Research Article: 2022 Vol: 21 Issue: 1

A Conceptual Roadmap for Implementing Localization in the Indian Automotive Industry in a Post-Pandemic Scenario

Boopalan Balu, National Institute of Technology, Tiruchirappalli

Rajesh Jayapal, SRM Institute of Science & Technology, Tiruchirappalli

Koteswara Rao Gunupuru, University of Hyderabad

Ramanjaneyulu Mogili, National Institute of Technology, Tiruchirappalli

Citation Information: Balu, B., Jayapal, R., Gunupuru, K.R., & Mogili, R. (2022). A conceptual roadmap for implementing localization in the indian automotive industry in a post-pandemic scenario. Academy of Strategic Management Journal, 21(S1), 1-15.

Abstract

The automotive industry has one of the most sophisticated global supply chains, with multi-national import-export flows running through every major automaker. Internationalization in the 1990s brought about a high degree of global sourcing along with organizational changes which brought out much needed increased in productivity. But with the COVID-19 pandemic halting many trade routes, many manufacturers are switching to regional suppliers and are therefore accelerating the process of localization. Such a change is not only beneficial to the economy of the home country, but also is considered as an environment-friendly initiative in line with green supply chain strategies. This study aims to provide a roadmap for bringing about such a change in the Indian automotive sector by combining the best localization practices followed by automakers across the world. Specific components which can be localized are studied in detail and separate strategies for localizing these components are presented. Such a roadmap will support the Indian Government's existing initiatives such as the ‘Make in India’ and will also lay the foundation for supporting India’s vision of an ‘Atma Nirbhar Bharat.

Introduction

Since the late nineteenth century, when the first few prototypes were made, the automotive sector, which includes automobiles and auto parts, has been in constant evolution. The automobile sector has emerged as a driver of growth prospects in developing countries, owing to the industry’s extensive interconnections with other industries.

The automotive parts supply chain works as one of several layers in the overall operation of the automotive supply chain. It does, however, account for the majority of automotive supply chain operations in terms of complexity and market valuation. The component supplier universe involves a range of players, including Original Equipment Manufacturer (OEM)-owned captive manufacturing units, contract manufacturers who work under OEM production and supply agreements, and independent suppliers who may or may not be part of the OEM’s distributor network if they meet the latter’s quality and other technical requirements.

As original equipment manufacturers form the primary consumer category of auto components, the automotive component industry’s patterns are influenced by changes in the automotive industry. The key components that are traded internationally are gearboxes, drive axles, clutches, bumpers, radiators, road wheels, suspension shock absorbers, steering wheels and brakes.

The Indian automotive industry is heavily reliant on Chinese components. According to rating agency ICRA Ltd, China accounts for nearly a quarter of India’s $17.5 billion in component imports. India imports ten times the amount of auto components it exports from China (Export-Import Bank of India, 2017). Imports of auto components from China are on the rise, challenging the local auto component manufacturing ecosystem and contributing to India’s already large trade deficit with China in the coming years. Electronic components in cars, which will be used in the upcoming launch of a slew of new electric vehicles, are driving Chinese exports to India (EVs). China supplies the majority of the imports, which include drive transmissions, steering, electricals, interiors, and engine components.

Since India lacks a well-established EV parts manufacturing ecosystem, it relies heavily on imports from China. Non-EV parts are imported mostly for tactical purposes, such as capacity shortages and cost savings. In India, we are unable to obtain the necessary quality, and rejection rates are high. Rejection rates in China are as low as 3%, though they are still about 20% in India. Components are 10% cheaper in many other cases, making it more viable to import electrical components, steering gears, and other products, according to a component importer based in Chennai (Export-Import Bank of India, 2017).

We expect imports of EV components and sub-components from China to increase as a result of India’s electrification roadmap and China’s leadership in EVs (60% of global volumes) and battery technology (Export-Import Bank of India, 2017). EV components made in China would still be cheaper than those made in India, despite localization goals and import duties. According to experts, India lacks mandatory requirements for aftermarket items, making it appealing for sub-standard, low-cost Chinese components to enter the Indian market.

Traditional levels of localization in the Indian automotive industry were good, but with changes in technology and the transition from BS4 to BS6, there was not enough time to maintain those levels. During BS4, there was approximately 95% local content. Since testing and validation for regional components would not have been feasible in a short duration, several devices had to be imported from global counterparts when BS6 was introduced.

For all OEM manufacturers, localization \ has become a primary long-term strategy. Localization is important not only because of the Make in India initiative, but also because it allows for backward integration, which protects against exchange rate fluctuations and shortens the supply chain. The following benefits make localization a solution for supply chain threats.

• Minimized idle equipment or unreasonably high maintenance costs due to shortage of spare parts and equipment service base optimization of production and product service costs through reducing transportation costs outside the country and customs duties.

• Increased control over the timing and expense of product production and delivery.

• Development of personnel potential

Previously, there were some limitations to localization—for example, some pieces were only available from a single country. China is in the lead since it is the world’s factory. However, amid Covid-19, there will be a greater emphasis on self-sufficiency, with many countries promoting manufacturing in their own region. Following the stabilization of Covid19, I assume there will be a fast-track to deep localization. Furthermore, India automotive bearings market to increase at around 16% CAGR till 2020 & the supply chain would have to be readjusted as a one-plus-one concept; for example, if there was previously only one global source for some products (possibly due to economies of scale or competitive advantage), now there must be an alternative. Herein lays India's opportunity: we have the potential to play a significant role in the global auto industry.

Literature Review

Rise of Globalization and Subsequent Challenges

Before moving into localization in the automotive supply chain, it is essential to understand the history of import-export flows in this sector. The automobile sector experienced a boom in internationalization during the mid-1990s, following the Western adoption of Japanese solutions (especially those developed by Toyota) in both technical as well as organizational fronts (Volpato, 2004). This globalization led to a boom in outsourcing and global sourcing, followed by an increase in first-tier supplier (FTS) concentration and FTS engagement by the means of co-design, shared platforms, integration of management schemes and systems, modularization, and consortiums.

Sourcing goods from suppliers on a global scale still has its limitations, which the COVID-19 pandemic has highlighted. Just-in-time service and product customization, provided by local sourcing, is difficult to achieve in global sourcing. Therefore, global sourcing can only be applied to highly standardized components and parts in manufacturer catalogs. Moreover, Cho & Kang (2001) identified four challenges of global sourcing- trade regulations (quotas and restrictions), transport delays and associated logistics problems, cultural differences in the business practices of various supplier countries, and exchange rate instabilities. In comparison, local sourcing is considered the lowest and least sophisticated form of sourcing strategies (Trent & Monczka, 2003).

With the advent of the COVID-19 pandemic, research shifted towards risk management, resilience, digitalization and glocalization. Xu et al. (2020) used COVID-19 implications on the effectiveness and responsiveness of green supply chains are being investigated through critical reading and causal analysis of facts and numbers (GSCs). Since it is impossible to predict how global crises, like the COVID-19 pandemic, will materialize, many industries across the GSC spectrum will be severely impacted from supply sources to final customers. Administrative experiences with interruption visibility in GSCs, reaction time frames, and delayed industry responses to the COVID-19 were examined. They provided recommendations in the form of administrative insights to alleviate their risk, upgrading of GSCs’ versatility in multiple industrial sectors, and resilience development by enhancing visibility and responsiveness.

Belhadi et al. (2021) utilized the supply chain resilience theory to investigate the impact of the COVID-19 epidemic on the automobile and airline supply chains. An empirical survey was performed to uncover primary short-term tactics that firms have adopted to mitigate supply chain disruptions induced by the pandemic, using a mixed qualitative and quantitative approach. Regarding the COVID-19 occurrence, the SCRes of the automobile sector were analyzed for time to recover (TTR) and financial effect (FI). The dissemination of COVID-19 in a given location was found to significantly impact TTR and subsequent FI in the automobile supply chain, impacting the closure span.

Increasing Interest in Research on Localization

We realize the need to explore localization as a potential solution for averting the risks mentioned earlier. Eberhardt et al. (2004) studied multiple internal and external forces acting on foreign manufacturing subsidiaries in China that work for/against localization and developed an analytical framework of these forces. They identified the salience of these forces and drew ramifications to the sourcing methodology and production network. There was no evidence for the “vintage effect” since some firms that had been established longer than the average six years had significantly higher localization than some much older firms.

The factors conducive to localization are the cost savings that was possible due to localization and the possibility to tailor make the product according to the customer requirements. The arguments found against localization were the over sourcing by the parent company and the lack of acceptable stable quality levels.

Earlier, Chatterjee (2009) identified multi-domestic “localization” and “glocalization” as standardized and typical strategies practiced by China and India for achieving global supply-chain competitiveness. He emphasized that supply chain relationships developed by mutual trust and learning leads to competitive agility. This can be accelerated by bringing about a shift from contract/catalogue mindset to network/innovation mindset.

Bayo-Moriones et al. (2011) investigated the relation between the type of global supply chain quality assurance practices and its influence on supplier localization. Their study concluded that the implementation of internal quality practices is related to supplier localization in low-cost countries while external quality practices might be easier to implement when suppliers are located nearby. Product endorsement followed by product verification are laid emphasis upon.

All these studies bring out the necessity to impart training to workers in an organization, specifically focused on localization. Such training for enhancing the automotive company’s SC could be imparted by implementing PVD- product and vendor development program (Mahmood et al., 2011). This program is sub-divided into three components: localization, product development, and vendor monitoring. The localization program deals explicitly with five steps: vendor identification and pre-selection; quality, costs, and delivery (QCD) evaluation; final vendor selection; part and tool development; and drawing. Vendor identification deals with choosing local vendors who meet the raw material requirements.

Bohnenkamp et al. (2020) introduced a contrasting solution for global sourcing called deep localization. The proposed four-phase framework highlights that social capital (cognitive, relational, and structural capital, Hartmann & Herb, 2014) plays a crucial facilitating effect in sustaining this deep localization strategy. Transparency in addressing critical topics is enabled by the frequent conduction of workshops for all involved parties. Like Mahmood’s PVD program, the success of deep localization depends on the setting up of an effective taskforce exclusively for the operation of localization.

In general though, Localization refers to the improved utilization of local resources in energy systems, and it could take the form of local fuel harvesting and storage, the promotion of local business opportunities, and the development of products and services based on local raw materials and labor.

Localization: A Potential Solution for Averting Supply Chain Risks

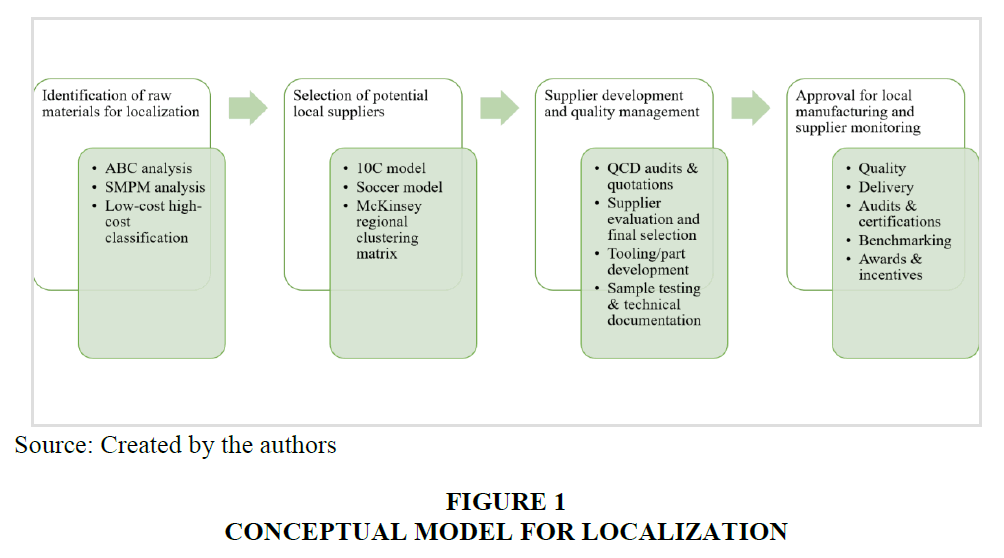

Now that we have established localization as a potential solution for averting SC risks, companies need to understand the strategies they can implement to implement localization in their supply chains. The strategic pathway to localization has been studied by various authors and is portrayed in different ways. A conceptual four-step linear model for localization is framed by taking common elements in such procedures, illustrated by Figure 1. The linearity of a critical point that many authors notice is that the success of implementation of localization programs depends on the setting up of an exclusive team, which is responsible for executing and monitoring the localization process. This team, hereafter referred to as the supply chain localization team (SCL team), has indispensable duties to play in each step in the localization of materials/components. The linearity of the figure is derived from the importance of each of the steps in a county seeking to improve percentage of localized products. The paper discusses in detail the significance of each of the steps in context to India in specific. Countries with a high percentage of localization can forgo/bypass the steps because of pre-existing norms that already cover the basis of the steps. This discussion is beyond the scope of this paper.

Identification of Raw Materials which can be Localized

The first step towards SC localizations discusses what raw materials companies need to localize first.

ABC analysis

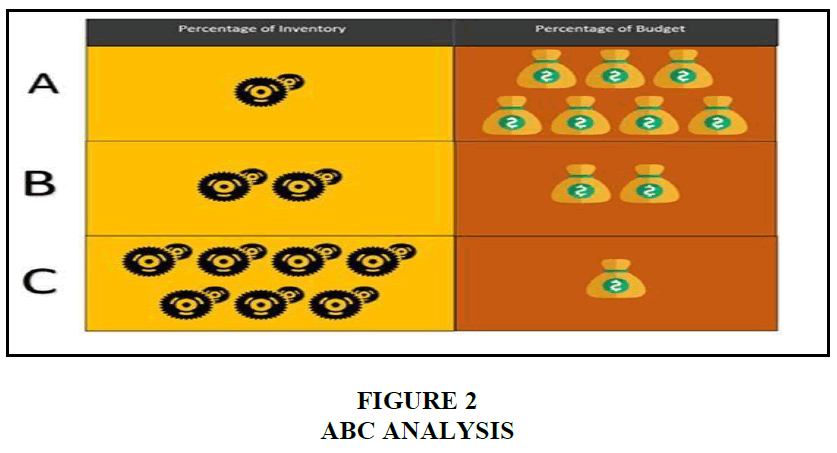

Companies can make use of the ABC inventory analysis to decide on what raw materials to localize first. According to the ABC Analysis, we understand that in most companies, A components being the lowest in quantity contribute the most to the financial spend whereas C components being the highest in quantity contribute least to the spend.

Hence A-category components are considered the most significant as they form the greatest fraction of the total financial spend, components of category B are regarded as relatively less important and C class components are regarded the least significant. Applying this framework to companies, they can start by localizing C category components because these components have high logistics costs. In some cases, the cost incurred in transporting a unit of C components surpasses the unit material cost of C itself. Packaging materials and fasteners are some examples of C grade components. After obtaining considerable levels of localization of their C-class materials, companies proceed to localize B and A class materials respectively. This behavior of the companies stems from the ideology that companies who set up their foothold in India do not feel ready in sourcing critical A class material from the local suppliers immediately. Companies that want to localize its items will start by localizing items that are less expensive and gradually proceed toward localizing more expensive items. This way then can establish a sense of security and trust initially at low stake. Figure 2 represents the classification of components based on percentage of inventory and budget

This classification of raw material serves as a basis for countries like India, which are stepping foot into localization in a post pandemic scenario. The slow transitioning from globalization into localization can be guided by this classification. By mapping existing vendor capabilities in India based on ABC classification, we can focus on developing adjacencies

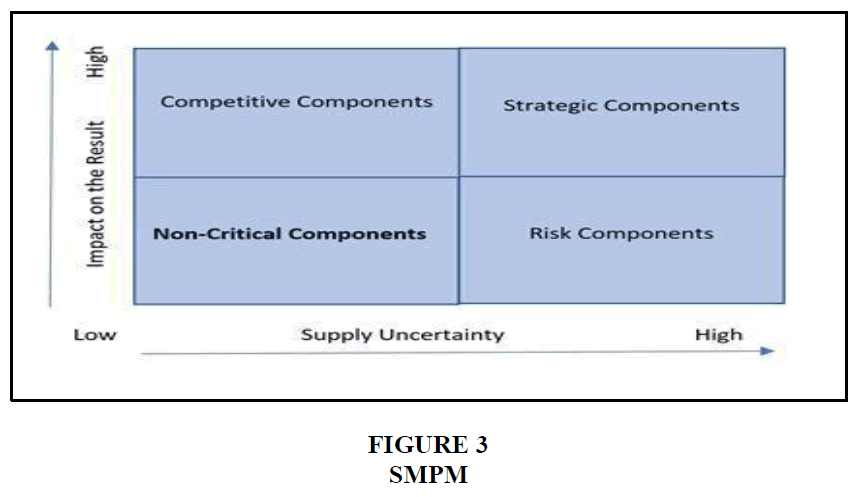

Strategic materials positioning matrix (SMPM)

The study published by Porter is the basis for this reference. SMPM is a model based on the Kraljic matrix, which is a method to segment the purchases or suppliers of a company based on complexity of supply market and importance of the purchase or suppliers. SMPM involves 2 possible theories. In Figure 3, the horizontal axis relates to the competitive forces proposed in Porter’s paper, applying for new products’ entry, threat of substitutes, power of bargaining of suppliers and buyers. Whereas the vertical axis relates to the dimensions of production strategy; customer service, innovation, quality, cost, flexibility and time for the delivery. Dealing with these dimensions, researchers have built the universal dimension value-added to the materials to identify each item’s effect on the company’s result. This is represented by Figure 3. To classify items according to these two axes, the SMPM classifies materials into four quadrants.

1. Competitive components have higher impact on the overall result and low supply uncertainty

2. Non-critical components have low impact on the overall results and have low supply uncertainty. Therefore, it is organized in a way to minimize the suppliers count and increase the cash flow for them.

3. Risk components correspond to the materials with little impact on overall result accompanied with high supply uncertainty.

4. Strategic components are the materials of high levels of impact on the overall results and also high supply uncertainty.

In the Indian automobile Industry context, competitive components having low supply uncertainty such as shafts, bearing and axles are vastly available and have been localized already to a large extent. Strategic components such as gear box parts, engine parts and steering parts have been predominantly imported to India. This category of components has very small localized market and hence will help in guiding on ways to identify potential vendors and ways to check quality and cost of the localized materials.

Low-cost and high-cost classification

When companies think of localization, it is important to categorize parts as “Relative Low cost” and “Relative High Cost”. Relative Low Cost refers to those parts whose local manufacturing costs are less than the imported parts’ cost. This usually happens when parts are produced in large volumes while requiring less skilled labor (in the country of localization). Relative higher cost refers to those parts whose local manufacturing costs are more than the imported parts cost. These parts are usually ones that require advanced technology and skilled labor in its production (in the country of localization). The country from which the parts were imported usually has the infrastructure and resources to fund this advanced technology, and hence the parts cost less there.

Companies need to localize Relative Low-Cost Components first and then work towards localizing Relative High-Cost components. The categorization of components as Relative Low cost or Relative High Cost varies from one country to another based on their resources, Labour set etc.

MAPPING this context to the Indian Automobile Industry we realize that as India leaps from globalization to localization, it’s important to prioritize the localization of Relative Low Cost components and then work towards localizing Relative High Cost Components.

Selection of Potential Suppliers or Vendors

The main purpose of the supplier evaluation is to scale back the purchasing risk while also maximizing the overall value of the product (Monczka et al., 2015). Supplier evaluation is a mandatory step for supplier selection for a long-term collaboration or a high-value onetime contract (Sollish & Semanik 2011).

The suppliers must meet certain entry conditions before they are considered for Evaluation such as financial stability, a sound corporate strategy, and a solid supportive management, a manufacturing capability that has been proven, and design capability. Several supplier evaluations models and frameworks, each with their own metrics and criteria could be found in literature.

10C model

Carter & Ferrin (1995) introduced the 7 Cs of supplier evaluation, later updating three more factors making the 10C model of supplier evaluation (SM 2005). The factors considered by Carter are Competency, Capacity, Commitment, Control, Cash, Cost and Consistency as the original seven, with Culture, Clean and Communications being the new updates to the criterion. The shortcomings of the 10C method are that it does not consider the external factors like subcontracting, the technological advancements that will be made in the field, factors which are crucial for an industry like automobile, where the competition to incorporate advancements decides the relevance of the product.

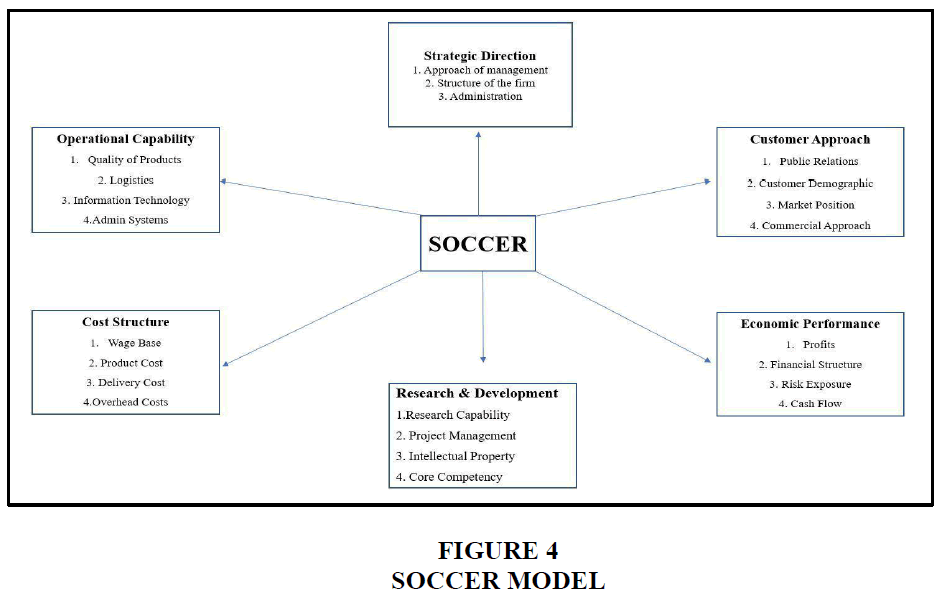

SOCCER model

The SOCCER Supplier evaluation model (Carter, 2015) consists of the elements Strategy, Operational Capability, Customer Approach, Cost Structure, Economic Performance, and Research & Development (Figure 4).

The advantage of the SOCCER evaluation, especially for the automobile industry, is that it considers the Research & Development factors which are often neglected in the other models. By incorporating the R&D in the criterion, we ensure that the advancements made in any part are incorporated in the final product, keeping the product updated and relevant.

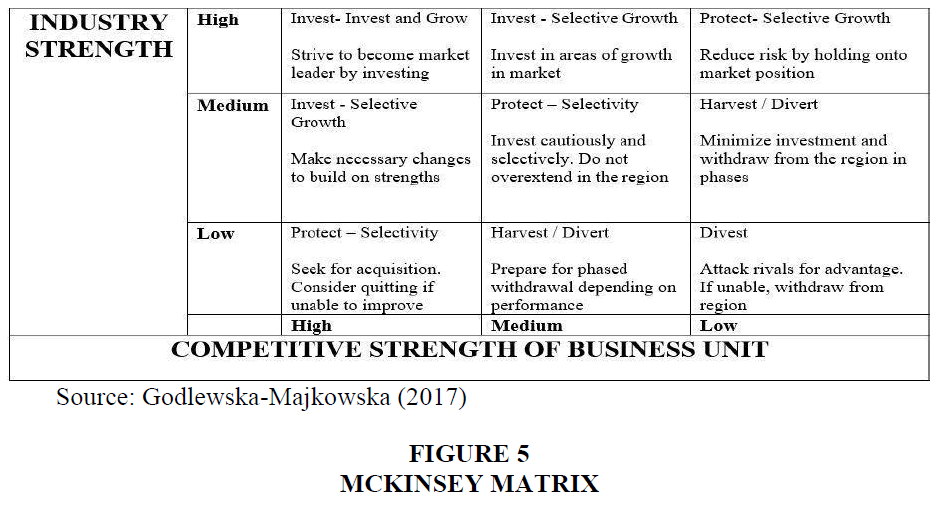

Supplier clustering and Mckinsey matrix

The concept of regional strategy groups is based on using the Mckinsey Matrix, with Godlewska-Majkowska (2017) attempting to modify the method for spatial analysis. The original notion of regional strategic groups is a solution that allows for undertaking localization analysis for sectors in areas with varying levels of statistical division while considering competitive analysis. The Mckinsey matrix was proposed with a modification illustrated by Figure 5, to introduce the regional strategic group to strategic analysis.

The Mckinsey Matrix method allows us to curtail the subjective evaluation’s effect by accounting for the individual variables and their unequal impact on the final index size. We can evaluate factors like entrepreneurship development which play a vital role due to the assembly nature of the sector and the requirement for cooperation in the application of new quality standards. Factors like labor market and the demographic of the available labor show us details like the competitiveness in the region, which will enable us to make negotiations accordingly. The analysis allows us to identify if long-term investment with the supplier in the area is viable, allowing us to make long-term decisions.

Supplier Development and Quality Management

The next stage of localization following the selection of suppliers is to evaluate the supplier, specifically through QCD audit and evaluation, according to both Bohnenkamp et al. (2020) and Mahmood et al. (2011).

Quality Inspection of the Local Suppliers

After the supplier selection step, the SCL Team performs a quality, costs and delivery (QCD) evaluation on all the nominated suppliers in the potential pool using cost-based, categorial, or weighted-point systems. Many functional departments of the manufacturer, the first-tier, and the second-tier suppliers from this pool are involved in this step. Initially, historical records of suppliers are verified to screen off non-compatible suppliers. Next, a drawing of the part to be localized along with technical documentation is sent to all the potential vendors along with a request for quotation and deadline for submitting the quote. The suppliers would then submit the quote, including an estimated local price for making the specified part, terms and conditions, delivery schedules and quality assurance. The manufacturers then inspect and audit the interested suppliers at their production premises to check their manufacturing processes, quality management systems, materials and component testing and other necessary checks.

While visiting the suppliers, a note of performances with reference to critical evaluation criteria as suggested by (Monczka et al. (2015)as well as the previous section needs to be recorded. To reduce the existing supply base to pave the way for local suppliers, Monczka et al. (2015) suggests four supply base rationalization and optimization approaches.

Based on these criteria, surveys are held for supplier evaluation. Survey development is undertaken by the SCL Team. This typically involves a 7-step process (Monczka et al., 2015). Finally, the most qualified vendor selection is made with the approval of higher management and a letter of intent is issued.

Tooling/Part development

At this stage, the manufacturer checks if the supplier needs tooling development programs and monitors the localization progress through the SCL team. The supplier would choose the trim and final assembly lines to produce local parts and CKD items, while the SCL team keeps a watch on the testing of samples at each stage. Barriers to supplier development, categorized as buyer-specific issues, supplier-specific issues, and buyersupplier interface barriers must be minimized through open-communication, trustworthy managerial attitude, relationship management, competitive advantage realization through business goal orientation, and other best management practices.

Once the tooling development is completed, samples of the localized part are sent to the manufacturer. The manufacturer performs quality, material and fitment tests and other necessary multi-checks to ensure whether the chosen supplier can deliver the required standard of quality. The manufacturer then checks if there is any modification of technical specifications on the localized sample part and sends design changes if any for approval. Detailed study and comparison report of the original part and localized part is made to check the suitability of substitution. Final drawing, technical documentation, quality and inspection standards, terms and conditions and all other paperwork is finalized and approved before the supplier is allowed to enter mass-production of the localized component.

Roadmap for Localization

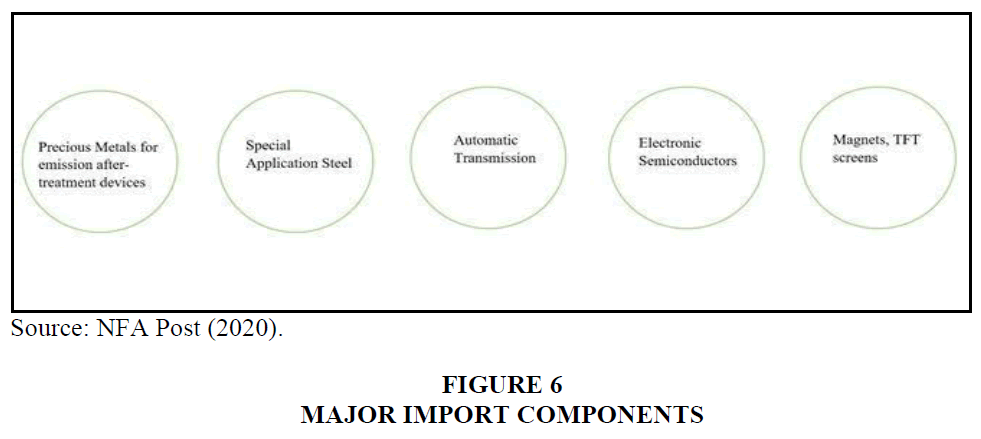

According to the EY India Report on Localization of Automobile Industry in India, the components in Figure 6 were categorized as major imports. In this section we will discuss these components in detail and identify why these components are being imported. Suitable solutions for localization will also be discussed. According to estimates, direct import content for the industry is around 5% and direct imports (supplier components and/or raw material) is around 15%.

Electronic Semiconductor - Roadmap to Localization

India has made previous attempts at building fabrication units for the manufacturing of electric semiconductors needed in the automobile industry. These didn’t pan out due to several reasons, including failure to tie up funding. The greatest barriers were the high venture required and high demand variability.

Initiatives taken by other country governments in this regard include investing the capital. This is apart from various other favors like offering loans at very low rates and tax holidays. India will have to follow these footsteps as only a few companies in India presently have the required balance sheet strength. According to market experts the government can join hands with the high-end business houses in the nation who need not necessarily put up the entire initial capital but can lead with creating a consortium with international partners.

In the electronics industry, the chip in itself is a tiny yet highly invaluable part. The government has announced a production-linked incentive scheme for electronic components.

Special Application steel – Roadmap to Localization

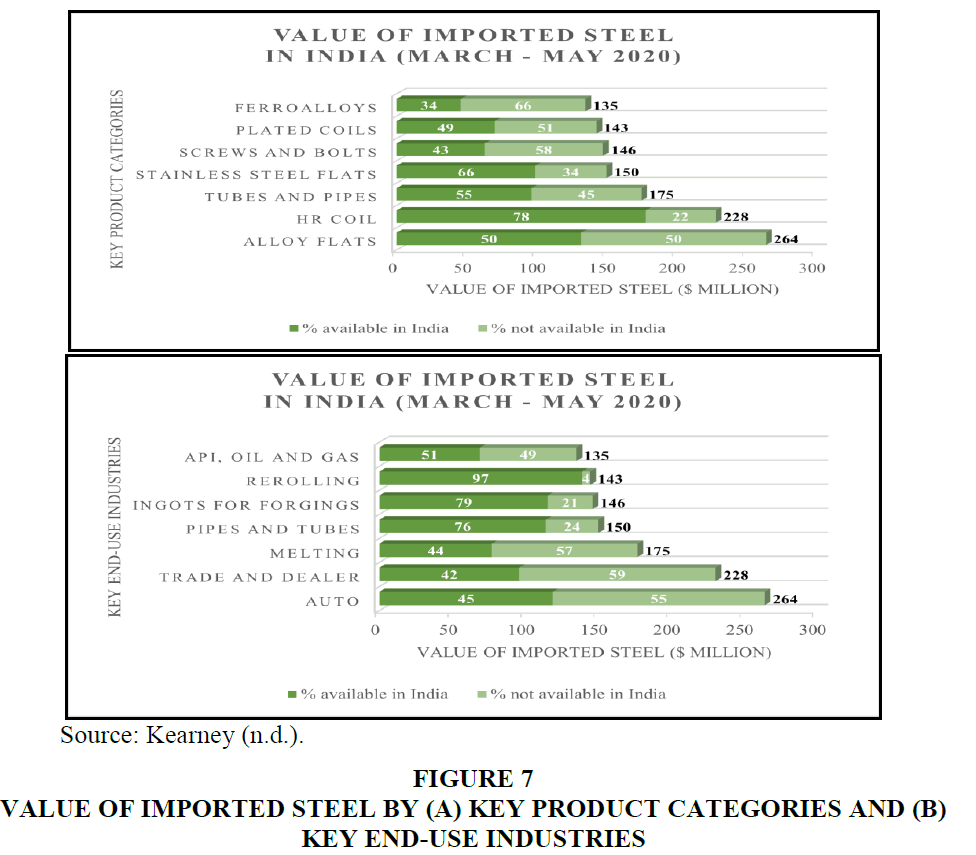

Despite the domestic supply of steel, there is a huge import of steel to India. This import can be attributed to several reasons such as commercial reasons, availability and operational factors, quality, price and availability of steel in such huge quantities. Importers also believe that imported steel matches customers’ quality demand and delivery time. Increasingly importers are attributing lower prices of imported steel as a reason for importing. 29% of importers quoted “unawareness about domestic producers” as the reason for import. The value of imported steel by India during March-May 2020 by key product categories and by key end-use industries is shown in the Figures 7(a) and 7(b) respectively.

To make end users aware about the domestic steel industry, India needs to make information regarding them available to all. India’s industry must build domestic capabilities for HVA production by employing deeper analytics into imports knowledge and SQCO coverage to find required grades and product classes. The Steel Research and Technology Mission of India should be used as an organization to initiate cross-border and cross-industry data sharing to boost HVA production. Initiatives like use of alternate technology for higher furnace productivity ought to be undertaken.

As the world moves toward digital technologies, the industry should be compelled to embrace rising technologies. There will be a requirement for comprehensive industry-level digital infrastructure, together with standardization, digital data management and collaboration with different industries. The Ministry of Steel has taken a step forward by implementing (Steel Import Monitoring System) SIMS. However, the government has to enhance analytics like demand foretelling, insights and linkages across datasets.

Magnets and TFT Screens

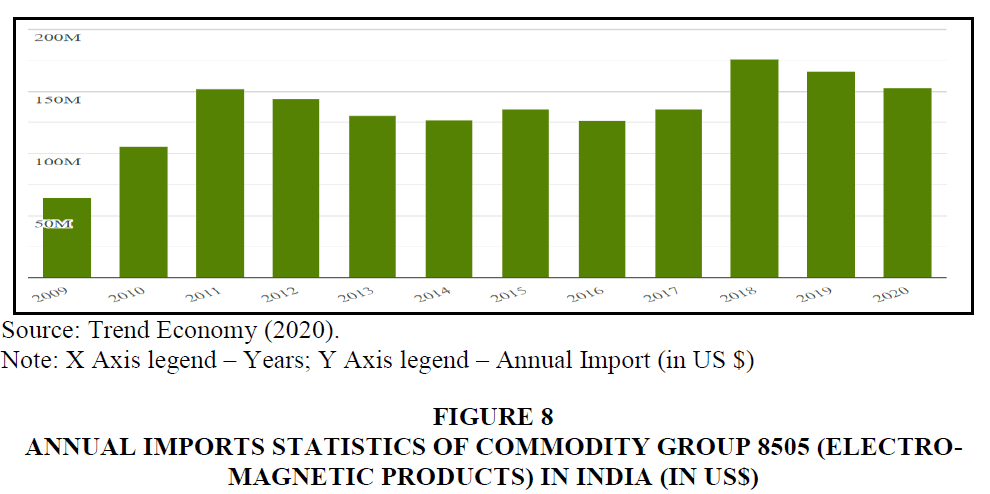

In 2020, India imported $152 million worth of product category 8505 “Electromagnets; Permanent magnets and materials which become permanent magnets after magnetization; clamps, electro-magnetic or permanent magnet chucks and similar holding devices; clutches, electro-magnetic couplings, and brakes; electro-magnetic  lifting heads”.

lifting heads”.

Figure 8 represents the imports structure of 8505 - Electro-magnets; Permanent magnets and materials which become permanent magnets after magnetization; clamps, electro-magnetic or permanent magnet chucks and similar holding devices; clutches, electromagnetic couplings, and brakes; electro-magnetic lifting heads.

Figure 8 Annual Imports Statistics of Commodity Group 8505 (Electro-Magnetic Products) in India (in US$)

Tier-2 suppliers’ technology in India is often found to be inadequate to the counterparts of Japanese and western suppliers. This happened due to a lack of advancement in native and local technology with respect to precision machining, electronics, and machine construction. Precision machining in the order of microns is impossible with the current technological foundation available in India and investing in precision tools and machines requires a large financial investment that most of the Tier-2 suppliers of India cannot afford. Moreover, the import expenditure on these machineries and equipment incurs a high fixed cost which leads to a higher component cost. As a result, the Indian government should take steps to promote domestic manufacturing of electromagnetic components and instate policies to support it.

Automotive Transmission

India is known for importing a wide range of automotive parts from China including transmission and steering, engine parts, suspension and braking, electricals and electronics, cooling systems and interiors of the vehicle. According to company and industry sources, India, like other countries, is dependent on China for goods such as electronic components because it is not feasible to manufacture or source them as cheaply in the country. Hence, any efforts to limit or increase the cost of imports without creating alternatives would damage local businesses.

According to ACMA, the auto-component industry’s worth in India being USD 57 billion has started moving forward toward deep localization to reduce the risk of business from Chinese imports due to the border conflict between the two countries which only serves as a trigger to increase the rate of the manufacturing process. All of the resources were devoted to engine production and model improvements, and transmission technology did not receive the attention or resources it deserved. During this time, China heavily localized all automotive transmission technologies, including DCT, AT, and CVT (The New Indian Express, 2020).

Furthermore, the domestic automotive transmission sector is attempting to reduce reliance on imports from China after experiencing a severe scarcity of essential automotive components as a result of the coronavirus pandemic, as Chinese companies remain the leading suppliers of automotive transmission components. Adding to this, sustained government intervention in the form of a push for infrastructure, which includes residential, commercial, and industrial construction should be maintained.

Precious Metals for Emission After-Treatment Devices

Catalytic converters, which are used by auto-manufacturers to minimize harmful emissions, require platinum, palladium, and rhodium. Prices of rare metals, which serve as catalysts in catalytic converters, have risen dramatically in recent years, many times. This affects the cost of BS-VI vehicles directly, and many OEMs are considering a variety of options to mitigate the impact on the expenditure.

Due to the introduction of stricter BS-VI norms, precious metals, usage in aftertreatment systems is growing. Palladium demand rises as the share of gasoline vehicles rises. The government raised the import duty on these precious metals by 2.5% in the national budget, despite the fact that the cost of these metals is much higher making it a two-for-one deal.

India imports 7-9 tons of platinum, 4-5 tons of palladium, and 1-1.5 tons of rhodium per year.

The prices of these metals have been extremely volatile in recent years as shown in Table 1. It shows the price of the elements per ounce in USD in the period of 2018 to 2020. PT refers to Platinum, PD refers to Palladium, RH refers to Rhodium and FX refers to foreign exchange.

| Table 1 Price Trends of Precious Metals | ||||

| PGM Index - $/Oz | Platinum | Palladium | Rhodium | Foreign Exchange |

| 1st March 2018 | 984.0 | 1049.0 | 1870.0 | 64.5 |

| 1st Mach 2019 | 874.0 | 1545.0 | 2790.0 | 70.0 |

| 1st March 2020 | 865.0 | 2573.0 | 12700.0 | 72.2 |

| 23rd March 2020 | 625.0 | 1655.0 | 6500.0 | 76.1 |

The government of India should encourage Indian manufacturers to develop specific technologies to reduce imports and provide subsidies for the establishment of catalytic converter plants. In addition to this, financial stimulus and alternative financing methods to make the financing options competitive to support the industries.

Conclusion

Global supply chains face severe disruptions during pandemics, disasters, wars and other crises. Manufactures run the risk of closing operations during such crises if the supply of raw materials and components are disrupted. To avert such risks, they should shift their focus on localizing their supply chains through local sourcing in an agile manner.

This paper provides a reinterpretation of a high-level conceptual strategic model for localization that is generally followed by companies seeking to move to local suppliers. Setting up a supply chain localization team (SCL Team) is crucial for ensuring the success of supplier localization strategies. An overview about classification of raw materials to have a conclusive idea on what raw material needs to be localized first. Three strategies frequently adopted by industries have been discussed, namely, ABC classification, Kraljic matrix and Relative Cost Classification. The evaluation of suppliers, mainly through audits and QCD analysis, is a necessary step that cannot be overlooked to ensure the least risk involved in the procurement while ensuring the best raw materials. Evaluation models such as 10C model, McKinsey Matrix method, and SOCCER model along with their relative pros and cons are listed. After finalizing the local suppliers, manufacturers make it mandatory for local suppliers to ensure that their local produce is competent with the imported foreign produce. This is done by establishing strict total quality management systems, tooling and part development programs, and training the local suppliers to maintain global quality standards. Post-localization, SCL team continuously monitors the local suppliers and makes recommendations for performance improvements and cost optimization.

The second half of the paper discusses India's major imports in the automotive sector. It provides a roadmap for localizing each of the components. Recommendations provided by our paper could be utilized for policy makers, local suppliers, OEMs and the automotive sector as a whole to gain world-class competency in the Indian market by shifting to localization.

Our paper provides a conceptual model which has been reimagined in our understanding through various other works of supply chain localization literature. While our model covers up most of the critical procedures involved in the strategic SC localization, the frameworks mentioned are non-exhaustive. However, like any other conceptual idea, verification of this model by implementing it in a real-life scenario is necessary for validation. Herein lies the future scope of our study which is to perform case-study based analysis of various automakers who are localizing their supply chain and drawing parallels with their localization models. Quantitative studies with well-defined metrics are also needed for measuring the success of such localization models so that stronger recommendations can be made.

References

Bohnenkamp, T., Schiele, H., & Visser, M.D. (2020). Replacing global sourcing with deep localisation: The role of social capital in building local supply chains. International Journal of Procurement Management, 13(1), 83-111.

Carter, J.R., & Ferrin, B.G. (1995). The impact of transportation costs on supply chain management. Journal of Business Logistics, 16(1), 189.

Kearney. (n.d.). Rewriting the growth story for India’s steel industry. Retrieved from: https://www.nl.kearney.com/metals-mining/article/?%2Fa%2Frewriting-the-growth-story-for-india-s-steel-industry

Monczka, R.M., Handfield, R.B., Giunipero, L.C., & Patterson, J.L. (2015). Purchasing and supply chain Management. Cengage Learning.

NFA Post. (2020). Atma Nirbhar’ increases localization, export of Indian auto industry: EY India report. Retrieved from: https://thenfapost.com/2020/09/17/atma-nirbhar-increases-localisation-export-of-indian-auto-industry-ey-india-report/

Sollish, F., & Semanik, J. (2011). Strategic global sourcing best practices. John Wiley & Sons.

The Economic Times. (2020). Price drop of precious metals used in auto industry temporary, may rebound soon. Retrieved from https://auto.economictimes.indiatimes.com/news/auto-components/price-drop-of-precious-metals-used-in-auto-industry-temporary-may-rebound-soon/74809748

The New Indian Express. (2020). Indian auto component industry aims to cut dependence on Chinese imports: ACMA. Retrieved from https://www.newindianexpress.com/business/2020/jun/24/indian-auto-component-industry-aims-to-cut-dependence-on-chinese-imports-acma-2160740.html

Trend Economy. (2020). Annual International Trade Statistics by Country (HS02). Retrieved from https://trendeconomy.com/data/h2/India/8505

Volpato, G. (2004). The OEM-FTS relationship in automotive industry. International Journal of Automotive Technology and Management, 4(2-3), 166-197.