Case Reports: 2020 Vol: 26 Issue: 1

A Case Study on Economic Development of Tanzania

Vishwas Gupta, Lovely Professional University

Abstract

The United Republic of Tanzania is one of the East African countries landlocked by 8 different nations has a literacy rate of almost 70% and is growing by 7% of GDP per year. It is a $ 80 billion economy with a per capita income of almost $1700. The nation which has almost 15% of agriculture land offers 80% employment in agriculture area only rest 20% is employed in industries and services. Except agriculture main industries are mining and wood products. The presence of mineral resources, tourism and natural gas has led to an increase in the attraction of foreign investors into the country by 14.5 percent. FDI has covered almost half of the country’s current account deficit and 6.5 percent of its GDP. Investors are attracted due to proper implementation of macroeconomic policies, effectiveness in privatization and amount of natural resources available in Tanzania. The main obstacles to why some investors tend to withdraw capital inflows are lack of transparency, infrastructure, and low development in industrial sector. The following case will highlight the economic development and hindrance faced by Tanzania and how is has overcome and growing rapidly.

Keywords

Tanzania, Economic Development, Trade, Africa, Agriculture, Services, PESTLE Analysis

Introduction

Tanzania is one among the developing countries in the world and is the second largest economy in the East African community. Most people live in poverty meaning they have no access to basic necessities of life. It is estimated that about 34% of Tanzania live in poverty. Tanzania economy is characterized with various sectors which contribute to its development but it largely depends on agriculture as the main backbone of the economy.

Tanzanian currency is called SHILLINGS and the national language is SWAHILI. Trade organizations in which Tanzania is part of include EAC (East African Community), SADC (South African Development Countries), African Union and WTO (World Trade Organization). Despite being the poorest economy in terms of per capita income the overall growth rates is due to development of tourism sectors and gold mining (Juma et al., 2016).

In the ease of doing business, Tanzania is ranked at 131 recording its annual inflation rate at 6.1 early this year. The main industries are agriculture processing Industry and mining. Export and import trade prevail in the economy as Tanzania exports consumer goods and imports capital goods. The main export commodities include gold, tobacco, fish products, coffee, cotton, diamonds, sisal and horticulture. Main trading partners are China, Switzerland, South Africa, India and Kenya. Consumer goods and capital goods are the main imports into the country (Kasidi & Mwakanemela, 2013).

Teaching Objectives

The case will explain the learners the various concepts of economic development, the minute details of economic history of Tanzania and scope of development in various sectors. The case can be ideally positioned for a micro or macro-economics class of UG or an introduction to or analyzing the business environment class for MBA I term. The case can be used with an audience of UG and MBAs participants:

Mapping of Concepts

1. Macro and Micro Economic Variables

2. PESTEL Analysis

Demography of Tanzanian Economy

The United Republic of Tanzania in Table 1 is the 31st largest country in the world and 14th in Africa. It is bordered by countries such as Kenya, Uganda, Rwanda, Burundi, Zambia, Malawi and the Republic of Congo. Its capital city is Dodoma which is the De jure and the largest city is Dar Es Salaam which is the De facto.

| Table 1: Religious Population Of Tanzania | ||

| Religion | Population | % |

|---|---|---|

| Christian | 31191200 | 61.4 |

| Muslims | 17881600 | 35.2 |

| Folk Religion | 914400 | 1.8 |

| Others | 812800 | 1.6 |

| Total | 50,800,000 | 100.00 |

0 Source: Global Religious Futures.

Population is unevenly distributed and areas such as the Northern parts and Eastern coastal parts are sparsely populated. Rural population accounts to about 70 percent although it seems to be declining because many people migrate to urban areas. Tanzania being the mainland it has an Island called Zanzibar.

As of 2015, total population is about 50.8 million while 2014 estimates show that total population was about 49,639,138. Low population, high death rates and low life expectancy are the effects of HIV/AIDS and Malaria which affects the total population in the country. Total dependence rate is at 92.4. Tanzania is ranked at 26th in the world with 947,300 square kilometers of land. Due to high birth rates in the country, total population is estimated to be at 51 million. 44% constitutes population under the age of 15, 52 % between 15 and 64 and 3.1 % is above 64. There are 120 ethnic groups since the population is well diversified, Sukuma being the largest ethnic group constituting about 16% of total population in Tanzania.

As of October 24th, the total population was at 54,841,035 compared to that of 1st July, 2015 which was at 52,290,795.

History of Tanzania

Tanganyika and Zanzibar united to form Tanzania on 26th April 1964 which was under the late President Mwl. Julius Kambarage Nyerere of Tanganyika and Abeid Amani Karume of Zanzibar, whereby Tanganyika got its independence on 9th December 1961 and Zanzibar’s revolution was on 12th January 1964. The first president of Tanzania was Mwl. Julius Kambarage Nyerere, He introduced a system called ujamaa (socialism) meaning family hood where by all means of production were owned and shared all community members. The ujamaa system came about as a need of development published under the Arusha Declaration which put emphasis on agriculture at national economy and introduction of villages.

Economic development has been showing slow growth rates during 1980s due to poor education, low level of technology and the dependence on foreigners and largely depended on agriculture through export of cash crops such as cotton which was grown on plantations.

Great importance was given on education and literacy rate during Mwl. J.K Nyerere rule. The government adopted a structural adjustment program so as to eliminate the Ujamaa system and therefore encouraging the involvement of private sector in the economy. The program had various policies which aimed at removal of trade restrictions, improving monetary control and reforming the financial sector as a way of liberalizing the economy. This paved way for foreign and domestic Investments. Even after Independence during 1980s, Tanzania economy was still facing corruption and heavy debts. The second President of Tanzania Hon. Ali Hassan Mwinyi privatized business and encouraged foreign investment which led to a steady growth of the economy. In 2008-2009 there was an economic slump in which Tanzanian economy was badly affected. The IMF extended aids so as to help the country out of the global economic crisis (Tanzania Invest).

Despite aids and grants from the IMF, Tanzania is still dependent on foreign countries due to serious debt. It has an external debt of about $USD 7.9 billion and the debt servicing constitutes about 40% of the government expenditure. In order to repay this debt, the country is forced to qualify for loans from other countries.

Economic Overview

Despite being one of the poorest economies Tanzania has achieved overall growth rates basing on production of gold mines such as the famous Geita gold mine in Mwanza and also basing on the tourism sector which acts as a source of attraction of investors into the country. Some of the sectors which contribute to the economic development of Tanzania include mining, agriculture, banking and financial sectors, telecommunication sector, energy and industrial service.

The government of Tanzania encourages development through promoting investment of these sectors at large. The economy mainly depends on agriculture which absorbs about one quarter of the GDP (Gross Domestic Product). Some international donors such as the IMF and WB have provided several funds so as to help boost the economy of Tanzania taking into consideration the infrastructure sectors such as railways, ports, roads and pipelines which are important trade links for inland country. These donors have encouraged positive growth of the economy because they have been able to make important economic structural reforms in various sectors example the financial sectors (Wheeler et. al., 2017).

As of 2014 the country was estimated to have a population of about 49 million and poverty still being a problem because a lot of people live in hardships. A big percent of citizens still live below the poverty line. Rural areas have no access to education and knowledge about the banking and financial services. Nonbanking financial Institutions and non-governmental organizations play a key role in provision of free education to people especially women in the rural areas so as to make them aware of what is going on in the economy.

The improvement of the banking systems in urban areas has enabled growth rates and investment although interest rates are still high in the country. Regions such as Dar Es Salaam was able to loosen its monetary policy.

The overall micro economic performance remained strong as the real GDP grew by 7.3% in 2013 and it fell to 7.0% in 2014 where by construction, trade, transport, tourism and agriculture were the main contributors of economic growth through increase in revenue during these two years. In 2011 inflation was seen to be at 20% and by January 2015 it fell to 4% reasons being decline in global food, energy prices and the rising local food prices. Nonalcoholic beverages inflation rate has also reduced to 10.2% from 10.6% and the annual inflation rate excluding food and energy has increased to 2.2% from 2.1% which made the inflation rate to stabilize at 6.4% in July and August 2015 according to the National Bureau of Statistics.

Tanzanian shilling has lost value against various major international currencies one being the US dollar since January 2015. This has caused a nominal depreciation rate of more than 20% and it has reflected the strength of the US dollar on the international markets leading to a decrease in foreign capital inflow into the country. Cost of importing goods has also become high while balance of payment is still stable with the current account deficit at 10% of GDP. Due to a decrease in oil prices on international markets balance of payments has decreased to 9.5%.

Politically, Tanzania is a multiparty system country with a stable and democratic government under the President Hon. Jakaya Mrisho Kikwete who is concluding a second five year term this October when general elections are to be conducted. It maintains peace, harmony and stability under the CCM government which has made it favorable towards the foreigners. Presence of a stable government has attracted many foreign investors from different countries such as China, United Kingdom and Switzerland. This has made Tanzania maintain various international relations.

Human Development Index in Tanzania

1. HDI is a tool developed by the United Nations to measure the country’s level of economic and social development basing on three indicators which are life expectancy at birth, mean years of schooling, expected years of schooling and GNI per capita. The value of HDI in 2013 was 0.488 making the country rank 159 out of 187 which is the lowest HDI in the development of a country. GDP per capita was at 600.66 US dollars in 2014 in Tanzania.

2. Life expectancy at birth:

3. This refers to the number of years a newborn baby would expect to live if prevailing patterns of age specific mortality rates at the time of birth stays the same throughout the infant’s life. According to World Bank report, life expectancy at birth measured in 2013 total population was 61.24 years and in 2014 estimates were 59.91 years for male and 62.62 years for female.

4. Mean years of schooling:

5. This refers to the average number of years of education received by people ages 25 and older converted from education attainments levels using official durations of each level.

6. Expected years of schooling:

7. It is the number of years of schooling that a child of school entrance age can expect to receive if prevailing patterns of age specific enrollment rates persist throughout the child’s life. Whereby in Tanzania school age entrance is 7 years old for all the children.

8. Gross National Income:

9. It is the gross national income divided by the midyear population. It also refers to the aggregate income of an economy generated by its production and its ownership of factors of production, less the income paid for the use of factors of production owned by the rest of the world, converted to international dollars using PPP rates divided by the midyear population. 2014 estimates show that GNI was at 4.8%.

10. The status of Tanzania on achieving school enrollment and reducing mortality rates is still not impressive as people are still under low living standards with low incomes inequality, inadequate education level, technology is low resulting to low level of productivity, dependency burdens and limited information.

Economic and Non-Economic Factors That Have Led To Tanzanian Development

Foreign Trade

The development of trade in Tanzania has been a key role in eradicating poverty in the country since private sector controls the growth of the national economy. Major imports include capital goods, intermediate goods and consumer goods. Major trading partners are USA, China, Norway, UK, Finland, Kenya and Zambia. Trade has led to attraction of foreign investors due to the availability of political stability and natural gas discoveries. Natural gas exploration about 55 trillion cubic feet has been discovered and this will help supply electricity in the country. It has risen to 14.5% making Tanzania the leading destination of FDI and it is ranked as 131 out of 189 countries this year after FDI covered almost half of its current account deficit and 6.5% of its GDP which is shown in Table 2.

| Table 2: Us And Tanzania Foreign Trade In Usd Dollars | |||

| YEARS | EXPORTS | IMPORTS | BALANCE |

|---|---|---|---|

| 2011 | 260.2 | 59 | 201.2 |

| 2012 | 245.4 | 114.9 | 130.5 |

| 2013 | 412 | 70.3 | 341.6 |

| 2014 | 302.2 | 86.1 | 216.1 |

| 2015 | 117.6 | 79.8 | 37.8 |

Government Policies

Tanzanian government is made up of various policies which are set out to guide, rule and solve any social, political and economic problems. Good governance, transparency and accountability are leading principles of the government. Its policies are such as Trade policy, National Health policy, and Mineral policy of Tanzania, Education and Training policy. Financial sector policy, Agricultural and livestock policy, National Investment policy and child development policy. Implementation of these policies has led to the development of Tanzania.

Corruption

It is a noneconomic factor which create gap among the Tanzanians people. Good governance is essential for the reduction of poverty and controlling corruption in the country. Tanzania faces both grand and petty corruption due to weak government laws in different agencies. Most of the foreign investors have stated that corruption in areas like taxation; custom service and procurement create a difficult environment for them to do business in the country due to high demand of bribery. The government has made a special body which deals with controlling corruption in the country it is called Prevention of Corruption Bureau (PCB).

Human Resource

It refers to a set of individuals who make up the work force of an organization or an economy through application of skills, knowledge and motivating people towards achieving development of the economy. Human resource also includes technology, health care, investment and literacy rates. Poor human resource will ultimately lead to low level of productivity hence poor per capita income. It is considered as an important factor of economic development since man provides labor power for production and if labor power is efficient and skilled it will contribute to economic growth.

In Tanzania, human resource is facing various challenges especially in the health sector making it difficult to achieve economic development as workers cannot work with poor health conditions. In other word there is shortage of not only qualified health workers but also unskilled and uneducated workers. Therefore, the government has to ensure enough support to the workers through establishment of resource and health care projects so as to promote active participation of workers.

Sectors Promoting Economic Development of Tanzania

Agriculture

It is the main economic activity of the economy contributing about 26% to the GDP and employing about 75% of labor force. Agriculture being the key sector of the economy it assists in poverty reduction especially in the rural areas where most people cannot afford to buy food and have no food security. Not only does it provides employment opportunities but also provides 95% of food to the people. During 1990s agriculture was mainly controlled by the government but after liberalization of the economy many people engaged freely in this activity. In 2001 and 2002 it was seen to contribute at around 5% to the GDP of Table 3.

| Table 3: Dataset: African Economic Outlook | ||||||||||||

| Country | Tanzania | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| Indicator | ||||||||||||

| Table 1 - Macroeconomic Indicators | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. |

| Real GDP Growth | .. | .. | .. | .. | .. | .. | .. | .. | 6.4 | 6.9 | 7 | 7.2 |

| Real GDP per capita growth | .. | .. | .. | .. | .. | .. | .. | .. | 3.4 | 3.9 | 3.9 | 4.2 |

| CPI inflation | .. | .. | .. | .. | .. | .. | .. | .. | 12.7 | 16 | 7.9 | 5.8 |

| Budget balance % GDP | .. | .. | .. | .. | .. | .. | .. | .. | -6 | -4.6 | -5.8 | -5.2 |

| Current account balance % GDP | .. | .. | .. | .. | .. | .. | .. | .. | -11.9 | -14.2 | -13.7 | -15 |

| Table 2 - GDP by Sector (percentage) | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. |

| Agriculture, hunting, forestry, fishing | .. | .. | .. | .. | .. | 29.7 | .. | .. | .. | 28.7 | .. | .. |

| Mining and quarrying | .. | .. | .. | .. | .. | 3.7 | .. | .. | .. | 3.8 | .. | .. |

| Manufacturing | .. | .. | .. | .. | .. | 8.6 | .. | .. | .. | 9.2 | .. | .. |

| Electricity, gas and water | .. | .. | .. | .. | .. | 2.3 | .. | .. | .. | 2.4 | .. | .. |

| Construction | .. | .. | .. | .. | .. | 8.5 | .. | .. | .. | 8.9 | .. | .. |

| Wholesale and retail trade, hotels and restaurants | .. | .. | .. | .. | .. | 15.7 | .. | .. | .. | 16 | .. | .. |

| Transport, storage and communication | .. | .. | .. | .. | .. | 7.3 | .. | .. | .. | 8.3 | .. | .. |

| Finance, real estate and business services | .. | .. | .. | .. | .. | 11.2 | .. | .. | .. | 10.1 | .. | .. |

| Public Administration, Education, Health & Social Work, Community, Social & Personal Services | .. | .. | .. | .. | .. | 9 | .. | .. | .. | 8.6 | .. | .. |

| Other services | .. | .. | .. | .. | .. | 3.8 | .. | .. | .. | 4 | .. | .. |

| Gross domestic product at basic prices / factor cost | .. | .. | .. | .. | .. | 100 | .. | .. | .. | 100 | .. | .. |

| Table 3 - Public finances (percentage of GDP) (a) | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. |

| Total revenue and grants | .. | 18.5 | .. | .. | .. | .. | 20.1 | 20.6 | 21.6 | 21.8 | 21 | 20.3 |

| Tax revenue | .. | 10.3 | .. | .. | .. | .. | 13.5 | 13.9 | 14.4 | 14.6 | 14.1 | 13.9 |

| Oil revenue | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. |

| Grants | .. | 10.3 | .. | .. | .. | .. | 13.5 | 13.9 | 14.4 | 14.6 | 14.1 | 13.9 |

| Total expenditure and net lending | .. | 21.4 | .. | .. | .. | .. | 27.5 | 27 | 26.2 | 27.6 | 26.2 | 25.2 |

| Current expenditure | .. | 14.2 | .. | .. | .. | .. | 18.8 | 19.2 | 17 | 18.7 | 17.1 | 16.3 |

| Excluding interest | .. | 13 | .. | .. | .. | .. | 18 | 18.2 | 15.9 | 17.3 | 15.4 | 14.6 |

| Wages and salaries | .. | 3.7 | .. | .. | .. | .. | 5.7 | 6.7 | 6.6 | 6.9 | 6.2 | 5.9 |

| Interest | .. | 1.2 | .. | .. | .. | .. | 0.8 | 1 | 1.1 | 1.4 | 1.7 | 1.7 |

| Primary balance | .. | -1.8 | .. | .. | .. | .. | -6.6 | -5.4 | -3.5 | -4.4 | -3.5 | -3.2 |

| Overall balance | .. | -2.9 | .. | .. | .. | .. | -7.4 | -6.4 | -4.6 | -5.8 | -5.2 | -4.9 |

| Table 3 - Current Account (percentage of GDP) | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. |

| Trade balance | .. | -7.6 | -9.3 | .. | .. | .. | -13.4 | -12.1 | -19.8 | -15.3 | -16.2 | -17.5 |

| Exports of goods (f.o.b.) | .. | 11.1 | 11.8 | .. | .. | .. | 13.6 | 18.6 | 21.2 | 21 | 18.6 | 17.3 |

| Imports of goods (f.o.b.) | .. | 18.7 | 21.2 | .. | .. | .. | 27 | 30.7 | 41 | 36.3 | 34.8 | 34.8 |

| Services | .. | 1.2 | 0.4 | .. | .. | .. | 1.5 | 1.3 | 0.6 | -0.9 | 1 | 1.5 |

| Factor income | .. | -0.9 | -0.7 | .. | .. | .. | -0.3 | -1.3 | -1.1 | -1.1 | -1.4 | -1.5 |

| Current transfers | .. | 4.6 | 3.5 | .. | .. | .. | 3.3 | 4.2 | 4.1 | 3.1 | 2.9 | 2.5 |

| Current account balance | .. | -2.8 | -6.1 | .. | .. | .. | -9 | -7.8 | -16.2 | -14.2 | -13.7 | -15 |

| Figure 1 - Real GDP growth | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. |

| Real GDP growth (%) | 6.9 | 7.83 | 7.37 | 6.74 | 7.15 | 7.44 | 6.02 | 7.04 | 6.45 | 6.42 | 6.91 | 7 |

| Northern Africa (%) | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | .. |

| Africa (%) | 5.69 | 5.24 | 6.12 | 5.9 | 6.21 | 6.5 | 3.07 | 4.97 | 3.49 | 6.56 | 4.82 | 5.26 |

Source: www.oecd.org.

Many farmers tend to produce both food and cash crops. These include; rice grown in the western side of Dars Salaam and Mbeya region mostly, maize, sorghum, wheat, millet, cashew nuts, cotton, coffee, tobacco, rubber, tea, banana, paddy, sisal and cocoa. Export earning commodities include cloves, sisal, coffee, cotton and tea while the rest are mainly for consumption purpose. Some areas receive enough rainfall throughout the year making it easy for cultivation while other areas are prone to tsetse flies which badly affect production of crops. Crops such as millet and sorghum are drought resistant crops hence in case of drought periods production is still high (Gupta, 2012).

Most farmers are small holders of farms cultivating small pieces of land and do not have access to financial services or banking facilities especially the rural farmers. Lack of access to banking sector makes it difficult for farmers to obtain loans so as to carry out their production as only 9% have access to financial services and 4% only are able to obtain loans. Small holder farmers have low education and knowledge resulting to poor quality of crops. This causes the crops to fetch low prices in the markets (Ebohon, 1996).

Tanzania depends on export of cash crops which increases revenue. The main exported commodity is coffee since the 20th century and each year 30 to 40,000 metric tons are being produced where by 30% is Robusta and 70% is Arabica. About $115 million is generated from export of coffee. Coffee consumption is at 7% of total production in the national output (Gupta & Bose, 2019).

The Tanzanian Coffee Board (TCB) regulator stated in a report this October that demand for coffee has increased especially Arabica coffee in the New York markets. The economy is said to receive about $60 million dollars each year from exportation of coffee. Tanzanian Coffee production is projected to increase by 25% in 2016 recording about 1.2 million kg bags due to favorable weather with Italy and Japan being the major destination of coffee exports.

Cotton is another major exported cash crop in Tanzania. In 2013 it was seen that tobacco export contributed to about USD 356 million. Total exports crops from Tanzanian industries contribute to 30% and raw materials is at 65%.

According to UNESCO (United Nations Educational, Scientific and Cultural Organization 24% only out of 44 million hectares of land have been utilized for cultivation of crops and existence of water resources, favorable climatic condition and fertile lands have led to a decrease in poverty condition.

Kilimo Kwanza is a government program which was established by the President Jakaya Kikwete in 2009 for the aim of transforming the Tanzanian agriculture. It is mainly concerned with promoting agriculture sector through utilizing modern farming methods in order to improve production. It assists Tanzanian farmers to access markets for their products.

Livestock industry is another major agricultural activity in Tanzania. From total amount of agriculture GDP, 30% is from livestock industry and 5.5% from all household’s income. Livestock includes cattle at 18.8 million, pigs at 1.6 million, sheep and goats. Animal exports products have generated about USD 223 in 2013 due to established partnership between Europe and small scale commercial farmers in Tanzania who carry out livestock activity. Beef constitutes about 40% and 30% is from milk.

Challenges facing the agriculture sector include;

1. High rainfall dependency and low irrigation process

2. Lack of agricultural knowledge and low level of technology such as use of ploughs.

3. Lack of financial access so as to obtain farm inputs example chemical fertilizers and pesticides.

4. Low quality of agricultural produce resulting to crops fetching low market prices.

5. Lack of storage facilities and poor infrastructure in the rural areas making it difficult to transport commodities to be processed and sold.

Despite the above challenges, a small number of organized farmers have attracted a greater percentage of FDI inflows such as sisal, sugar and barley production. Macro finance bank provides support to the agriculture sector as well as the President of Tanzania. He encourages investment in agriculture so as to boost development of the economy. Tanzania Agriculture Development Bank is a bank established in 2015 by the government in order to ensure implementation of agricultural policies and strategies guiding the performance of the sector in general (Moshi & Kilindo 1999).

Industry and Construction

This is another major contribution to the economic development of the country. It includes mining, quarrying and manufacturing industry

Mining Industry

It was originally owned by the government. During 1980s and 1990s private ownership of mines was introduced due to the presence of foreign enterprises. About one million people were employed in the mining sector by 2008. By 2011 the mining sector contributed to about 2.1% to the Tanzanian economy. US $45 million was then injected into the economy by the World Bank for the aim of improving the small scale mining industry in rural areas.

Mining is one of the fastest growing sectors in Tanzanian economy. In 2013 it contributed to about 3.3% to the country’s GDP. It has largely changed the economic growth of Tanzania. The country is endowed with various mineral resources such as gold, diamonds, gemstones, nickel, coal, tanzanite and uranium.

Some articles claim that mining is the leading sector in Tanzania since its export values tend to increase every year due to the presence of the mineral resources gold being the number one exported mineral. It is the 4th largest producer of gold in Africa. Investment opportunities are quite open in the mining sector as many investors from different parts of the world are investing in the gold mines.

UK, India, China, USA, South Africa, Kenya, Netherlands, Oman, Canada and Germany are the main investors in Tanzanian mining sector.

About 130.2 million tons of gold reserves are available in Tanzania and between the year 2013 and 2015 it is predicted that the average annual growth in the mining sector will be 7.7% because minerals contribute to about 52% of the country’s exports gold being the leading export. Tanzania aims at ensuring that the sector contributes to about 10% in 2025.

Acacia mining is a company owning three gold mines in Tanzania. Its Chief Executive Officer reported that gold production has increased to 181,660 ounces in 2015 compared to 2014 as the production was 168,375 ounces. Gold production has therefore increased by 8%. This has boosted the economic status of the country.

Impacts of the Mining Sector in Tanzania;

Silica dust affecting the miners as well as tuberculosis disease.

Existence of illegal mining in the country creating risk to the workers.

Example the previous Minister of Mining and Energy resource was found guilty after conducting frauds deals and supplying gold to some firms.

Child labor employed in mines.

There was a serious case in 17th April 2015 were by 19 people were killed after the collapse of an illegal mine near the Bulyanhulu Gold mine in Kahama district. Many children were rescued from the same collapse.

Service Sector

The service sector contributes to about 49% to the country’s GDP as revealed by the UNCTAD (UN Conference on Trade and Development) economic development report despite being ignored in the past years. 21% of the Tanzanian population is employed in the service sector including the financial and banking sector. Other subsectors such as telecommunication service and transport have also been developed since 2009 to 2012.

In order to increase the revenue of the country, Tanzania should make reforms in its tax administration system by promoting transparency, fair and affordable systems of collecting tax from citizens and economic sectors.

Tax revenue contribution to Tanzanian economy is about 12% and it is considered to be lower compared to other economies. In 2014 6 billion US dollars were donated into the country but then this was not sufficient to cover up investment in the service sectors despite government spending on such sectors.

The following are some of the service sectors in Tanzania;

Banking sector

Telecommunication and

Transport service.

Banking Sector

Bank of Tanzania (BOT) is the central bank of the country responsible for maintaining price stability as well as issuing the Tanzanian shillings including notes and coins. The banking sector largely contributes to the economic growth of a country. Banking sector in Tanzania facilitates efficiency in credit allocation and increasing financial competition. This made it register large growth for the past few years. The financial market comprises of commercial banks, bureaus de change, financial institutions and merchant banks. 56 banks were licensed in March 2015.

Tanzanian famous banks include;

CRDB

EXIM BANK

NMB

NBC

According to the BOT report, total assets of the banking sector were 19,522.92 billion in 2013, a growth of 14.95% from TZS 16,984.49 billion in 2012. Total deposits also increased to 13.46% from 2012 and total capital was at 19.41%.

Rural areas in Tanzania do not have access to the banking sector because people do not own valuable assets which would support loan extensions. They also lack education on how banks operate.

Economic outlook of the banking sector is still positive due to economic growth despite having high interest rates. Mobile money service has acted as the key role in boosting the banking sector. Foreign owned banks add up to 48% of the total assets in the banking industry and the stiff competition among the commercial banks has led to improvements in quality of financial services.

Financial System of Tanzania

The money related area in Tanzania has experienced generous basic change since the 2003. Monetary segment resources have extended quickly drove by development in private credit. This has upgraded money related intermediation, subsequently progressively supporting financial development. The usage of the Second Era Money related Division Changes, attracting part on proposals from 2003, has supported these advancements. However the financial framework stays little and generally wasteful, and access to fund stays low. Just one of every six Tanzanians approaches budgetary administrations from formal establishments, which analyzes inadequately to the nation's friends. While effectiveness is low, gainfulness stays solid because of wide intrigue edges. These persevere as littler banks have been not able contend successfully with the bigger banks, which are capable, through their increasingly broad branch systems, to raise assets effortlessly.

While foundational chance seems contained, vulnerabilities in the monetary division have elevated. Quick credit development has been raising the proportion of private segment credit to GDP (Gross domestic product) and related credit chance. With regards to the worldwide downturn, the fundamental weakness lies in exposures to bothered parts (for the most part money harvests, the travel industry, and transportation). Fixation in the advance portfolio is likewise of worry, as stress tests show that disappointment of their separate biggest indebted individuals would direct various banks to require extra capital. Still the shortcomings stay in supervision, remembering for requirement and prudential information assortment and examination. The system for banking supervision has been improved (counting by putting it on a hazard based balance), yet the crucial proceeding with consistence holes with the Basel Center Standards (BCPs) for Powerful Financial Supervision. Supervisory procedures keep on not be completely hazard based, nearby examination discoveries regularly need satisfactory documentation and implementation is feeble, bringing about blended consistence in with prudential prerequisites. Under-provisioning seems far reaching, despite the fact that the crucial examination (hampered by fragmented information) shows that banks would require just restricted extra funding to consent completely with the provisioning guidelines. Additionally, holes in prudential information assortment and examination forestall a far reaching appraisal of fundamental and individual dangers in the money related part and the specialists are asked to address these holes with criticalness.

Significant emergency, the executives instruments and segments of a monetary security net are set up, yet significant inadequacies exist and are being tended to by the specialists. The emergency the board structure seems satisfactory for goals of individual banks, yet less so for a broad emergency. Deficient spotlight on foundational chance, the absence of an instrument for infusing crisis liquidity, and an underfunded Store Protection Reserve could exacerbate a budgetary stun and ought to be tended to. With Store specialized help, the specialists are making improvements to emergency readiness that incorporate point by point alternate courses of action, an unequivocal structure for foundational crisis liquidity help and recapitalization, institutional game plans for participation among government offices, and normal emergency reenactment works out.

Foundational liquidity the board has improved, yet there is degree for additional fortifying. The operational system has been explained, with offers of remote trade and government protections as the fundamental instruments for evacuating basic infusions of liquidity coming about because of outside spending support, yet a more clear differentiation is required among sanitization and intercession goals in return showcase tasks. Endeavors have been made to improve liquidity anticipating, and conditions in the currency showcase have gotten less unpredictable, despite the fact that this is somewhat because of abundance liquidity in the framework.

Capital market improvement, still at an early stage in Tanzania, is significant for expanding access to long haul subsidizing and giving appropriate positions to institutional financial specialists. Tanzania's security showcase stands to profit impressively from nearer combination in the East African People group (EAC), which will permit economies of scale and sharing of market foundation. Fruitful execution of current intends to change capital streams require legitimate sequencing of changes and usage of supporting arrangements. Change of the benefits division-and especially bringing the Government managed savings Administrative Authority into activity immediately-will be pivotal, both to forestall amassing of potential monetary liabilities and to give a steady wellspring of longer-term financing.

Telecommunication Sector

Tanzania communication sector has also played a significant role towards the social and economic development of the country. It was formerly known as TPTC (Tanzanian Posts and Telecommunications Corporation) which acted as the monopoly and later when communication sectors were fully liberalized by the government TPTC was divided into TTCL (Tanzania Telecom Company Limited) and TCC (Tanzania Communication Commission). Today the sector contributes to the country’s growth after expanding its cellular services, radio networks as well as the internet services.

Mobile companies operating in Tanzania

1. Airtel

2. Vodacom

3. TTCL

4. Zantel

5. Tigo

Cellular services have also promoted the use of money services among the mobile network and users such as Vodacom- Mpesa, Tigo pesa and Airtel money transfer. A fast-developing source of revenue is collected from mobile money transfer and money banking services through mobile networks.

Vodacom network in Tanzania is planning to spend almost USD 100 million to expand its network in rural areas. This will boost the development of infrastructure and power supply in the rural areas. In 2013, Airtel estimated that about 10% GDP is from mobile service. Most of the foreign investors and operators tend to withdraw from investing in Tanzania due to high import tariffs and high taxes on cellular facilities by some authorities.

Viettel Group is the largest Vietnam mobile network, the brand name Halotel who has invested in Tanzania. The focus has been directed towards setting up of mobile networks in more than 4000 villages so as to improve rural development and effective communication. The aim is to ensure that people transform into more innovations. The company is set out to provide free instruments to public schools.

It is important to invest in information technology and communication sectors because this would assist in controlling challenges in tax collection by the TRA (Tanzania Revenue Authority) among the formal and informal sectors. Investment in mobile networks will reduce revenue gap because revenue will increase and corruption problem will be controlled since customers and customs officials will not be able to meet.

Transport Sector

Transport is very important in any economy in order to facilitate smooth trade. Tanzanian roads are maintained under the management of an agency called TANROADS “Tanzanian Roads” which has been able to improve the national roads. Road safety still remains a major problem due to poor maintenance of vehicles, overloading and poor driving.

TATOA is an example of a famous truck company which facilitates transportation of goods in and out of the country so as to smoothen trade among SADC country. Drivers ensure safe handling of goods from delivery to the destination. Transport sector includes airway, railway and water networks. Tanzania has a total of 28 airports with J.K Nyerere being the largest airport. The main Tanzanian railway is known as TAZARA which was formerly called Tanzanian railway. It facilitates transportation of bulky goods to different countries including Uganda, Kenya and Zambia. Marine transport in Tanzania is managed by Tanzania Ports Authority (TPA). Mtwara, Dar es Salaam and Tanga are some of the famous ports in the country which facilitate imports and exports. Example when importing cars from Japan Dar es Salaam port is used. Citizens have to pay tax for the importation of cars and therefore leading to an increase of the country’s revenue.

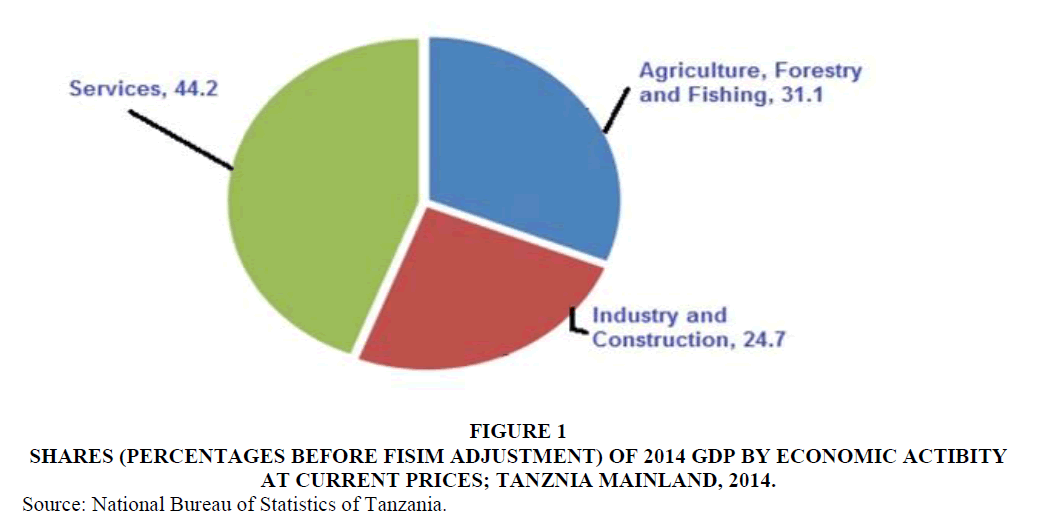

Tanzania is planning to import about 138 Chinese modern buses into Dar es Salaam. This is due to the support provided by the government through improvement in marine transport by modernizing ports and efforts of spending in infrastructure. The port currently collects over TZS 40 billion per month. If it is maintained efficiently it will determine the price of goods and services since it can minimize transport cost. Therefore, an improvement in the transport sector will lead to economic development by promoting competition. The government should make efforts to ensure budget allocation to this sector in Figure 1.

Figure 1:Shares (Percentages Before Fisim Adjustment) Of 2014 Gdp By Economic Actibity At Current Prices; Tanznia Mainland, 2014.

Source: National Bureau of Statistics of Tanzania.

Tourism Sector

This sector is comprised of national parks, game reserves and luxurious resorts by the beach. They tend to attract foreigners leading to an increase in the foreign exchange. It is the second pillar of the Tanzanian economy as it provides employment to many jobless people. The development of tourism has led to the improvement of infrastructure in regions with tourist attractions. Tanzania expects about 750000 tourists to arrive in the country generating about 950 dollars. This sector is expanding rapidly three times the contribution of agriculture. Share of GDP contribution from tourism is 12.1 percent according to World Travel and tourism Council Data in 2015 (Reuters Africa).

Conclusion

The economic development of Tanzania is seen to be a slow progress pushed by the development of its contributing sectors and adding to the country’s GDP. The government should therefore encourage investment in priority sectors such as tourism and agriculture and ease restrictive policies such as lower tariffs and import taxes on trade. This will encourage flooding of more foreign investors into the country promoting economic development. Rural areas should also be checked by establishing various programs which assist in reducing poverty and provision of free education on banking and financial facilities.

Teaching Notes

Questions

Q1. Why is Tanzania the leading destination of FDI?

The presence of mineral resources, tourism and natural gas has led to an increase in the attraction of foreign investors into the country by 14.5 percent. FDI has covered almost half of the country’s current account deficit and 6.5 percent of its GDP. Investors are attracted due to proper implementation of macroeconomic policies, effectiveness in privatization and amount of natural resources available in Tanzania. The main obstacles to why some investors tend to withdraw capital inflows are lack of transparency, infrastructure, and low development in industrial sector. Majority of investors are in mining, oil and gas. These include China, South Africa, UK, Canada and Europe.

Q2. What are the main sectors that contribute to the economic development of Tanzania?

Agriculture and tourism are considered to be the main sectors contributing to the economic development of the country. Agriculture is considered to be the mainstay of the economy as it provides employment to about 75% of labor force. Not only does it provide employment but also 95% of food to the population. Most people are engaged in agriculture so as to provide food for their families and obtain income from cash crops. The government of Tanzania has largely invested in agriculture through agricultural products from the farmers to the industries. Agriculture sector tends to export cash crops and the leading crops include coffee and cotton. Exportation of these crops generates revenue and increase in foreign exchange in the country. Some banks provide loans to the farmers so as to undertake the agricultural activities by purchasing farm inputs such as chemical fertilizers. This has generally increased the living standard of people by reducing poverty especially in rural areas. Therefore, it is the main contributor to the economic development of the country.

Tourism is now considered as the main pillar of the economy because it leads to an increase in the foreign reserves through flooding of the tourist investors into the country. The contribution of tourism is three times that of agriculture.

Q3. What are the economic and noneconomic factors for the development of Tanzania?

Economic and noneconomic factors for the development of Tanzania include:

1. Government policies

2. Foreign trade

3. Human resource

4. Corruption

References

- Ebohon, O.J. (1996). Energy, economic growth and causality in developing countries: a case study of Tanzania and Nigeria. Energy policy, 24(5), 447-453.

- Gupta, V. (2012). Research Methodology in Social Science. Enkay Publication.

- Gupta, V., Bose, I., (2019). Redefining Indian Exports and Imports: A study on the Post BRICS Scenario. NMIMS Journal of Economics and Public Policy, IV (4), 48-63.

- Juma, N., Kwesiga, E., & Honig, B. (2016). Building a symbiotic sustainable model: A community based enterprise. Journal of the International Academy for Case Studies, 22(3), 110-133.

- Kasidi, F., & Mwakanemela, K. (2013). Impact of inflation on economic growth: A case study of Tanzania.

- Moshi, H.P.B., & Kilindo, A. A. (1999). The impact of government policy on macroeconomic variables: A case study of private investment in Tanzania.

- Reuters Afrcia. (n.d.). Retrieved from reuters.com: https://af.reuters.com/news/country/?type=tanzaniaNews

- Tanzania Invest. (n.d.). Retrieved from https://www.tanzaniainvest.com/

- Tanzania Population. (n.d.). Retrieved from World Population: http://worldpopulationreview.com/countries/tanzania-population/

- Tanzania Truck Owner Association. (n.d.). Retrieved from TATOA: https://tatoa.co.tz/

- Wheeler, S.A., Zuo, A., Bjornlund, H., Mdemu, M.V., van Rooyen, A., & Munguambe, P. (2017). An overview of extension use in irrigated agriculture and case studies in south-eastern Africa. International Journal of Water Resources Development, 33(5), 755-769.

- Organization for Economic Cooperation and Development. (n.d.). Retrieved from OECD.STAT: https://stats.oecd.org/Index.aspx?DataSetCode=AEO