Research Article: 2022 Vol: 26 Issue: 3

A Quest for Sustainium (Sustainability Premium): Review of Sustainable Bonds

Sumit Kumar, Indian Institute of Management Kozhikode

Citation Information: Kumar, S. (2022). A quest for sustainium (sustainability premium): review of sustainable bonds. Academy of Accounting and Financial Studies Journal, 26(2), 1-18.

Abstract

The purpose of this systematic review is to explore the performance of sustainable bonds and investigate if there is evidence of the sustainability premium or sustainium. The content of this study is compiled from a review and meta-synthesis of eligible journal articles to review the performance of the sustainable issuance. It further investigates the role of sustainable bond issuances from various integral factors like the current pricing & overall performance approach, policies, role and contribution in achieving sustainability, Investor's sentiments, and its spread in developing countries. Sustainability bonds finance a combination of social and green bonds; hence, yields of both bonds are compared against conventional bonds. The findings showed that sustainability bonds had gained popularity over the last decade because of the capital shift to green capacity. In 2020, the sustainability bonds outperformed conventional bonds because of various factors and drivers. Empirical findings showed that the sustainability bond guidelines, social bond principles, and green bond principles play a vital role in promoting the sustainable bonds market. The review confirmed that sustainable bonds offer a slightly tighter yield than traditional corporate bonds and command a marginally better price.

Keywords

Sustainable Bonds, Social Bonds, Green Bonds, Sustainability Premium, Climate Bond.

Introduction

Sustainability remains a dominant concept across different industries and disciplines, including the bonds market. Building on this realization, the current systematic literature review explores whether sustainable bonds offer better performance than common bonds. According to Bos (2018), sustainability bonds blend social and green bonds. They offer social and environmental benefits to a target population. These bonds can be used fully or partially to finance or refinance new or existing projects (Bos, 2018).

They are fixed-income securities whose revenues are only utilized to fund a mix of social and environmental projects. Sustainability Bond Standards (SBG), Social Bond Principles (SBP), and Green Bond Principles (GBP) are four basic ICMA guidelines for sustainability-related debt instruments (ICMA, 2020a; Mehta et al., 2021).

The International Capital Markets Association (ICMA) has divided sustainable bonds into five categories. Sustainable Bonds, Sustainable Revenue Bonds, Sustainable Project Bonds, and Sustainable Securitized Bonds are examples of sustainable bonds. A high-level overview of the categories of sustainable ties can be found in Table 1.

| Table 1 Sustainable Bond Product Category |

|

|---|---|

| Sustainable Bond Type | Details |

| Standard Sustainable Bonds | Typical debt obligation with sustainability financing commitments. |

| Sustainable Revenue Bonds | Credit exposure is linked to the cashflows of sustainable project income |

| streams such as fees, payments, taxes, and so on. | |

| Sustainable Project Bond | Proceeds will be used to fund a project with sustainability objectives. |

| Sustainable Securitized Bond | A bond is secured by the project’s revenue stream that fits into sustainability criteria. |

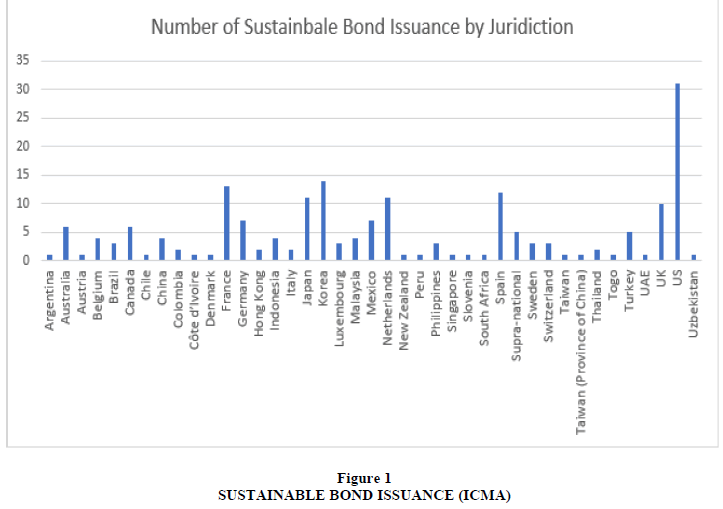

Overview of the Sustainable Bond Market (Issuance): Environmental, social, and governance (ESG) issues in investment strategy and portfolio design have accelerated the issuance of sustainable bonds (Kumar et al., 2021). The International Capital Markets Association (ICMA) maintains a database of sustainable bonds issued in various regional jurisdictions. The United States has pioneered sustainable bond issuance, as demonstrated in the graph below Figure 1.

The issuing of sustainable bonds increased dramatically in 2019. The following are some of the most notable sustainable bond deals and issuers.

Sustainability bonds are compared to standard regular bonds in this analysis. Various literature sources were sought for this, and the conclusion was analyzed. The International Capital Market Association's (ICMA) sustainable bond rules create sustainability bonds. They are a method of structuring or financing a bond’s coupon rate based on environmental, social, and governance (ESG) goals (Mehta et al., 2021). These bonds are becoming increasingly popular among investors and authorities who want to achieve global value. Business organizations and investors can use the bonds to improve their social and environmental initiatives (IOSCO, 2019). The format of sustainable bonds is similar to that of sustainability-linked loans, in which the interest rate is controlled by a predetermined sustainability goal (Environmental Finance, 2020). According to empirical studies, these bonds have expanded in capacity over the last few years, with tighter yields than traditional standard bonds. The goal of this systematic literature review (REVIEW) is to verify or debunk the assertions.

The sustainable bond market has raised awareness of environmental concerns in the financial industry during the previous ten years, with suitable targets, indicators, and projects (Environmental Finance, 2020). From the "green halo," issuers' attitude evolved to strategic targeting of investors. The bonds are currently incorporated into ESG liquidity targets, investors' strategic relationships with issuers, and regional diversity (Environmental Finance, 2020). The growth and domination of sustainable bonds are ascribed to the diversification and shift in global agreement to achieve sustainable aims and priorities. These bonds provide an innovative answer to the growing financing shortage for green initiatives, generating returns on investment (ROI) while also having a progressive environmental impact (Arora & Raj, 2020). With recently reported growth relative to common bonds, the bonds are crucial to the sustainable finance industry. A conventional average adhesive, such as municipal and corporate bonds, comprises the government or firm transferring raised funds to various projects at their discretion. In contrast, sustainability bonds are for ecologically favorable initiatives.

| Table 2 Snapshot Of The Most Significant Deal And Sustainable Bond Issuance |

||

|---|---|---|

| Largest Corporate | East Nippon Express Way | Value : $1,387M |

| Largest Municipal | California Health Facilities Authority |

Value: $500M |

| Largest Financial Institution | Cassa Depositie prestiti Spa | Value : $849M |

| Largest Single sustainability Bond | Federal State of NRW | Value: $2,547 M |

| Largest Issuer | World Bank | Value: $3,705 M |

| Largest Agency | T Corp | Value: $1,230M |

| Largest Sovereign | Republic of Korea | Value: $500M |

(www.environmental-finance.com).

Methodology

We chose the systematic review method because it provides for a full appraisal of the topic from a variety of perspectives drawn from the existing literature. The method comprises going over a list of recent research publications relevant to the topic. It is a reliable source of evidence-based material that may be used to analyze the subject at hand.

Structured reviews and meta-analyses allow for collecting relevant evidence on a topic based on pre-specified eligibility criteria and study questions (Mengist et al., 2019). Full-text peer-reviewed papers and scholarly articles published between 2017 and 2021, published in the English language, and good themes were the inclusion criteria for this study. The early searches generated many publications; nevertheless, this study retrieved 25 peer-reviewed and scholarly articles and assembled content after screening them using predetermined inclusion and exclusion criteria. Table 3 shows a list of journals or publications, together with information about their magazine and Scopus impact ratings. "Does sustainable bond give greater performance than the standard normal bond?" is the research question that led to the extraction of the relevant article.

| Table 3 Journal/Scholarly Articles And Publisher Distribution |

||||||

|---|---|---|---|---|---|---|

| # | Article Name | Author(s) | Journal | Publisher | Year | Journal Impact IF of Scopus |

| 1 | The Pricing of Green Bonds: Are Financial Institutions Special? |

Fatica et al. | Journal of Financial Stability | ScienceDirect | 2021 | 3.72 |

| 2 | Green, Sustainability, And Social Bonds For COVID-19 Recovery A Thematic Bonds Primer Mobilizing Financial Markets For Achieving Net Zero Economies. |

Mehta et al. | - | ACGF | 2021 | - |

| 3 | Drivers Of Green Bond Issuance and New Evidence on The "Greenium." |

Löfer et al. | Eurasian Economic Review | Springer | 2021 | 1.09 |

| 4 | How To Issue Green Bonds, Social Bonds, And Sustainability Bonds |

Climate Bonds Initiative | - | Climate Bonds Initiative | 2021 | - |

| 5 | Green Bonds: A Catalyst For Sustainable Development |

Aggarwal & Pathak | Journal of Contemporary Issues in Business and Government |

P-ISSN | 2021 | - |

| 6 | Emerging Market Green Bonds Report 2020 On The Road To Green Recovery |

Amundi Asset Management | - | Amundi | 2021 | - |

| 7 | Sustainable Bonds Insight 2020 | Environmental Finance | Bond Database | 2020 | - | |

| 8 | A Comparative Study On The Performance Of Green And Traditional Bonds |

Arora & Raj | International Journal of Business and Management Invention (IJBMI) |

ISSN | 2020 | 4.72 |

| 9 | Understanding The Role Of Green Bonds In Advancing Sustainability |

Maltais & Nykvist | Journal of Sustainable Finance & Investment | Taylor & Francis Group | 2020 | 2.08 |

| 10 | Are Green Bonds Funding the Transition? Investigating The Link Between Companies' Climate Targets and Green |

Tuhkanen & Vulturius | Journal of Sustainable Finance & Investment | Taylor & Francis Group | 2020 | 2.08 |

| Debt Financing | ||||||

| 11 | Sustainability Bonds and Green Bonds Within the Retail Sector |

Jones & Comfort | International Journal of Sales, Retailing & Marketing |

EPrint | 2020 | 5.24 |

| 12 | The Evolution of Pricing Performance of Green Municipal Bonds |

Partridge & Medda | Journal of Sustainable Finance and Investment | Taylor & Francis Group | 2020 | 2.08 |

| 13 | Network Connectedness of Green Bonds and Asset Classes. |

Reboredo, Ugolini & Aiube | Energy Economics | Elsevier | 2020 | 2.96 |

| 14 | Drivers Of Green Bond Market Growth: The Importance of Nationally Determined Contributions to The Paris Agreement And Implications For Sustainability |

Tolliver, Keeley, & Managi | Journal of Cleaner Production | ScienceDirect | 2020 | 7.25 |

| 15 | Voluntary Process Guidelines for Issuing Sustainability- Linked Bonds |

ICMA (b) | - | ICMA | 2020 | - |

| 16 | Survey Of Green Bond Pricing And Investment Performance |

Liaw | Journal Risk Financial Management | MDPI | 2020 | 0.44 |

| 17 | What Future For The Green Bond Market? How Can Policymakers, Companies, And Investors Unlock The Potential Of The Green Bond Market? |

Deschryver & de Mariz | Journal Risk Financial Management | MDPI | 2020 | 0.44 |

| 18 | Economic Impacts Of Green Finance: Is It Possible To Measure The Productivity Of Green Bonds In China |

Stigliani | Climate Policy Initiative | UK PACT | 2020 | 4.01 |

| 19 | Sustainable Finance In Emerging Markets And The Role Of Securities Regulators |

IOSCO | International Organization of Securities Commissions | IOSCO | 2019 | 9.18 |

| 20 | The Green Advantage: Exploring The Convenience Of Issuing Green Bonds |

Gianfrate & Peri | Journal of Cleaner Production | ScienceDirect | 2019 | 7.25 |

| 21 | Green Finance: Fostering Sustainable Development In India |

Jha & Bakhshi | International Journal of Recent Technology and Engineering | ISSN | 2019 | 0.16 |

| 22 | Business Models For Sustainable Finance: The Case Study Of Social Impact Bonds |

Torre et al. | Sustainability | MDPI | 2019 | 2.97 |

| 23 | The Alignment Of Global Equity And Corporate Bonds Markets With The Paris Agreement: A New Accounting Framework |

Thomä et al. | Journal of Applied Accounting | Emerald Publishing Limited | 2019 | 1.7 |

| 24 | Social Bonds For Sustainable Development: A Human Rights Perspective On Impact Investing |

Park | Business and Human Rights Journal | Cambridge University Press | 2018 | 1.20 |

| 25 | New Financing For Sustainable Development: The Case for NNP- or Inclusive Wealth- Linked Bonds. |

Yamaguchi & Managi. | Journal of Environment & Development | - | 2017 | 1.84 |

Table 4 presents a comprehensive synopsis of the 25 selected articles based on the topic, objective, findings, and recommendation. The data presented was critical for the eligibility assessment of each article.

| Table 4 Summary Of The Articles Based On Topic |

||||

|---|---|---|---|---|

| S.No | Article Name | Objectives | Findings | Recommendation |

| 1 | The Pricing of Green Bonds: Are Financial Institutions Special? | To investigate implications of sustainability label on bonds issuances. | Sustainability or green bonds issuedbenefited from a premiumcompared to standard bonds. |

Sustainablebonds should be promoted morebecause of associated benefits. |

| 2 | Green, Sustainability, And Social Bonds For COVID-19 Recovery A Thematic Bonds Primer Mobilizing Financial Markets For Achieving Net Zero Economies |

To offer an overview of thematic bond types' performance in emerging trends. | Better prices recorded in 2020 with surety for similar return in coming years. | Green, social, and sustainability bonds need further investigation on yields trends |

| 3 | Drivers Of Green Bond Issuance and New Evidence On The "Greenium." | To determine whether green bonds' premium, "greenium" exists in ordinary bond markets. | Findings indicated that sustainability bonds have an average of 15-20 basis points lower than conventional bonds; hence, a "greenium" exists. |

Further studies needed on premium aspects of sustainable bonds |

| 4 | Sustainable Bonds Insight 2020 | To establish the strategic approach currently applicable in sustainable finance. |

Sustainability, social, and green bond market had $321 billion in 2019, a 52% annual increment | A sustainable finance approach should be promoted risk-adjusted returns |

| 5 | A Comparative Study On The Performance Of Green And Traditional Bonds | To assess the performance of sustainability bonds against standard or conventional bonds for investment perspective viability. |

Green bonds had better performance than normal bonds between 2011-2017 | Sustainability bonds should be encouraged for investment perspective viability |

| 6 | Emerging Market Green Bonds Report 2020 On The Road To Green Recovery | To offer a comprehensive overview of the regulatory and policy enhancement affecting effect the sustainability bond market. |

The policies favor international green bonds compared to conventional standard bonds and established lower volatility. |

Greenbonds are better for sustainability recovery. |

| 7 | Understanding The Role of Green Bonds InAdvancing Sustainability | To address issues or queries about factors that attract issuers and investors to the sustainability bond market | The shift to sustainability strategies attracts investors and issuers to the green bond market | Enhanced sustainability goals and priorities are necessary for a sustainable finance market |

| 8 | How To Issue Green Bonds, Social Bonds, and Sustainability Bonds |

To build on existing knowledge about social, sustainability,and green bonds across the region. |

Sustainability bonds are applicable for green projects with better prices across the globe. |

Further studies on the issuance of sustainability bonds in the world |

| 9 | Green Bonds: A CatalystFor Sustainable Development | To assess the effect of technological shifts and enhanced government policies on sustainability policies |

Green/sustainability bonds are instruments for the achievement of sustainable development goals and associated climate projects |

Promote the issuance of the bonds to increase completion of green projects |

| 10 | Sustainable Finance In Emerging Markets And The Role Of Securities Regulators | To explore ESG dimensions concentrating on financial system and transparency | Substantial enhancement in green projects investment, renewable energy investments and sustainable funding, and disclosure of ESG risks. |

Further research on the relationship between ESG and sustainability bonds. |

| 11 | Are Green Bonds Funding The

Transition? Investigating The Link Between Companies' Climate Targets And Green Debt Financing |

To test and develop a conceptual model linking climate targets to sustainable bonds for corporate transition and efficient climate governance. | There is little pressure for sustainability bond issuers to employ or attain over ambitious technology- oriented targets. Only policy action to minimize greenwashing should be a priority for green bond issuers. |

Effective sustainability bonds policy will encourage their adoption across the globe. |

| 12 | Sustainability Bonds And Green Bonds Within The Retail Sector | To outline characteristics of sustainable investments relevant within a retail industry of the economy |

Green investments are prone to many challenges, such as independent assurance and greenwashing concerns |

Further studies should be conducted on risks |

| between continuing and sustainable growth. |

||||

| 13 | The Evolution Of Pricing Performance Of Green Municipal Bonds | Investigated the performance of the conventional bond. | Findings showed a necessity to grow green municipal and corporate bonds for additional sustainable infrastructure projects. |

Conversion of ordinary bonds to sustainability scale is recommended |

| 14 | Network Connectedness Of Green Bonds And Asset Classes. | To identify associations between sustainability bonds and diverse asset classes for enhanced investment across the US and EU asset sectors. |

A weak link was discovered between sustainability bonds and conventional high-yield bonds based on different scales. | Require enhanced policy and strategies to develop a strong link |

| 15 | Drivers Of Green Bond Market Growth: The Importance Of Nationally Determined Contributions To The Paris Agreement And Implications For Sustainability | To illustrate prime factors of sustainability bond market development compared to traditional bond market enhancement. | There are statistically significant positive impacts among identified variables | Need a further explanation of identified drivers |

| 16 | Voluntary Process Guidelines For Issuing Sustainability-Linked Bonds | To assess the significance of Sustainability-Linked Bonds ("SLBs") based on Sustainability Performance Targets (SPTs) and KPIs. | Findings indicated that SLBs aims to enhance the development of fundamental roles played by debt markets in financing and promoting sustainability-oriented corporations |

Need further discussion of the roles of debt markets |

| 17 | The Green Advantage: Exploring The Convenience Of Issuing Green Bonds | To explore the feasibility of sustainability bonds to financial transition for a low-carbon economy to attain the Paris Agreement's goal to change the rhetoric into action. |

Findings indicate that sustainability bonds are better financially compared to non- green bonds. These bonds are the potential for greening the economy with minimal financial burdens. |

Further investigations required on low- carbon economy |

| 18 | Green Finance: Fostering Sustainable Development In India | To explore many green financing policies and strategies in the private and public sectors in India | Findings showed that sustainability finance is pivotal in attaining economic growth for sustainable development priorities. |

Need further explanation on financing policies andstrategies across the world |

| 19 | Survey Of Green Bond Pricing And Investment Performance | To establish the difference in sustainability bonds' yield against conventional bonds at greenium issuance. | Green bonds have comparable yields to norm bonds; however, they are earmarked for financing environmental and climate projects. |

Requiremore studies on yields comparison. |

| 20 | What Future For The Green Bond Market? How Can Policymakers, Companies,And Investors Unlock The Potential Of The Green Bond Market? | To review the spectrum of sustainability bond market involvement. | The sustainability bond market is smaller compared to the conventional bond market | More comparison on the spectrums should be accomplished. |

| 21 | Social Bonds For Sustainable | To highlight implications of socialand sustainability | Suggests reform to social bond market enhancing | Need further analysis on social |

| Development: A Human Rights Perspective On Impact Investing | bonds to financial returns. | external assurance, investor assessment, maximizing leverage. | bonds implication. | |

| 22 | Business Models For Sustainable Finance: The Case Study Of Social Impact Bonds | To explore conceptualizing SIBs on difference across social industries and regions | Policymakers should engage more in a completely collaborative SIB framework to attain the desired social influence. |

Social bonds have impacts on sustainable projects but require further assessment |

| 23 | Economic Impacts of Green Finance: Is It Possible to Measure the Productivity Of Green Bonds In China | To determine why investors find sustainability bonds attractive for social, governance, and environmental results in fixed financial portfolios. |

In 2019, the sustainability bond market had a market niche of US$258 billion with fixed income for other ecological sustainability projects. |

Recent yields of sustainability or green bonds are required |

| 24 | The Alignment of Global Equity and Corporate Bonds Markets With The Paris Agreement: A New Accounting Framework |

To establish core compliance elements of international finance flows of bonds to climate scenarios and reduction of global warming below 2°C. | Principles, supervisory, investment management, and corporate bond coverage require improvement to yield more and support described corporate bond investment. | Need further information on sustainability bonds and global warming projects |

| 25 | NewFinancing For Sustainable Development: The Case For NNP- Or InclusiveWealth- Linked Bonds. | To attract investors and government in investing natural capital corresponding to financial assets. |

The gross national product (GNP)–oriented bonds help trim public debt concerning annual sustainability to ensure lasting sustainability. | Further studies on NNP are recommended. |

Results and Discussion

This investigation aimed to see if a sustainable bond outperformed an ordinary bond. To answer the topic from the standpoint of previous researchers, the study used 25 articles. The findings are provided and interpreted in this section based on the study topic and question. According to the results of Environmental Finance (2020), the total value of issuance for social, green, and sustainability bonds in 2019 was $321 billion, up 52 percent over the previous year. The total amount of debt issued by 2020 will be more than $1 trillion. East Nippon Expressway corporate has a market value of $1,387 million in the sustainability bond market. The largest sustainability bond markets were issued by Spain, Korea, and Germany. For mainstream investors, sustainability-linked linked bonds can provide ESG investment in large quantities (Environmental Finance, 2020; Stigliani, 2020). Global sustainability bond issuance surged by 65 percent quarterly in 2020, indicating high yields and long-term climatic or environmental viability (Stigliani, 2020; Mehta et al., 2021). (Thomä et al., 2019; IOSCO, 2019). The sustainable bonds promoted market participation to incorporate and unveil ESG and defined standards for covering corporate bonds and international-listed stock. Because of the ESG links, sustainability bonds have seen the significant price and demand increases, according to the research.

In comparison, the prices of sustainability bonds in 2019 and 2020 were more significant than the yields of conventional bonds. Because investors do not sacrifice financial rewards for environmental benefits, the global issuance of sustainability or green bonds outpaced common bonds. According to studies, sustainability bonds receive a premium over conventional bonds. Sustainability bonds have a lower yield than typical standard bonds with a "greenium" (Arora & Raj, 2020; Fatica et al., 2021; Löfer et al., 2021). Because of the benefits of green investments, it is acceptable to conclude that sustainability bonds offer higher price-performance and attract many investors based on these findings.

The ever-changing capital towards sustainable business policies encourages issuers and investors to the sustainable bond market, and supports corporations with green policies and strategies, according to the studies analyzed (Maltais & Nykvist, 2020). The rapid expansion of sustainability bonds can be ascribed to the high yields linked with them. Furthermore, these linkages are environmental protection mechanisms, with data indicating a positive impact on long-term development (Climate Bonds Initiative, 2021; Aggarwal & Pathak, 2021). However, the findings show that there is minimal pressure for sustainable bond issuers to pursue science-based goals, instead of focusing on minimizing greenwashing within planetary constraints. When compared to normal norm bonds, sustainable bonds are more cost-effective. The goal of these bonds is to foster a green municipal bond market and raise funds for long-term infrastructure projects (Gianfrate & Peri, 2019; Tuhkanen & Vulturius, 2020; Jones & Comfort, 2020; Partridge & Medda, 2020). Sustainable bonds also have a narrower bid/ask spread, which means more liquidity.

Because of the different time scales, sustainable bonds are not classified as high-yield bonds. The findings have consequences for green bond portfolio investors and cash flows for economic policies (Reboredo et al., 2020). Furthermore, issuances for climate and sustainability investments are fueled by macroeconomic, contribution, and institutional considerations. These factors also lead to an increase in the flow of funds for green development efforts in numerous sectors (Jha & Bakhshi, 2019; Tolliver et al., 2020). Because of improved investor assessment, the social bond market also enjoys better prices and lower rates, while SLBs provide funding for long-term sustainability. Despite having similar structures to green bonds, conventional bonds offer funds for environmental or climate projects despite having a lower market size (Park, 2018 ;ICMA, 2020b; Liaw, 2020; Deschryver & de Mariz, 2020). GNP–linked bonds increase fiscal sustainability, and policymakers are asked to embrace SIB models for greater returns. Global sustainability bonds outperformed conventional bonds and demonstrated lower volatility (Yamaguchi & Managi, 2017; Torre et al., 2019; Amund Asset Management, 2021).

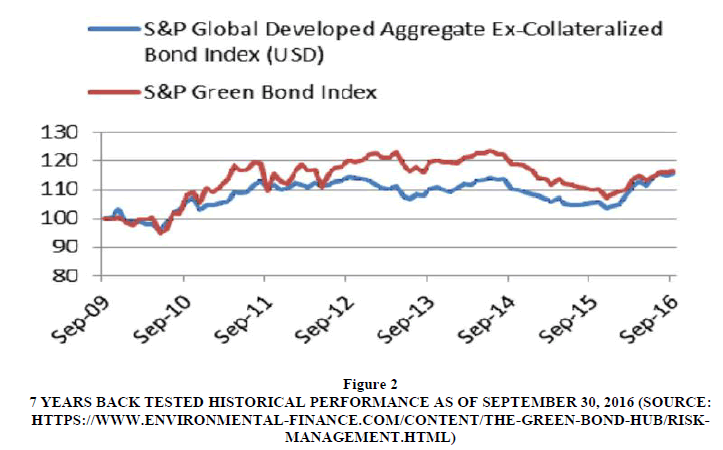

Market insight: Whereas the academic debate provides a framework for analyzing a financial instrument's performance, it is critical to monitor its performance in the market. Green financing is clearly the most popular fixed-income investment option, as seen by market positioning. Several "Green Bond Indices," which track the growth and maturity of the green bond market, have been introduced in recent months. In comparison to the regular bond index (S&P 500, 2016), which gained 2.05 percent, the S&P 500 Green Bond Index returned 2.18 percent. Investors' preference for green issuance is reflected in the fact that the Green Bond index outperformed the regular bond index by 11 basis points. The below picture gives a snapshot of the S&P Global Aggregate Ex-Collateralized Bond index with the S&P Green Bond index Figure 2.

Figure 2:7 Years Back Tested Historical Performance As Of September 30, 2016 (Source: Https://Www.Environmental-Finance.Com/Content/The-Green-Bond-Hub/Risk- Management.Html.

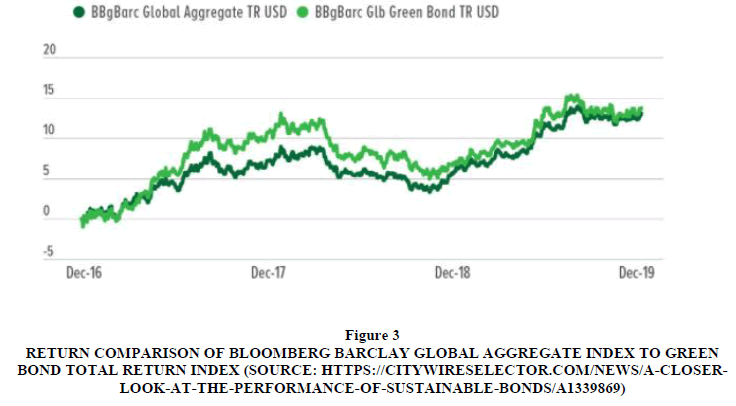

When comparing the returns of Bloomberg's Barclay global aggregate index to the Bloomberg global green bond index, we can see that the green bond index had a return of 14.1 percent. The Bloomberg global aggregate index, on the other hand, returned 13.4 percent. The green bond index outperformed the regular Barclays global aggregate by 70 basis points in this case as well. Figure 3 depicts the same.

Figure 3:Return Comparison Of Bloomberg Barclay Global Aggregate Index To Green Bond Total Return Index (Source: Https://Citywireselector.Com/News/A-Closer- Look-At-The-Performance-Of-Sustainable-Bonds/A1339869).

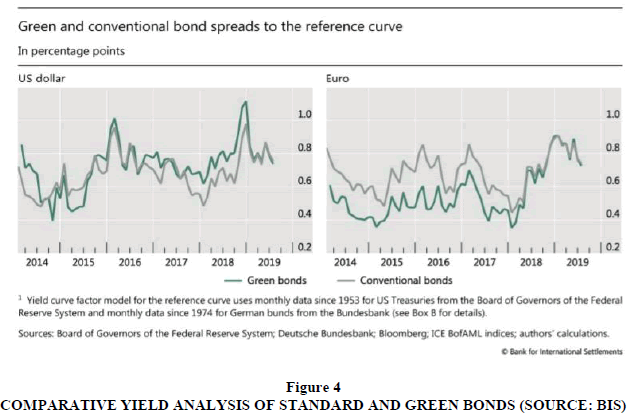

Even after the COIVD hit 2021, green investing in fixed income instruments are still on a roll. According to the financial times (ft.com), half a trillion dollars in green bond issuance is predicted in 2021, continuing upward. The cumulative average growth rate of green, social, and sustainable distribution was 37.6 percent, according to research provided by (Nordea, 2020). A comparative yield study of the common bond demonstrates that the yield spread between standard bond issuance and green bond issuance moves parallel when compared to green bond issuance. Meanwhile, the higher price point is owing to institutional investors' interest in green and ESG investments, which explains the green bond's tighter yield. As it integrates the two remaining vital pillars of ESG integration into the investment portfolio, the bond market expects strong development in sustainable and social bond issuances. The same is depicted in Figure 4 below.

Factors of Growth & Challenges

Role in Sustainability: Maltais & Nykvist (2020) have revealed that companies that rely on sustainable finance can attract and retain most of their consumers, offer premium prices, and nurture operational efficiency by getting the best employees and enhancing their productivity. These key outcomes can improve a brand's reputation and make more informed decisions in the workspace and the vast market. Gianfrate & Peri (2019) even insist that green bonds tend to be more financially convenient than conventional ones because the issuers expect lower returns. As a result, the Investor will focus on making sustainable initiatives that can work towards enhancing the natural ecosystem, too. At the same time, Paranque & Revelli (2017) have described how green bonds always incorporate ethical guidelines into the business operations by ensuring that the companies engage in fair, equitable, and pro-social. These measures will guide the companies in minimizing any extensive exploitation that has been quite common among capitalists. Similarly, Leitao et al. (2021) have illustrated how green bonds such as Sol Green and S&P Green have affected the European Union carbon market by lowering emissions. The outcomes portray the need for companies to prioritize sustainable bonds in improving the wider society.

Role of Policies: The insufficient and ineffective regulatory framework for green bonds has been a severe concern for prospective investors and corporations that want to issue the bonds (Jakubik & Uguz, 2020). Even Park (2018) has captured how private governance of green bonds, which consists of third-party assessment, ratings, investment standards, and certification schemes, is mainly decentralized. At the same time, the absence of government regulators has undermined the extensive incorporation of consistency, accountability, and legitimacy, too (Park, 2018). As a result, the implementation of extensive multi-sector supervision can play a crucial role in establishing policies that can oversee the issuance and investment of green bonds (Dou & Qi, 2019). Some countries and international regulatory agencies have made an effort to implement several policies that can create a sense of order in the market. For instance, in 2014, the International Capital Markets Association (ICMA) established the green bond principles (GBP) to create appropriate frameworks that investors can utilize to access the bonds (Reboredo & Ugolini, 2019). Even Azhgaliyeva et al. (2019) have identified how the Sustainable Bond Grant Scheme (SBGS), Green Bond Grant Scheme (GBGS), and Climate Bond Initiative's Climate Bond Standards as some of the regulatory frameworks that have enhanced the issuance of green bonds in South-East Asia countries. Besides that, China's National Development and Reform Commission (NDRC) has introduced the Green Bond Issuance Guidelines to facilitate the issuance of the bonds in the country (Dou & Qi, 2019). The regulations have focused on maintaining lower prices and ensuring that the green bonds are financing sustainable projects.

The policies are essential in creating efficient approval channels, transparent disclosure of project information, and legitimate certification and assessment (Dou & Qi, 2019). Furthermore, Tolliver et al. (2020) have identified the "(1) Economic Instruments, (2) Information and Education, (3) Policy Support, (4) Regulatory Instruments, (5) Research, Development and Deployment (RD&D), and (6) Voluntary Approaches; within these, feed-in-tariffs (FiT), renewable portfolio standards (RPS), tradeable renewable energy certificates (REC), and tax incentives" as some of the effective policies that have overseen the implementation of green bonds (p.2). These aspects pinpoint the key areas that should be a priority in the sustainable bond market. Additionally, Jakubik & Uguz (2020) have highlighted how insurance companies need to establish policies to oversee the appropriate issuance of green bonds in the equity market.

Investor's sentiment: Pineiro-Chousa et al. (2021) have revealed that investors' sentiment has influenced the growth of the green bond market by portraying how the finances have supported initiatives such as water management and climate change. Besides that, Wang et al. (2021) have described how environmental news influenced investors' sentiment, affecting the issuance and investment of green bonds. Nanayakkara & Colombage (2020) have also insisted that the investors' sentiment is most likely to increase the trading volume and market liquidity. As a result, regulators need to create an environment that fosters positive feelings among investors to make the green bonds more attractive. Similarly, Dan & Tiron-Tudor (2021) have pinpointed how social networks offer vast information and influence the investors' sentiment, contributing to informed decision-making in the market.

Influence on Developing Countries: An analysis of the impact of sustainable bonds on developing countries is another critical area that has emerged from the literature. In this case, Banga (2018) reveals how the green bond market has provided an opportunity for developing countries to access climate finance that can foster sustainability and environmental conservation. The accessibility to reliable and affordable financial resources is necessary for developing countries to improve their environment. However, most developing countries have struggled to achieve such expectations due to the insufficient financial resources that can support their initiatives. For instance, Donastorg et al. (2017) have described how dependency and depletion of fossil fuel and the inability to meet sustainable development goals have pushed developing countries to use green bonds to support their environmental protection initiatives. Hence, Tolliver et al. (2019) have pinpointed how the Paris Agreement and the Sustainable Development Goals have emphasized the long-term and cost-efficient financial resources.

Influence on Developing Countries

Analyzing the influence of sustainable bonds on developing countries is another critical area that has emerged from the literature. In this case, Banga (2018) reveals how the green bond market has provided an opportunity for developing countries to access climate finance that can foster sustainability and environmental conservation. The accessibility to reliable and affordable financial resources is necessary for developing countries to improve their environment. However, most developing countries have struggled to achieve such expectations due to the insufficient financial resources that can support their initiatives. For instance, Donastorg et al. (2017) have described how dependency and depletion of fossil fuel and the inability to meet sustainable development goals have pushed developing countries to use green bonds to support their environmental protection initiatives. Hence, Tolliver et al. (2019) have pinpointed how the Paris Agreement and the Sustainable Development Goals have emphasized the long-term and cost-efficient financial resources.

Challenges to the Growth of Sustainable Bonds

Pricing Approach: The absence of standardized pricing criteria can interfere with its credibility requirements because the sustainable bonds market is still in an initial growth phase. Hence, an in-depth understanding of key financial indicators of sustainable bonds is quite helpful. For instance, Nanayakkara & Colombage (2019) have revealed that green bonds are associated with tighter yield spreads and premiums than conventional ones. Furthermore, the green bonds tend to have lower cash flows concerning traditional bonds, thereby showing how the investors usually appreciate the green label that can foster their ethical investment practices (Nanayakkara & Colombage, 2019). As a result, such factors can determine the prices associated with the issuance of sustainable bonds. Bond Prices and return of the bond can be attributed using Principal Component Analysis (Kumar, 2022). It is a method using which higher dimensional data can be expressed as a combination of Linear factors (Roland et al., 2021).

The financial indicators can create a general overview of how the financial institutions determine reasonable prices. Currently, green bonds have not been quoted against any standard bond. (Liaw, 2020). However, differences in the prices between green and conventional bonds have arisen due to ratings, periods, and currencies (Liaw, 2020). Hence, the market conditions are critical in determining the pricing model for green bonds. Hachenberg & Schiereck (2018) have pinpointed that the environmental, social, and governance (ESG) rating and industrial guidelines significantly influence the pricing of green bonds. In most instances, the ESG approach consistently results in incentives that can favor the issuers, thereby controlling the prices that they offer to the investors. At the same time, the green bonds tend to trade tighter while the conventional bonds trade in a marginally more comprehensive approach (Hachenberg & Schiereck, 2018).

On the other hand, Fatica et al. (2021) have highlighted how the green bonds offered by the corporates and supranational institutions are premiums while other smaller financial institutions do not depict any yield differences in their green bonds. Similarly, it is difficult to portray a linkage between the compensation of the green bonds during the issuance (Fatica et al., 2021). As a result, it might be hard to determine whether the financial issuers have a green premium that they always attach to the bonds. Return of the Sustainable bond can be attributed to the Stakeholders theory (Kumar & Baag, 2021).

Social and Cultural Issues

The social screening of bond investing is also influenced by socio-cultural aspects of the region and society. Buddhist Philosophy for example strongly encourages the growth with environmental concerns (Kumar, 2021). Durand et al. (2013) provide some evidence from their findings that holdings and returns depend on the country's cultural norm based on seven Pacific Basin markets. In the equity investment, this is very much evident that investment can go on the very anti-ESG theme as some practices like Porn, Marijuana, etc., is not entirely illegal in some geographies. Therefore, in those geographies, Green-Social-Sustainable bond growth can be challenging. In the Equity market, we have already noticed this. Fabozzi et al. (2008) show that sin stock exhibited high returns in 1970–2007 in several international markets. They analyze the returns of approximately 267 stores in alcohol, tobacco, biotech, defense, and adult entertainment in 21 countries. Trinks & Scholtens (2017) show that sin stock exhibits high returns during 1991–2012 in several international markets. Individual stock levels are selected instead of excluding industries, and sin is broadly defined, having as many as 14 various issues, which contraceptives and meat are part of it. A large sample was used for this data, covering 94 countries and 1,634 stocks. A study by Hoepner & Schopohl (2016) revealed that the return generated by excluded companies, relative to the benchmark index of the funds, is abnormal.

Conclusion

Sustainable bonds are the debt instruments issued to raise capital for green and social projects. The structured literature review suggests that the sustainable bond offers a lower yield and higher price than the conventional corporate bond in some cases. If we compare the performance of green Bonds to the traditional fixed income bonds, green bonds outperform conventional fixed Income bonds. Still, with sustainable bonds, a combination of “Green and Social factors,” there is no conclusive evidence of sustainable bonds outperforming standard fixed income issuances. Therefore, though we expect a sustainium in the market shortly, the little spread over the fixed income yield cannot be termed as true “Sustainium.”

What we can confirm with great confidence is that this type of funding instrument is now being one of the most preferred fixed-income funding instruments, and in the future, the market is going to pick up. We discussed the growth in this financing instrument because of natural awareness of ESG auditing and reporting and being always in a good ESG standing. In a brief period, the sustainable bond has become a favorite fixed income investment instrument among hedge funds, Institutional Asset Managers, Pensions and Insurance funds, etc. The primary growth driver of sustainable bonds is its objective itself. The sustainability goal associated with the sustainable bond issuance is making it more attractive in this period of ESG awareness. Investors’ sentiments are also upbeat because of the inherent objective of sustainable bonds. There are several rating agencies now that have started rating sustainable bonds based on their ESG performances. More depth in the rating of the bonds will further increase the bond liquidity in this type of security, and that will further fuel the growth of the sustainable financial instrument. Regulatory aspects around the green and sustainable investments would also make this financial instrument very lucrative to institutional investors. Global organizations like IFC, ICMA, World bank are also playing significant role in the growth of this sustainable financing instrument. So far, we have seen the growth of sustainable bonds in developed countries (Refer Figure 3) but we do expect this market to grow in the emerging market too.

We also discussed the challenges around the development and growth of sustainable bonds, one of them is the lack transparent bond pricing approach. So far there is no sustainable yield curve available to price a sustainable bond. Lack of a well-defined pricing approach can create pricing opacity and that can become impediments in the liquidity management of this special financing vehicle. Another challenge comes from socio-cultural issues. There are multiple geographies and economies where certain products and practices which are clearly screened out from the ESG umbrella, are okay to include in the investment as they are part of the culture.

Findings indicated that sustainable bonds had witnessed a steady growth in the last decade and continue to gain popularity as the call for environmental sustainability remains a global goal. Even though the prices have no significant differences between conventional and sustainability bonds, the latter has some driving factors, which boost their yields in the market. In summary, the review's empirical findings imply that sustainable bonds offer a tighter yield than conventional bonds because they fall in line with sustainable development goals and plans.

References

Aggarwal, S., & Pathak, S. (2021). Green bonds: A catalyst for sustainable development. Journal of Contemporary Issues in Business and Government, 27(1), 2633-2651.

Amundi Asset Management (2021). Emerging market green bonds report 2020: On the road to green recovery. Amundi, 1-38.

Arora, R., & Raj, M. (2020). A comparative study on the performance of green and traditional bonds. International Journal of Business and Management Invention (IJBMI), 9(7), 40-46.

Azhgaliyeva, D., Kapoor, A., & Liu, Y. (2019). Green bonds for financing renewable energy and energy efficiency in South-East Asia: A review of policies. Journal of Sustainable Finance & Investment, 10(2), 1-28.

Indexed at, Google Scholar, Cross Ref

Banga, J. (2018). The green bond market: A potential source of climate finance for developing countries. Journal of Sustainable Finance & Investment, 9(1), 1-16.

Indexed at, Google Scholar, Cross Ref

Bos, B. (2018) Social and sustainability bonds: riding the wake of the green bond market. NN Investment Partners.

Climate Bonds Initiative (2021). How to issue green bonds, social bonds, and sustainability bonds. Climate Bonds Initiative, 1-48.

Dan, A., & Tiron-Tudor, A. (2021). The determinants of green bond issuance in the European Union. Journal of Risk and Financial Management, 14(9), 1-14.

Indexed at, Google Scholar, Cross Ref

Deschryver, P., & de Mariz, F. (2020). What future for the green bond market? How can policymakers, companies, and investors unlock the potential of the green bond market? Journal Risk Financial Management, 13(61), 1-26.

Indexed at, Google Scholar, Cross Ref

Donastorg, A., Renukappa, S., & Suresh, S. (2017). Financing renewable energy projects in developing countries: A critical review. IOP Conference Series: Earth and Environmental Science, 83(1), 1-8.

Indexed at, Google Scholar, Cross Ref

Dou, X., & Qi, S. (2019). The choice of green bond financing instruments. Cogent Business & Management, 6(1), 1- 19.

Indexed at, Google Scholar, Cross Ref

Durand, V. (2013). Positive family intervention for severe challenging behavior, A Multisite randomized clinical trial. Journal of Positive Behavior Interventions, 15(3), 133-143.

Indexed at, Google Scholar, Cross Ref

Environmental Finance(2020). Sustainablebondsinsight 2020.EnvironmentalFinance,1-64. https://www.environmental-finance.com/assets/files/research/sustainable-bonds-insight-2020.pdf

Fabozzi, F.J., Ma, K.C., & Oliphant, B.J. (2008). Sin stock returns. The Journal of Portfolio Management, 35(1), 82‐ 94.

Fatica, S., Panzica, R., & Rancan, M. (2021). The pricing of green bonds: Are financial institutions special? Journal of Financial Stability, 54(100873), 1-20.

Indexed at, Google Scholar, Cross Ref

Gianfrate, G., & Peri, M. (2019). The green advantage: Exploring the convenience of issuing green bonds. Journal of Cleaner Production, 219, 127-135.

Indexed at, Google Scholar, Cross Ref

Hachenberg, B., & Schiereck, D. (2018). Are green bonds priced differently from conventional bonds? Journal of Asset Management, 19(6), 1-18.

Indexed at, Google Scholar, Cross Ref

Hoepner, A.G., & Schopohl, L. (2016). On the price of morals in markets: An empirical study of the Swedish AP‐ Funds and the Norwegian Government Pension Fund. Journal of Business Ethics, 151, 665-692.

Indexed at, Google Scholar, Cross Ref

ICMA (2020). Green, social and sustainability bonds: A high-level mapping to the sustainable development goals. 1-9. https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/June-2020/Mapping-SDGs-to- Green-Social-and-Sustainability-Bonds-2020-June-2020-090620.pdf

ICMA(2020).Voluntary process guidelinesfor issuingsustainability-linked bonds, 1-11.

IOSCO (2019). Sustainable finance in emerging markets and the role of securities regulators: Final report. International Organization of Securities Commissions, 1-22.

Indexed at, Google Scholar, Cross Ref

Jakubik, P., & Uguz, S. (2020). Impact of green bond policies on insurers: Evidence from the European equity market. Journal of Economics and Finance, 45(2), 1-13.

Indexed at, Google Scholar, Cross Ref

Jha, B., & Bakhshi, P. (2019). Green finance: Fostering sustainable development in India. International Journal of Recent Technology and Engineering, 8(4), 3798-3801.

Indexed at, Google Scholar, Cross Ref

Jones, P., & Comfort, D. (2020). Sustainability bonds and green bonds within the retail sector. International Journal of Sales, Retailing & Marketing, 9(1), 37-43.

Kumar, S. (2021). Relevance of buddhist philosophy in modern management theory. Psychology and Education, 58(3), 2104-2111.

Kumar, S. (2022). Effective hedging strategy for us treasury bond portfolio using principal component analysis. Academy of Accounting and Financial Studies Journal, 26(2), 1-11.

Kumar, S., Baag, P.K., & Shaji, K.V. (2021). Impact of ESG Integration on Equity Performance between Developed and Developing Economy: Evidence from S and P 500 and NIFTY 50. 20(4), 01-16.

Leitao, J., Ferreira, J., & Santibanez Gonzalez, E. (2021). Green bonds, sustainable development, and environmental policy in the European Union carbon market. Business Strategy and the Environment, 30(4), 2077-2090.

Indexed at, Google Scholar, Cross Ref

Liaw, K.T. (2020). Survey of green bond pricing and investment performance. Journal Risk Financial Management, 13(193), 1-12.

Indexed at, Google Scholar, Cross Ref

Löfer, U.K., Petreski,A.,&Stephan,A.(2021).Driversof greenbondissuanceand newevidence on the greenium. Eurasian Economic Review, 11, 1–24.

Indexed at, Google Scholar, Cross Ref

Maltais, A., & Nykvist, B. (2020). Understanding the role of green bonds in advancing sustainability. Journal of Sustainable Finance & Investment, 1-21.

Indexed at, Google Scholar, Cross Ref

Mehta, A., Tabanao, R., Afable, N., Iyer, K., Crowley, S., & Andrich, L.M. (2021). Green, sustainability, and social bonds for COVID-19 recovery: A thematic bonds primer mobilizing financial markets for achieving net- zero economies. ACGF, 1-7.

Mengist, W., Soromessa, T., & Legese, G. (2019). Method for conducting systematic literature review and meta- analysis for environmental science research. MethodsX, 1-21.

Indexed at, Google Scholar, Cross Ref

Nanayakkara, M., & Colombage, S. (2019). Do investors in the green bond market pay a premium? Global evidence. Applied Economics, 51(40), 1-13.

Indexed at, Google Scholar, Cross Ref

Nordea (2020). A closer look: Sustainable Bond Supply in the first half of 2020, https://insights.nordea.com/en/sustainability/sustainable-bond-supply-2020/

Paranque, B., & Revelli, C. (2017). Ethical-economic analysis of impact finance: The case of green bonds. Research in International Business and Finance, 47, 1-10.

Indexed at, Google Scholar, Cross Ref

Park, S. (2018). Social bonds for sustainable development: A human rights perspective on impact investing.Business and Human Rights Journal, 3(2), 233-255.

Indexed at, Google Scholar, Cross Ref

Partridge, C., & Medda, F. (2020). The evolution of pricing performance of green municipal bonds. Journal of Sustainable Finance and Investment, 10(1), 44-64.

Indexed at, Google Scholar, Cross Ref

Pineiro-Chousa, J., Lopez-Cabarcos, M.A., Caby, J., & Sevic, A. (2021). The influence of investor sentiment on the green bond market. Technological Forecasting and Social Change, 162, 1-7.

Indexed at, Google Scholar, Cross Ref

Reboredo, J., Ugolini, A., & Aiube, F. (2020). Network connectedness of green bonds and asset classes. Energy Economics, 86, 1-56.

Indexed at, Google Scholar, Cross Ref

Roland, G., Kumaraperumal, S., Kumar, S., Gupta, A.D., Afzal, S., & Suryakumar, M. (2021). PCA (Principal Component Analysis) Approach towards Identifying the Factors Determining the Medication Behavior of Indian Patients: An Empirical Study. Tobacco Regulatory Science, 7, 6-1, 7391-7401.

Statista (2021). Yields on 10-year government bonds in the eight largest economies worldwide from January 2020 to September 2021, by country. https://www.statista.com/statistics/1254148/ten-year-government-bond- yields-largest-economies/

Stigliani, U.G. (2020). Economic impacts of green finance: Is it possible to measure the productivity of green bonds in China? Climate Policy Initiative, 1-29.

Thomä, J., Hayne, M., Hagedorn, N., Murray, C., & Grattage, R. (2019). The alignment of global equity and corporate bonds markets with the Paris Agreement: A new accounting framework. (Open Access). Journal of Applied Accounting Research, 20(4), 439- 457.

Tolliver, C., Keeley, A., & Managi, S. (2020). Drivers of green bond market growth: The importance of Nationally Determined Contributions to the Paris Agreement and implications for sustainability. Journal of Cleaner Production, 244, 1-47.

Indexed at, Google Scholar, Cross Ref

Torre, M., Trotta, A., Chiappini, H., & Rizzello, A. (2019). Business models for sustainable finance: The case study of social impact bonds. Sustainability, 11(7), 1-23.

Indexed at, Google Scholar, Cross Ref

Trinks, P.J., & Scholtens, B. (2015). The opportunity cost of negative screening in socially responsible investing. Journal of Business Ethics, 1-16.

Indexed at, Google Scholar, Cross Ref

Tuhkanen, H., & Vulturius, G. (2020). Are green bonds funding the transition? Investigating the link between companies' climate targets and green debt financing. Journal of Sustainable Finance & Investment, 1-24.

Indexed at, Google Scholar, Cross Ref

Wang, G., Yu, G., & Shen, X. (2021). The effect of online environmental news on green industry stocks: The mediating role of investor sentiment. Physica A: Statistical Mechanics and its Applications, 573, 1-14.

Indexed at, Google Scholar, Cross Ref

Yamaguchi, R., & Managi, S. (2017). New financing for sustainable development: The case for NNP- or inclusive wealth-linked bonds. Journal of Environment & Development, 26(2), 214-239.

Received: 13-Jan-2022, Manuscript No. AAFSJ-22-10859; Editor assigned: 15-Jan-2022, PreQC No. AAFSJ-22-10859(PQ); Reviewed: 03-Fab-2022, QC No. AAFSJ-22-10859; Revised: 18-Fab-2022, Manuscript No. AAFSJ-22-10859(R); Published: 25-Feb-2022