Research Article: 2020 Vol: 24 Issue: 1

A Bibliometric Analysis of Research on Goods and Service Tax (GST) From 2004 To 2019....

Kuldeep Dhar, GLA University

Utkal Khandelwal, GLA University

Abstract

GST is a one-tax framework at a national level for production and sale of products and services. The implementation of the GST has replaced several other taxes. Approximately 152 countries are following this tax system. In 2004, the GST was formed in India with a task force to enforce the Kelkar Committee report, which examined central and state-level indirect tax systems. After the Kelkar Committee report, there were so many researchers have been published on implementations and calculations of GST. This research is an attempt to present bibliometric analysis of published research and review papers on goods and service tax. The purpose of this research is to recognize the pattern of goods and service tax research. By reviewing 177 research and review papers published in Scopus database from 2004 to 2019. The analysis outlines the year wise publication, most cited papers on “Goods and Service tax”, most prolific authors, most prolific journals, most involved countries and institutions and keyword analysis of the goods and service tax research. The findings contain basic perspectives for the growth of goods and service tax research and recent developments.

Keywords

Goods and Service tax, GST, Tax system, Bibliometric study.

Introduction

GST refers to "Goods and Service Tax" which removes the previous multi level tax system and on the production, sale and use of goods and services. It will eliminate all indirect taxes on goods and services from central and state governments in India. The system was first adopted by France in 1954. Approximately 152 countries are following this tax system. In 2004, the GST was formed in India with a task force to enforce the Kelkar Committee report, which examined central and state-level indirect tax systems. The Kelkar Committee report claims that the GST's national double tax reform, which could place higher taxes on sales of almost all goods and services in the economy, is a fair market and increases the tax base; a effective income distribution will boost stability (Poddar & Ahmad, 2009). The Government finds that the GST is not a modification of India's existing tax structure, but rather a change to eliminate certain back doors and drawbacks in the indirect taxation framework (Poddar & Ahmad, 2009). GST is a onetax framework at a national level for production and sale of products and services (Tiwari & Singh, 2018; Pegu, 2017). The implementation of the GST has replaced several other taxes. There is now a tax, which is regulated solely by the central government at national level. GST is a simple policy of tax that increases the collection of taxes (Dash, 2017). This also results in a transparent infrastructure that avoids systemic fraud and corruption. The corporate tax structure will simplify tax reform, lower inflation rates and make the system more transparent. The GST simplifies tax reform. GST will address numerous growth issues by strengthening the relationship between the structures of VAT / GST and possible risks associated with dual taxation and involuntary non-taxation schemes. GST will have a stable basis for early collection of VAT. Corporation / taxpayer manage and collect taxes and charge a share of taxes equal to their margin. GST shifts the company to tax sales to the end-user.

The GST reforms would have a crucial role to play for trade, government and consumers:

1. Trade: GST should be used as a stepping stone to harmonize trade and foster economic growth through major changes: (a) reduced tax multiplicity (Nayyar & Singh, 2018; Jain, 2013) (b) tax parity, in particular with export goods (Salleh, 2018; Jain, 2017) (c) single country or single domestic economic market (Tiwari & Singh, 2018) (d) simpler tax with reduced rates and exemptions (Revathi & Aithal, 2019) (e) costeffectiveness (Palil, 2013; Bidin, 2014).

2. Government: GST promises a great deal to be achieved for a public open operating structure: (a) a clear and accelerated tax system— one global tax system (Dani, 2016); (b) a growing tax base (Banik & Das, 2018); (c) a significant increase in revenue collection (Tiwari and Singh, 2018); (d) a more efficient use of money (Nayyar & Singh, 2018); (e) a more efficient use of consumer savings— a reduction in cascading effects (Nayyar & Singh, 2018; Gupta, 2016).

3. Consumers: GST gives a great deal to average Indians in terms of better taxation: (a) a drop in goods and services prices as a result of a sharp drop in tax cascades (Kumar, 2017); (b) increased household and purchasing power (Mukherjee, 2015); (c) increased common men's savings (Kumar, 2017); (d) increased investment efficiency (Tiwari & Singh, 2018).

After the Kelkar Committee report, there were so many researchers have been published on implementations and calculations of GST. This research is an attempt to present bibliometric analysis of published research and review papers on goods and service tax. This paper aims to handle the following research questions:

Q1. What is the year wise number of publications on Goods and Services tax?

Q2. Which are the most cited papers on Goods and Services tax?

Q3. Who are the most prolific authors?

Q4. Which sources have published the highest number of researches on Goods and Services tax?

Q5. Which are the most involved countries and institutions in the research on Goods and Services tax?

Q6. Which are the most occurring keywords in the research publication on Goods and Services tax?

Method

This study is an attempt to present the research publication summary as a form of bibliometric analysis on “Goods and Service tax” from the year 2004 to 2019. A bibliometric analysis is often in work to construe the numeric data in a specific research subject area, to determine the publication dynamics on a specific topic, and for ascertaining the publication tendency within a certain subject area (Lee et al., 2018). Bibliometric study is an analytical approach that uses the empirical and quantitative study to explain the distribution dynamics of research papers with a particular topic and a given period of time (Almind & Ingwersen, 1997; Persson et al, 2009). The findings of such researches provide and assist future researchers to assemble their literature survey in the planned manner. Another important benefit of bibliometric research is to summarize the precise topic literature in quantitative manner (Merigo et al., 2015).

For bibliometric analysis Scopus database was used for searching the papers having “Goods and Service tax in title, abstract or keyword from the year 2004 to 2019. This database was chosen because of its wider acceptability of publication in various academic institutions and regulative bodies. The keyword “Goods and Service Tax” was used for searching papers. Initially 229 documents were found but further our searching was confined to research articles and reviews and ignores the conference papers and others. 177 research and review papers have been published during the year of 2004 to 2019.

Further these papers have been classified on the basis of year wise publication, most cited papers on “Goods and Service tax”, most prolific authors, most prolific journals, most involved countries and institutions and keyword analysis.

Results and Findings

Year-Wise Publication on Green Branding

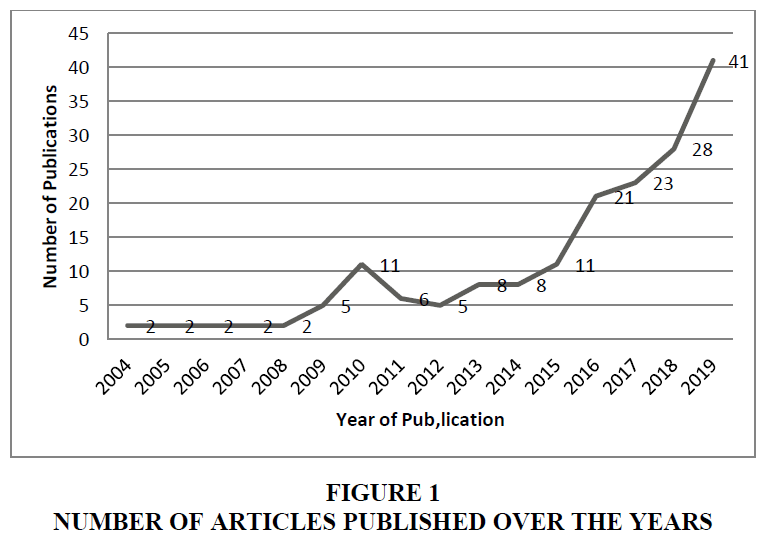

Figure 1 presents the year wise publications of “Goods and service tax” (GST) published from the year 2004 to 2019. It is clear from the figure 1 that research publications on goods and service tax (GST) are continuously increasing and showing the rapid increase in the interest of researchers towards goods and service tax (GST). This figure also established that from the year 2004 to 2015, research publication on goods and service tax (GST) has a little growth year wise but after 2015 there is a significant growth in research publications in this area.

Most Cited Papers

Based on the Scopus database, a list of the top ten most cited papers is presented in the Table 1. The most cited paper with 313 citations as per the Scopus database is “New estimates for the shadow economies all over the world” authored by Andreas Buehn of University of Cooperative Education Bautzen, Friedrich Schneider of Johannes Kepler University Linz and Claudio E. Montenegro of World Bank with Scopus total citations of 313.This study presents presented the estimations of the shadow economies for 162 countries, including developing, Eastern European, Central Asian, and high income OECD countries over 1999 to 2006/2007. Second top cited entitled, “Investigating citizenship: An agenda for citizenship studies” with number of citation 228. This paper is authored by Engin et al.. Turner of Open University, U.K. Third top cited paper with number of citation 40 titled, “The Howard government, regulatory federalism and the transformation of commonwealth-state relations” authored by Andrew Parkin and Geoff Anderson of Flinders University.

| Table 1 10 Top Cited Papers on Goods and Service Tax | |||

| Authors | Title | Year | Cited by |

| Buehn A., Schneider, F. and Montenegro, C.E. | “New estimates for the shadow economies all over the world” | 2010 | 313 |

| Isin E.F., Turner B.S. | “Investigating citizenship: An agenda for citizenship studies” | 2007 | 228 |

| Parkin A., Anderson G. | “The Howard government, regulatory federalism and the transformation of commonwealth-state relations” | 2007 | 40 |

| Tosun M.S., Abizadeh S. | “Economic growth and tax components: An analysis of tax changes in OECD” | 2005 | 28 |

| Pope J., Owen A.D. | “Emission trading schemes: potential revenue effects, compliance costs and overall tax policy issues” | 2009 | 26 |

| Mewton R.T., Cacho O.J. | “Green Power voluntary purchases: Price elasticity and policy analysis” | 2011 | 21 |

| Balatbat M.C.A., Lin C.-Y., Carmichael D.G. | “Comparative performance of publicly listed construction companies: Australian evidence” | 2010 | 20 |

| Gale M., Muscatello D.J., Dinh M., Byrnes J., Shakeshaft A., Hayen A., MacIntyre C.R., Haber P., Cretikos M., Morton P. | “Alcopops, taxation and harm: A segmented time series analysis of emergency department presentations” | 2015 | 19 |

| Randolph B., Pinnegar S., Tice A. | “The First Home Owner Boost in Australia: A Case Study of Outcomes in the Sydney Housing Market” | 2013 | 15 |

| Valadkhani A., Layton A.P. | “Quantifying the effect of the GST on inflation in Australia's capital cities: An intervention analysis” | 2004 | 13 |

| Delgado F.J., Presno M.J. | “Tax policy convergence in EU: An empirical analysis [Convergencia de la política impositiva en la unión europe a: Un análisis empírico]” | 2010 | 11 |

| Gauja A. | “The pitfalls of participatory democracy: A study of the Australian democrats' GST” | 2005 | 11 |

Most Prolific Authors

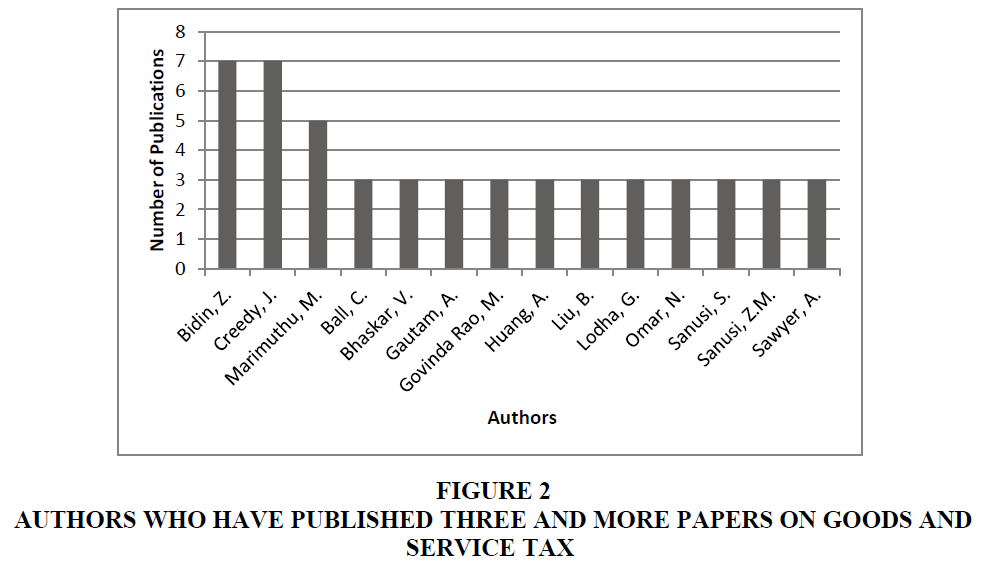

Figure 2 presents the details of those authors who have published more than 2 papers on “Goods and service tax” during the year from 2004 to 2019 on scopus database. In this analysis, most prolific authors on goods and service tax publications are Bidin Zainol of Universiti Utara Malaysia and John Creedy of Victoria University of Wellington. Both of these authors have published 7 papers each on “Goods and Service tax”. Third most prolific author of this area is Dr Munusamy Marimuthu, of Universiti Utara Malaysia. He has published five Scopus indexed research paper on Goods and Services tax.

Most Prolific Journals

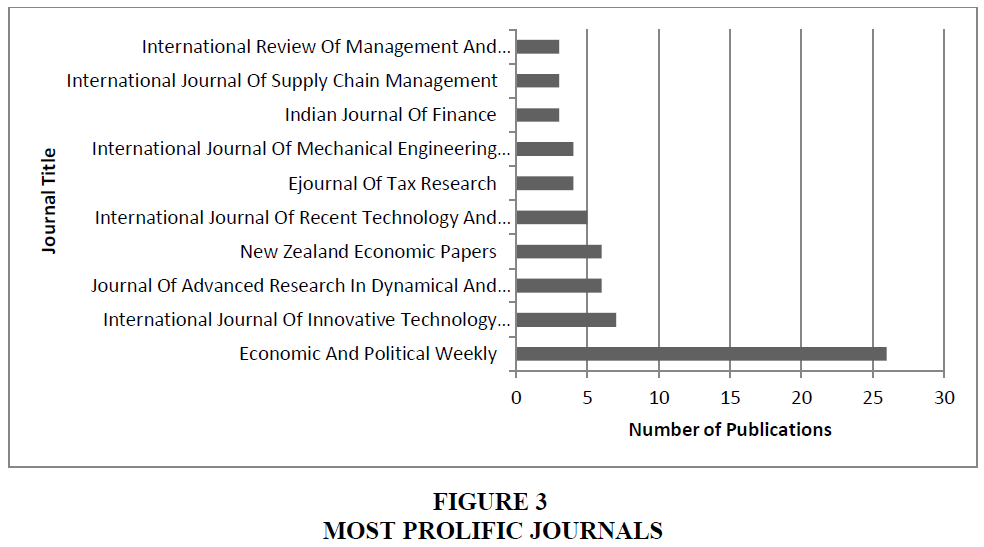

Figure 3 shows that some prominent and well-known Journals, which published researches on Goods and Services tax. In this field, Economic and Political Weekely emerge as a most prolific journal. This journal published 26 papers on Goods and Services tax during the year 2004 to 2019. This journal published by Sameeksha Trust, India.

Country Wise Publication of Green Branding

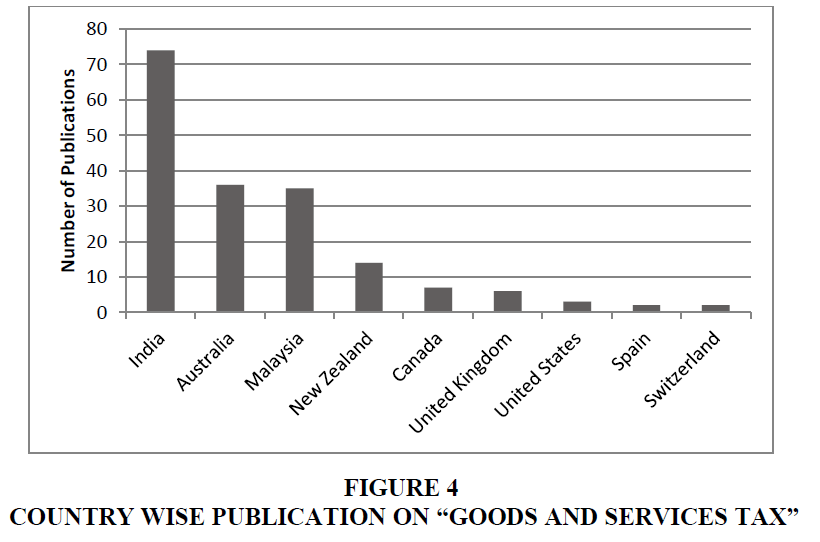

Figure 4 shows the country wise contribution in the research publication on “Goods and Services tax”. This figure shows the top nine countries published the researches on mentioned area. This figure clearly established the contribution of India in the research of Goods and services tax with total number of 74 Scopus indexed publication from 2004 to 2019. Australia is at second highest publication contribution of 36 papers followed by Malaysia and New Zealand with 35 and 14 papers respectively.

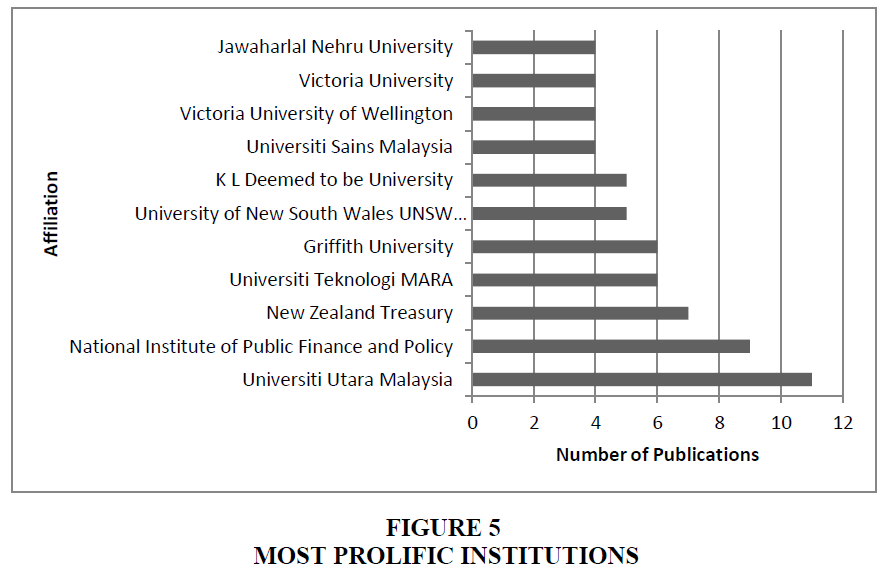

Most Prolific Institutions

Figure 5 presents the the major institutions which have a higher number of published papers on goods and services tax, the most important institute is the Universiti Utara Malaysia, totalling 11 papers. Other institutions which have published 5 or more than five papers are National Institute of Public Finance and Policy (India), New Zealand Treasury (New Zealand), Universiti Teknologi MARA (Malaysia), Griffith University (Australia), University of New South Wales UNSW (Australia) and K L University (India).

Keyword Occurrence Analysis

Keyword occurrence analysis is performed to locate the frequency of keywords that have been used in the goods and services tax published researches. This analysis helps to identify which research themes and topics have been spotted most by the researchers. Table 2 presents all the keywords whose occurrence is five or more than five times in Scopus published research during the period of 2004 to 2019. The most occurred keyword in the research of goods and service tax is GST, which occurred 32 times.

| Table 2 Keyword Occurrences in Goods and Services Tax Research Publications | ||

| S.No. | Keyword | Occurrences |

| 1 | GST | 32 |

| 2 | Goods and Services tax | 23 |

| 3 | Australia | 16 |

| 4 | Tax System | 13 |

| 5 | Human | 11 |

| 6 | Tax | 11 |

| 7 | Economics | 9 |

| 8 | India | 9 |

| 9 | Taxation | 9 |

| 10 | Awareness | 8 |

| 11 | Humans | 8 |

| 12 | Malaysia | 8 |

| 13 | VAT | 8 |

| 14 | Attitude | 7 |

| 15 | Economic Growth | 7 |

| 16 | Goods and Services tax (GST) | 7 |

| 17 | Adult | 6 |

| 18 | Article | 6 |

| 19 | Commerce | 5 |

| 20 | Female | 5 |

| 21 | Gross Domestic Product | 5 |

| 22 | Indirect tax | 5 |

| 23 | Male | 5 |

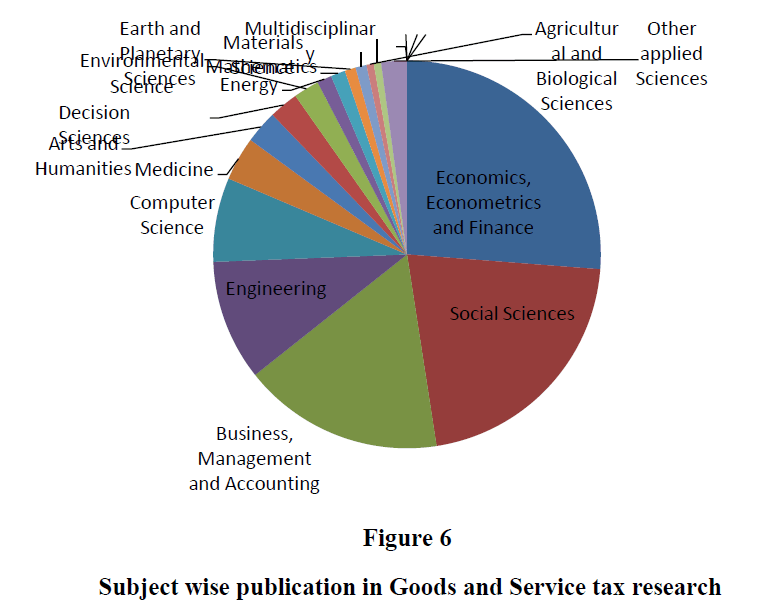

Subject Wise Coverage

Scopus is one of the very good indexing for journals. These journals belong to different subject areas. Some journals covers single subject area and some covers multiple subject area on the basis of that figure 6 presents the subject wise publications of Goods and services tax researches in Scopus journals. This figure explains that Economics, Econometrics and Finance is the most attractive subject area for goods and service tax research with 86 publications in these subject area journals and it is obvious as taxes are generally an economics and finance term. Further 70 papers have published in the subject area of Social Sciences, 55 in Business, Management and Accounting and 33 in Engineering.

Discussion and Conclusion

This article presents the bibliometric analysis of wide variety of researches published on “Goods and Service tax” during the period of 2004 to 2019. Total 229 articles were found comprised “Goods and service tax” in title, abstract and keywords. Further we limit this analysis on research and review papers only and thus 177 papers were considered for further analysis. This paper focused on year-wise trend of publication on goods and service tax, identify those papers that cited most, most prolific authors in the area of goods and service tax, countries and institutions that are prominently involved in researches of this area. In addition, this paper also presents keyword occurrence analysis and subject area of the journals where these researches have published. This analysis provides a direction to those who are entering the field of goods and service tax research, providing information on which journals to consult, which authors, institutions and countries are most eminent and keywords which was frequently used in the goods and service tax researches.

Based on the analysis, it is clear that researches on goods and service tax increased continuously from 2004 to 2019 and show a rapid increase after 2015. This is surely because of the adoption of goods and service tax by the Government of India on 1 July 2017 by abolishing all indirect taxes. This has also proved in country wise publication of goods and service tax as country whose authors have contributed the maximum papers is India. Indian authors have published 74 papers during 2004 to 2019 on goods and service tax. The most cited paper is “New estimates for the shadow economies all over the world” (Schneider et al., 2010).The most prolific authors in the area of goods and service researches are Bidin Zainol of Universiti Utara Malaysia and John Creedy of Victoria University of Wellington. Beacause of Bidin Zainol the Universiti Utara Malaysia emerged as a most prolific institution in the GST research. The journal in which highest number of goods and service tax research have been published from 2004 to 2019 is Economic and political weekly. This study also presents keyword occurrence analysis which illustrated “GST”, “Goods and Services tax”, “Australia”, “Tax System”, “Human” and “Tax” are the keywords which occurred more than 10 times in 177 researches of goods and service tax. This research also presents the researches published in various subject area journals. Based on these social sciences journals emerged as a most attractive area for the researches of goods and service tax.

There are various unambiguous implications of this research that contribute in the sphere of tax research. First, the results related to year-wise publication and top cited articles recommend the increasing interest of goods and service tax research. These diverse researches focus on different areas of business such as financial inclusion, supply chain management, advertising, economics and others as well. Various researches present their own calculations of GST by considering different financial and economic variables. Thus, it will be important that future researchers identify gaps in these conceptual frameworks and theories that could be investigated in the future and need to broaden the goods and service tax impacts on different business dimensions.

Secondly, the analysis related to author-wise publications and journal that published most researches helps research students to identify goods and service tax researches and possible avenues for their future researches. In the same line country wise publication analysis and institutions wise research details of goods and service tax presents global interest in the area of goods and service tax research. Thirdly, Keyword occurrence analysis helps the future researches to identify the research hotspots of goods and service tax research. The keyword of an article can represent its main content, and the frequency of occurrence can reflect structure and development of goods and service tax research themes on which researchers have focused more and diverseness of vicinity in which goods and service tax research researches have conducted.

Limitations and Scope for future research

As a natural phenomenon, this research is also not free from limitations, which can be considered as scope for future research. First, this research considered Scopus database in searching green branding papers. So, the papers which are not indexed in Scopus were not included in this research. Future researcher may consider more databases such as Web of science, Google scholar and more. Second, there are various graphical representations tools used in bibliometric research such as Gefi, Vosviewer, Citenet etc that was not used in this research future researcher may used these for better representation of these bibliometric data. Thirdly, this study limit to 16 years of goods and service tax researches from 2004 to 2019. Future researchers may extend further. Another important limitation of this work is primarily the bibliometric analysis that focuses more on counts and exploring associations between authors, affiliation and ideas. Future researchers may go for deeper work in terms of Meta analysis, systematic literature review, reviewing methodologies and application of goods and service tax researches.

References

- Almind, T.C., & Ingwersen, P. (1997). Informetric analyses on the world wide web: Methodological approaches to ‘webometrics.’ Journal of Documentation, 53(4), 404–426.

- Bidin, Z., Marimuthu, M., & Othman, M.Z. (2014, August). Understanding and probable area of difficulty of tax agents towards the proposed Goods and Service Tax in Malaysia. In Knowledge Management International Conference (KMICe) (12-15).

- Dani, S. (2016). A research paper on an impact of goods and service tax (GST) on Indian economy. Business and Economics Journal, 7(4), 1-2.

- Dash, A. (2017). Positive and negative impact of GST on Indian economy. International Journal of Management and Applied Science, 3(5), 158-160.

- Gupta, S. (2016). Goods and Services Tax (GST): A comprehensive and uniform indirect tax reform in India. VISION: Journal of Indian Taxation, 3(2), 31-53.

- Jain, A. (2013). An empirical analysis on goods and service tax in India: Possible impacts, implications and policies. International Journal of Reviews, Surveys and Research.

- Jain, M. (2017). A major step towards indirect taxation in Indian economy. International Journal of Research in Economics and Social Sciences, 7(12).

- Kumar, A. (2017). Goods and service tax in India-problems and prospects. International Journal in Management & Social Science, 5(7), 488-495.

- Lee, V.H., Hew, J.J., & Loke, S.P. (2018). Evaluating and comparing ten-year (2006–2015) research performance between Malaysian public and private higher learning institutions: a bibliometric approach. International Journal of Innovation and Learning, 23(2), 145-165.

- Merigo, J. M., Gil-Lafuente, A. M., & Yager, R.R. (2015). An overview of fuzzy research with bibliometric indicators. Applied Soft Computing, 27, 420-433.

- Mukherjee, S. (2015). Present state of goods and services tax (GST) reform in India.

- Nayyar, A., & Singh, I. (2018). A comprehensive analysis of goods and services tax (GST) in India. Indian Journal of Finance, 12(2), 57-71.

- Palil, M.R., Ramli, R., Mustapha, A.F., & Hassan, N.S.A. (2013). Elements of compliance costs: Lesson from Malaysian companies towards Goods and Services Tax (GST). Asian Social Science, 9(11), 135.

- Pegu, B. (2017). The Proposed GST (Goods and Services Tax) and Indian Economy. International Journal of Interdisciplinary Research in Science and Culture, 3(1).

- Persson, O., Danell, R., & Schneider, J.W. (2009). How to use Bibexcel for various types of bibliometric analysis. Celebrating scholarly communication studies: A Festschrift for Olle Persson at his 60th Birthday, 5, 9-24.

- Poddar, S., & Ahmad, E. (2009). GST reforms and intergovernmental considerations in India. Government of India, Ministry of Finance, Department of Economic Affairs, Working Paper, 1, 2009.

- Revathi, R., & Aithal, P. S. (2019). Review on global implications of goods and service tax and its indian scenario. Saudi Journal of Business and Management Studies, 4(4), 337-358.

- Salleh, M.C.M., Yussof, S.A., & Abdullah, N.I. (2018). Impact of the Government Service Tax (GST) on the Malaysian Takaful Industry: Issues and challenges. Advanced Science Letters, 24(5), 3178-3183.

- Schneider, F., Buehn, A., & Montenegro, C. E. (2010). New estimates for the shadow economies all over the world. International Economic Journal, 24(4), 443-461.

- Tiwari, H., & Singh, S. N. (2018). Goods and service tax: Economic revival of India. Paradigm, 22(1), 17-29.