainability, accountability and corporate governance: Exploring multinationals’ reporting practices.Bus. Strategy Environ.2008,17, 1–15.

Indexed at, Google Scholar, Cross Ref

Krosinsky, C. & Purdom, S. (2017). Sustainable investing: Revolutions in theory and practice. London, UK: Routledge.

Indexed at, Google Scholar, Cross Ref

Landau, A., Rochell, J., Klein, C., & Zwergel, B. (2020). Integrated reporting of environmental, social, and governance and financial data: Does the market value integrated reports? Business Strategy and the Environment, 29(4), pp. 1750-1763. DOI:10.1002/bse.2467.

Indexed at, Google Scholar, Cross Ref

Landi, G.andSciarelli, M.(2019), "Towards a more ethical market: the impact of ESG rating on corporate financial performance",Social Responsibility Journal, Vol. 15 No. 1, pp. 11-27.https://doi.org/10.1108/SRJ-11-2017-0254

Indexed at, Google Scholar, Cross Ref

María Mar Miralles-Quirós, José Luis Miralles-Quirós, & Jesús Redondo Hernández(2019) ESG Performance and Shareholder Value Creation in the Banking Industry: International Differences, Sustainability, 2019.

Indexed at, Google Scholar, Cross Ref

Mervelskemper and Streit (2016), Enhancing Market Valuation of ESG Performance: Is Integrated Reporting Keeping its Promise? Business Strategy and the Environment, Vol. 26, Issue 4

Indexed at, Google Scholar, Cross Ref

Mozaffar Khan(2019)Corporate Governance, ESG, and Stock Returns around the World,Financial Analysts Journal,75:4,103-123.

Indexed at, Google Scholar, Cross Ref

Murphy, D.andMcGrath, D.(2013), "ESG reporting-class actions, deterrence, and avoidance",Sustainability Accounting, Management and Policy Journal, Vol. 4 No. 2, pp. 216-235.

Indexed at, Google Scholar, Cross Ref

Nielsen, A.E.; Thomsen, C. Reporting CSR–what and how to say it?Corp. Commun. Int. J.2007,12, 25–40.

Indexed at, Google Scholar, Cross Ref

OECD (2017), ESG Investing: Practices, Progress and Challenges (oecd.org)

Ortas, E.; Álvarez, I.; Zubeltzu, E (2017). Firms’ Board Independence and Corporate Social Performance: A Meta-Analysis.Sustainability2017,9, 1006.

Indexed at, Google Scholar, Cross Ref

PatrickVelte(2017): Does ESG performance have an impact on financial performance? Evidence from Germany Journal of Global Responsibility ISSN:2041-256.

Indexed at, Google Scholar, Cross Ref

Queiroz (2009), Stakeholders theory and its contribution to the Sustainable Development of a tourism destination, WIT transactions on Ecology and the Environment, Vol. 120, 791-798.

Indexed at, Google Scholar, Cross Ref

Renata Paola Dameri and Pier Maria Ferrando(2021), Value creation disclosure: the international integrated reporting framework revisited in the light of stakeholder theory, Journal of management & governance. - Dordrecht : Springer, ISSN 1385-3457, ZDB-ID 1375940-1. - Vol. 23.2019, 2, p. 537-575.

Indexed at, Google Scholar, Cross Ref

Rezaee, Z(2016). Business sustainability research: A theoretical and integrated perspective.J. Account. Lit.2016,36, 48–64.

Indexed at, Google Scholar, Cross Ref

Rickard Garvare & Peter Johansson(2010)Management for Sustainability-A stakeholder theory,Total Quality Management & Business Excellence,21:7,737-744.

Indexed at, Google Scholar, Cross Ref

RuhayaAtan,Md. MahmudulAlam,JamaliahSaid,MohamedZamri(2018) The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies, Management of Environmental Quality, Vol 29, Issue 2.

Indexed at, Google Scholar, Cross Ref

SalimChouaibi,JamelChouaibi(2021), Social and ethical practices and firm value: the moderating effect of green innovation: evidence from international ESG data, International Journal of Ethics and Systems, ISSN:2514-9369

Indexed at, Google Scholar, Cross Ref

Schanzenbach, Max Matthew and Sitkoff, Robert H.(2020), ESG Investing: Theory, Evidence, and Fiduciary Principles. (October 1, 2020). Journal of Financial Planning.

Silvana Signori, Leire San-Jose Jose Luis Retolaza, Gianfranco Rusconi(2021), Stakeholder Value Creation: Comparing ESG and Value Added in European Companies, Sustainability2021,13(3), 1392.

Indexed at, Google Scholar, Cross Ref

Sisodia, R.; Sheth, J.N.; Wolfe, D.B(2014).Firms of Endearment: How World-Class Companies Profit from Passion and Purpose, 2nd ed.; Pearson: Upper Saddle River, NJ, USA, 2014; ISBN 978-0-13-338259-4.

Indexed at, Google Scholar, Cross Ref

Smith, J. H. (2003) The Shareholder vs. Stakeholders Debate, “MIT Sloan Management Review”, 44 (4), 77–82)

Sridharan, V. (2018). Bridging the disclosure gap: investor perspectives on environmental, social & governance (ESG) disclosures. Retrieved from https://repository.upenn.edu/mes_capstones/72.

Indexed at, Google Scholar, Cross Ref

Steurer et al. (2005), Corporations, Stakeholders and Sustainable development: A theoretical exploration of Business-Society Relations. Journal of Business Ethics 61(3), 263-281

Indexed at, Google Scholar, Cross Ref

Sudipta bose, Amitav Saha & Indira Abeyasekra(2020), The Value Relevance of Corporate Social Responsibility (CSR) Expenditure: Evidence from Regulatory Decisions Abacus: a journal of accounting, finance and business studies 455-494

Indexed at, Google Scholar, Cross Ref

Sultana, S., Zulkifli, N., & Zainal, D. (2018). Environmental, social and governance (ESG) and investment decision in Bangladesh. Sustainability, 10(6), 1831. DOI:10.3390/su10061831.

Indexed at, Google Scholar, Cross Ref

Sustainalytics (2017), ESG Research and Ratings, Research Report,

Syed, M., A. (2017). Environment, social, and governance (ESG) criteria and preference of managers. Cogent Business & Management, 4(1). DOI: 10.1080/23311975.2017.1340820.

Indexed at, Google Scholar, Cross Ref

Thomas M. Jones, Jeffrey S. Harrison & Will Felps(2018), How Applying Instrumental Stakeholder Theory Can Provide Sustainable Competitive Advantage, Academy of Management ReviewVol. 43, No. 3

Indexed at, Google Scholar, Cross Ref

UNPRI (2018), Principals of Responsible Investment, Annual Report 2018,

Williams, R. (2003) Women on corporate boards of directors and their influence on corporate philanthropy.J. Bus. Ethics2003,42, 1-10.

Indexed at, Google Scholar, Cross Ref

Windsor, D.(2017), "Value Creation Theory: Literature Review and Theory Assessment",Stakeholder Management(Business and Society 360, Vol. 1), Emerald Publishing Limited, Bingley, 75-100.

Indexed at, Google Scholar, Cross Ref

World Bank. (2018). Incorporating environmental, social and governance (ESG) factors into fixed income investment.

Zamagni, S. (2006), "Responsabilità sociale delle imprese e democratie stakeholding", Università degli Studi di Bologna, sede di Forlì, Working Paper, no. 28.

Zhang, J.Q.; Zhu, H.; Ding, H.(2013) Board composition and corporate social responsibility: An empirical investigation in the post Sarbanes–Oxley era.J. Bus. Ethics2013,114, 381–392.

Indexed at, Google Scholar, Cross Ref

Zhang, L (2012). Board demographic diversity, independence, and corporate social performance.Corp. Gov. Int. J. Bus. Soc.2012,12, 686–700.

Indexed at, Google Scholar, Cross Ref

Zivin, J. G. & Neidell, M. (2012). The impact of pollution on worker productivity. American Economic Review, 102(7), pp. 3652-3673.

Indexed at, Google Scholar, Cross Ref

Received: 30-Nov-2022, Manuscript No. AMSJ-22-12940; Editor assigned: 05-Dec-2022, PreQC No. AMSJ-22-12940(PQ); Reviewed: 23-Dec-2022, QC No. AMSJ-22-12834; Revised: 28-Jan-2023, Manuscript No. AMSJ-22-12940(R); Published: 08-Feb-2023