Research Article: 2023 Vol: 27 Issue: 3

A financial simulation of solar energy investment appraisal for McDonalds, south africa

Sharanam Abbana, Durban University of Technology

Ferina Marimuthu, Durban University of Technology

Naresh Nunden, Durban University of Technology

Citation Information: Abbana.S., Ma r imut h u . F., & Nunden.N. (2023). A Financial Simulation of Solar Energy Investment Appraisal for Mcdonalds, South Africa, International Journal of Entrepreneurship, 27(3),1-15

Abstract

The sun is an infinite source of inexhaustible energy that has the most negligible impact on climate change. Several countries have been forced to study and create ecologically acceptable renewable energy solutions to meet the growing need for electrical energy while avoiding the adverse environmental repercussions and other concerns associated with fossil fuel combustion. The current electrical energy crisis in South Africa, alongside regular load-shedding situations, has been the impetus for this study. Despite a global drive towards renewable energy, South Africa still obtains more than 90% of its electrical energy from coal-fired power stations and currently, above-inflationary tariffs are expected to increase. Solar photovoltaic (PV) energy is one of the renewable energy sources accessible. This study aimed to financially simulate and appraise a solar energy investment for McDonald’s South Africa, an intensive fast-food restaurant electrical energy consumer, to determine the investment's viability. This study adopted an exploratory quantitative methodology consisting of solar panel simulations on a census of 125 free-standing McDonalds’ Drive-Thru restaurants located across South Africa. Secondary data was gathered from public domains comprising NREL solar PV watts calculator and the Treetops' solar system online commercial quotations. Subsequently, the financial data was inserted into the study's investment appraisal model comprising of various capital budgeting techniques, including the payback period, return on investment, and the internal rate of return. The financial simulation investment analysis results indicate that investing in solar energy is profitable for McDonalds South Africa in the longer run.

Keywords

Electrical Energy, Financial Simulation, Investment Appraisal, Mcdonalds South Africa.

Introduction

The modern world still significantly relies on fossil fuels such as oil, natural gas, and coal compared to other energy sources, namely modern renewable sources, traditional biomass and nuclear power (Ikram, 2021). The notion that fossil fuel usage is unsustainable and contributes to climate change and global warming is gaining traction (Khan, et al., 2021). It is widely recognized that the rise of anthropogenic greenhouse gas emissions into the atmosphere, primarily as a result of energy generation and consumption from fossil fuels, have risen drastically to approximately 76% of the earth’s surface over the last decade (Denchak, 2019).

As major energy consumers, businesses contribute significantly to greenhouse gas emissions with a larger carbon footprint than other consumers. As a result, businesses are looking into initiatives to lower their carbon footprint and be more ecologically conscious by incorporating renewable energy into their operations. Businesses have also experienced increased energy costs due to government intervention, such as imposing carbon taxes. Compared to the twentieth century, commercial electrical energy usage surged by almost 500 percent in the twenty-first century (Hirsh, et al, 2015). This was due to solid economic growth, increased demand and rising GDP. Capital investment in solar panels has recently been one of the most popular solutions for reducing energy consumption and carbon footprint (Gielen, et al., 2019).

Fast-food restaurants are among the most energy-intensive structures in the modern era (Jo, et al. 2020). The fast-food sector consumes an average of 82000 GW of electrical energy per year, nearly 2.5 times more than other commercial establishments (Almeida, 2018). Energy is a fixed cost necessary for the operation of the fast-food sector, unlike variable costs such as ingredients and labour (Jo, et al.,2020).

McDonald’s are one of the most well-known fast-food corporations globally (Rajawat, et al., 2020). This behemoth aims to reduce its global greenhouse gas emissions. As of 2019, there have been investments in renewable energy such as wind and solar power. In 2020, McDonald’s opened its first zero carbon-energy restaurants operated solely on solar power (Maze, J. 2020).They plan to continue reducing their carbon footprint and finding meaningful solutions in the race against climate change (Petrovich, et al.,2019).

Over the past decade, South Africa has had stable growth in the demand for electrical energy due to healthy economic growth and an increase in population. However, the growth in demand coupled with ageing energy infrastructure and corruption experience resulted in regular load-shedding, a system used to relieve stress on the primary energy source when electricity demanded exceeds the supply from the primary power source (Eskom. 2020). Further escalations in load-shedding were expected when the country went into level five lockdown during the COVID-19 pandemic in 2020 (Zayed, 2020).

Fast-food chains globally face a decline in demand due to COVID-19 (Nhamo, et al., 2020). As governments globally increasingly promulgated legislation for social distancing and lockdowns, most restaurants were shut down for sit-in meals and were operating at a minimum of 50% capacity. Fast-food restaurants were impacted and this resulted in significant financial losses, unprecedented liquidity challenges as well as direct and indirect job losses (Thulasiraman, et al., 2021). As an energy-intensive organisation, McDonald’s faces considerable risks in terms of its sustainability and reduced profitability due to the above-inflationary increases in energy and related production costs, regular load-shedding, alongside a decline in current demand.

With a declining fast-food sector alongside frequent load-shedding and COVID-19, the shift from traditional sources of energy to solar energy is vital in South Africa as the country’s current economy is gloomy and is still on the road to recovery (Shahsavari, et al., 2018).

Investment appraisal is a numerical representation of a business's operations in the past, present, and predicted future. Appraisals like the one in this study are meant to be used for decision-making of a proposed new project utilized in strategic planning to run simulations, assess the costs of new initiatives, set budgets, and allocate company resources (Kopp, 2020).

This study aims to financially simulate solar energy investments at McDonalds’ Drive-Thru restaurants across South Africa on a national and provincial basis to determine if the investment is viable.

The rest of the article proceeds as follows: Section 2 discusses the literature. Section 3 deals with the methodology. Section 4 presents the results and discussion, while section 5 concludes the study.

Literature Review

Solar panels are panels mounted with solar cells exposed to the sun's radiation to generate electrical energy. Solar energy is one of the modern-day renewable energy sources.

A Global Review

(Saavedra et al.2021) reviewed the current state of global renewable energy generation. Many industrialised countries, including China, the United States, and Germany, are the leading countries in installing solar PV systems and are seeking to advance in this domain. Furthermore, they suggested that solar systems have exorbitant short-term and initial expenses but can be cost-effective in the medium and long run.

The developing economies are energy poverty-stricken in many regions of the world. More than two billion people still lack access to reliable energy sources and rely mainly on traditional biomass energy such as wood and other solid fuels (Shahsavari, 2018). Many of these developing countries, on the other hand, have realised that reliable and sustainable modern energy is a critical component for development. The governments are attempting to reduce their reliance on fossil fuels by enacting laws, providing economic and tax incentives, and increasing more research and development in solar energy (Shahsavari, 2018).

Welsh’s study (Welsh, 2017) aimed to understand what type of return on investment a PV system can provide in a South Carolina residential area. The study used an investment simulation and a solar PV watts calculator provided by NREL to calculate the internal rate of return and net present value on the simulated areas. The author concluded that tilting of the solar panels has minimal effects on the financial return, and that it is viable in the longer run (Welsh, 2017).

An African Review

Most rural areas in many African countries lack access to electrical energy. These countries still rely on fossil-fuel powered generators to supply their basic electrical demands (Shahsavari, 2018). According to studies, solar energy systems could be the answer to powering the whole continent (Al Garni, et al., 2018).

Al Garni (Al Garni, 2018) appraised different solar PV system configurations through a techno-economic feasibility analysis at Saudi Arabia. The author ran the simulations through the Matlab software and concluded that solar PV power plants could be solely run without being connected to the grid.

Ukoba, Fadare, and Jen (Ukoba, et al. 2019) measured the performance of solar systems in a typical African residential building. The results showed that the solar PV model has a very elevated prospect of powering Africa. Furthermore, the authors stated that solar energy could also contribute positively to socio-economic factors, improving quality of life.

South Africa is the 12th largest carbon dioxide emitter globally and is accountable for more than half of Africa’s emissions. Coal contributes to more than 90% of electrical energy production. Fossil-fuel combustion is the major source of carbon dioxide in South Africa (Shahsavari, 2018).

Being a tropical and developing country, South Africa has the perfect setting for solar investment and the ability to contribute more towards a sustainable environment. Semelane et al.’s study adopted a local South African municipality as their case study and did not explore the South African commercial side. The authors suggested that South Africa needs to start considering phasing out coal with empirical research to support the feasibility of manufacturing solar panels in-house (Semelane et al., 2021).

(Semelane et al.,) also reviewed South Africa from a broader perspective. The study examined the economic factors of producing solar systems locally, leading to job creation countrywide. The authors provided evidence showing solar panels can positively impact on South Africa’s Gross Domestic Product.

Eskom Holdings Limited (Eskom. 2020) is a South African public electrical energy utility founded by the South African government in 1923 (Jonathan, et al., 2019). Eskom supplies majority of the nation’s electrical energy. Coal-fired power plants generate 90% of South Africa's electrical energy. Over the past decade, the Eskom power plants have been overloaded, causing the electrical energy system to be unstable and unsustainable. Eskom has the option of increasing its supply energy or to lower its demand for electrical energy. This is when Eskom introduced load-shedding, which is the interruption of energy supply (Ting, 2020).

South Africa has been facing a series of temporary electrical energy shutdown in recent years. Eskom has been employing load-shedding on a rotational basis for many hours in a day, affecting most parts of the country due to its incapacity to meet the energy demand and prevent uncontrolled blackouts. Load-shedding is a last-resort intervention when the energy demand exceeds the supply (Gehringer, et al., 2018).

Load-shedding was and continues to be a catastrophe for consumers and businesses across South Africa. Therefore, both the commercial and private sectors seek alternative methods to obtain energy during load-shedding. Although this is still insufficient, many businesses chose to produce their electrical energy using generators (Mbomvu, et al., 2021).

Literature also shows that Eskom, a state-owned entity and a monopoly over recent years, attempted to resist growth of renewable energy in the supply mix of electrical energy (Ting, 2020). The coal-mining sector, alongside the traditional manner of producing electrical energy, significantly influences the country’s economy. However, studies revealed that South Africa had witnessed tremendous growth in the renewable energy sector (Ting, 2020).

McDonalds

McDonald’s is an American fast-food restaurant and is one of the leading trademarks worldwide, reaching 120 countries with around 35 000 restaurants (Rajawat, et al., 2020). The first stand-alone restaurant was opened in 1948 in San Bernardino, California after Mac and Dick McDonald had seen great success in the 1930’s with their drive-in hotdog stand [30]. In South Africa, there are 225 restaurants across all nine provinces (World Atlas. 2019).

McDonald’s outlets have sit-ins and Drive-Thru. Normally, the free-standing McDonalds have the Drive-Thru (Nuque-Joo, et al., 2019). After the COVID-19 pandemic, there has been an accelerated demand towards Drive-Thru and delivery. Becker et al. [Becker, S. et al. 2020] surveyed and analyzed that after the COVID-19 outbreak, the shift from traditional sit-ins moved to Drive-Thru and delivery by over 40 percent.

Literature on zero-emissions buildings has grown recently (Johnson, 2021 & Wells, L. 2018). For instance,(Johnson, T.et al.,2021) reviewed a net-zero energy building analysis for McDonald’s USA. Another instance is where McDonald’s completed its first zero carbon-energy restaurants in 2020, located near Disney’s All-Star Resorts in Florida, which is designed to create enough solar energy to cover 100% of its energy needs annually (Maze,2020). The definition of a commercial building and restaurant has evolved into zero-emissions with the modern era (Wells, et al. 2018).

Capital Budgeting

Capital budgeting is the process of determining long-term financial requirements for various projects. Capital budgeting is critical since current investment decisions frequently determine a company's future return and profitability (Marimuthu, 2019).

There are many techniques to appraise the feasibility of capital investment, but capital budgeting considers many factors when investing on a long-term basis. Capital budgeting is a process used for assessing potential long-term investments. It is mainly adopted for investments that are significant in an amount which are used to invest in non-current assets (Marimuthu, 2019). These methods are easy to understand and consider the time value of money. The common capital budgeting techniques are payback period, return on investment (ROI), and internal rate of return (IRR).

Payback Period

A payback period is the amount of time needed to recover the initial cost of an investment. Before undergoing them, it is typically used to evaluate investments by assessing the related risk (Marimuthu, 2019).

A discounted payback period is when the initial cost of an investment equals the discounted value of the projected cash flows when the cumulative net present value breaks even (Marimuthu, 2019).

Related work shows the argument between simple and discounted payback periods. The time value of money is a critical criterion, especially when investing. A simple payback period might show a much faster payback whilst practically that might not be the case (Hancock, 2014 & Sovacool, 2020).

Return on Investment

A return on investment aims to directly evaluate the amount of profit made on a given initial investment cost. It is determined by dividing an investment’s profit or cash flow by its initial outlay and reported as a percentage (Marimuthu, 2019). It is a popular measure of an investment’s profitability with such comprehensibility and versatility. If an ROI is positive, the investment is beneficial, whilst on the other hand, a negative ROI is the contrary. High positive ROIs may be risk associated, and low positive are risk-averse (Fernando, 2021).

Internal Rate of Return

The internal rate of return is used to evaluate investments by estimating a rate of return which indicates the project’s potential for profitability. Based on the IRR, a company will decide to invest or not. It is a breakeven discounted rate (Marimuthu, 2019 & Mellichamp, 2017). IRR is a required second metric of profitability when coupled with NPV. IRR is calculated as a percentage, whereas NPV is measured in monetary terms. Evaluating investments that appear to be similar in terms of profitability but differ in size or scope, these two metrics are necessary (Mellichamp, 2017).

Theoretical Framework

Monte Carlo simulation

The Monte Carlo simulations theory derived its name from a famous gambling destination in Monaco because different chances and outcomes are key to the theory as how casino games are also grounded (Kenton, 2021). Stanislaw Ulam, a mathematician who worked on the Manhattan Project, was the first to invent the approach. Stanislaw kept himself occupied after the war whilst recovering from his brain surgery by playing endless rounds of solitaire. He became fascinated by plotting the results of each of these games to observe their distribution and calculate the chances of winning (Kenton, 2021 & Muralidhar, 2003).

A Monte Carlo simulation is used to determine the results of an investment appraisal developed to carry out the financial analysis that includes the identified risk variables. This type of simulation is used to examine tough investment decisions in depth. It allows getting a complete statistical representation of the output variables while utilising multiple criteria simultaneously. This study adopts the Monte Carlo simulation as it will add value to the study’s investment appraisal (Gianmarco, 2018).

The method in this study uses a census at different parameters of values that can be assumed by the input variables and calculating their output based on the capital budgeting equations. The underlying factor, in this case, is a hybrid of a simulation process and capital budgeting techniques. The standard simulation involved 125 McDonalds Drive-Thru across South Africa in this study. After all, the financial simulation input shown in this study has been computed in the investment appraisal.

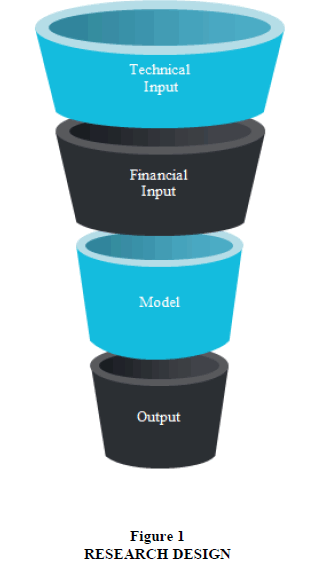

The first step is the definition of relevant input for the financial simulation. The input is divided into two parts: technical and financial input. The technical input involves the simulation process from which the numbers derived will be used in the financial aspect. Thereafter, the investment appraisal was formulated on Microsoft excel spreadsheets. The results indicated whether the McDonald’s South Africa should go ahead or not.

Capital Structure Theories

(Modigliani, 1958 & Miller, 1963) originated and published the initial theory of capital structure, the irrelevance theory. Thereafter, the irrelevance theory laid the foundation for several other capital structure theories. The basic objective of capital structure is to find the best balance of debt and equity that optimises the company's value. Modigliani and Miller’s main theories are known as MM Proposition I and II. The initial theory was revised due to criticism of not incorporating taxes (Zunckel, 2018 & Marimuthu, 2019). MM Proposition I without taxes, known as the irrelevance theory, published by Modigliani and Miller (Modigliani. 1958), states that under perfect market conditions, in the absence of corporate taxes, bankruptcy costs, transaction costs, where all market participants have equal information, the value of an unleveraged firm is equal to the value of a leveraged firm. In other words, in the absence of the aforementioned costs, the firm's worth is decided by its earnings power and the value of its assets, not by how investments are financed. This was referred to as the MM I theory (Zunckel, 2018 & Marimuthu, 2019). Therefore, the irrelevance theory is also elemental to the study’s investment appraisal. In other words, McDonald’s could either fund the solar panels investment through equity or debt-fund. The study’s investment appraisal is to determine whether solar panels' investment is feasible or not, particularly the type of finance. MM Proposition II with taxes implies that when there are corporate taxes, the higher the share of debt in the capital structure, the better because of the interest tax shield. Modigliani and Miller (Modigliani,1963) updated their original proposition to incorporate taxes in their model after realising that there was no perfect market, contrary to their earlier theory. They said that companies that use debt financing benefit from a tax break, with leveraged companies having a higher worth (Zunckel, 2018 & Marimuthu, 2019).

The second proposition does not seem to be a fit-in because even if McDonald’s finances the solar panels through debt and incurs finance charges, their electrical energy costs will decrease concurrently. In other words, the electrical energy savings might be greater than the finance charges; as a result, the interest tax shield would not make a significant impact compared to the energy savings on the reduction of McDonald’s taxable income.

Methodology

Various research instruments can be used to achieve project feasibility. The study employed a quantitative approach as the research strategy. However, this study focused on the following hybrid of a financial simulation process and an investment appraisal. In this study, the census adopted is the 125 McDonalds Drive-Thru across South Africa’s nine provinces as displayed in Table 1.

| Table 1 Mcdonalds Drive-Thru South Africa |

|

|---|---|

| Province | Drive-Thru |

| Eastern Cape | 14 |

| Free State | 3 |

| Gauteng | 27 |

| KwaZulu-Natal | 19 |

| Limpopo | 7 |

| Mpumalanga | 11 |

| Northern Cape | 5 |

| North West | 11 |

| Western Cape | 28 |

| Total | 125 |

The Financial Simulation and Investment Appraisal Process

Firstly, the financial simulation process pictured in Figure 1 is explained which forms part of the technical input, thereafter the capital budgeting aspect is explained and how it is integrated which forms part of the appraisal and financial input.

The technical input consists of data which were available on public domain. The data consisted of McDonalds restaurant address, solar system size, electrical energy consumption, the total amount of solar energy depending on the location and finally the cost of the solar system.

The financial input of the appraisal consisted of the initial cost of the solar system, discounting rate and the annual electrical energy savings, which were derived from the National Renewable Energy Laboratory PV Watts calculator (NREL) and the Treetops website, which were needed for the capital budgeting techniques.

On average, a typical South African McDonalds fast-food restaurant consumes from 250 to 400 kWh (Burger, 2016). Therefore, the appraisal looked at three different levels of energy consumption with a minimum energy consumption level of 250 kWh, most likely energy consumption level of 325kWh and a maximum energy consumption level of 400 kWh.

A solar panel simulation was utilised to obtain data and information. The PV watts calculator on the NREL (National Renewable Energy Laboratory) website was used as the simulator. This is a website where one may learn about solar energy and is also user-friendly. NREL calculates how much of electrical energy solar panels can generate under various scenarios. The PV watts calculator calculates performance using data from over 30 years of solar irradiance. The PV watts calculator was chosen for the simulation aspects of this study because of NREL's knowledge of solar energy. The PV watts calculator is very easy to use and comprehend, making the simulation process for this study much easier.

Once the solar energy annual kWh was derived from NREL, it was then used to obtain an estimated cost used in the investment appraisal (which is explained below) of the required Solar PV system from Treetops Renewable Energy Systems CC.

The national level data comprised of the average of all nine provinces. It is, in other words, the results for each individual Drive-Thru, added up for its respective province and divided by the number of Drive-Thru outlets in that province. Thereafter, the nine provinces’ results were added up and divided by nine, resulting in the national average data.

The Appraisal Methods Adopted in the Study Include

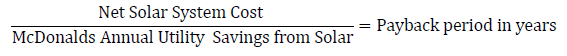

Payback Period: The Payback Period is the length of time it takes to pay off the solar investment through electricity savings. To perform the calculation, the study took the cost price of the solar system and divided it by the restaurant's simulated/estimated annual electricity bill savings. This was obtained using the following formula:

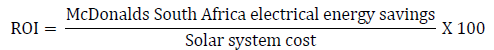

The Return on Investment (ROI): The Return on Investment (ROI) is also a viable capital budgeting technique that can directly reflect a given investment's savings. ROI estimates the amount of savings anticipated throughout the lifespan of solar panels. The ROI formula ( Devarakonda, 2019)included components such as:

McDonalds present kilowatt-hour (kWh) utility rate (Load-curve); McDonald’s annual electricity bill without any solar consideration; and the lifetime costs of the solar system.

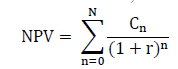

Internal Rate of Return (IRR): The last measuring instrument that the study considered was the Internal Rate of Return (IRR). The IRR is a metric used to estimate the profitability of future potential investments. The IRR is a discount rate that makes the NPV of all cash flows equal to zero in a discounted cash flow analysis. The study considers the rate of return from NPV cash flows received from a solar investment. The IRR was adapted and obtained using the following formula (Marimuthu, 2017 & Fernando, 2021):

NPV – Net Present Value

N – Number of years of the solar energy investment

n – Each period/year

Cn- Electrical energy savings (Cash flow)

r – Internal rate of return (IRR)

Assumptions of the Study

According to (Leszczensky & Wolbring), a simulation study must be anchored on specific assumptions. These assumptions place the study in a specific framework, which would make the study replicable. Given this, the simulation was performed based on the following assumptions:

• Energy losses - System losses are normal due to certain conditions at times. It is assumed to be constant throughout the year at a percentage rate of 14.08% of the net output 0.

• Maintenance costs - There might be a contingency of quality issues. If the system does not execute as anticipated over the stipulated time, then it might lead to maintenance, replacement, and increased insurance costs.

• Eskom tariffs and interest rates - These rates constantly fluctuate from time to time and are assumed to remain constant throughout this study.

• Depreciation - Depreciation is not considered in this financial appraisal as it is a non-cash item.

Discounting factor - A discounting rate is taken as the prescribed interest rate at 7%. This rate was used throughout this study to ensure uniformity as each organisation and companies faces different unique capital costs in their respective markets. Hence, the rate of 7% was relevant to McDonalds South Africa. The discounting of 7% was considered as interests on loans are tax deductible and at times, equity might be harder to rise internally (Vismara, 2019).

Results and Discussion

The results of the investment appraisal methods are summarised in Table 2 for McDonalds South Africa nationally and thereafter provincially.

| Table 2 Capital Investment Decision |

|||||

|---|---|---|---|---|---|

| McDonalds | Payback period | ROI | IRR (Short-term) |

IRR (Long-term) | Decision |

| South Africa (National) | 4,71 Years | 21,21% | 7,36% | 20,72% | Accept |

| Eastern Cape | 4,69 Years | 21,33% | 7,54% | 20,85% | Accept |

| Free State | 4,68 Years | 21,3% | 7,5% | 20,8% | Accept |

| Gauteng | 4,69 Years | 21,33% | 7,54% | 20,85% | Accept |

| KZN | 4,93 Years | 20,27% | 5,89% | 19,71% | Accept |

| Limpopo | 4,69 Years | 21,33% | 7,54% | 20,85% | Accept |

| Mpumalanga | 4,69 Years | 21,33% | 7,54% | 20,85% | Accept |

| Northern Cape | 4,69 Years | 21,33% | 7,5% | 20,8% | Accept |

| North West | 4,6 Years | 21,33% | 7,54% | 20,85% | Accept |

| Western Cape | 4,69 Years | 21,33% | 7,5% | 20,8% | Accept |

| Source: Authors own contribution | |||||

The quickest payback period on a provincial level is the North West with 4.6 years and the longest is KZN with 4.93 years. The national payback period is 4.71 years. It can also be said that the investment will take close to five years to break-even. With similar and good payback periods, approximately just under five years, throughout the nine provinces and nationally indicates that the solar energy investment is not much of a risk.

The ROI on a national basis sum up to 21.21%, whilst on a provincial basis, the lowest is at KZN with 20.27% and the highest is practically at seven out of the nine provinces at 21.33%. The ROIs of the national average and the provinces are all above 20% proving to be a fruitful return on the solar energy investment.

The IRR both on the short-term and long-term indicate that greater savings and cash flow will increase as the time goes by. Despite KZN having the lowest IRR, it is still a risk adverse and profitable investment both on a small and big scale.

The national average cost of the solar energy panels varied from a minimum consumption of 250 kWh at R 2 873 216, most likely of 325 kWh at R 3 734 796 and maximum consumption of 400 kWh at R 4 597 010. On the other side, the national average energy savings varied from a minimum consumption of R 609 527, mostly likely consumption of R 792 332 and a maximum consumption of R 975 245.

The results indicated that solar energy is feasible for all 125 McDonalds Drive-Thru in the nine provinces as the payback period was reasonable throughout, an optimistic average ROI, the short and long-term IRRs imply that savings and cash flow will increase with time.

The findings further showed that the solar energy initial outlay and electrical energy savings varied with the different parameters used in the study. The provinces' average solar energy cost varied from a minimum average consumption at R 2 705 712 from Northern Cape to a maximum consumption cost at R 4 578 675 from Eastern Cape. The provinces average electrical savings at a minimum consumption level sum up to R 577 219 from Northern Cape to a maximum consumption level of R 1 015 184.

Eskom’s commercial tariff was used in making the estimated numbers of the electrical energy savings and the cost of the solar system more realistic and accurate. The tariff remained constant throughout the appraisal.

The different geographical areas numbers also differed from one another due to different weathers in different areas. For instance, at a minimum consumption level of 250kWh, whilst the Eskom tariff remained constant, the cost of the solar system at Gauteng is R 2 953 454 whilst at Western Cape, the cost is R 2 808 821. The cost varies irrespective of being at the same consumption level, but due to the weather conditions and the availability of sunlight in that particular area.

The other financial benefits of this appraisal are explained below:

Electrical energy is a semi-variable cost to McDonalds South Africa. A semi-variable cost contains both a fixed and variable cost. The cost varies during different periods of production and demand (Marimuthu & Du Toit., 2017). This will lead to cost savings on electrical energy consumption and increased profitability.

This appraisal can lead to a business expansion. Such expansion of an organization occurs when it has reached a point of growth and is looking for new ways to make more profit (Arensberg, 2018). The study’s investment appraisal can contribute to McDonalds South Africa’s business plan, expansion and financial analysis as the investment can bring in another stream of cash flow.

Benchmarking is the process of determining essential business practices and areas of improvement which are compared to that of relative market competitors (Torun, et al. 2018). This financial appraisal can benefit McDonalds South Africa to lead ahead of its industry peers.

The net amount of cash being moved in and out of an organisation is referred to as cash flow. A cash inflow relates to monies received whilst monies spent are referred as outflows (Hayes, 2021). The investment shows an initial huge amount of cash outflow, however the study’s appraisement displays that the cash flows saved which the electrical energy is spending exceeds that cash outflow. It is actually an additional source of cash flow for McDonalds other than its main operating activity.

One of the options McDonalds can explore is to approach the Sustainable Energy Fund for Africa (SEFA), managed by the African Development Bank to access funds. SEFA provides financial support to private sector investments in green energy. The investment appraisal also forecasts as to what quantum may be required by McDonalds South Africa to undertake this investment hence it can help to establish a funding strategy.

An added advantage of this study’s simulations and appraisal is its accessibility and simplicity, which allows any researcher to assess the profitability of any solar energy project and then optimise it to achieve a profitable project configuration. The appropriateness of any appraisal is determined by whether the data utilised is current and accurate, just as the profitability of any project is determined by time. Another advantage is that this simulation and appraisal gives McDonalds a futuristic financial performance view of installing solar panels.

However, the drawback of this appraisal is that it is based on varied assumptions, which indicate that the financial simulation and investment appraisal is vulnerable and open to manipulation. It is meaningless to have a closed solution to solve complex problems; hence the Monte Carlo adoption allows for a numerical solution for the underlying problem and tries to budget to get the numbers as accurate as possible (Gianmarco, 2018).

This study recommends that McDonalds South Africa and all provinces should accept the solar energy investment as it proves to be a profitable investment based on the financial simulation and appraised results.

Conclusion

South Africa experiences long periods of sunshine and receives many more hours of sunlight during the year than most countries due to its tropical climate. Therefore, the investment in solar panels will be beneficial to McDonald’s because of the availability of abundant solar energy in South Africa.

This study's financial simulation and investment appraisal can be helpful to McDonald’s, other fast-food restaurants, and other business and government sectors.

As presented and discussed, it is recommended that McDonald’s emphasize energy management, which uses electrical energy-efficient measures and its own generation. It is evident that McDonald’s is a huge consumer and can turn all its buildings into Net-Zero Energy buildings.

It is further recommended that, based on the study’s findings that South Africa needs a much more capable and innovative electrical energy supplier. Eskom needs to switch from coal to other renewable sources as the energy crisis in South Africa is not improving alongside with the challenges brought about by COVID-19.

Acknowledgement

The authors acknowledge the contribution of Dr Haruna Maama.

References

Al Garni, H. Z. (2018). Optimal Design and Analysis of Grid-Connected Solar Photovoltaic Systems.

Arensberg, M. B. (2018). Population aging: Opportunity for business expansion, an invitational paper presented at the Asia-pacific economic cooperation (APEC) international workshop on Adaptation to population aging issues, july 17, 2017, Ha Noi, Viet Nam. Journal of Health Population and Nutrition. 37, 1-11.

Indexed at, Google Scholar, Cross Ref

Becker, S., Haas, S., Kuehl, E., Marcos, I., & Venkataraman, K. (2020). Delivering when it matters: Quick-service restaurants in coronavirus times. McKinsey & Company.

Bigoni, G. Impact of Risks on Investment in Solar Photovoltaic.

Devarakonda, S. (2019). Calculating the Economic Viability of Corporate Trainings (Traditional & eLearning) using Benefit-Cost Ratio (BCR) and Return On Investment (ROI). International Journal of Advanced Corporate Learning, 12(1), 41-57.

Indexed at, Google Scholar, Cross Ref

Fernando, J. 2021. Internal Rate of Return (IRR). Coporate finance and accounting. Accessed 28 October 2021.

Fernando, J. 2021. Return on Investment (ROI). Financial Ratios.

Indexed at, Google Scholar, Cross Ref

Gehringer, C., Rode, H., & Schomaker, M. (2018). The effect of electrical load shedding on pediatric hospital admissions in South Africa. Epidemiology, 29(6), 841.

Indexed at, Google Scholar, Cross Ref

Gielen, D., Boshell, F., Saygin, D., Bazilian, M. D., & Gorini, R. (2019). The role of renewable energy in the global energy transformation. Energy Strategy Reviews. 24, 38-50.

Indexed at, Google Scholar, Cross Ref

Hancock, K. J., & Vivoda, V. (2014). International political economy: a field born of the OPEC crisis returns to its energy roots. Energy Res Soc Sci, 1, 206-16.

Indexed at, Google Scholar, Cross Ref

Hayes, A. 2021. What is Cash Flow? Cash Flow. Accessed 30 October 2021.

Ikram, M. (2021). Models for predicting non-renewable energy competing with renewable source for sustainable energy development: Case of Asia and Oceania region. Global Journal of Flexible Systems Management, 22(2), 133-60.

Indexed at, Google Scholar, Cross Ref

Jo, J., Choi, E. K. C., & Taylor, J. (2020). Challenges and Benefits of Implementing Green Practices at a Restaurant. In SAGE Business Cases. International CHRIE.

Johnson, T., Palmisciano, G., Breuker, M., Yoo, J., Olgyay, V., Tolbert, R. and Zirnhelt, H. 2021. NET ZERO Energy Building Analysis For Mcdonalds Usa, Llc.

Jonathan, E. C., Mafini, C., & Bhadury, J. (2020). Supply chain risk mitigation in South Africa: A case study of Eskom. Benchmarking: International journal of information technology, 27(3), 1105-25.

Indexed at, Google Scholar, Cross Ref

Kenton, W. 2021. Monte Carlo Simulation. Financial Analysis. Accessed 17 October 2021.

Khan, K. A., Hasan, M., Islam, M. A., Alim, M. A., & Ali, M. H. (2018). A study on conventional energy sources for power production. International journal of advance research and innovative ideas in education, 4(4), 214-28.

Kopp, C., Financial Modeling. 2020.

Leszczensky, L., & Wolbring, T. (2022). How to deal with reverse causality using panel data? Recommendations for researchers based on a simulation study. Sociological Methods and Research. 51(2), 837-65.

Indexed at, Google Scholar, Cross Ref

Marimuthu, F., and Du Toit. 2017. Cost and management accounting: Fundamentals - A southern African approach. 2nd ed. Juta.

Marimuthu, F. (2019). Determinants of debt financing in South African state-owned entities. Account Finance Control, 3(1), 40.

Indexed at, Google Scholar, Cross Ref

Mbomvu, L., Hlongwane, I. T., Nxazonke, N. P., Qayi, Z., & Bruwer, J. P. (2021). Load shedding and its influence on South African Small, Medium and Micro Enterprise profitability, liquidity, efficiency and solvency. Business Resolut Work Pap, 2021, 001.

Indexed at, Google Scholar, Cross Ref

Mellichamp, D. A. (2017). Internal rate of return: Good and bad features, and a new way of interpreting the historic measure. Comput Chem Eng, 106, 396-406.

Indexed at, Google Scholar, Cross Ref

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review. 48(3), 261-97.

Modigliani, F., & Miller, M. H. (1963). Corporate income taxes and the cost of capital: a correction. The American Economic Review. 53(3), 433-43.

Muralidhar, K., 2003. "Monte Carlo Simulation." In Encyclopedia of Information Systems, edited by Hossein Bidgoli, 193-201. New York: Elsevier.

Nhamo, G., Dube, K., Chikodzi, D., Nhamo, G., Dube, K., & Chikodzi, D. (2020). Restaurants and COVID-19: A focus on sustainability and recovery pathways. Counting the cost of COVID-19 on the global tourism industry, 205-224.

Indexed at, Google Scholar, Cross Ref

Nuque-Joo, A., Kim, D., & Choi, S. (2019). Mcdonald's in Germany: Germans, still lovin'it?. ASMJ, 18(2), 1-20.

Oxford. 2021. Oxford English Dictionary. Oxford University Press.

Petrovich, B., Hille, S. L., & Wüstenhagen, R. (2019). Beauty and the budget: A segmentation of residential solar adopters. Ecol Econ, 164, 106353.

Indexed at, Google Scholar, Cross Ref

Rajawat, A., Kee, D. M. H., Malik, M. Z. B. A., Yassin, M. A. Q. B. M., Shaffie, M. S. I. B. A., Fuaat, M. H. B., ... & Santoso, M. E. J. (2020). Factors: Responsible for McDonald's performance, Journal of the Canadian Dental Association. 3(2), 11-7.

Indexed at, Google Scholar, Cross Ref

Ruan, G., Wu, D., Zheng, X., Zhong, H., Kang, C., Dahleh, M. A., ... & Xie, L. (2020). A cross-domain approach to analyzing the short-run impact of COVID-19 on the US electricity sector. Joule, 4(11), 2322-37.

Indexed at, Google Scholar, Cross Ref

Saavedra, A., Galvis, N. A., Mesa, F., Banguero, E., Castaneda, M., Zapata, S., & Aristizábal, A. J. (2021). Current State of the Worldwide Renewable Energy Generation: a Review. International Journal of Applied Science and Engineering, 9(3), 115-127.

Indexed at, Google Scholar, Cross Ref

Semelane, S., Nwulu, N., Kambule, N., & Tazvinga, H. (2021). Economic feasibility assessment of manufacturing solar panels in South Africa–A case study of Steve Tshwete Local Municipality. Sustainable Energy Technologies and Assessments, 43, 100945.

Indexed at, Google Scholar, Cross Ref

Semelane, S., Nwulu, N., Kambule, N., & Tazvinga, H. (2021). Evaluating economic impacts of utility scale solar photovoltaic localisation in South Africa. Energy Sources, Part B: Economics, Planning, and Policy, 16(4), 324-44.

Indexed at, Google Scholar, Cross Ref

Shahsavari, A., & Akbari, M. (2018). Potential of solar energy in developing countries for reducing energy-related emissions. Renewable and Sustainable Energy Reviews, 90, 275-91.

Indexed at, Google Scholar, Cross Ref

Sovacool, B. K., Hess, D. J., Amir, S., Geels, F. W., & Yearley, S. (2020). Sociotechnical agendas: Reviewing future directions for energy and climate research. Energy Research & Social Science, 70, 101617.

Indexed at, Google Scholar, Cross Ref

Thulasiraman, V., Nandagopal, M. G., & Kothakota, A. (2021). Need for a balance between short food supply chains and integrated food processing sectors: COVID-19 takeaways from India. Journal of Food Science and Technology, 1-9.

Indexed at, Google Scholar, Cross Ref

Ting, M. B., & Byrne, R. (2020). Eskom and the rise of renewables: Regime-resistance, crisis and the strategy of incumbency in South Africa's electricity system. Energy Research & Social Science, 60, 101333.

Indexed at, Google Scholar, Cross Ref

Torun, M., Peconick, L., Sobreiro, V., Kimura, H., & Pique, J. (2018). Assessing business incubation: A review on benchmarking. International journal of innovation studies, 2(3), 91-100.

Indexed at, Google Scholar, Cross Ref

Ukoba, K., Fadare, O., & Jen, T. C. (2019, December). Powering Africa Using An Off-Grid, Stand-Alone, Solar Photovoltaic Model. Journal of Physics: Conference Series, 2,022031.

Indexed at, Google Scholar, Cross Ref

Vismara, S. (2019). Sustainability in equity crowdfunding. Technological Forecasting and Social Change, 141, 98-106.

Indexed at, Google Scholar, Cross Ref

Wells, L., Rismanchi, B., & Aye, L. (2018). A review of Net Zero Energy Buildings with reflections on the Australian context. Energy Build, 158, 616-28.

Indexed at, Google Scholar, Cross Ref

Welsh, T. M. (2017). The Profitability of an Investment in Photovoltaics in South Carolina. Clemson University.

WorldAtlas. 2019. How Many McDonalds Locations Are There In The World? : Society.

Zayed, M., 2020. An Update on Load Shedding in South Africa. Accessed 11 November 2021.

Zunckel, S. (2018). An analysis of factors influencing the capital structure of small, medium and micro enterprises: A growth and survival perspective

Received: 08-Feb-2023, Manuscript No. IJE-23-13296; Editor assigned: 10-Feb-2023, Pre QC No. IJE-23-13296 (PQ); Reviewed: 24-Feb-2023, QC No. IJE-23-13296; Revised: 28-Feb-2023, Manuscript No. IJE-23-13296(R); Published: 07-Mar-2023