Review Article: 2025 Vol: 29 Issue: 2S

A Focus on the Technology Advancements in LPG; Impact on Distribution and Utilization of Clean Energy Sources

Priya Krishnan, SRM Institute of Science and Technology, Kattankulathur, Chennai

Nisha Ashokan, SRM Institute of Science and Technology, Kattankulathur, Chennai

Arya Muyayill, Pricewaterhousecoopers AC, Hyderabad, Telangana

Arepaka Bangaru Venkatarama Naga Sainath, SRM Institute of Science and Technology, Kattankulathur, Chennai

Citation Information: Krishnan, P., Ashokan, N., Muyayill, A., & Sainath, A.B.V.N. (2025). A focus on the technology advancements in LPG; Impact on distribution and utilization of clean energy sources. Academy of Marketing Studies Journal, 29(S2), 1-19.

Abstract

A tremendous growth of 17 crore new LPG connections, in the period of nine years from 2014 to 2023, has increased customer usage to 31.4 crore active LPG consumers which is a significant stride in bringing in clean fuel to millions in India. Fuel retailers like IOCL have introduced 5-kg cylinders for consumers of lower incomes or who have less demand which has increased accessibility to all segments of the population. In this background, the study aims to understand the distribution and retailing of LPG in the Indian state of Kerala and measure the effectiveness of marketing strategies of commercial cylinders by the distributors of Indian Oil Corporation. As many studies suggest, marketing strategies help an organization to make optimum utilization of its resources to provide a message to its target market. The study utilized a descriptive research approach, which involved gathering primary data through structured interviews with distributors, as well as obtaining secondary data from publications, articles, and government records. A convenience sampling strategy was employed to poll 50 distributors. The study highlights significant patterns in Kerala's LPG industry. This study investigates the present extent to which technology is being incorporated into the distribution network. It explores several aspects such as the use of GPS-enabled delivery systems and online platforms that directly interact with customers. The report suggests potential areas for future innovation, such as the utilization of predictive analytics to optimize supply chain operations and the possibility of employing smart cylinder technology to improve safety and efficiency. This study enhances our comprehension of LPG as a crucial environmentally friendly energy alternative in India, emphasizing the technological and infrastructural aspects that will determine its future.

Keywords

Liquefied Petroleum Gas (LPG), Clean Energy, Technology advancements, Environment.

Introduction

Liquefied petroleum gas (LPG), often known as LP gas, refers to various liquid mixtures including volatile hydrocarbons such as propene, propane, butene, and butane. Since as early as 1860, it has been utilized as a portable fuel source, and its production and consumption for both home and industrial purposes have continuously grown. A standard commercial cylinder combination may include ethane, ethylene, and a volatile mercaptan, an odorant added for safety. Cylinders are used to contain gases at elevated pressures. Liquefied gases are gaseous substances that can transform into a liquid state when confined to pressurized cylinders at ordinary temperatures. Liquid and vapor coexist within the cylinder in a state of equilibrium. The primary advantage of LPG is its ability to facilitate the transition from unsustainable biomass to a clean and secure cooking fuel (https://www.mylpg.in/).

Liquefied Petroleum Gas (LPG) is used interchangeably in both commercial and home settings. The only difference between household and commercial cylinders is their size, with the domestic cylinder weighing 14.2 kg and the commercial cylinder weighing 19 kg. The price of commercial LPG cylinders is aligned with international prices, while domestically it is subsidized by the government by approximately 200 to 250 rupees. The industrial cylinder is available in a blue color. This refers to the use of Public Sector Norms, which are different from the use of red in domestic settings. There are also larger and smaller sizes available.

They provide significantly larger cylinders for their bigger customers and use tankers for delivery to big industries.

The worldwide market for liquefied petroleum gas is projected to experience a compound annual growth rate of 3.7% from 2023 to 2030, resulting in a total value of USD 154.49 billion by 2030. In 2022, Europe had the largest market share of 28.87% in the LPG industry. The worldwide Liquified Petroleum Gas (LPG) market has reached a volume of around 320 million tons in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 3.40% from now until 2035. Liquified Petroleum Gas (LPG) is a gaseous fuel composed of many carbon-based molecules, including butene, propene, propane, and butane. The use of liquefied petroleum gas in India reached around 28.5 million metric tons for the financial year 2023, showing marginal growth compared to the previous year (https://www.statista.com/statistics/1052428/india-lpg-consumption-volume/).

In December 2023, India's consumption of Liquefied Petroleum Gas (LPG) reached 2.62 million Metric Tons (MMT), marking a 2.3% growth compared to December 2022 and an 11.6% increase from the levels recorded in December 2019 before the pandemic, as stated in the Industry Consumption Review Report by the Petroleum Planning & Analysis. India has experienced remarkable growth in the utilization of LPG in the last ten years, primarily due to ambitious government initiatives such as the Pradhan Mantri Ujjwala Yojana, urbanization, and an increasing need for greener energy sources. Obtaining specific global rankings is challenging because there is no public data available. However, considering India's large population and increasing demand for LPG, it is highly likely that India is one of the top consumers of LPG worldwide. This trend underscores the crucial transition towards environmentally friendly energy alternatives within the nation and showcases India's substantial influence in the worldwide LPG industry. India has experienced a significant increase in the use of LPG over the past decade, primarily due to government initiatives like the Pradhan Mantri Ujjwala Yojana (PMUY) and an increasing emphasis on clean energy. The spike is likely driven by a confluence of factors, including rising disposable incomes and urbanization. Ranking countries in Asia with certainty can be difficult due to limited access to statistics. However, India's large population and its quickly increasing demand for LPG indicate that it is a strong candidate for being the top consumer of LPG in the continent (LPG Consumption Report).

India's substantial increase in clean cooking solutions demonstrates its dedication and emphasizes its growing significance as a key participant in the Asian LPG industry. The LPG usage had a decline of -2.7% in March 2023 and an overall gain of 0.9% throughout the fiscal year 2022-23. In March 2022, there was a 9.6% increase in growth, and the cumulative growth for the fiscal year 2021-2022 was 2.5% according to the LPG Consumption Report of 2023.

The current study was conducted in Kerala, with a primary focus on the utilization, expansion, and technological improvements in the region. Kerala has experienced a remarkable increase in the use of Liquefied Petroleum Gas (LPG) as the main fuel for cooking. The main reason for this increase is the government's efforts led by the Pradhan Mantri Ujjwala Yojana (PMUY), which provides subsidized LPG connections to economically disadvantaged households. You can find more information about this initiative at https://www.pmuy.gov.in/.

The program has significantly increased the availability of renewable energy throughout the entire state. Moreover, the growth of urban areas and the rise in disposable incomes in Kerala have prompted a transition from traditional biomass fuels to the more convenient and cleaner option of LPG (https://ppac.gov.in/). As a result, Kerala has one of the highest rates of LPG usage in India.

You can find more information about this at https://kerala.data.gov.in/resource/state-wise-consumption-liquefied-petroleum-gas-lpg-2014-15-2020-21.

This increase in utilization is not restricted to home environments. Liquefied Petroleum Gas (LPG) is being increasingly utilized in commercial sectors such as street food vendors and small restaurants due to its high efficiency and lower emissions. The state's tourism business is also considering the incorporation of LPG to enhance its reputation as an environmentally friendly and enduring sector. Despite the persistence of problems such as price instability, Kerala's impressive development in the use of LPG demonstrates its dedication to adopting clean energy solutions and enhancing living conditions.

Although limited precise data defines the exact percentage of technological breakthroughs in Kerala's LPG sector, the following paragraph outlines the areas where advancements are likely to occur, as well as probable sources for obtaining further information.

Kerala, due to its extensive adoption of LPG, offers a favorable setting for technological advancements in the distribution and consumption of LPG. Progress is probable in domains such as:

Distribution and Logistics

Implementing GPS monitoring technologies, route optimization software, and predictive analytics has the potential to enhance the efficiency of LPG delivery, particularly in Kerala's varied topography (https://ppac.gov.in/- LPG profile report, 2023).

Smart Cylinders and Metering

The adoption of smart cylinders equipped with sensors to monitor LPG levels and potentially detect leaks could be emerging, though perhaps initially within specific commercial applications (https://ppac.gov.in/)-LPG Profile report, 2023).

Customer Interface

According to the LPG Profile study for 2023, there is a growing popularity of mobile apps and online portals that allow users to arrange LPG refills, track delivery, and resolve customer complaints.

Renewable Energy Integration

While still in the study phase, investigating the potential use of localized solar or biomass energy to power some components of LPG bottling or logistics could be of future interest, considering Kerala's dedication to clean energy.

The Three Major Public Sector Oil Marketing Companies (OMCs)

1. IndianOil Corporation Limited (IOCL): Search their Indane Gas website for distributors: [https://www.indancegas.com]

2. BharatPetroleum Corporation Limited (BPCL): Search for Bharat gas distributors: https://www.ebharatgas.com/

3. Hindustan Petroleum Corporation Limited (HPCL): Searchfor HP Gas distributors: https://www.hindustanpetroleum.com/

Justification for the Region

Kerala offers a distinctive and persuasive opportunity for studying the adoption of LPG and its consequences. The state's remarkably high LPG penetration, propelled by forward-thinking government policies such as the Pradhan Mantri Ujjwala Yojana, presents an exceptional opportunity to examine the effects of a widespread transition to clean fuel on a societal scale. You can find more information on the state-wise consumption of liquefied petroleum gas (LPG) from 2014-15 to 2020-21 at https://kerala.data.gov.in/resource/state-wise-consumption-liquefied-petroleum-gas-lpg-2014-15-2020- 21.

Furthermore, Kerala's varied topography, combination of urban and rural regions, and dedication to sustainable development provide an abundant setting to examine issues related to the distribution of resources, the possibilities for technological advancements, and the impact of LPG in improving living conditions while addressing environmental issues.

A pilot study titled "Measuring Environment Awareness in Nineteen States in India" suggests that the state exhibits one of the greatest levels of environmental consciousness in the country. This conclusion is based on characteristics such as motivation, knowledge, and talents. The source of this information is a publication by P. Harju-Autti in 2013. The present study is centered on the technological improvements in LPG inside Kerala and proposes the implementation of a multi-faceted method. Firstly, it will examine the present extent to which existing technology solutions are being used in the distribution network, such as delivery vehicles equipped with GPS, smart meters, and online platforms that customers may access.

Additionally, the study could investigate the possibility of additional advancements, such as utilizing the Internet of Things (IoT) for detecting leaks, employing predictive analytics to improve supply chains specifically for Kerala's landscape, or assessing the viability of small-scale LPG generators for generating localized power. Crucially, it should consider the effects of these improvements on the ability of people in different areas and income brackets within Kerala to obtain and afford LPG.

Literature Review

Marketing plays a crucial role in a successful business strategy in today's highly competitive corporate world. This remark is agreeable to both public-sector oil firms and commercial businesses. These enterprises, which operate in a highly competitive field, depend significantly on robust logistical support, distinctive products, and effective marketing tactics to achieve success. Research and studies provide insights into various aspects of the oil industry and highlight the importance of marketing and its diverse responsibilities in driving growth and ensuring long-term viability, therefore supporting this paradigm.

An essay released online in 2011 by C Anirvinna & NV Ravi emphasizes the importance of marketing planning and logistical support for both public-sector oil enterprises and major private operators. The statement highlights the advantages that public sector organizations gain from government support and robust infrastructure. They have a strong market position due to these benefits. The article also highlights the strategies employed by enterprises in the oil sector to address challenges, such as the extraction of crude oil in challenging geographical conditions and the acquisition of oil and gas assets overseas to sustain their expansion.

Karunamoorthy's 2013 study emphasizes the importance of marketing strategies, specifically in rural areas, as a catalyst for growth. The study utilizes data from a survey of 2000 individuals in Bangalore city to make inferences regarding the perceptions and utilization patterns of LPG among customers in that area. This study provides valuable data that firms may utilize to tailor their marketing strategies to the specific needs of rural markets.

The study by Agarwal, Mittal, Patterson & Giorcelli, released in 2021, specifically examines how research contributes to creating value for customers. The study differentiates between supply-side and demand-side research, emphasizing the significance of each in improving delivery systems and generating gains in consumer value. This evidence-based approach aligns with the evolving marketing landscape, where data-driven insights are crucial.

In 2014, a study was undertaken by Ravi Sarathy and Elitsa Banalieve, focusing on economic development models in underdeveloped nations specifically in the oil sector. This analysis meticulously scrutinizes the marketing strategies of companies by employing diverse economic frameworks, emphasizing both the opportunities and challenges they face. This comparative research provides valuable insights that companies can utilize to adapt their strategies in response to the economic conditions in which they operate.

The 2000 study conducted by Tuhin K. Das, Chandrima Deb & Tushar Jash analyzes the dual pricing structure introduced by the Government of India in the petroleum business, with a specific focus on the LPG market. The study demonstrates the impact of this framework on energy use and the environment, offering valuable perspectives on governmental decisions and their consequences for businesses and consumers.

Although the industry strives to uphold a strong ethical reputation, there are recognized deficiencies, particularly in the sales and marketing departments (Gaurav Lodha, Amit Vyas 2012). It also highlights difficulties encountered by the sales team in establishing goals and underscores the importance of recognizing the salesperson's impact on oil firms, both in the public and private sectors.

The availability of clean cooking energy, such as Liquefied Petroleum Gas (LPG), is a major concern in India, particularly in rural areas that lack sufficient energy resources. Nevertheless, the financial hardship faced by a substantial portion of rural households poses a major barrier to the widespread adoption of LPG as the main cooking fuel (Anuradha, et al., 2020).. According to a 2021 study by N. Chindarkar et al., approximately 40-45% of households in rural areas do not have enough financial resources to cover the present monthly cost of subsidized LPG. This monetary limitation underscores the necessity for specific assistance to facilitate their shift towards greener cooking energy options.

Traditionally, gas cylinders have been the primary means of distributing LPG to households in India. This distribution technique had challenges in terms of logistics, finances, and accessibility, especially in rural regions. According to Teji Mandi's report from 2023, the Indian government is actively promoting the adoption of piped LPG connections for households. This strategic adjustment aims to ensure a reliable and consistent gas supply while eliminating the need for physically transporting cylinders. Piped LPG connections offer a practical and environmentally responsible solution to achieve the broader goals of accessibility and reliability in energy distribution (Gould & Urpelainen, 2018).

New technological developments in the LPG industry are showing promise as ways to improve distribution safety and efficiency. While they haven't yet gained much traction in rural regions, innovations like GPS-enabled delivery systems and smart cylinder technologies show potential, according to Kumar et al. (2020). LPG distribution may be made more efficient using predictive analytics and route optimization tools, which will save expenses and increase accessibility in rural areas. Additionally, by monitoring gas levels and spotting leaks, IoT-enabled smart cylinders improve safety and provide end consumers with more assurance while using LPG. Even while these technologies show promise, widespread adoption is still difficult, especially in rural areas.

In rural areas, it is crucial to tackle the issues of accessibility and availability of LPG to ensure its continued usage as a cooking fuel. In 2020, Agrawal et al. conducted a study that highlighted home delivery as a prominent element that affects the usage of LPG in rural areas of India. Remarkably, just around 50% of clients residing in rural areas receive home delivery of LPG cylinders. As a result of the lack of this service, individuals must travel long distances to buy cylinders, which significantly increases the overall cost and work involved in utilizing LPG. Moreover, there is significant variation in the average distance traveled between states, underscoring the need for a uniform and transparent distribution system nationwide.

Agrawal et al. (2020) proposed the need for increased commissions to rural distributors as a means of addressing these challenges. To make deliveries more cost-effective, it is possible to raise home delivery rates and incentivize rural distributors with higher commissions, thus promoting long-term usage of LPG in rural areas (Nakip, et al., 2021). This modification will promote a shift towards cleaner and more sustainable cooking energy, while simultaneously enhancing accessibility and rendering LPG a more feasible and cost-effective choice for households.

The socioeconomic advantages of LPG adoption are examined by Afridi et al. (2023), with a particular emphasis on how much less time women spend on cooking-related tasks. According to their research, switching to LPG can help households save as much as 35 minutes a week on domestic production chores, albeit this overall decrease in time is still quite small. The study also emphasizes the important health advantages of using cleaner fuels, such as a decrease in the rate of respiratory ailments due to reduced exposure to toxic emissions from conventional biomass fuels (Pareek, 2016). This study emphasizes how LPG adoption boosts economic output and improves health outcomes, especially for women living in rural homes.

In rural India, LPG adoption is mostly determined by three factors: affordability, accessibility, and awareness, or the "3As," according to Kumar et al. (2017). They investigate how economic factors, especially household income, have a major impact on LPG uptake through a case-control study. Whether or not rural families switch to LPG depends largely on accessibility issues like the distance to LPG distribution hubs and the availability of traditional biomass fuels. The report also emphasizes the significance of public awareness initiatives that emphasize the advantages and security of clean energy, as these efforts have been demonstrated to raise LPG adoption rates. In summary, the study highlights the necessity of tackling both informational and logistical obstacles to enhance the uptake of LPG in rural regions (Patil, et al., 2021).

Households, especially those in energy-deficient states of rural India, must transition to cleaner cooking energy sources such as LPG due to the critical need for environmental and public health. Logistical challenges and economic constraints have hindered the extensive use of LPG. To surmount these problems, the government should focus on promoting the installation of piped LPG connections and addressing issues like home delivery and distribution costs (ArunKumar, et al., 2021). India has the potential to achieve significant advancements in the promotion of cleaner and more sustainable energy alternatives. This may greatly improve the quality of life for millions of people and have a positive impact on the environment. One way to achieve this is by ensuring that liquefied petroleum gas (LPG) is affordable, easily accessible, and consistently supplied.

Research Gap

Overall, there are gaps in literature concerning the technological developments in LPG that have been recognized.

1. Despite technological developments, the LPG distribution system in Kerala experiences inefficiencies that put pressure on resources and the supply of services. This study investigates current technology deficiencies, pinpointing critical domains where innovation has the potential to greatly enhance system efficiency. The study examines the possibilities of predictive analytics to improve inventory management, route optimization tools to decrease delivery costs, and future blockchain applications to promote transparency in LPG subsidy distribution.

2. The emphasis is on identifying realistic and scalable technological solutions that are specifically designed for the unique setting of Kerala. The distribution system of Liquefied Petroleum Gas (LPG) in Kerala is facing issues that can be resolved by technical innovation, despite its crucial role in the state's energy mix. At present, the state's LPG sector shows a minimal uptake of

3. This study examines the inefficiencies in the distribution of LPG in Kerala, with a focus on exploring how technological solutions might be used to improve supply chains, simplify consumer engagement, and enhance transparency. Possible domains for technological involvement encompass consumer-oriented applications, anticipatory analytics for projecting demand, and the investigation of blockchain technology for the management of subsidies.

Problem Statement

The integration of digital solutions aims to address the existing issues in the distribution process of LPG networks in India, such as inventory management, route optimization, and customer service inefficiencies. Research could concentrate on investigating the incorporation of digital solutions, such as Internet of Things (IoT) devices, data analytics, and mobile applications, to optimize LPG distribution processes. This may entail examining the viability of integrating digital platforms for immediate tracking of cylinder inventory, anticipatory maintenance of distribution vehicles, streamlining delivery routes based on demand trends, and improving customer interaction through online booking and feedback systems. Tackling this research issue has the potential to enhance the effectiveness and customer-focused nature of LPG distribution systems in India, thereby enhancing the availability of clean cooking fuel for families throughout the nation.

Evaluation of the preparedness of the infrastructure for the expansion of LPG: Although the government has made efforts to enhance the use of LPG, especially through initiatives like the Pradhan Mantri Ujjwala Yojana (PMUY), it is still necessary to evaluate the preparedness of the infrastructure to facilitate future growth. This entails assessing the capability of LPG bottling plants, transportation networks, storage facilities, and distribution sites to handle the growing demand for LPG cylinders. In addition, the research could explore the possibility of using cutting-edge technology, including automation and remote monitoring systems, to enhance the efficiency of current infrastructure and resolve any potential obstacles in the distribution process (Yusuf & Alawneh, 2018). This research aims to identify infrastructure deficiencies and propose methods to address them, to promote the sustainable expansion of LPG distribution in India. By doing so, it seeks to ensure that all sectors of the population have dependable access to clean cooking fuel.

Methodology

This study used a descriptive research design to examine the LPG distributors in Kerala. The collection of primary data involves conducting organized interviews with LPG distributors to gain insights into existing technology, difficulties, and prospective advancements. To enhance the study, supplementary data is collected from publications, journals, and official records obtained from the Indian Oil Divisional Office in Kozhikode. Purposive sampling was utilized to target Kerala LPG Distributors that IOCL had identified, providing a more specialized perspective on a crucial market segment. In addition to roughly approximating the basic features of LPG distributors, this approach guarantees that the sample appropriately reflects the dynamics of LPG distribution in Kerala.

Objectives of the Study

1. To identify the various factors that influences the selection of Indane.

2.To understand marketing techniques adopted by the distributor.

3.To examine the distributors’ sales strategies

4. To analyze the satisfaction level of distributors

Theoretical Model Framework

The framework for this model connects technological advancements in LPG with its impact on distribution, utilization, and the broader energy transition:

Input

Technological advancements (smart cylinders, IoT, BioLPG, automated logistics).

Processes

Optimization of distribution networks, Digitalization of LPG services and transactions . Safer, more efficient consumption of LPG

Outcomes

Expanded access to LPG in underserved regions, Reduced carbon footprint in distribution and usage Increased penetration of cleaner LPG alternatives (BioLPG). Reduced dependency on biomass and other polluting fuels.Complementary role of LPG in clean energy transitions. This model operates within the broader clean energy transition, where LPG, with technological support, helps bridge the gap towards achieving sustainable and renewable energy goals in developing nations like India.

Limitations of the Study

The regional focus on Kerala limits the study's potential to properly capture the diversity of LPG distribution networks in India. The use of purposive sampling raises the possibility of biases because the chosen distributors could not be entirely representative of all LPG distributors in the nation. Based on historical data, the study's analysis used predictive models like ARIMA and Linear Regression to project distributor expansion. Although these models are good at capturing time-series trends and correlations, the small dataset may have an impact on how well they function. Furthermore, the depth of the forecasts may be limited by the employment of only two forecasting models without considering possible external influences like changes in market dynamics or policy. However, these models offer a strong basis for comprehending growth trends in LPG distribution within the chosen area Figure 1.

Data Analysis and Interpretation

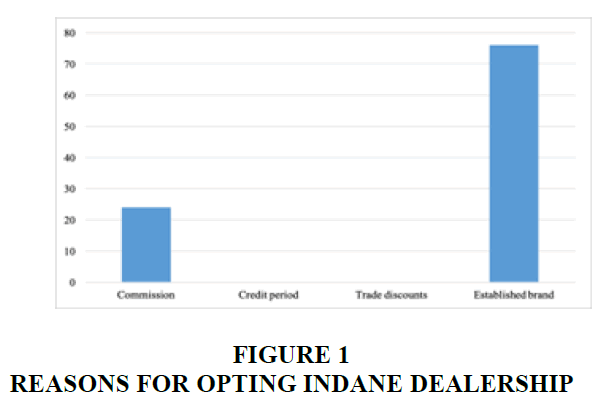

Reason for Opting for Indane Dealership

Inferences: The figure shows that 76% of the respondents have opted for Indane due to its established brand. And none of the respondents have opted because of the credit period and the trade discounts offered by the company.

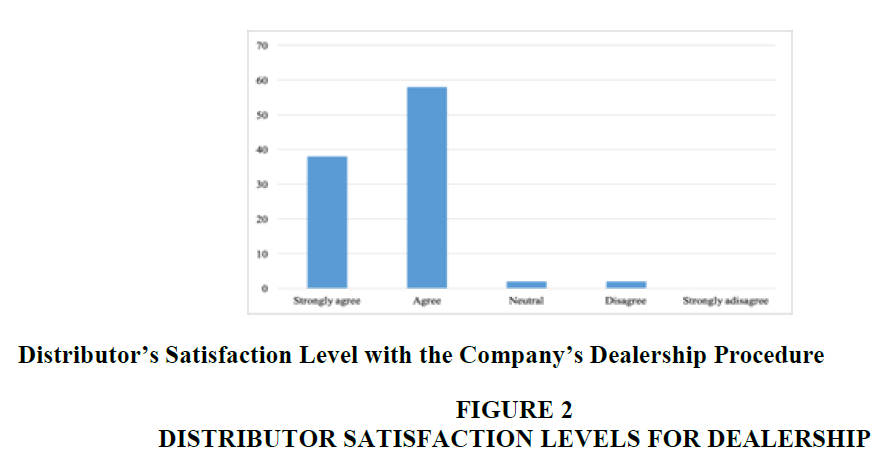

Inferences: The Figure 2 represents the satisfaction level of the company’s dealership procedure by the distributors. 38% of the respondents strongly agreed to this, 58% agreed to this, 2% of the respondents disagreed with this and 2% stood in neutral decision.

Distributor’s Satisfaction Level with the Company’s Dealership Procedure

Figure 2 Distributor Satisfaction Levels for Dealership

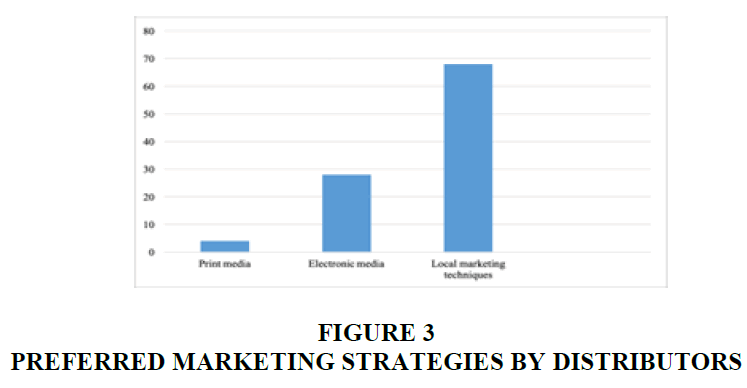

Strategies Distributors Think the Best to Market the Products

Inferences: The above Figure 3 shows strategies the distributors think are the best to market their products. 68% of the respondents think of local marketing techniques, 28% electronic media, and 4% print media respectively.

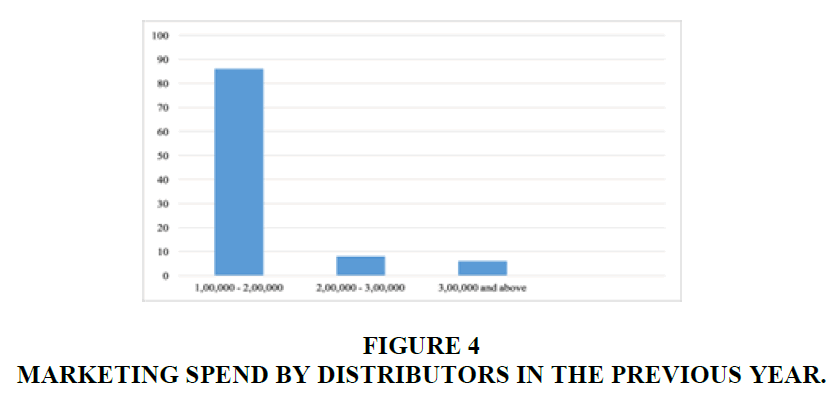

Spending on marketing by the distributors during the previous year

Inferences: The Figure 4 represents the range of money distributors spent on marketing last year. 86% of them have spent approximately 1-2 lakhs, 8% spend 2-3 lakhs, and 6% spend 3 lakhs and above.

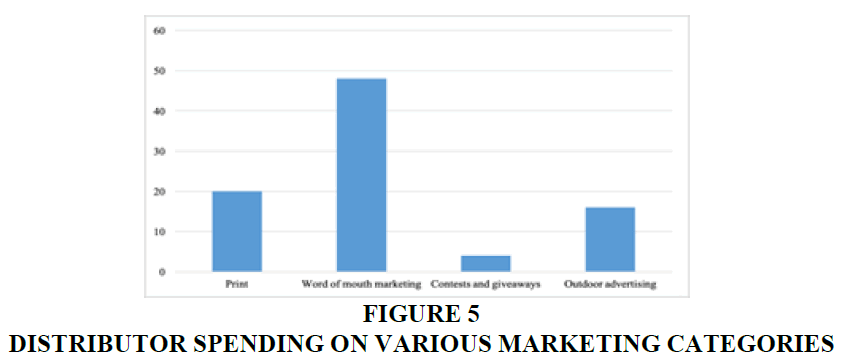

Distributor’s Level of Spending on the Following Heads of Marketing

Inferences: This Figure 5 shows the level of spending by distributors on the following heads of marketing. More respondents spend money on Banner advertising. Least spend on Transport advertising.

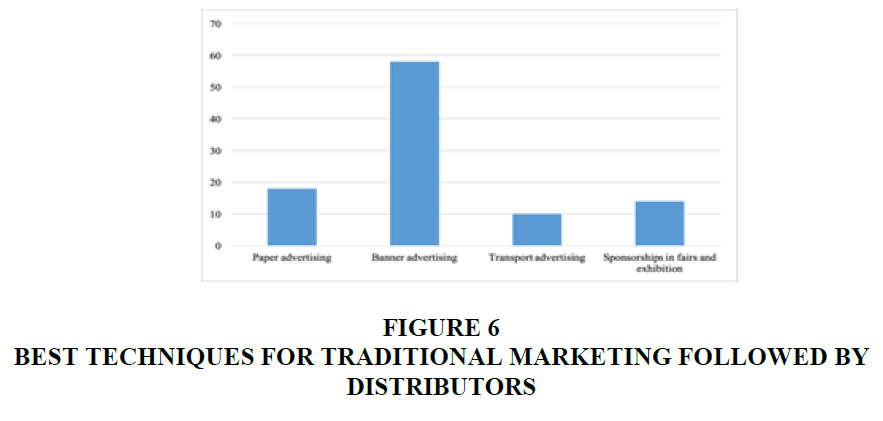

Techniques That Are Best For Traditional Marketing Followed By the Distributors

Distributors

Inferences: This graph represents the techniques that are best for traditional marketing followed by distributors. In this, the majority followed word-of-mouth techniques. And the least of them followed contests and giveaway techniques Figure 6.

Summary of the Findings

The study reveals that Indian Oil has been marketing commercial cylinders to the market through its distributor network. These cylinders have huge demand in the market, especially from the commercial segment and hospitality industries. Indian Oil has captured a major portion of the LPG market. They have been giving discounts and attracting more and more customers through various promotional activities through which they are increasing their presence in the market.

Statistical Analysis

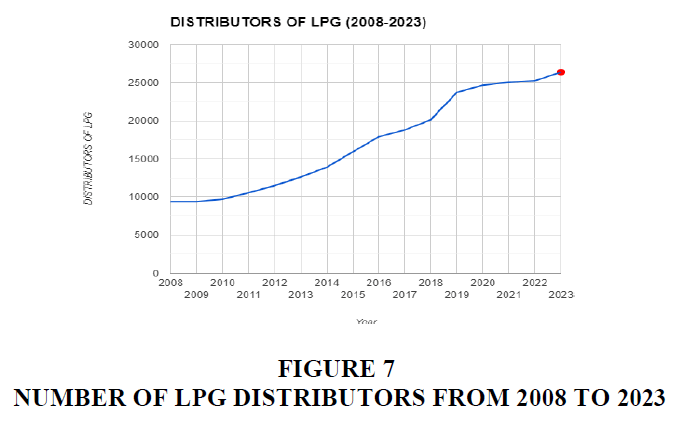

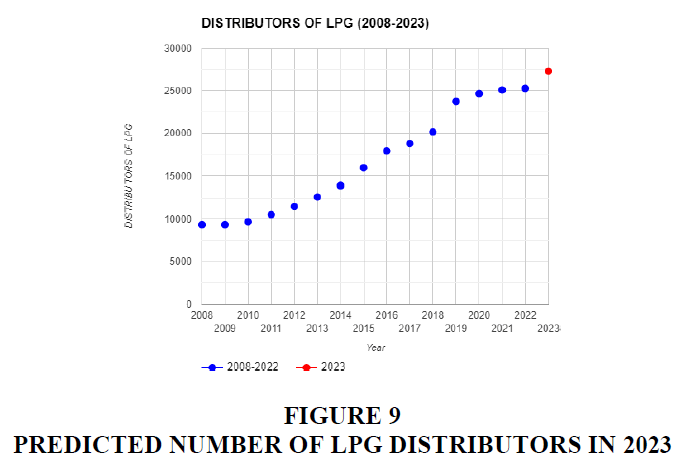

This study explores how technology contributes to meeting the demand for Liquefied Petroleum Gas (LPG) in India. We examine records of LPG suppliers from 2008 to 2023 to predict the number of suppliers needed in 2024 for expected growth. The goal of this analysis is to showcase how technological progress can enhance LPG distribution networks and ensure market satisfaction.

ARIMA

This study uses the ARIMA model to predict the quantity of LPG distributors in India for the year 2023. We analyze data on distributor numbers from 2008 to 2022 as shown in Table 1 and illustrated in Figure 7.

| Table 1 Number of LPG Distributors Over the Years | |

| Year | Distributors in numbers |

| 2008 | 9365 |

| 2009 | 9366 |

| 2010 | 9686 |

| 2011 | 10541 |

| 2012 | 11489 |

| 2013 | 12610 |

| 2014 | 13896 |

| 2015 | 15930 |

| 2016 | 17916 |

| 2017 | 18786 |

| 2018 | 20146 |

| 2019 | 23737 |

| 2020 | 24670 |

| 2021 | 25083 |

| 2022 | 25269 |

| 2023 | 25385 |

Before training the model, we preprocess the data to ensure it is in a format for analysis. This may involve procedures such as differencing to make the time series data stationary. The ARIMA model is then created by determining values for its three parameters (p, d, and q). These parameters represent autoregression, differencing order, and moving components respectively usually identified through tests or methods like Akaike Information Criterion (AIC). Once we have determined the ARIMA model we train it using distributor count data. This training helps the model understand patterns and seasonal variations within the dataset. Using this trained model, we forecast that there will be around 26,383 distributors in India by 2023.

To evaluate how well our model performs it is advisable to compare metrics, like Mean Squared Error (MSE) or Mean Absolute Error (MAE) with distributor count data for 2023.

On average these measurements show the gap between the predicted number (26,383) and the real figures. To improve accuracy, we can consider trying out ARIMA model setups, including factors like market growth or policy modifications. If there are trends, in the data we might also want to consider using a seasonal ARIMA model (SARIMA). By leveraging the ARIMA model's ability to capture trends and seasonality in time series data, this analysis provides an initial forecast of 26,383 LPG distributors for 2023. Evaluating evaluation metrics and considering potential model enhancements can refine the forecast and ensure its accuracy for future planning efforts Table 2.

| Table 2 Forecasted Distributors Count in the Year 2023 Using ARIMA | |

| Year | Forecast in no. |

| 2023 | 26383 |

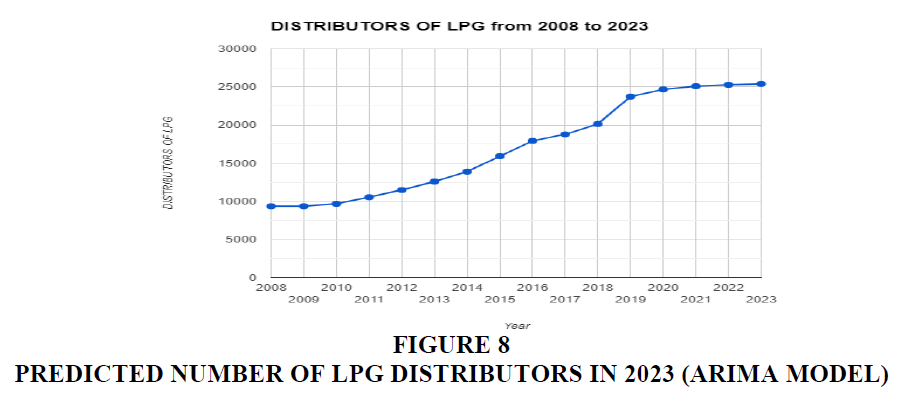

Linear Regression

The code in use relies on a Linear Regression model to predict the number of distributors expected in 2023. The forecast, illustrated in the table and chart suggests around 27,299 distributors Figure 8. This outlook provides insight into stakeholders to help them foresee growth patterns and make choices regarding expanding distribution networks or allocating resources.

It's essential to evaluate the model's real-world accuracy to ensure its reliability. Comparing metrics like Mean Absolute Percentage Error with distributor data for 2023 will set a performance standard offering useful guidance for improving future predictions. Linear Regression is an option for this task because of its ability to model linear relationships in datasets effectively reducing the need for data manipulation while producing dependable forecasts.

By providing stakeholders with predictions this data-oriented approach encourages a decision-making culture. Consequently, it enhances adaptability and competitiveness in the changing market environment Tables 3-4, Figure 9.

| Table 3 Forecasted Distributors Count in the Year 2023 using Linear Regression | |

| Year | Forecast in no |

| 2023 | 27299 |

| Table 4 Comparing the Models with MAPE | |

| Model | MAPE |

| ARIMA | 5.77% |

| Linear Regression | 2.50% |

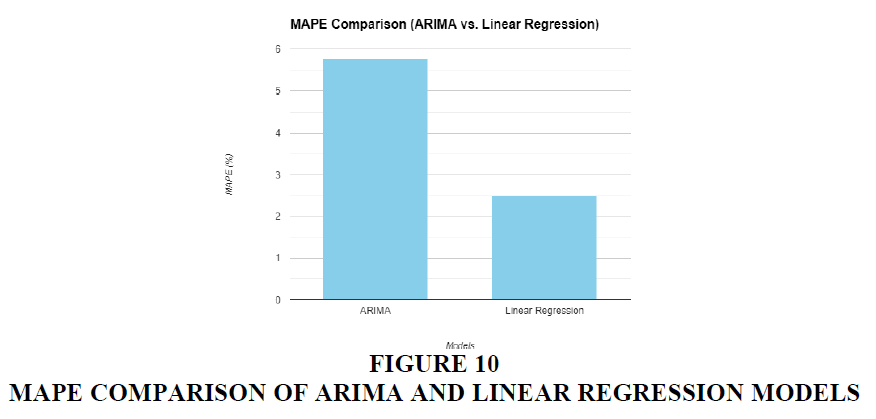

Assessing Model Fit Using MAPE

The objective of this research is to evaluate the predictive power of different machine learning models in estimating the quantity of LPG distributors over a given duration Figure 10. Two popular models are trained and evaluated using sixteen years of historical data on LPG distributors, from 2008 to 2023: ARIMA and Linear Regression. Using the actual number of distributors (25,385) as a known value, the year 2023 is used as the benchmark. Mean Absolute Percentage Error (MAPE) is the accuracy metric we use to evaluate each model's ability to replicate this known value. It is anticipated that the outcomes will show how the two models are different. As Linear Regression has a 2.50 MAPE, we expect it to perform better than ARIMA (5.77). This suggests the superior ability of Linear Regression to identify the underlying trends in the data from LPG distributors. Upon evaluation, the model exhibiting the best performance will be selected to predict the number of LPG distributors in 2024. It is projected and illustrated on the Table 5 below.

| Table 5 Forecasted Numbers for the Year 2024 using Linear Regression | |

| Year | Forecast |

| 2024 | 28162.67 |

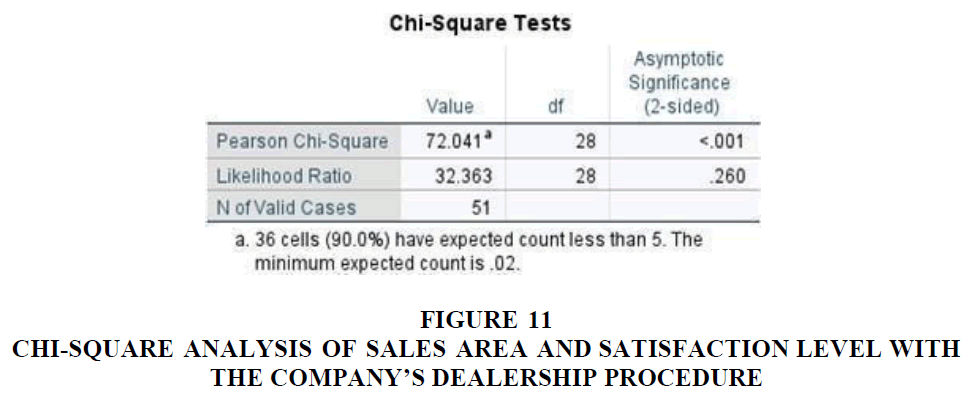

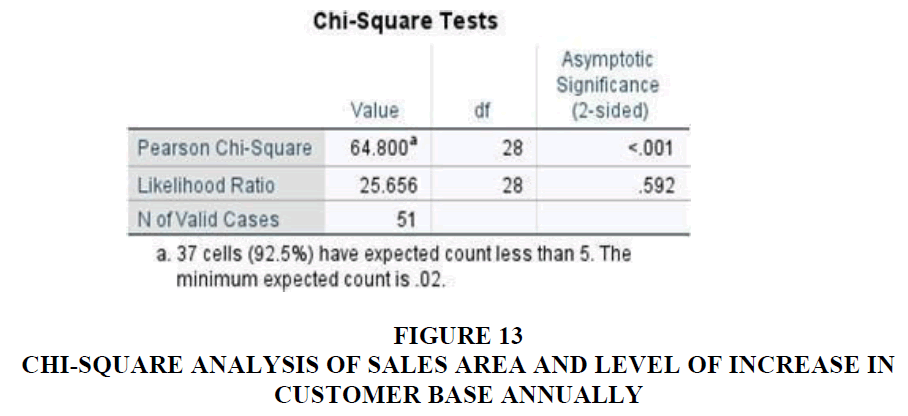

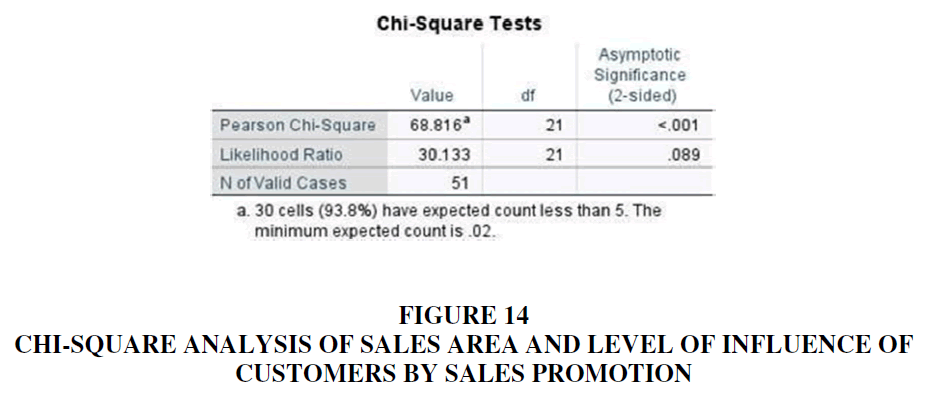

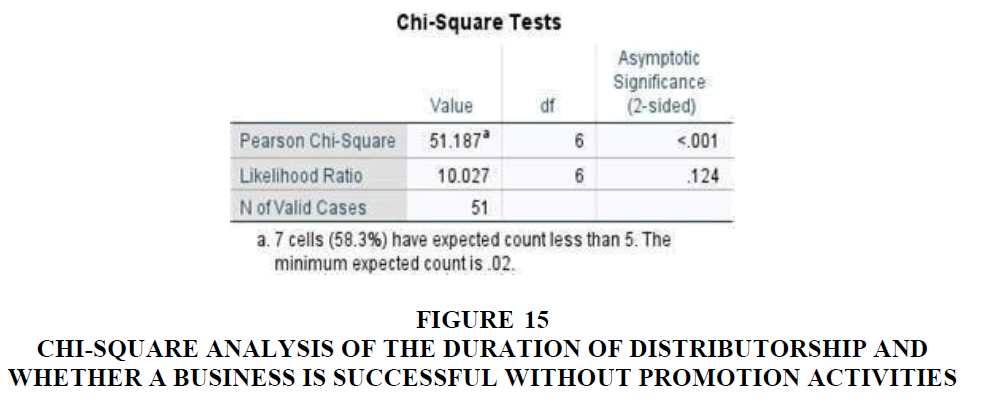

Chi-Square Analysis

H1: Study of the relationship between sales area and satisfaction level of the company's dealership procedure.

Inference: There is a significant relationship between the sales area and the satisfaction level of the company's dealership procedure Figures 11-15.

Figure 11 Chi-Square analysis of Sales area and Satisfaction level with the Company’s Dealership Procedure

Figure 15 Chi-Square analysis of the duration of Distributorship and whether a Business is Successful without Promotion Activities

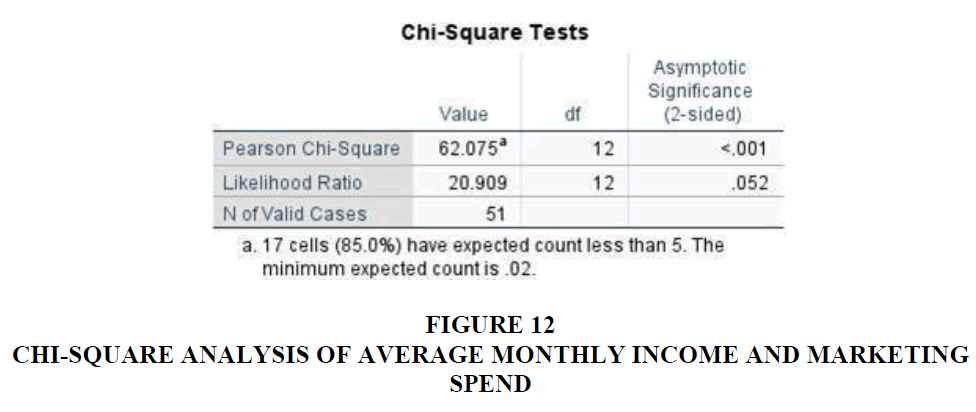

H2: Study of the relationship between average monthly income and distributed level of spending on the various heads of marketing.

Inference: There is a significant relationship between the average monthly income and distribution level of spending on the various heads of marketing.

H3: Study of the relationship between sales area and level of increase in customer base annually.

Inference: There is a significant relationship between sales and the level of increase in customer base annually.

H4: Study of the relationship between sales area and the levels of influence of sales promotion to customers.

Inference: There is a significant relationship between sales area and the levels of influence of customers by sales promotion.

H5: Study of the relationship between the duration of distributorship and whether a business is successful without promotion activities.

Inference: There is a significant relationship between the duration of distributorship and whether a business is successful without promotional activities.

Results and Discussion

We can examine from the study that there is a strong relationship between distributors' average monthly income and their spending on various marketing initiatives. Distributors that want to build a solid market presence frequently use tactics like sales promotions and discounts to take on a bigger market share. As their efforts pay off, they see an increase in their income levels, which prompts them to allocate more money to marketing initiatives. Spending on marketing is a clear indication of a distributor's dedication to growing their customer base and revenue. Distributors spend money on marketing techniques like sales promotions and discounts to draw in more clients and increase sales volume. Their average monthly income often increases because of their efforts, which typically leads to a boom in revenue. As a result, distributors frequently put some of these increased earnings back into marketing to maintain and accelerate their company's growth. Also, we can find that there is a relationship between the sales area and the success of sales promotion initiatives. Initiatives for sales promotion frequently have a crucial impact on how customers behave and how sales are generated. Distributors are better positioned to take advantage of sales promotions if they have a solid presence in their respective sales territories and strong client connections. Strategies for sales promotion are essential for drawing clients and motivating them to make purchases. Distributors can increase their sales territories by luring new clients if they are skilled at creating solid interpersonal bonds and using personal influence. They can further entice these customers to buy through successful sales campaigns, strengthening their hold onto the market. Additionally, these knowledgeable distributors are aware of the requirements and preferences of their clientele. They may increase engagement and conversion rates by configuring their sales promotion activities to match these inclinations. The effectiveness of sales campaigns is considerably increased when they can connect with clients on a personal level. The distributor's efforts to build credibility and promote trust have a direct impact on customer influence in sales-related areas. A distributor is more likely to see a greater impact from sales promotion campaigns if they have gained the consumers' respect and trust inside their sales territory. The relationship between the distributor and the client is a critical predictor of the success of sales promotions since customers frequently tend to favor recommendations and promotions from sources they trust. In essence, the study emphasizes the connections between income levels, marketing expenditures, sales regions, and the efficiency of sales promotion in the context of distribution. Successful distributors are aware of the mutually beneficial link between these elements and strategically make use of them. Distributors may increase their income, broaden their market reach, and maximize the effects of sales promotions by investing in efficient marketing methods and building strong client relationships, ultimately generating a vibrant business ecosystem.

Conclusion and Future Scope

India has made tremendous progress in recent years in encouraging a switch to clean cooking fuels, particularly Liquefied Petroleum Gas (LPG). This action is essential in the fight against air pollution brought on by the widespread use of solid fuels in Indian households. The government should focus on promoting LPG use to hasten this transition, particularly among lower-income consumers and those who live in remote locations where the use of solid fuels is common. The research indicates that most LPG distributors choose dealerships with well-known and recognized brands. To increase their sales, these distributors are actively creating structured marketing calendars and assigning particular budgets. They use a variety of marketing techniques and place high value on sustaining solid client relationships, successfully influencing client behavior. Thus, distributors, arranged according to geographic regions, have a substantial impact on the increase in commercial cylinder sales. Their strategy entails spotting potential clients and offering top-notch service, leading to the development of strong client relationships that boost sales volume. India's LPG market is expected to increase significantly, which might lead to more competitive consumer prices and a noticeable shift toward cleaner and safer household cooking options. A switch to healthier and more environmentally friendly cooking techniques will likely occur in Indian households because of this positive trajectory. India can speed up the transition to clean cooking fuels and greatly raise the standard of living for its people by utilizing marketing methods, customer connections, and LPG uptake successfully.

Acknowledgement

This paper was presented at the International Conference on Emerging Technologies, Analytics, and Operations (ICETAO 2024).

References

Afridi, F., ET AL., (2023). Time for clean energy? Cleaner fuels and women’s time in home production. The World Bank Economic Review, 37(2), 283-304. Oxford University Press.

Agarwal, R., Mittal, N., Patterson, E., & Giorcelli, M. (2021). "Evolution of the Indian LPG industry: Exploring conditions for public sector business model innovation." Research Policy, 50(4).

Indexed at, Google Scholar, Cross Ref

Agrawal, S., ET AL., (2020). "India residential." Energy for Sustainable Development, 63, 1-6.

Anirvinna, C., & Ravi, N. V. (2011). "An analysis of marketing and consumption trends in the Indian oil industry." Indian Journal of Commerce and Management Studies, 2(1), 33-48.

Anuradha, P., ET AL., (2020). "Microcontroller-based monitoring and controlling LPG leaks using the Internet of Things." In IOP Conference Series: Materials Science and Engineering (Vol. 981, No. 3, p. 032021). IOP Publishing.

Indexed at, Google Scholar, Cross Ref

ArunKumar, K. E., ET AL., (2021). "Forecasting the dynamics of cumulative COVID-19 cases (confirmed, recovered, and deaths) for the top 16 countries using statistical machine learning models: Auto-Regressive Integrated Moving Average (ARIMA) and Seasonal Auto-Regressive Integrated Moving Average (SARIMA)." Applied Soft Computing, 103, 107161.

Chindarkar, N., Jain, A., & Mani, S. (2021). "Examining the willingness to pay for the exclusive use of LPG for cooking among rural households in India." Energy Policy, 150, 112107.

Indexed at, Google Scholar, Cross Ref

Das, T. K., Deb, C., & Jash, T. (2000). "Environmental consequences of parallel marketing of LPG in India." Energy, 25(1), 81-84.

Indexed at, Google Scholar, Cross Ref

Gould, C. F., & Urpelainen, J. (2018). LPG as a clean cooking fuel: Adoption, use, and impact in rural India. Energy Policy, 122, 395-408.

Karunamoorthy, S., et al., (2013). "Marketing strategies to add economic value: Reactions to corporate social responsibility advertising in print media—An Indian company case."

Kumar, P., et al., (2020). Affordability, accessibility, and awareness in the adoption of liquefied petroleum gas: A case-control study in rural India. Sustainability, 12(11), 4790. MDPI.

Lodha, G., & Vyas, A. (2012). "Sales promotion approaches and marketing strategies followed in the domestic LPG sector of India." International Journal of Marketing and Technology, 2(10), 137-151.

Nakip, M., et al., (2021). "An end-to-end trainable feature selection-forecasting architecture targeted at the Internet of Things." IEEE Access, 9, 104011-104028.

Pareek, P. K. (2016). "Domestic LPG marketing in the Indian perspective." Int. J. Innovat. Technol. Res, 4(1), 2596-2600.

Patil, R., et al., (2021). "Barriers to and facilitators of uptake and sustained use of LPG through the PMUY in tribal communities of Pune district." Energy for Sustainable Development, 63, 1-6.

Indexed at, Google Scholar, Cross Ref

Yusuf, A., & Alawneh, S. (2018). GPU implementation of sales forecasting with linear regression. Ayomide Yusuf, Shadi Alawneh (2018) GPU Implementation of Sales Forecasting with Linear Regression IJIRCST, 6.

Received: 27-Aug-2024, Manuscript No. AMSJ-24-15189; Editor assigned: 28-Aug-2024, PreQC No. AMSJ-24-15189(PQ); Reviewed: 20-Sep-2024, QC No. AMSJ-24-15189; Revised: 26-Sep-2024, Manuscript No. AMSJ-24-15189(R); Published: 12-Oct-2024