Research Article: 2019 Vol: 23 Issue: 3

A New Approach of Bank Credit Assessment for SMEs

Elizabeth Tiur Manurung, Parahyangan Catholic University

Elvy Maria Manurung, Parahyangan Catholic University

Abstract

This research is aim to discover a solution for some difficulties on accessing bank credit by small and medium enterprises. Much research has been conducted in various countries in Asia especially in Indonesia on this issue, but not much has been focused on the method of assessment of credit by banks. Through several case studies in West Java province, this research reveals new method of credit assessment in several rural banks that replace the traditional 5C method. Using mixed method starts with document study of credit application, statistical test along with observation and interview on several small and medium business entrepreneurs, this study has resulted in findings of small entrepreneurs' credit applications approved by banks using new method called 3 pillars. The result also shows that collateral as key factor to accept or reject credit application previously, is no longer significant. Hopefully, the result of this research could provide another solution for either bank or SMEs to assessing-accessing credit and get some funding from banks. From this study it is also proved that this 3 pillars solution increase the access to get funding from banks, and improve the company's performance in terms of sales and net profit because its increase production capacity.

Keywords

SME, Bank Credit Assessment, 5C, Collateral, 3 Pillars.

JEL Codes

D89, G21, G29, M41, M42

Introduction

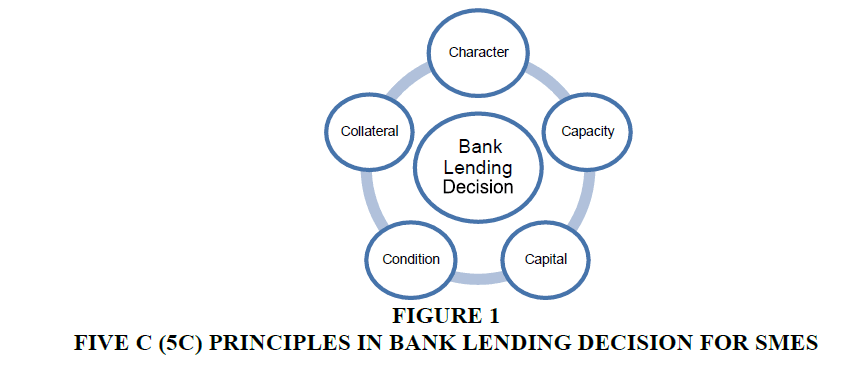

Research on development of SME's has been widely conducted. In the case of Indonesia studies, the development of SMEs still constrained severely by several factors. The three main factors that hinder the progress of SMEs are: (i) capital limitations, (ii) managerial and operational shortcuts, and (iii) limited marketing. The three are suspected the main reason for "stagnancy" of SMEs that makes them not able to develop. several other issues related to capital faced by SMEs include: (i) low information or knowledge of banking services provided by and owned by SMEs, (ii) banks still prioritize physical collateral such as land and building as one of the requirements for approval of loan application, (iii) high interest rates, and (iv) poor knowledge of financial recording. In many cases, traditional way such as 5C-character, capacity, capital, condition, and collateral-principles (Kasmir, 2008; Dheeraj, 2018). This principle needed for making real “judgement” regarding the different aspects of credit proposal/application. Ahlberg & Andersson (2012) conclude that mutual trus also important for making right decision in credit lending by bank. Their suggestion is the lender should have good relationship with its customers or vice versa, so the next step which to collect credible information become easier and enhance the process of making right decision.

Various standard operating procedures are performed by banks to get customers who are truly eligible for credit. According to Kashmir (2015), credit decisions will be given to customers who meet the 5C Principles as shown in Figure 1 of consideration in providing credit, namely: (1) Character-the nature and character of prospective borrowers who really should be reliable; (2) Capacity-analyzing the ability of prospective borrowers to repay the loans; (3) Capital-analyzes the effectiveness of capital use through liquidity ratios, solvency, and profitability; (4) Condition-analyzing the prospects of the business sector being financed should have good props connected to economic, social and political conditions; (5) Collateral-is the guarantee given by the debtor candidate whether physical or nonphysical, the guarantee should exceed the credit given and must be seen the validity and the perfection.

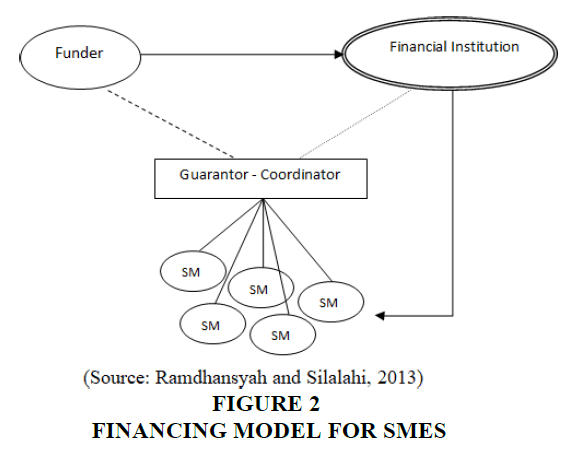

Capital is the main problem of SMEs in developing their business (Syarif & Budhiningsih, 2006; Lestari, 2013). Government has important role to increase SMEs profitability and rent ability through some policies. The study then suggested that the number and types of bank credit for SMEs are made multiple and varied, along with government policies focused on small and medium enterprise development. The government of Indonesia has started to distribute people business-credit (KUR) to overcome the difficulties of access to the capital of this small-medium business by state-owned banks since 2007. However, in practice, not many SMEs can enjoy the KUR service. Ramdhansyah & Silalahi (2013) also found that in addition to the limitations of SMEs in accessing external capital the majority of SMEs rely solely on personal funding and the complexity of credit application procedures in banks, SME entrepreneurs actually want a financing model involving financiers or financial institutions along with the role of coach or coordinator. The model offered is like in the Figure 2.

According to Ramdhansyah & Silalahi (2013) besides the limitations of SMEs in accessing external capital and the complexity of credit application procedures in the banking sector, many SMEs want a financing model involving financiers or financial institutions as a coach or coordinator. The findings imply the need for other models, means or methods that are more suitable for the conditions of small and medium enterprises, in order to be able apply for credit to the bank.

The effective assessment of credit risk is an essential component of a comprehensive technique to credit risk assessment and critical to the long-run of not only banking institutions but also the economy as a whole (Win, 2018). Therefore, many scholars across finance and economics around the world search and examine, or even investigate, such assessments by banks in different countries using diverse theoretical underpinnings and methodologies. This research different with the others in the objective, which is to find a new approach of bank credit assessments using mix method research method.

SMEs and Banking in Indonesia

Indonesia Law No. 9/1995 defines that small-scale economic enterprises are businesses that have a turnover of less than IDR 1 billion and have assets of less than IDR 200 million. This law has been refined into Law No. 20 of 2008. In Law no. 20/2008, the classification of SMEs renewed into: (i) micro business group, is a very small business type with assets estimated at less than IDR 50 million a year, and assets reaching IDR 300 million per year; (ii) small business clusters with assets of IDR 50-500 million, and turnover per year is estimated to be between IDR 300 million-2.5 billion; (iii) a medium-sized group with assets between IDR 500 million-10 billion, and a turnover per year of IDR 2.5-50 billion.

Another definition of small and medium enterprises is also attached to the number of employees owned. In accordance with the explanation of the Central Bureau of Statistics (BPS, 2017), the so-called small business (micro) is a company that has a workforce of 1-4 people; while small businesses have a workforce between 5-19 people. This classification, according to BPS is solely based on the number of workers regardless of the type of business enterprise, using engine power or not, and regardless of the amount of company capital.

The difficulty of accessing bank funding for micro or small enterprises, generally because entrepreneurs are often unable to make financial statements of their business results. Banking is difficult to analyze and measure the financial condition of prospective borrowers if financial statements are not available. Likewise, the ability of debtor candidates to pay is difficult to measure when this is the key in bank lending decisions. This situation shows that the contribution of banks in development through the strengthening of small and medium businesses appears to be ineffective. Loan disbursement data for small and medium enterprises by banking financial institutions in Indonesia until 2014 is shown in Table 1.

| Table 1: The Distribution Of Smes Credit In Year 2014 | |

| Explanation | Growth (%) |

| Government Bank | 7% |

| Private Bank | 0% |

The term “banking” is shown in everything concerning bank, which includes the institution, business activities, and the way and process in carrying out its business activities. Currently in Indonesia there are two types, namely Commercial Bank and Bank Perkreditan Rakyat or Bank Credit for Society (BPR). Both types of banks do business conventionally.

Banking has a function as a channel of funds in the form of credit to the community in need. Credit comes from the Latin word “credere” which means to believe. That is, the lender believes the recipient of the credit that the funds he gave will be returned according to the agreement. For the debtor, it means receiving credibility, which implication is that he is obliged to repay the loan within the timeframe (Kasmir, 2015).

Loans in the form of provision of money are based on the agreement between the bank and the borrower, and the borrower must pay off the debt at a predetermined time, in accordance with Law No. 10/1998 article 1.11 of Indonesia Republic. Credit can be divided into several types depending on the aspect. From usability aspect, credit is divided into investment credit, working capital, and profession. Unlike the Commercial Bank, Rural Bank only provides limited financial services to the community and has a narrower scope than Commercial Bank.

The development of rural banks in Indonesia in recent years is quite stable. Based on OJK (Financial Service Authority) data as of April 2014, rural banks have provided credit amounting to IDR 62,815,334,865.00 to the public, an increase of 9.32% from July 2013. The benefits of BPR increased significantly for small entrepreneurs. BPR bank debtors, generally small or very small or micro enterprises engaged in various fields. These small and micro entrepreneurs, in addition to accessing credit from banks, can also access credit from other financial institutions, venture capital firms, or facilities of creative economic entities (Kompas dated 27 February 2017).

The business community in general and the micro entrepreneurs in particular always try to enlarge their business, either by increasing their sales turnover or by improving their business operations (Iqbal, 2002). This increase in business requires a substantial amount of funding, which can be obtained by using a bank loan (Brigham & Eishardt, 2017). The company wants to improve its business operations because it wants to increase its business profit, to achieve its sustainability.

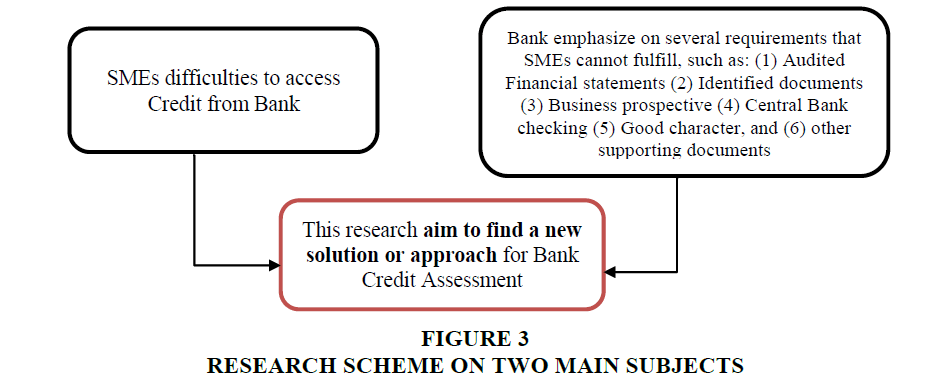

This research scheme focuses on the two main subjects as explanation in Figure 3.

Research Method

The research using quantitative and qualitative method, or better known as mix-method. The design of this mixed method research uses a method or procedure of collecting data, analyzing using statistical tests, along with recording the results of observations and interviews into daily journals. The two case studies in West Java are SMEs that do not implement complete financial records, only sales records exist. Thus, to analyze financial reports quantitatively becomes difficult. Additional interviews with business owners and bank officers are needed to know-how the procedures for applying for a current credit application are reviewed and approved by the bank. Thus, quantitative and qualitative methods are used together to understand the research problem. The study adopted convergent designs, that is collecting quantitative and qualitative data simultaneously, combining data, comparing results, and elaborating combined results to explain all phenomena. The goal is to see whether the results of quantitative analysis with qualitative convergent will give the same results (Creswell, 2015).

The research was conducted on credit approval process at “BBPR” bank of Bandung, and “BBPR” bank of Lembang District in West Java. The banks offer three types of credit to the public, namely consumer loans, investment loans and working capital loans. Interest rates for credit products are divided by the plafond, regardless of whether the credit is a consumer loan, investment credit or working capital credit. Especially for micro-entrepreneurs, Loans less than or equal to IDR 50,000,000.00 bear an average interest rate of 27% to 30%, while credits more than IDR 50,000,000.00 will bear the average interest rate around 18% to 21%. In addition, debtors who receive credit from the company are also charged a provision fee of 1% and an administrative fee of 1.5% of the credit received.

The first part of the research result is the observation result of external economic condition related to banking. In this section, one of the reviews is about the micro- entrepreneurs who started the start-up business, which in general is still not able to obtain funds from the banks. As depicted in the opening of the local start-up festival in 2017, micro entrepreneurs can access funds through the Venture Capital Company, which is now largely established by largescale companies, thus not only relying on bank funding alone. Until now, the realization of capital channeled to start-up companies through the government facilities is around IDR 96.75 trillion. The minimum use of bank capital can be proven based on the results of a special survey of creative economy 2016, that is 92.37% micro entrepreneurs in creative business type generally use their own capital financing, and the rest using bank financing or Venture Capital (Kompas Newspaper dated February 27th, 2017).

Other data show that according to Bank Indonesia (BI), the credit disbursed by Indonesian banks at the end of January 2017 was 4,338 trillion, growing by 8.2% per annum, lower than January 2015 which grew by 9.3%. Banks are still cautious in disbursing loans as the ratio of non-performing loans is still high around 2.9% by the end of 2016, the average NPL (Non Performing Loan) of the banking industry (Central Bureau, 2017). The decline in bank lending in 2016 is consistent with the results of Bank Indonesia 2017 survey conducted by Financial Industry Leader PwC in Indonesia (David Wake). It is said that in the last 2 years Indonesia's banking sector has faced major challenges in terms of rising risk credit (94% of respondents), challenge of net profit (75%), and decreasing loan demand, data collected from 30% respondents.

The Financial Services Authority (OJK) estimates that by 2017 banking credits will grow 13%. In January 2017, working capital loan grow 7% per annum and investment loans grew by 9.3% annually (Kompas Newspaper dated March 3rd, 2017).

Results and Discussion

This study finds that the purpose of credit use from banks is generally to improve the operating/production performance of micro and small enterprises. For example, the debtors in BBPR Lembang are vegetable farmers, including cabbage, tomato, green vegetables, eggplant, etc. More specifically, the purpose of using working capital and investment loans is to increase the company's work capacity or increase its production capacity. Any company that wants to improve its business capacity, will generally propose a credit proposal to the Bank. The improvement of Indonesia's economic condition in 2017 is expected not only to be felt by a handful of people but by all Indonesian people, so that welfare imbalance can be reduced.

The results of the study also provide an understanding of some documents commonly used by the three banks examined related to credit process, among them are:

1. Application form credit application.

2. Credit proposal analysis by the Credit Committee.

3. Letter of credit offer.

4. Warranty Statement report.

5. Report of survey result to prospective debtor.

6. Credit binding credit agreements, guarantees, power of attorney/statements, etc.

7. Debtor identity documents.

While the documents used are related to the debtor's finances, for example

1. Current bank account or last three months savings.

2. Simple financial statement or proof of sale and purchase.

3. Permission and business identity.

4. Business surveys in the form of photographs of the business premises of the debtor.

5. Central bank (BI) checking on behalf of the debtor, and

6. Other supporting/supporting documents that are supporting documents requested by the bank, if they are necessary or if they are required in the covenant set by the Credit Committee.

In the three banking studied, it was obtained also understanding about the process of credit activities made since the beginning of credit application by prospective borrowers, until the disbursement of credit is as follows:

1. A prospective debtor submits a credit proposal form through a credit marketing staff assigned to each branch office. This applies both to new facilities, additions, extensions, and changes to credit terms.

2. Credit marketing will check the completeness of the debtor's documents and perform the initial analysis.

3. Furthermore, credit marketing submits the prospective debtor's file to the Credit review division to further analysis the loan application from the prospective debtor. The analyst must ensure the correctness of data and information provided by the debtor. Based on data from prospective borrowers, the preparation and preparation of Credit Analysis Memorandum (MAK) is made.

4. For the completeness of analysis of a MAK, it can be used guidelines/instructions for making MAK.

5. If the application is deemed appropriate, then the MAK file shall be submitted to the Credit Committee for approval.

6. Decision on giving/rejection of credit by Credit Committee is basically based on information and result of credit analyst assessment conducted by Branch/Head Office as work unit directly related to debtor/debtor candidate.

7. The result of credit decision shall be notified to prospective debtor; which when each agrees credit engagement will be made.

8. Any credit disbursement must be credited to the debtor's account at that bank. Therefore any debtor/debtor who obtains credit facility must open an account on his behalf in the Bank.

Credit Approval Process: “Three (3) Pillars Analysis”

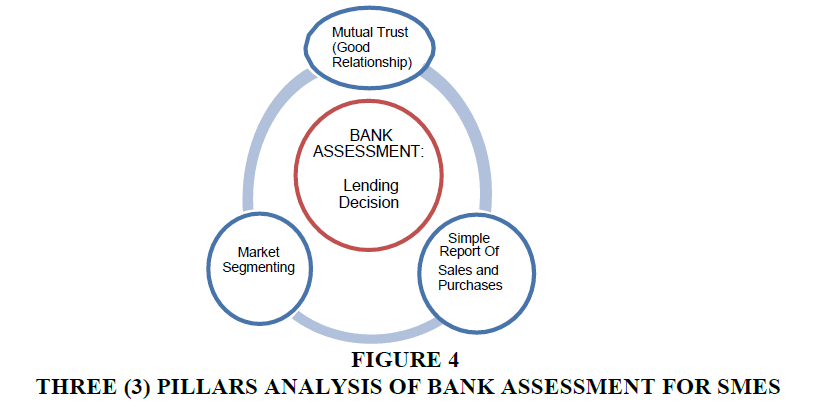

There are significant obstacles in the credit decision process of the three banks under study. That is, prospective borrowers do not prepare annual Financial Statements, let alone audited reports. As a result, analysis based on Principle 5C, namely: Character, Capacity, Capital, Condition, Collateral, difficult to do. For example, a bank cannot measure the Capacity variable because there is no Profit/Asset Ratio, since no debtor's financial report is available. Also the effectiveness of the use of capital cannot be calculated, namely rent ability, solvency and liquidity, which is also due to the absence of financial statements of prospective borrowers. The Bank has other indicators that can be used for credit decision making of micro and small debtors. An illustration of credit decisions based on other indicators can be seen in the description below, which uses the example of a Debtor Candidate for “Crispy” Production Household Production Business and “Hamster Farming” entrepreneurs, who proposed a Credit of IDR 15,000,000.00. The next step is to look at the completeness of the file required to submit to credit review for analysis. In turn, all files are submitted to the Credit Committee for further processing and decide whether to be credited or denied.

When it is summarized, the loan decision by 3 banks is focused on 3 pillars analysis (Figure 4), namely: (1) aspect of the borrower's financial condition, (2) aspect of future business prospect (market segmenting), and (3) aspect of ability to pay debtor candidate. The abovementioned 3 pillar methods can be summarized in a matrix from the example of one of the prospective Debtors of the Production House Dry Cakes Producers, with the following data as shown in Table 2.

| Table 2: Financial Condition Of Prospective Debtor (Production Business of “Home Dried Cookies”) | |||

| Proposed Credit | IDR 15,000,000 | ||

|---|---|---|---|

| 1 | Home dried Cookies production | Liquidity Analysis: | Never delay to pay the debt |

| 2 | Debt to Equity | 2:10 | |

| 3 | Sales | 200 jars/month | |

| 4 | Gross Profit | Never counted | |

| 5 | Operating profit | about 80% | |

| 6 | Return on Equity | 80:100 | |

| 7 | Acounts Receivable turn over | Rarely there are accounts receivable | |

| 8 | Inventory turn over | Not calculated | |

| 9 | Debt turn over | Rarely there are accounts payable | |

| 10 | Income before Interest & Depreciation | approximately 80% | |

| 11 | Interest expense | There is rarely a debt | |

| 12 | Ability to pay | >100% | |

(Source: "BBPR" West Java).

“Micro entrepreneur who produces home-cooked dried cookies, and proposes a credit proposal of IDR 15,000,000”.

Table 2 appears that prospective borrowers do not make financial statements, so not all indicators of credit decision measurement can be calculated. However, based on interviews with prospective borrowers, it appears that prospective borrowers really understand the business of making the pastry. Although it does not have a structured record, the prospective borrower records the operations of his business with his own structure and procedure as he or she recalls; only have the information as shown in Table 2 above.

According to the prospective business debtor the production of the dry cake is very profitable even very promising although the profits in numbers he cannot certainly know. However, as the result of the interview, he said that "from the initial cash capital of IDR 5 million, now it has grown to more than four times as much as the assets of the making of cookies, raw material assets, and finished goods inventory to be sold and other fixed assets”. That's the reason he proposed a credit proposal to the Bank. The purpose of the prospective borrower to ask for credit to the Bank is to buy additional oven for baking cookies, so that he/she can increase the capacity of his business operations because demand for the product is getting bigger especially on holidays, and in turn the profit of his business can increase also.

The next step is to analyses the second Pillar, that is the prospect of prospective borrower financed by the Bank, in this case the cake business. The prospect of prospective borrower is assessed by considering current and future economic conditions, as well as people's demand for cake consumption. Therefore, to analyses the second pillar, it must first be understood the external condition that is, the improvement of economic condition resulted in increasing public purchasing power. Including increased purchasing power for food and beverage consumption. In general, the society today does not consume cookies only on special days, but many also consume them on ordinary days. So based on this description, it can be concluded that the prospect of the prospective business cake of future borrowers is quite good, because the demand is increasing.

Table 2 presents the information from several interviews with the debtor, and the analysis of future demand prospects and market segmenting. The bank may obtain information on the monthly sales report; purchase or cost report per month. The existence of sales and purchase/cost information per months may cause banks to calculate debt payment capability from debtors; The debtor also has a guarantee of his own business; Banks can be confident of good prospects for future borrowers because their products are increasingly in demand by the public; good character and adequate business management. This process has need a good relationship between Bank and the customers, similar to Ahlberg & Anderson (2012) research result that if the lender has a good relationship with the customers, it will easy to collection of credible information and thus enhance the process of making right decision.

Next step is making conclusion if it is considered feasible or not. The file on behalf of the prospective debtor is submitted to the Credit Committee for approval. The credit approval/refusal decision by the Credit Committee is also based on other sources of information e.g. from the Community of Dry Pastry Entrepreneurs, as well as the photographs of the locations where the debtor's business operations operate. The decision result of the Credit Committee shall be notified to the debtor, that the debtor is approved for credit, and subsequently made the credit agreement. In other words, information about the debtor's financial condition, although in the form and manner that is not in accordance with the Financial Reporting Standards, has been able to describe the turnover of his business and show the ability to repay the debtor's debts. The results of this study also prove that although the credit decision process is not based on Principle 5 Cs, but with different indicators, this process can still be done and produce decisions that can be accounted for. As a proof, the following outlined the impact of credit granting of IDR 15 million, has increased Debtor business net income of 59.5%, and the debtor can pay off all credit in a timely manner.

The second example, the debtor who has used Credit from the Bank with the sum of IDR 15,000,000 is the HS micro company, which is engaged in the hamster farm in Bandung. The credit has been used to supplement the cage, buy additional hamster seeds, buy additional hamster feed, and renovate the farm area. The Bank decides to grant credits to HS based on the following considerations: (1) the owner of the company is deemed to have honesty and credibility; (2) the company although small but well managed and efficient; (3) the company is able to pay its debts because it is supported by a strong finance that is profit generated each period about 85.86% of its sales; prospects for the company in the future are also good because of the increasing interest of the community, especially young children to maintain hamsters.

Table 3 describe how HS's revenues increase after using banking funding, through data of HS revenue before and after using credit from the Bank of IDR 15 million.

| Table 3: Hammy Shop (Hs) Company Sales Comparison: Prior and after Using Bank Credit | |||

| Month | Revenue (prior using credit) in IDR | Month | Revenue (after using credit) in IDR |

|---|---|---|---|

| 1 | 8.324.000 | 1 | 9.244.500 |

| 2 | 8.153.000 | 2 | 10.008.000 |

| 3 | 7.773.000 | 3 | 12.693.000 |

| 4 | 9.088.000 | 4 | 15.912.000 |

| 5 | 8.329.500 | 5 | 18.257.000 |

| 6 | 9.112.000 | 6 | 16.984.500 |

| 7 | 9.838.000 | 7 | 15.692.000 |

| 8 | 9.147.000 | 8 | 11.080.000 |

| 9 | 9.766.500 | 9 | 14.672.000 |

| 10 | 8.962.500 | 10 | 15.558.000 |

| Total: | 88.493.500 | Total: | 140.101.500 |

(Source: Manurung & Marco, 2012)

The data in Table 4 shows that the impact of the use of funds from the Bank's credit of IDR 15,000,000 has increased the company's sales by 58.5%. While the data of HS net profit before and after the existence of Credit from Bank are as follows.

| Table 4: Hammy Shop (Hs) Company Net Profit Comparison: Prior And After Using Bank Credit |

|||

| Month | Net Profit (IDR) | Month | Net Profit (IDR) |

|---|---|---|---|

| 1 | 7,026,645 | 1 | 7,268,975 |

| 2 | 6,955,000 | 2 | 8,268,310 |

| 3 | 6,616,650 | 3 | 10,989,610 |

| 4 | 7,815,380 | 4 | 13,974,390 |

| 5 | 7,162,130 | 5 | 16,220,580 |

| 6 | 7,876,760 | 6 | 14,864,825 |

| 7 | 8,470,900 | 7 | 13,838,310 |

| 8 | 7,939,150 | 8 | 9,350,870 |

| 9 | 8,439,705 | 9 | 12,743,585 |

| 10 | 7,681,420 | 10 | 13,711,060 |

| Total | 75,983,750 | 121.230.515 | |

Table 5 shows that after the company used additional funding from banks to increase its operating capacity, it turned out that the company's net profit increased by 59.5%. The increase in net profit of the company has been tested using the paired-sample t test statistic tool, with the result that the difference in net profit before and after the use of credit funds from the Bank is statistically significant, with a significance value of (0.001) with α=0.05.

| Table 5: Results Of Paired Sample T-Test Testing | |||||

| Paired Samples statistics | |||||

|---|---|---|---|---|---|

| Pair 1 | Mean | N | S | Std. Error Mean | |

| Before Credit | 7598375.00 | 10 | 633477.267 | 200323.101 | |

| After Credit | 12123051.50 | 10 | 2999522.761 | 948532.382 | |

| Paired Sample correlation | |||||

| Pair 1 | N | Correlation | Sig | ||

| 10 | 0.406 | 0.244 | |||

(Source: SPSS processing result (the author)).

The calculations are described as follows:

H1: μ1 ≠ μ2, there is a significant difference in the net income of a company if the company does not use credit facilities or when the company uses a credit facility.

Based on the results of hypothesis testing above, then the decision is taken as follows (Table 6): if probability >0.05, then H0 accepted; if probability <0.05 then H0 is rejected. Testing performed above shows the probability of 0.001 i.e. <0.05, then H0 rejected, means there is a significant difference in net income due to bank credit.

| Table 6: Result Of Paired Sample T-Test Testing | ||||||||

| Pair 1 | Mean | Std. Deviation |

Std. Mean |

Error 95% Confidence Lower Upper |

||||

|---|---|---|---|---|---|---|---|---|

| Before Credit | 4524676.500 | 2802441.173 | - | 886209.712 | 200323.101 | 5.106 | 9 | 0.001 |

| After Credit | - | - | - | - | - | - | - | - |

(Source: SPSS processing result (the author)).

From using statistical tools paired-sample t-Test, obtained statistically significant value of (0.001) with α=0.05. Through the calculation it can be concluded that the debtor can pay his credit to the Bank on time and credit will not be stuck.

Therefore, it can be concluded that although the micro entrepreneur can only provide certain financial information, which has not fulfilled the banking requirements for credit application, and in the form and structure of information that is only in accordance with the characteristics of the business concerned, access to funds through the banking system has been achievable. In other words, if all micro entrepreneurs can do the same, then Equity access to banking can be achieved. The micro entrepreneurs who have obtained Bank funding amounting to approximately IDR 15 million, it can increase the profit of about 59.5% to 80%, so it can pay credit to the Bank in a timely manner and does not result in bad loans. This research result is similar to Win (2018) research result as quotes that with Banking prudence and efficiency to manage their risk in different business cycle and environment would help to alleviate crises and losses.

Micro entrepreneurs need to get help in improving various aspects in running their business. Various parties can contribute to the development of micro or small enterprises, such as preparing simple financial statements of his business, providing knowledge about the business that he did not change often, or to provide assistance for sustainable business. Universities may also contribute through, for example, the provision of knowledge on the preparation of financial statements, especially those required by the Bank for the proposal of credit. So that access to banking more open and finance more strong and stable, and the goal of micro entrepreneurs to be sustainable and further develop their business can be achieved.

Conclusion

Based on the results of the research in three banks and two debtors, micro entrepreneurs who proposed credit proposal/application amounting to IDR 15 million proved to be able to fulfill the banking requirements even with minimal document data and with the structure of writing in accordance with the way the debtor himself. The requirements are met as follows: (1) make a report the amount of sales per month; (2) the report of purchase or cost per month (3) the form of “collateral” is only-simply their own business; (4) market segmenting (good business prospects); and (5) good character with adequate business management.

Implications of Research and Limitations

Other small or micro entrepreneurs can access funds to banks using this 3 pillar method, especially in rural banks in Indonesia which also use this method. Entrepreneurs is only to compile simple reporting of their business results in the form of sales and purchases monthly report, honestly following the model undertaken by small entrepreneurs in this study. From this study it is also proved that access to funding from banks has helped improve the company's performance in terms of sales and net profit because its increased production capacity.

However, in addition to access to funding from banks, the company should also maintain and improve the quality of production and marketing. Marketing and production are two key factors that should not escape the attention of small and medium enterprises. This research was conducted in several cities in West Java Indonesia. Different conditions in other provinces in Indonesia will not necessarily produce the same findings with this study. Therefore, it is advisable to conduct research for similar types of banks in other provinces or regions of Indonesia outside of West Java.

References

- Ahlberg, H., & Andersson, L. (2012). How do banks manage the credit assessment to small business and what is the effect of Basel III: An Implementation of Smaller and Larger Banks in Sweden. Master Thesis of Jonkoping International Business School-Jonkoping University.

- Asian Development Bank (ADB) (2014). ADB-OECD on enhancing financial accessibility for SMEs: Lesson from recent crisis. Annual Report. Philippine.

- Berry, A., & Levy, (1994). Indonesia?s small and medium industrial exporters and their support system. Paper Presented to the Conference ?Can Intervention Work?? The Role of Government in SME Success. World Bank, Washington DC.

- Brigham, E., & Ehrhardt, M.C. (2011). Financial management: Theory and practice, (Thirteenth Edition). South-Western Cengage Learning. USA.

- Circular Letter of the Minister of Finance of the Republic of Indonesia: No. 40/KMK.06/2003 Financing for Small-Medium Enterprises. Jakarta.

- Creswell, J.W. (2015). Education research (Riset Pendidikan). Pustaka Pelajar Publisher. Yogyakarta.

- Dheeraj, V. (2017). Credit analysis: What credit analyst look for? 5C?s credit analysis. Investment and Banking Training. JP Morgan Equity, IIT Delhi.

- Idris, I. (2010). Impact of credit for society study (Kajian Dampak Kredit Usaha Rakyat). Journal of Cooperatives and SME Assessment. Ministry of Cooperatives and Small-Medium Enterprises of the Republic of Indonesia, 5.

- International Federation of Accountants (2010a). Guide to using International standards on auditing in the audits of small- and medium-sized entities. New York: Small and Medium Practices Committee International Federation of Accountants.

- International Federation of Accountants. (2010b). Guide to using International standards on auditing in the audits of small- and medium-sized entities. New York: Small and Medium Practices Committee International Federation of Accountants.

- Iqbal, M.Z. (2002). International accounting: A global perpective, (Second Edition). South-Western Publisher. United States.

- Kasmir, (2008). Financial statement analysis (Analisis Laporan Keuangan). Rajawali Pers Publisher. Indonesia.

- Lestari, R. (2013). Syari?ah banking as driving force of indonesia SMEs (Perbankan Syariah Sebagai Daya Pendorong Usaha Kecil-Menengah Di Indonesia). Jenderal Sudirman University Journal of Indonesia, 3(1).

- Manurung, E.T., & Marco, M. (2012). The analysis of bank loan implementation to increase micro scale company profit (Case Study at Hammy Shop Bandung). Proceeding at The 2012 IBSM International Conference on Business and Management. Prince of Songkla University, Thailand.

- Ramdhansyah, R., & Silalahi, S.A. (2013). Development of SMEs funding model based on SMEs perception (Pengembangan Model Pendanaan UKM Berdasarkan Persepsi UKM). Journal of Business and Finance, 5(1).

- Republic of Indonesia: Law No. 20/ 2008 about SMEs sector in Indonesia. Jakarta-Indonesia.

- Republic of Indonesia: Regulation of Financial Minister No. 07/ 1992 about Banking sector in Indonesia. Jakarta-Indonesia.

- Republic of Indonesia: Regulation of Financial Minister No. 40/KMK.06/2003 about Financing of SMEs sector. Jakarta-Indonesia.

- Sekaran, U., & Rouger, B. (2016). Research method for business: A skill-building approach, (Seventh Edition). John Wiley & Sons Inc. New York.

- Suci, Y.R. (2017). Development of Indonesia SMEs (Perkembangan Usaha Mikro, Kecil dan Menengah Di Indonesia). Journal of Canos Ekonomos, 6(1).

- Sutojo, S. (2000). Banking credit management strategy (Strategi Manajemen Kredit Bank Umum). Damar Mulia Pustaka, Jakarta.

- Syarif, T., & Budhiningsih, E. (2009). Study of strengthening aid loans contribution in supporting capital of SMEs (Kajian Kontribusi Kredit Bantuan Perkuatan Dalam Mendukung Permodalan UMKM). Journal of PKUKM, 4.

- The Law of the Republic of Indonesia No. 10 Year 1998 regarding the amendment to Law No. 7 of 1992 on Banking.

- The Law of the Republic of Indonesia No. 20/2008 regarding Small-Medium Enterprises.

- Tuanakotta, T.M. (2013) Audit based on ISA (Intenational Standards on Auditing). Salemba Empat Publisher, Jakarta.

- Win, S. (2018). What are the possible future research directions for bank?s credit risk assessment research? A Systematic review of literature. Int Econ Econ Policy.